1.

December 24, 1907

Albuquerque Citizen

Albuquerque, NM

Click image to open full size in new tab

Article Text

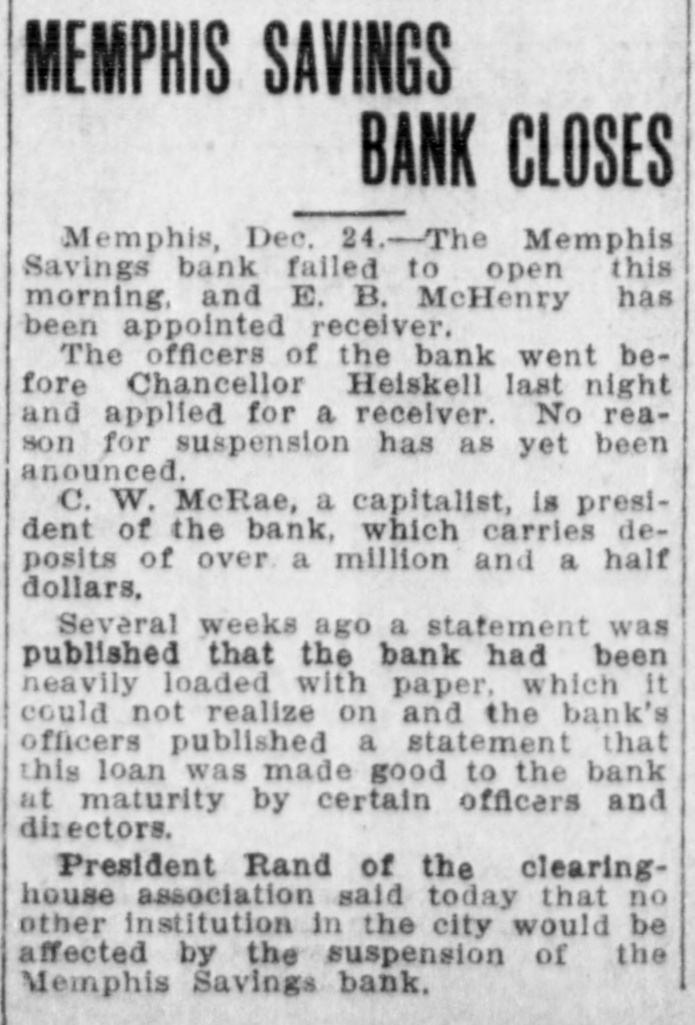

MEMPHIS SAVINGS BANK CLOSES Memphis, Dec. 24. The Memphis Savings bank failed to open this morning, and E. B. McHenry has been appointed receiver. The officers of the bank went before Chancellor Heiskell last night and applied for a receiver. No reason for suspension has as yet been anounced. C. W. McRae, a capitalist, is president of the bank, which carries deposits of over a million and a half dollars. Several weeks ago a statement was published that the bank had been neavily loaded with paper, which it could not realize on and the bank's officers published a statement that this loan was made good to the bank at maturity by certain officers and directors. President Rand of the clearinghouse association said today that no other institution in the city would be affected by the suspension of the Memphis Savings bank.

2.

