1.

November 10, 1881

The Pickens Sentinel

Pickens, SC

Click image to open full size in new tab

Article Text

Pensacola and Atlantic from the New Orleans and Pacific railroad, where they are just finishing a large contract.

### Nashville World: Considerable Surprise

Considerable surprise was caused yesterday by the sale of $1,500,000 in Confederate bonds, part of the assets of the Bank of Tennessee, for $5,000. The sale was effected by Robert Ewing, Clerk and Master, as Receiver for the bank, and the buyer was Raphael J. Moses, Jr., of New York. One million dollars more in Confederate bonds is in his possession.

Columbus Enquirer-Sun: A gentleman from Elbert county and a lady from Franklin had agreed to become one—the license was procured, the minister present, and the twain stood on the floor ready to join hands matrimonially, when a former flame of the lady stepped in and asked the groom expectant if the lady would prefer to marry him would he interpose any objections. He answered favorably, so did the lady, and the ceremony proceeded with a new groom.

2.

November 11, 1881

The Magnolia Gazette

Magnolia, MS

Click image to open full size in new tab

Article Text

dren are all alive and kicking, and it is presumed that Mr. C. is going through a similar exercise.

The contract for that portion of the Pensacola and Atlantic Railroad not heretofore let, consisting of about one hundred miles in the center of the line, has been awarded to A. J. Lane & Co., of Macon, Ga. The contractors will transfer about one thousand men to the Pensacola and Atlantic from the New Orleans and Pacific railroad, where they are just finishing a large contract.

Nashville World: Considerable surprise was caused yesterday by the sale of $1,500,000 in Confederate bonds, part of the assets of the Bank of Tennessee, for $5,000. The sale was effected by Robert Ewing, Clerk and Master, as Receiver for the bank, and the buyer was Raphael J. Moses, Jr., of New York. One million dollars more in Confederate bonds is in his possession.

3.

January 17, 1882

Public Ledger

Memphis, TN

Click image to open full size in new tab

Article Text

Claims Against the Bank of Tennessee. Nashville World The following decree was entered in the Changery Court yesterday in the case, of the State vs. Bank of Tennes see: In this cause, on application made in behalf of the holders of the new issue notes of the Bank of Tennessee, it was ordered. adjudged, and decreed by the court that the time for filing all claims against the Bank of Tennessee, or its assets in the receiver's hands, be extended to the first of March 1882, inclusively.

4.

March 8, 1883

Memphis Daily Appeal

Memphis, Hernando, Grenada, Jackson, Vicksburg, Atlanta, Griffin, Macon, Montgomery, Selma, TN

Click image to open full size in new tab

Article Text

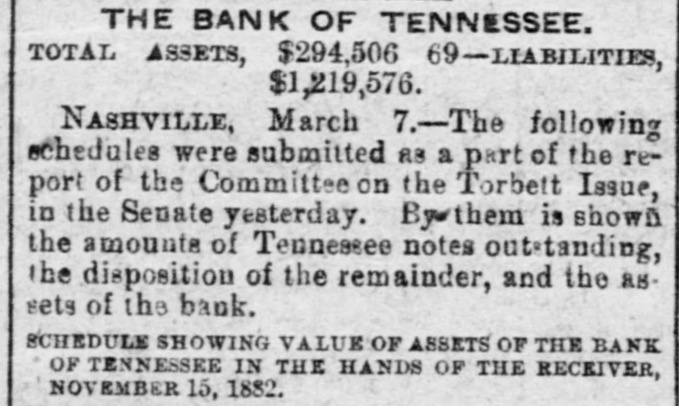

THE BANK OF TENNESSEE. TOTAL ASSETS, $294,506 69-LIABILITIES, $1,219,576. NASHVILLE, March 7.-The following schedules were submitted as a part of the report of the Committee on the Torbett Issue, in the Senate yesterday. Bywthem is shown the amounts of Tennessee notes outstanding, the disposition of the remainder, and the assets of the bank. SCHEDULE SHOWING VALUE OF ASSETS OF THE BANK OF TENNESSEE IN THE HANDS OF THE RECEIVER, NOVEMBER 15, 1882.

5.

