Click image to open full size in new tab

Article Text

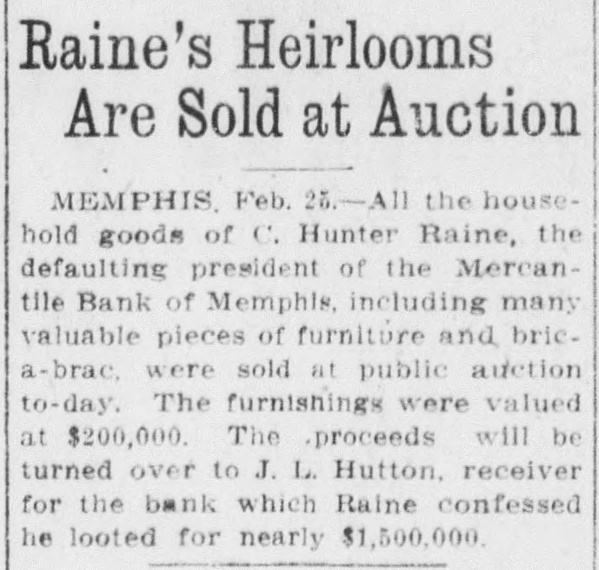

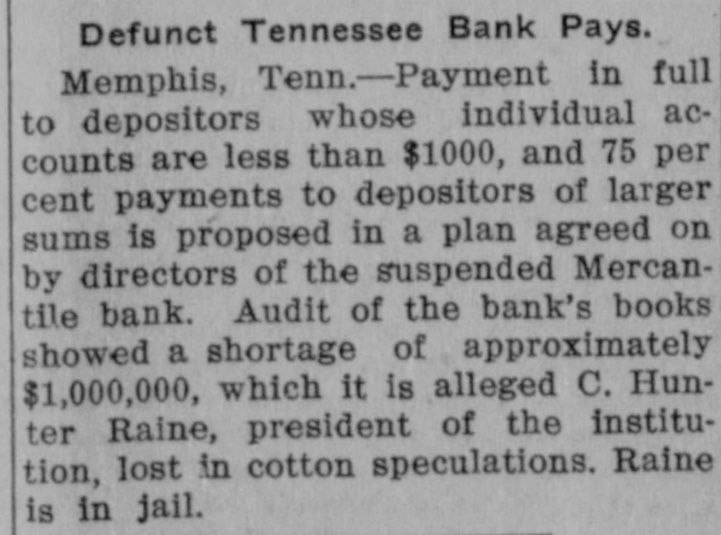

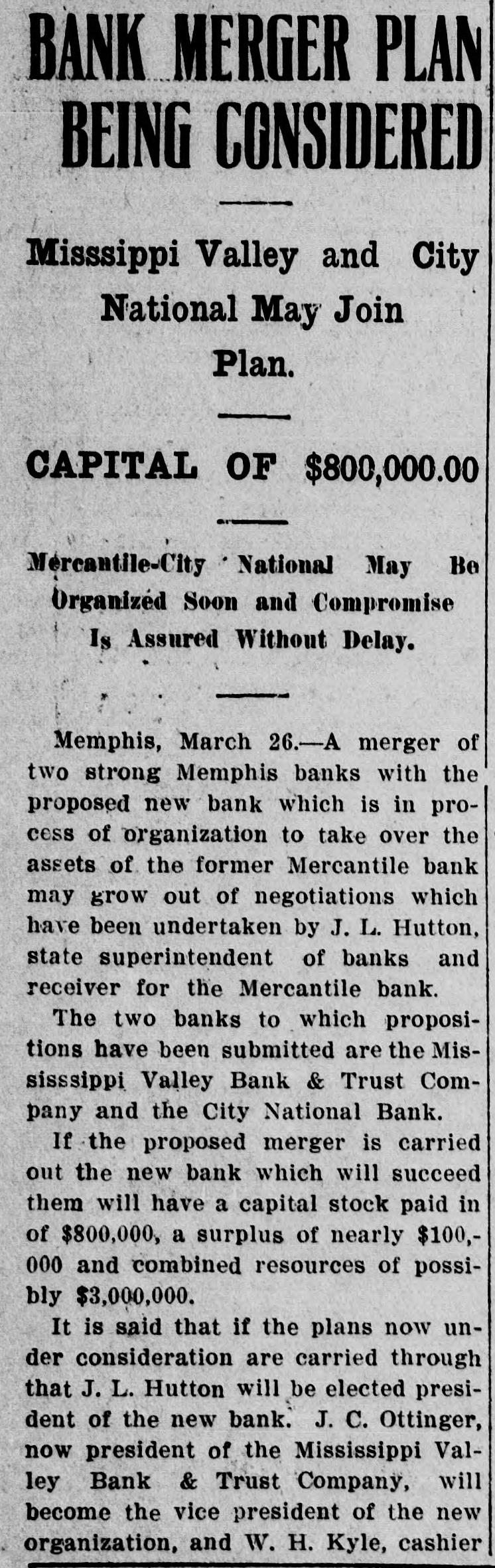

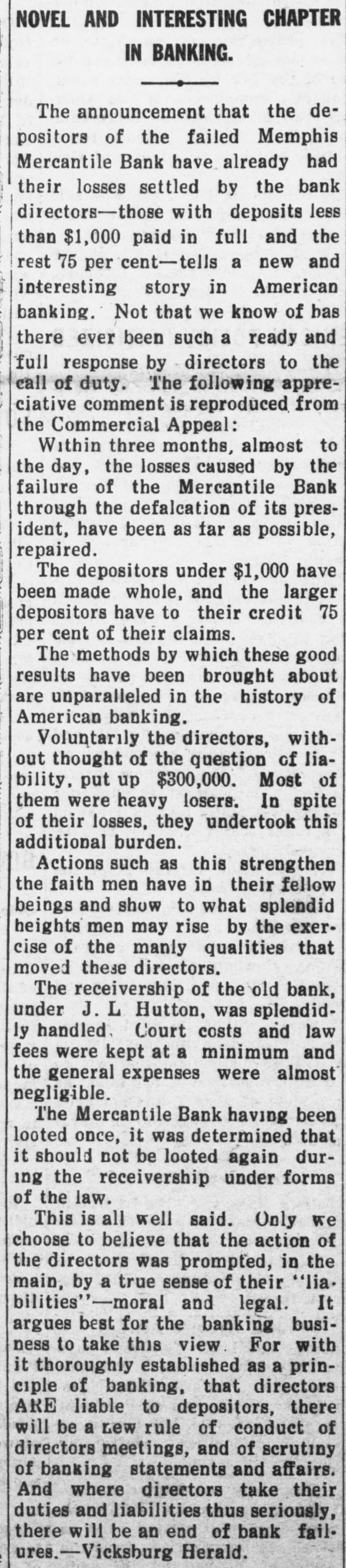

HEAD OF MEMPHIS BANK IS ACCUSED OF HUGE SWINDLE Memphis, Tenn., Feb. 10.-C. H. Rains, president of the Mercantile bank, one of the leading financial institutions of the city, was charged with embezzlement in a warrant sworn out today by z. N. Estes, county attorney. The accounts of the bank, which is a state institution, are alleged to be short between $700,000 and $1,000,000. Memphis, Tenn., Feb. 10.-Ten directors of the Mercantile bank, one of the most important financial institutions in the city, today filed a petition in chancery court, charging that the bank was insolvent as the result of the alleged misappropriation of more than $750,000 by C. Hunter Raine, president of the institution. In the petition Raine was held solely responsible for the apparent shortage, approximately $788,804, which, it is charged, he obtained "by a system of handling the bank's drafts, property and exchange in such a way as to deceive the directors and to conceal his manipulations," the total amount of which it was alleged, he lost in speculation. The petition places the liabilities of the bank at approximately $2,196,594 with assets of $1,408,089. In a published statement January 9, liabilities were given as $2,436,197. At that time the total deposits were $1,861,109, of which $344,233, were savings accounts. The bank is capitalized at $200,000 and has a surplus of $100,000. Resources, loans and discounts at the time of the statement, amounted to $1,130,496; actual cash on hand was $424,784; sums due from other banks amounted to $489,165; cash items in transit amounted to $137,778. These