December 24, 1907

Santa Fe New Mexican

Santa Fe., Santa Fe, NM

Click image to open full size in new tab

Article Text

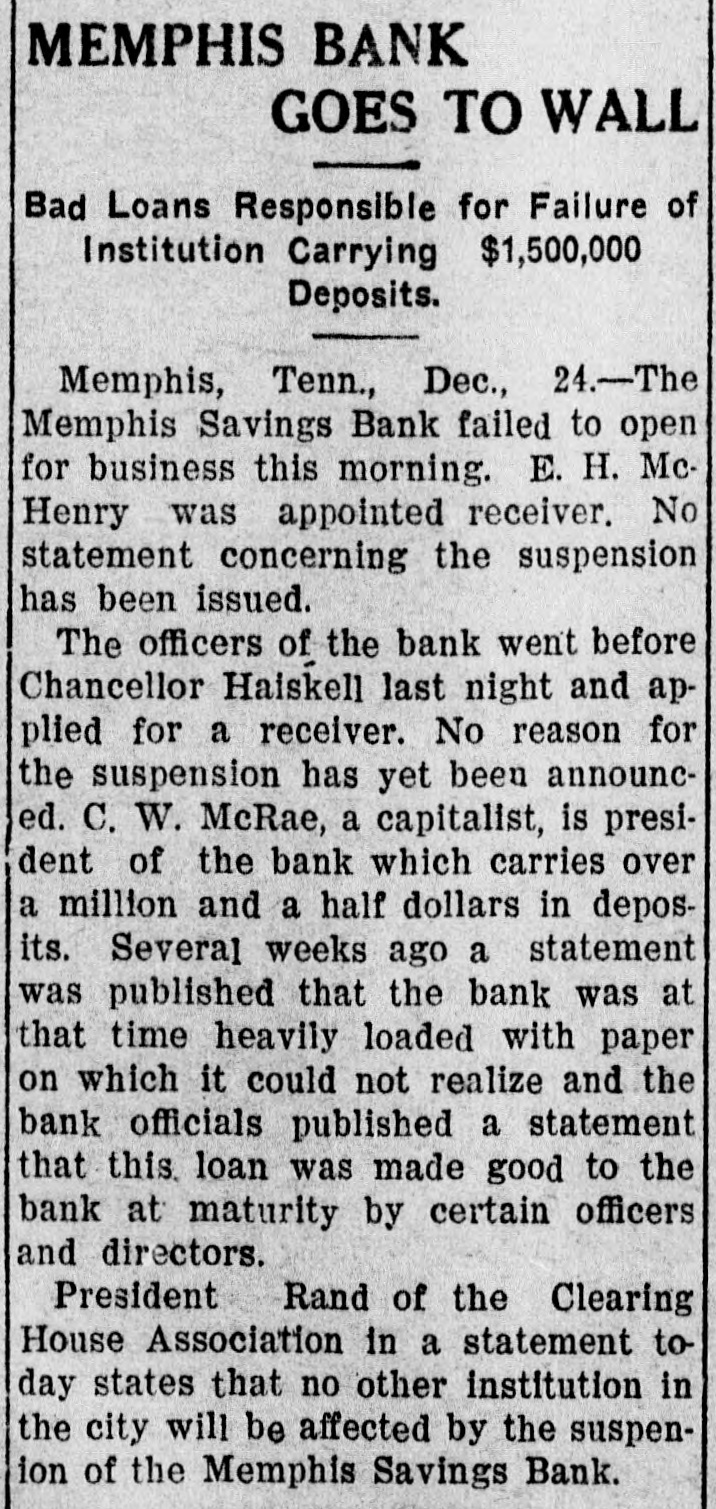

MEMPHIS BANK GOES TO WALL Bad Loans Responsible for Failure of Institution Carrying $1,500,000 Deposits. Memphis, Tenn., Dec., 24.-The Memphis Savings Bank failed to open for business this morning. E. H. McHenry was appointed receiver. No statement concerning the suspension has been issued. The officers of the bank went before Chancellor Haiskell last night and applied for a receiver. No reason for the suspension has yet been announced. C. W. McRae, a capitalist, is president of the bank which carries over a million and a half dollars in deposits. Several weeks ago a statement was published that the bank was at that time heavily loaded with paper on which it could not realize and the bank officials published a statement that this loan was made good to the bank at maturity by certain officers and directors. President Rand of the Clearing House Association in a statement to day states that no other institution in the city will be affected by the suspenion of the Memphis Savings Bank.

3.

December 24, 1907

The Daily Sentinel

Grand Junction, CO

Click image to open full size in new tab

Article Text

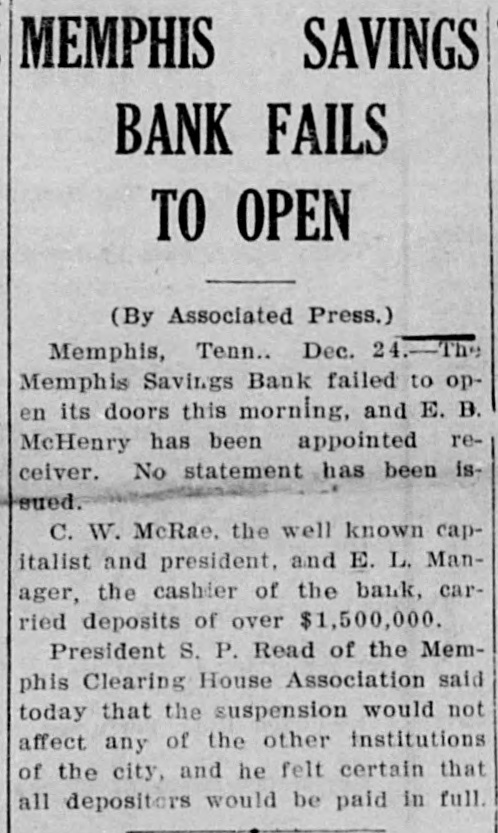

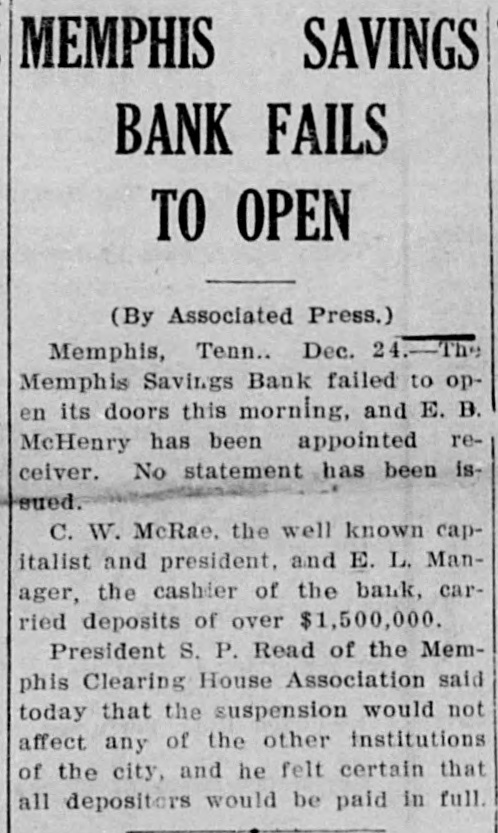

MEMPHIS SAVINGS BANK FAILS TO OPEN (By Associated Press.) Memphis, Tenn.. Dec. 24.-The Memphis Savings Bank failed to open its doors this morning, and E. B. McHenry has been appointed receiver. No statement has been issued. C. W. McRae. the well known capitalist and president, and E. L. Manager, the cashier of the bank, carried deposits of over $1,500,000. President S. P. Read of the Memphis Clearing House Association said today that the suspension would not affect any of the other institutions of the city, and he felt certain that all depositors would be paid in full.

4.