March 8, 1883

Memphis Daily Appeal

Memphis, Hernando, Grenada, Jackson, Vicksburg, Atlanta, Griffin, Macon, Montgomery, Selma, TN

Click image to open full size in new tab

Article Text

THE LEGISLATURE. THE HOUSE DEBT BILL PASSED THE SENATE ON FIRST READING. Special to the Appeal.) NASHVILLE, March 7.-Senate.-At 11 o'clock Mr. Galloway's bill providing for the construction, building and repairing of turnpike, macadamized and graded gravel roads, and providing for the collection of a ten cent tax on each $100 worth of property for the same, was taken up. The act is not compulsory. Passed third reading. The House joint resolution, "that our United States senators be instructed and our representatives in Congress requested to use their influence to have the tariff reduced to a basis for revenue only," was postponed indefinitely, which effectually kills the resolution. The Senate joint resolution to have printed for the use of the General Assembly 10,000 copies of Commissioner Hawkins's report on experimental tests of commercial fertilizers was adopted. The Senate joint resolution directing the treasurer to file a petition with the receiver in the case of State of Tennessee and Samuel Wateon, trustee, vs. the Bank of Tenneesee, in the Chancery Court at Nashville, for the pro rata payment of all the notes of the bank held by him, as treasurer of Tennessee, or which may hereafter be paid into his office, or be received by him in his official capacity, was adopted. The House bill to authorize church officers and their successors in office to convey real estate, passed third reading. The House bill to settle the bonded indebtedness of the State of Tennessee was taken up and passed first reading. It is thought it will pass the third reading within the next two days, as it is in accordance with the action of the Democratic caucue.

6.

July 25, 1883

The Home Journal

Winchester, TN

Click image to open full size in new tab

Article Text

Next Saturday, the 28th inst., al 12 M., pursuant to a deeree of the Chancery Court, Thomas Wrenne, receiver of the Bank of Tennessee, will sell at public auction in Nashville, about $172,000 of bonds of the State of Tennessee. Nearly all these bonds are "State debt proper" bonds, and under the late law will be funded in bonds paying dollar for dollar, and bearing 6 per cent. interest.

7.

August 15, 1883

Memphis Daily Appeal

Memphis, Hernando, Grenada, Jackson, Vicksburg, Atlanta, Griffin, Macon, Montgomery, Selma, TN

Click image to open full size in new tab

Article Text

TENNESSEE BONDS. Sale of 8165,000 Bouds, Mostly of the State Debt Proper. Special to the Appeal.] NASHVILLE, August 14.-Clerk and Marter Wrenne, receiver of the Bank of Tennersee, left this afterncon for New York to negotiate for the sale of $165,000 Tennessee bonds, mostly of that State debt proper.

8.

August 15, 1883

Memphis Daily Appeal

Memphis, Hernando, Grenada, Jackson, Vicksburg, Atlanta, Griffin, Macon, Montgomery, Selma, TN

Click image to open full size in new tab

Article Text

Heavy Sale of Tennessee Bonds. Nashville American: A short time ago Mr. Thomas W. Wrenne, clerk and master of the Chancery Court, and receiver of the Bank of Tennessee, sold $165,000 of bonde of the State of Tennessee, most of which were State debt proper bonds. As they only brought from thirty-seven osixty. nine cents on the dollar, Chancellor A. G Merritt re= fused to confirm the sale. This act on the part of the chancellor has been favorably commented on by all who are acquainted with the condition of the assets of the Bank of Tennessee, and the nature and extent of the claims agaiost them. The soundness of the chancellor's decision is a's) proven by the fact that Mr. Wrenne, the receiver, since the sale, has been offered seventy-two and a half cents for the whele of the bonds by New York mer. Excouraged by this offer and being otherwise informed that the prevaiing sentiment in Wall street is growing more favorable every day toward the acceptance of the fifty-and-three act as a final settlement of the State debt question, Mr. Wrenne leaves this afternoon for the purpose of obtaining additional bids ou these $165, 000 State debt proper bonds. Speaking with a prominent lawyer yesterday, who is well acquainted with all of the actions and decisions taken and made in the case of the State of Tennessee and others against the Bank of Tennessee, an American reporter learned that nothing could have been gained in the way of the immediate distribu ion of the Resets of the back among its creditors, even if the chancellor had confirmed the sale of the State debt proper bonds, because of the following facts; The assets are claimed by two diff rent classes of creditors of the bank, namely, the noteholders or owners of the Torbett issue, on one side, and the depositors on the other. The claims amount to upward of $2,000,000, about equally divided between two glasses of claimants. The whole of the assets will not amount to enough to pay forty per cent. on either class of claims. The law passed by the last Logistature provides that the noteholders shall first exhaust the assets of the bank in the payment of their claims, and after three have been applied for that purpose the State will issue its receivable wairants for the balance, to be absorbed by being received in payment of all taxes due the State, at the rate of one-fifth each year. As soon as the act was passed the depositors filed a petition in the Chancery Court here asking the chappellor to give them preference over the noteholders ás to the application of the assets of the bank. That question was argued fully and the chapcellor held that the notebolders had the preference, Tais decision, said the reporter's informant, is but a repetition of former decisions of the Supreme Court of this State and of the United State3 Supreme Court. Notwithstanding these decisions, the depositors prayed an appeal to the next term of the Supreme Court. This appeal, until passed upon by the Supreme Court, will prevent the of the from being distributed. a Until assets that appeal bank is decided it is still question as to which of the contestante is entitled to the assets of the Bank of Tennessee, are among which the proceeda of these bonds. the The bonds in question were sold before appeal was perfected, but the 8 le was made subject to confirmation by the court. The chancellor, knowing that DO distribution could be made as long as the appeal was pending, and feeling that the price realized from the bonds was too low, refused to confirm the sale and left the matter open uniii the Outober term of the court.