amounts with other items balanced the amount given as liablities. The alleged discrepancy was discovered by a representative of a New York correspondent of the bank who was sent to Memphis last week to audit the books of the Mercantile bank, when loans requested were found to be out of proportion to the amounts usually asked for at this season of the year. His report to the directors yesterday, which brought the situation to a climax, was the first intimation that the bank was not in a prosperous condition according to the directors. The bank was ordered to remain closed today by state banking officials, who are making an investigation of its affairs. It is stated that President Raine, who attended yesterday's meeting absolved all of the officers and directors of the bank of implication in alleged shortages and tendered his personal estate, which he valued at $350,000 to the bank. So far he has made no formal statement. G. C. Hutton, state superintendent of banking, arrived here today from Nashville and was appointed receiver for the bank, in accordance with a chancery bill filed by attorneys representing the bank's directors. Investigation of the condition of the bank's resources was started immediately. There was little excitement evident in financial circles. J. C. Ottinger, president of the Memphis Clearing House association, issued a statement declaring none of the members of the association were affected by the failure of the Mercantile bank. The warrant was served on Mr. Raine at his home. He was taken before Criminal Judge Palmer, where he pleaded guilty. Despite his protest that he did not want any bond fixed, Judge Palmer placed the amount at $250,000, but Mr. Raine declared he would make no effort to get the security and accompanied a deputy sheriff to the county jail.