December 24, 1907

Alexandria Gazette

Alexandria, VA

Click image to open full size in new tab

Article Text

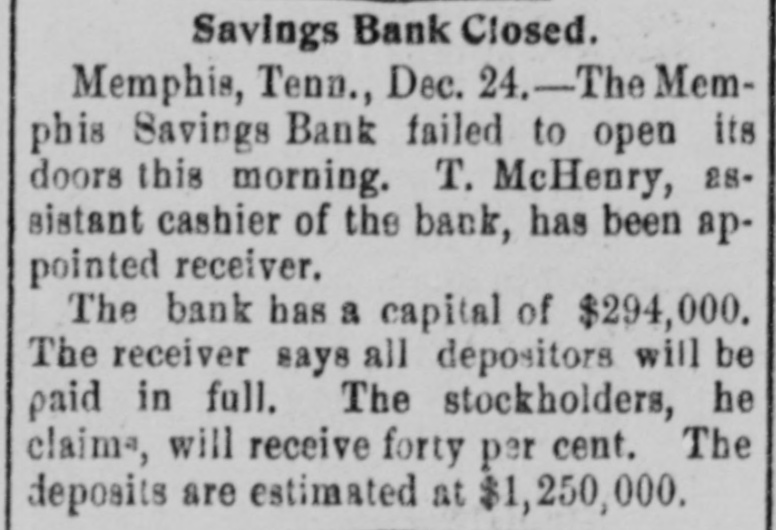

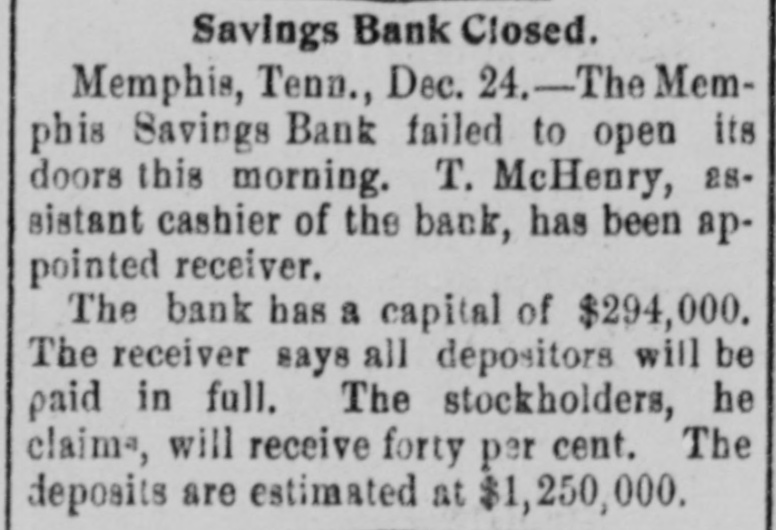

Savings Bank Closed. Memphis, Tenn., Dec. 24.-The Memphis Savings Bank failed to open its doors this morning. T. McHenry, 28sistant cashier of the bank, has been appointed receiver. The bank has a capital of $294,000. The receiver says all depositors will be paid in full. The stockholders, he claims, will receive forty per cent. The deposits are estimated at $1,250,000.

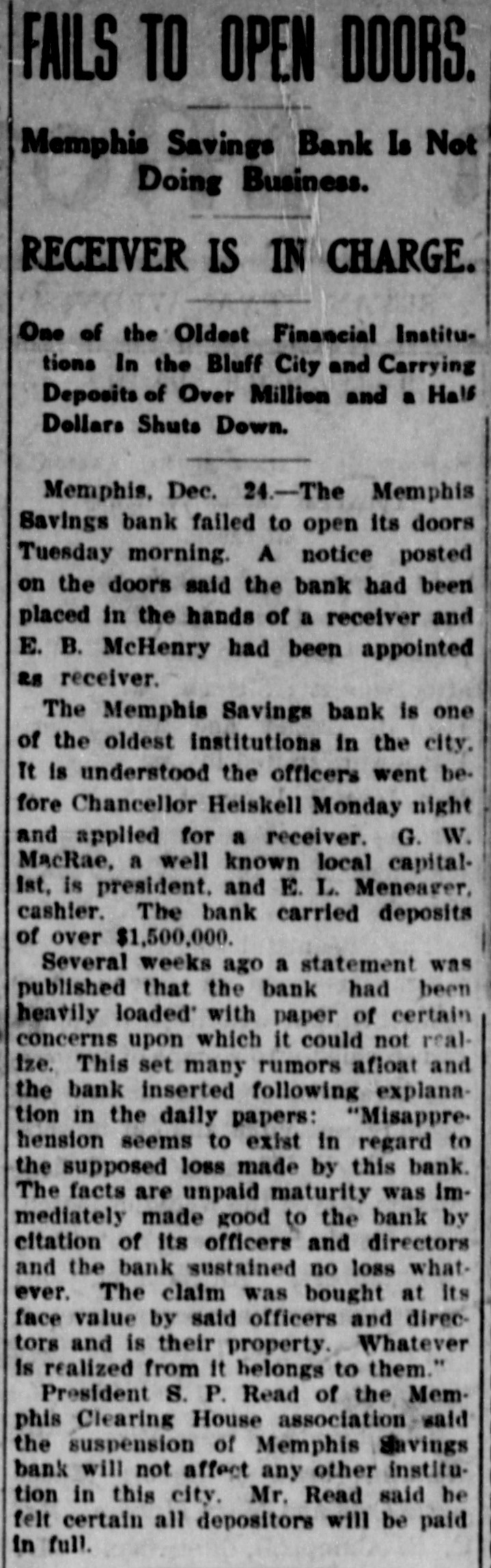

5.