9.

August 16, 1883

Public Ledger

Memphis, TN

Click image to open full size in new tab

Article Text

BANK OF TENNESSEE. Clerk and Master Wrenne's Important Mission to New York. The Litigation Over the State Proper Bonds- Interesting Points About the Assets. Nashville American,1 Ashorttime ago Mr. Thomas W. Wrenne, Clerk and Master of the Chancery Court, and Receiver of the Bank of Tennessee, sold $165,000 of bonds of the State of Tennessee, most of which were State debt proper bonds. As they only brought from thirty-seven to sixty-nine cents on the dollar, Chancellor A. G. Merritt re fused to confirm the sale. This act on the part of the Chancellor has been favorably commented on by all who are acquainted with the condition of the assets of the Bank of Tennessee, and the nature and extent of the claims against them. The soundness of the Chancellor's decision is also proven by the fact that Mr. Wrenne, the Receiver, since the sale, has been offered seventy-two and a half cents for the whole of the bonds by New York men. Encouraged by this offer, and being otherwise informed that the prevailing sentiment in Wall street is growing more favorable every day towards the acceptance of the 50 3 act as a final settlement of the State debt question, Mr. Wrenne leaves this ats ternoon for the purpose of obtaining additional bids on those $165,000 State debt proper bonds. Speaking with a prominent lawyer X yesterday, who is well acquainted with all of the actions and decisions taken and made in the case of the State of Tennessee and others againstthe Bank of Tennessee, an American reporter learned that nothing could have been gained in the way of the immediate I distribution of the assets of the bank t among its creditors, even if the Chan\ cellor had confirmed the sale of the t State debt proper bonds, because of a the following facts: The assets are a claimed by two different classes of creditors of the bank, namely, the note holders or owners of the Torbett issue, 1 on one side, and the depositors on the other. The claims amount to upwards p to of $2,000,000, about equally divided between two classes of claimants. The g t whole of the assets will not amount to I enough to pay forty per cent on either a class of claims. The law passed by d the last Legislature provides that the note holders shall first exhaust the e assets of the bank in the payment of 1 their claims, and after these have been t applied for that purpose the State will issue its receivable warrants for the 5 balance, to be absorbed by being reb ceived in payment of all taxes due the i State, at the rate of one-fifth each year. As soon as the act was passed i the depositors filed a petition in the Chancery Court here asking the Chani oellor to give them preference over the 8 note holders as to the application of the assets of the bank. t That question was argued fully and p the Chancellor held that the note8 b holders had the preference. a This decision, said the report's in formant, is but a repetition of former d S decisions of the Supreme Court of this State and of the United States Su t e preme Court. Notwithstanding these decisions, the depositors prayed an appeal to the next term of the Su. preme Court. This appeal, until I passed upon by the Supreme Court, t. will prevent the assets of the bank S from being distributed. Until that appeal is decided it isstill a question as to which of the contestants is entitled to the assets of the Bank of Tennes see, amongst which are the proceeds t of these bonds. The bonds in question D were sold before the appeal was perc fected. but the sale was made subject t to confirmation by the court. The a Chanoellor, knowing that no distri 0 bution could be made as long as the < appeal was pending, and feeling that mg the price realizea from the bonds was

10.