December 24, 1907

The Topeka State Journal

Topeka, KS

Click image to open full size in new tab

Article Text

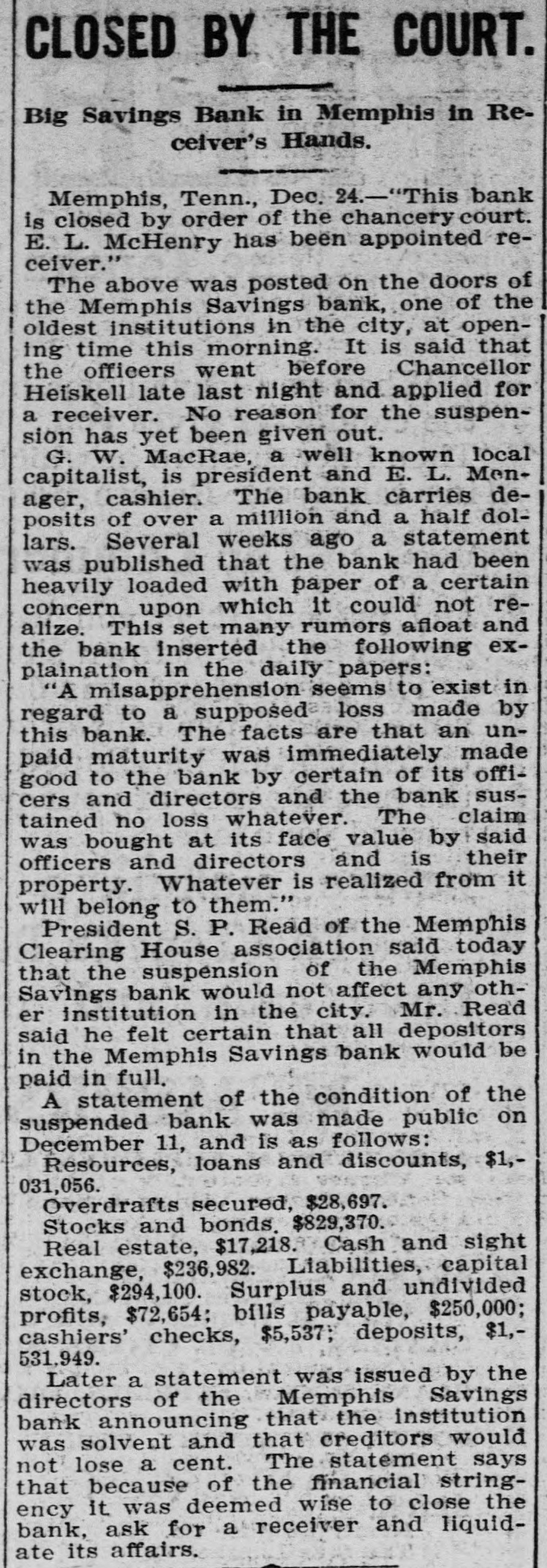

CLOSED BY THE COURT. Big Savings Bank in Memphis in Receiver's Hands. Memphis, Tenn., Dec. 24.-"This bank is closed by order of the chancery court. E. L. McHenry has been appointed receiver." The above was posted on the doors of the Memphis Savings bank, one of the oldest institutions in the city, at opening time this morning. It is said that the officers went before Chancellor Heiskell late last night and applied for a receiver. No reason for the suspension has yet been given out. G. W. MacRae, a well known local capitalist, is president and E. L. Menager, cashier. The bank carries deposits of over a million and a half dollars. Several weeks ago a statement was published that the bank had been heavily loaded with paper of a certain concern upon which it could not realize. This set many rumors afloat and the bank inserted the following explaination in the daily papers: "A misapprehension seems to exist in regard to a supposed loss made by this bank. The facts are that an unpaid maturity was immediately made good to the bank by certain of its officers and directors and the bank sustained no loss whatever. The claim was bought at its face value by said officers and directors and is their property. Whatever is realized from it will belong to them." President S. P. Read of the Memphis Clearing House association said today that the suspension of the Memphis Savings bank would not affect any other institution in the city. Mr. Read said he felt certain that all depositors in the Memphis Savings bank would be paid in full. A statement of the condition of the suspended bank was made public on December 11, and is as follows: Resources, loans and discounts, $1,031,056. Overdrafts secured, $28,697. Stocks and bonds. $829,370. Real estate, $17,218. Cash and sight exchange, $236,982. Liabilities, capital stock, $294,100. Surplus and undivided profits, $72,654; bills payable, $250,000; cashiers' checks, $5,537; deposits, $1,531,949. Later a statement was issued by the directors of the Memphis Savings bank announcing that the institution was solvent and that creditors would not lose a cent. The statement says that because of the financial stringency it was deemed wise to close the bank, ask for a receiver and liquidate its affairs.

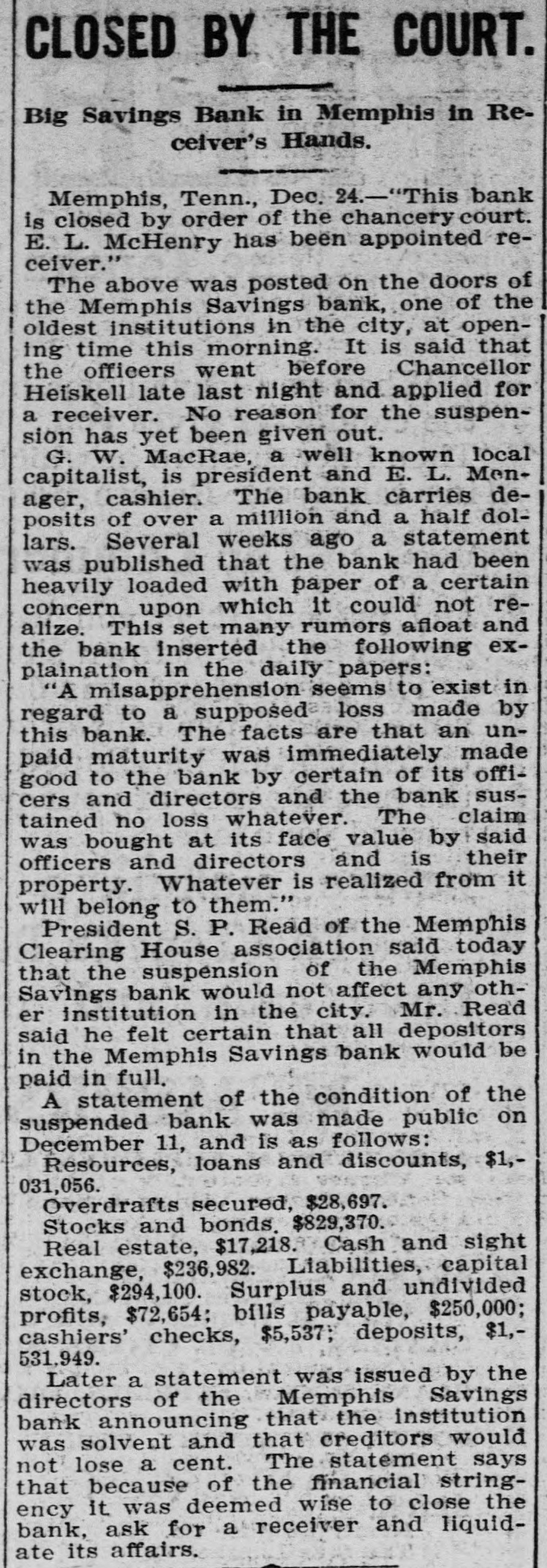

6.

December 24, 1907

Palestine Daily Herald

Palestine, TX

Click image to open full size in new tab

Article Text

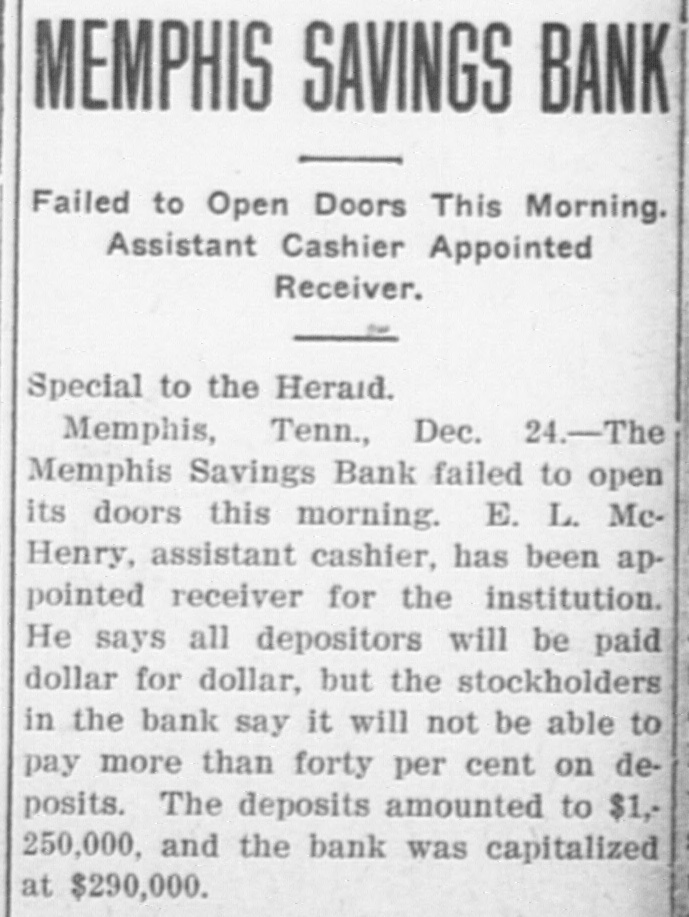

MEMPHIS SAVINGS BANK Failed to Open Doors This Morning. Assistant Cashier Appointed Receiver. Special to the Heraid. Memphis, Tenn., Dec. 24.-The Memphis Savings Bank failed to open its doors this morning. E. L. McHenry, assistant cashier, has been appointed receiver for the institution. He says all depositors will be paid dollar for dollar, but the stockholders in the bank say it will not be able to pay more than forty per cent on deposits. The deposits amounted to $1,250,000, and the bank was capitalized at $290,000.

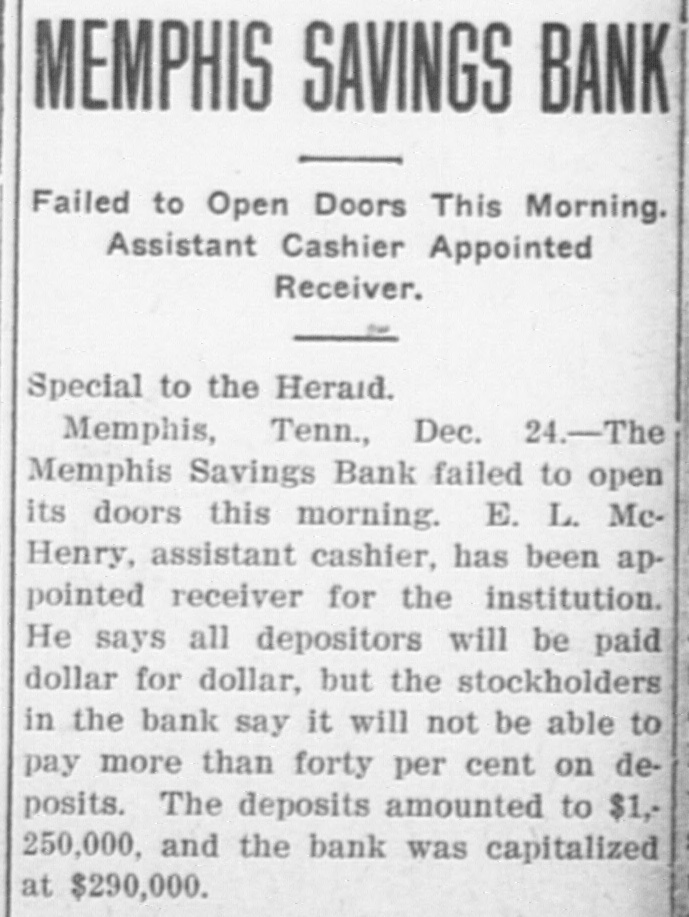

7.

December 24, 1907

The Seattle Star

Seattle, WA

Click image to open full size in new tab

Article Text

Bank Fails to Open. MEMPHIS, Tenn., Dec. 24.Memphis Savings bank, with a capital of $264,000 and deposits estimated at $1,250,000, failed to open its doors this morning. "E. T. McHenry. the assistant cashier, who was appointed receiver, said the depositors will be paid in full.

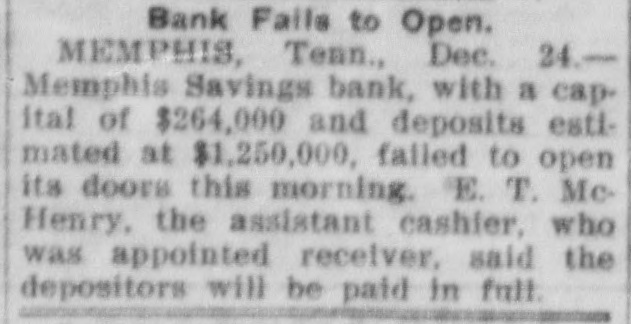

8.