December 20, 1883

Memphis Daily Appeal

Memphis, Hernando, Grenada, Jackson, Vicksburg, Atlanta, Griffin, Macon, Montgomery, Selma, TN

Click image to open full size in new tab

Article Text

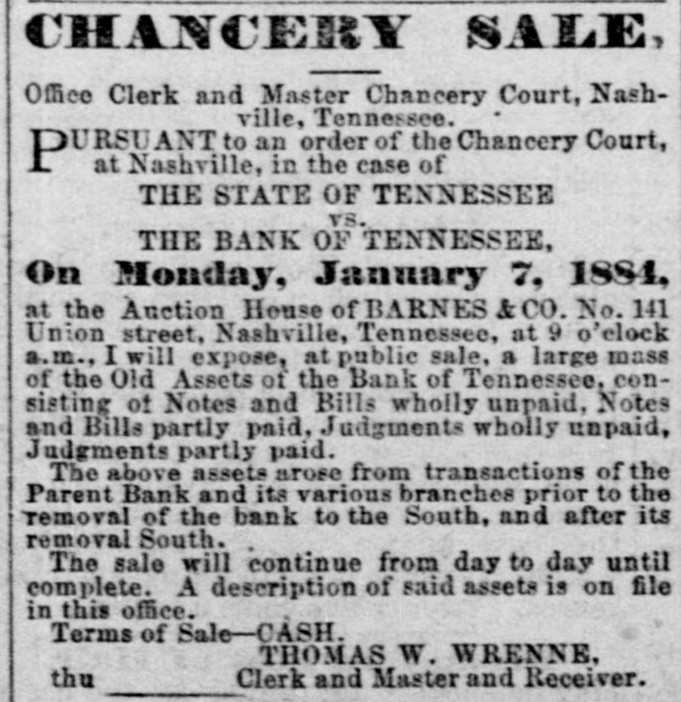

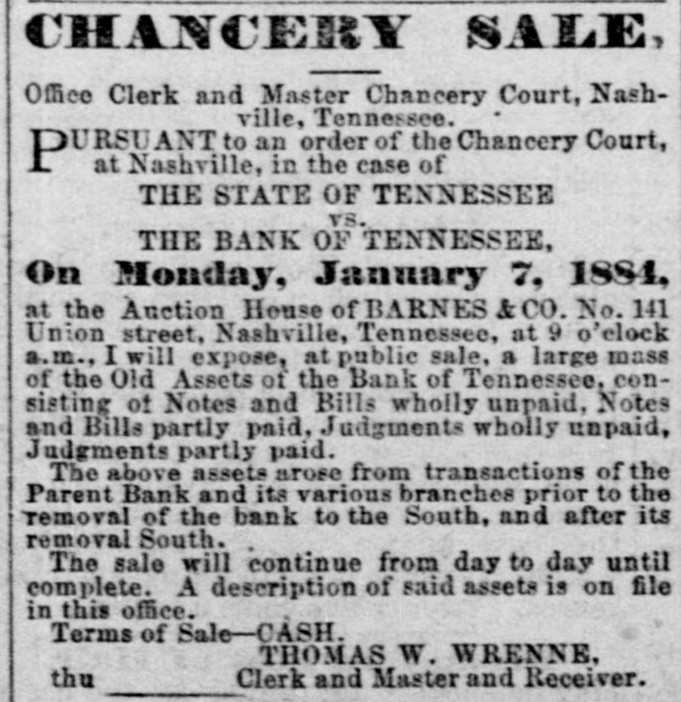

CHANCERY SALE, Office Clerk and Master Chancery Court, Nashville, Tennessee. URSUANT to an order of the Chancery Court, P at Nashville, in the case of THE STATE OF TENNESSEE vs. THE BANK OF TENNESSEE, On Monday, January 7, ISS4, at the Auction House of BARNES &CO. No. 141 Union street, Nashville, Tennessee, at 9 o'elock a.m., I will expose, at public sale, a large mass of the Old Assets of the Bank of Tennessee, consisting of Notes and Bills wholly unpaid, Notes and Bills partly paid, Judgments wholly unpaid, Judgments partly paid. The above assets arose from transactions of the Parent Bank and its various branches prior to the removal of the bank to the South, and after its removal South. The sale will continue from day to day until complete. A description of said assets is on file in this office. Terms of Sale-CASH. THOMAS W. WRENNE, thu Clerk and Master and Receiver.