December 25, 1907

Bryan Morning Eagle

Bryan, TX

Click image to open full size in new tab

Article Text

FAILS TO OPEN DOORS. Memphis Savings Bank Is Not Doing Business. RECEIVER IS IN CHARGE. One of the Oldest Financial Institutions In the Bluff City and Carrying Deposits of Over Million and a Half Dollars Shuts Down. Memphis, Dec. 24.-The Memphis Savings bank failed to open its doors Tuesday morning. A notice posted on the doors said the bank had been placed in the hands of a receiver and E. B. McHenry had been appointed as receiver. The Memphis Savings bank is one of the oldest institutions in the city. It is understood the officers went before Chancellor Heiskell Monday night and applied for a receiver. G. W. MacRae, a well known local capital1st, is president. and E. L. Meneager, cashier. The bank carried deposits of over $1,500,000. Several weeks ago a statement was published that the bank had been heavily loaded' with paper of certain concerns upon which it could not reallze. This set many rumors afloat and the bank inserted following explanation in the daily papers: "Misappre. hension seems to exist in regard to the supposed loss made by this bank. The facts are unpaid maturity was Immediately made good to the bank by citation of its officers and directors and the bank sustained no loss whatever. The claim was bought at Its face value by said officers and directors and is their property. Whatever Is realized from It helongs to them." President S. P. Read of the Memphis Clearing House association said the suspension of Memphis vings bank will not affect any other institution in this city. Mr. Read said be felt certain all depositors will be paid in full.

9.

December 25, 1907

The Montgomery Advertiser

Montgomery, AL

Click image to open full size in new tab

Article Text

MEMPHIS BANK NOW OLDEST SAVINGS INSTITUTION THERE CLOSES DOORS. Statement Issued in Which Claim is Made All Depositors WIII Be Paid in Full. Memphis. Tenn., Dec. 24.-"This bank is closed by order of the Chancery Court. E. L. McHenry has been appointed receiver." The above notice was posted on the doors of the Memphis Savings Bank, one of the oldest institutions in the city, at the usual time for opening this morning. It is understood that the officers went before Chancellor Heiskell last night and applied for a receiver. No reason for the suspension has been given out by the officers, but it is said a statement will be made public today. C. W. MacRae. a wellknown local capitalist. is President and E. L. Monoger, cashier. The bank carried deposits of over $1,500,000. Several weeks ago a statement was published that the bank had been heavily loaded with paper of a certain concern upon which It could not realize. This set many rumors afloat and the bank inserted the following explana-

10.

December 25, 1907

The Times Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

SAVINGS BANK SUSPENDS. Memphis Institution Closes, But Depositors Are Snfe. MEMPHIS, TENN., December 24."This bank is closed by order of the Chancery Court. C. E. McHenry has been appointed receiver." The above notice was posted on the doors of the Memphis Savings Bank, one of the oldest institutions in the city, at opening time to-day. G. W. MacRae, a well known local capitalist, is president, and E. L. Menager. cashier. The bank carries deposits of over a million and a half dollars. Several weeks ago a statement was published that the bank had been heavily loaded with paper of a certain concern. upon which it could not realize. This set many rumors afloat, and the bank inserted the following explanation in the daily papers: "A misapprehension seems to exist in regard to a supposed loss made by this bank. The facts are that an unpaid maturity was immediately made good to the bank by certain of its officers and directors, and the bank sustained no loss whatever. The claim was bought at Its face value by said officers and directors, and is their property. Whatever is realized from it will belong to them." President Read, of the Memphis Clearing-House Association said today that the suspension of the Memphis Savings Bank would not affect any other institution in the city. Mr. Read said he felt certain that the depositors in the Memphis Savings Bank would be paid in full. Later. a statement was issued by the directors of the bank, announcing that the institution was solvent. and that creditors would not lose a cent. It was said that because of the financial stringency It was deemed wise to close the bank, ask for a receiver and liquidate its affairs.

11.

December 25, 1907

The Sun

New York, NY

Click image to open full size in new tab

Article Text

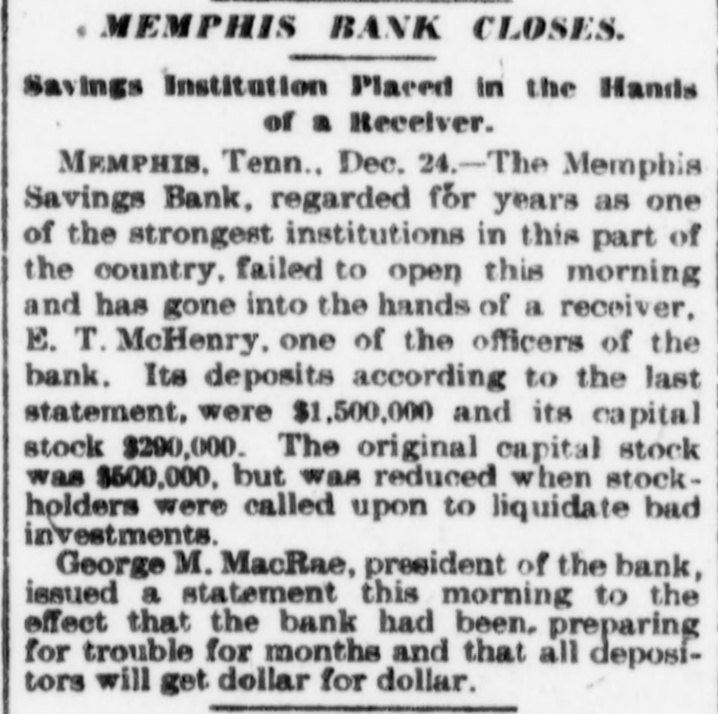

MEMPHIS BANK CLOSES. Savings Institution Placed in the Hands of a Receiver. MEMPHIS, Tenn., Dec. 24.-The Memphis Savings Bank, regarded for years as one of the strongest institutions in this part of the country. failed to open this morning and has gone into the hands of a receiver, E. T. McHenry. one of the officers of the bank. Its deposits according to the last statement, were $1,500,000 and its capital stock $290,000. The original capital stock was $500,000, but was reduced when stockholders were called upon to liquidate bad investments. George M. MacRae, president of the bank, issued a statement this morning to the effect that the bank had been, preparing for trouble for months and that all depositors will get dollar for dollar.

12.

December 26, 1907

The Caucasian

Shreveport, LA

Click image to open full size in new tab

Article Text

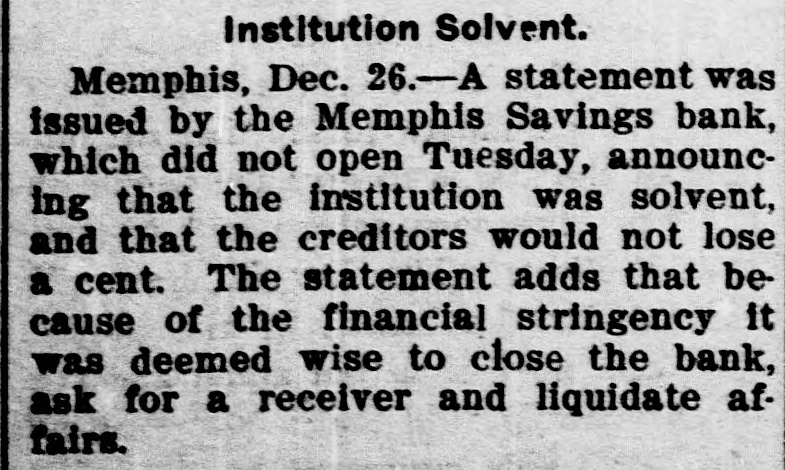

Institution Solvent. Memphis, Dec. 26.-A statement was issued by the Memphis Savings bank, which did not open Tuesday, announcing that the institution was solvent, and that the creditors would not lose a cent. The statement adds that because of the financial stringency it was deemed wise to close the bank, ask for a receiver and liquidate affairs.

13.

December 26, 1907

Gainesville Daily Sun

Gainesville, FL

Click image to open full size in new tab

Article Text

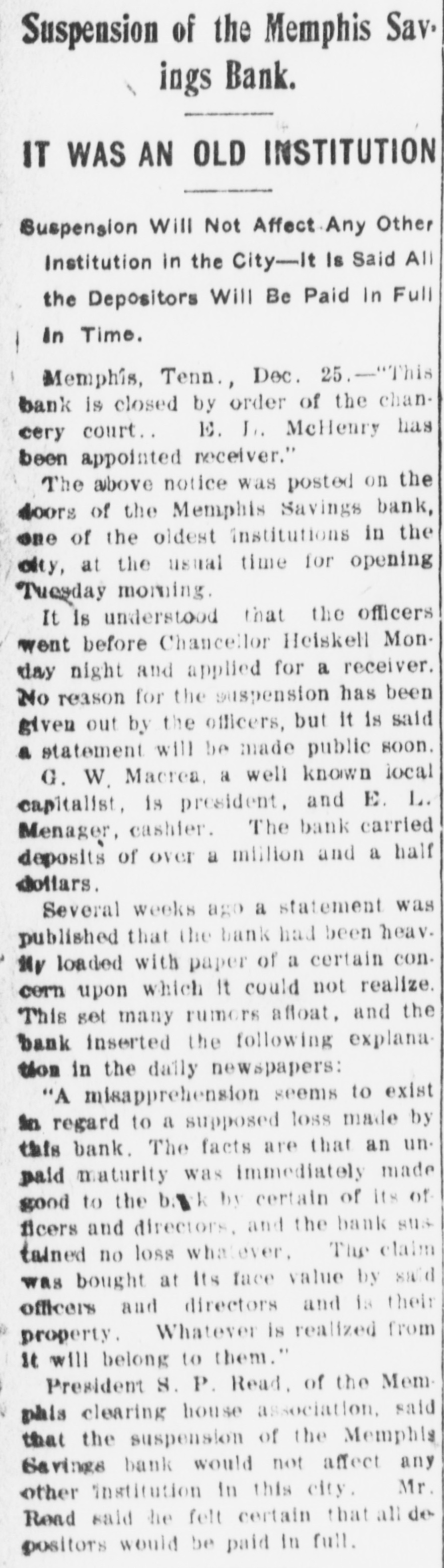

Suspension of the Memphis Sav. ings Bank. IT WAS AN OLD INSTITUTION Buspension Will Not Affect Any Other Institution in the City-It Is Said All the Depositors Will Be Paid In Full In Time. Memphis, Tenn., Dec. 25.-"This bank is closed by order of the chancery court. E. J. McHenry has been appointed receiver." The above notice was posted on the loors of the Memphis Savings bank, one of the oldest Institutions in the city, at the usual time for opening Tuesday morning. It is understood that the officers went before Chancellor Heiskell Monday night and applied for a receiver. No reason for the suspension has been Iven out by the officers, but it is said statement will be made public soon. G. W. Macrea, a well known local capitalist, is president, and E. L. Menager, cashier. The bank carried deposits of over a million and a half ollars. Several weeks ago a statement was published that the bank had been heav. nv loaded with paper of a certain concern upon which It could not realize. This set many rumors afloat, and the bank inserted the following explanation in the daily newspapers: "A misapprehension seems to exist In regard to a supposed loss made by this bank. The facts are that an unpaid maturity was immediately made good to the b. k by certain of its of ficers and directors. and the bank sustained no loss whatever, The claim was bought at Its face value by said officers and directors and is their property. Whatever is realized from it will belong to them." President S. P. Read. of the Memphis clearing house association, said that the suspension of the Memphis Savings bank would not affect any other institution in this city. Mr. Road said he felt certain that all de positors would be paid in full.

14.

December 27, 1907

The Bemidji Daily Pioneer

Bemidji, MN

Click image to open full size in new tab

Article Text

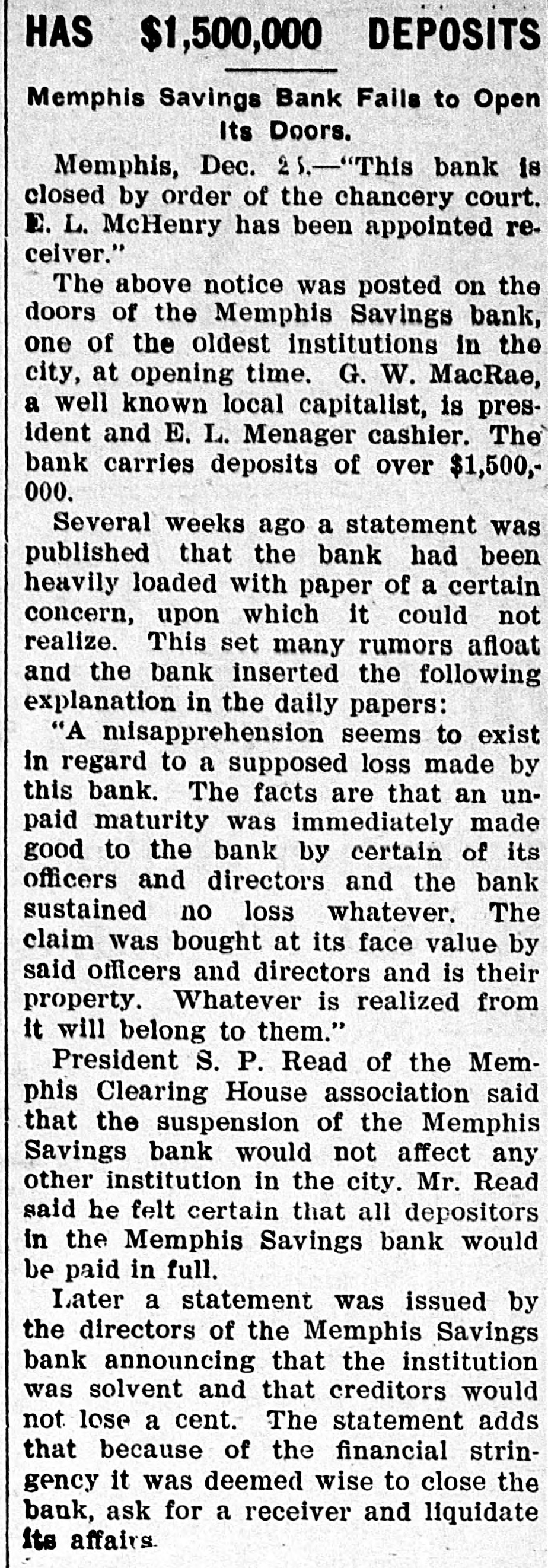

HAS $1,500,000 DEPOSITS Memphis Savings Bank Fails to Open Its Doors. Memphis, Dec. 25.-"This bank is closed by order of the chancery court. E. L. McHenry has been appointed receiver." The above notice was posted on the doors of the Memphis Savings bank, one of the oldest institutions in the city, at opening time. G. W. MacRae, a well known local capitalist, is president and E. L. Menager cashier. The bank carries deposits of over $1,500,000. Several weeks ago a statement was published that the bank had been heavily loaded with paper of a certain concern, upon which it could not realize. This set many rumors afloat and the bank inserted the following explanation in the daily papers: "A misapprehension seems to exist in regard to a supposed loss made by this bank. The facts are that an unpaid maturity was immediately made good to the bank by certain of its officers and directors and the bank sustained no loss whatever. The claim was bought at its face value by said officers and directors and is their property. Whatever is realized from it will belong to them." President S. P. Read of the Memphis Clearing House association said that the suspension of the Memphis Savings bank would not affect any other institution in the city. Mr. Read said he felt certain that all depositors in the Memphis Savings bank would be paid in full. Later a statement was issued by the directors of the Memphis Savings bank announcing that the institution was solvent and that creditors would not lose a cent. The statement adds that because of the financial stringency it was deemed wise to close the bank, ask for a receiver and liquidate its affairs.

15.

December 27, 1907

The Columbia Herald

Columbia, TN

Click image to open full size in new tab

Article Text

MEMPHIS BANK CLOSES ITS DOOR ONE OF THE OLDEST FINANCIAL INSTITUTIONS IN HANDS OF RECEIVER. MEMPHIS, Tenn., Dec. 25.-"This bank is clsed by order of the Chancery Court. E. L. McHnery has been appointed receiver." The above notice was posted on the doors of the Memphis Savings Bank, one of the oldest institutions in the city, at the usual time for opening this morning. It is understood that the officers went before Chancellor Heiskell last night and applied for a receiver. G. W. Macrae, a well-known local capitalist, is President, and E. L Menager Cashier. The bank carried deposits of over a million and a half dollars. Several weeks ago a statement was published that the bank had been heavily loaded with paper of a certain concern upon which it could not realize. This set many rumors afloat, and the bank inserted the following explanation in the daily papers: "A misapprehension seems to exist in regard to a supposed loss made by this bank. The facts are that an unpaid maturity was immediately made good to the bank by certain 01 its officers and directors. The claim was bought at its face value by said a officers and Directors and is their property. Whatever is realized from it will belong to them." President S. P. Read of the Memphis Clearing House Association, said today that the suspension of the Memphis Savings Bank would not affect any other institution in this city. Mr. Read said he felt certain that all of the depositors would be paid in full.

16.

December 29, 1907

The Birmingham Age-Herald

Birmingham, AL

Click image to open full size in new tab

Article Text

FRAUD ALLEGED IN BANK FAILURE Creditor of Memphis Savings Bank Files Suit WANTS AFFAIRS EXAMINED Blair Pierson Alleges That Bank Is Insolvent and That Loans Have Been Made On Insolvent Securities. Memphis, Tenn., December 28.-(Special.)--Alleging fraud, with the full knowl edge and consent of all officials and directors of the Memphis Savings bank, Blair Pierson, representing himself as a creditor, and declaring he represents other creditors, filed a suit in chancery court Saturday afternoon, asking the removal of E. B. McHenry as receiver. He also asked that the injunction granted by Chancellor Heiskell, against creditors of the bank bringing suit for judgment, be dissolved, and that the court order the costs prorated among the creditors to provide for a thorough probe of all affairs of the Memphis Savings bank since it was reorganized in 1905, and the capital stock increased from $50,000 to $300,000. Mr. Pierson alleges that the bank is insolvent, that loans have been made on insolvent securities and that the directors of the bank knew of this alleged insolvency many days prior to the actual application for a receiver. Mr. Pierson states that fraud was practiced in the recapitalization of the Memphis Savings bank, inasmuch as the holders of the $50,000 of stock, the issue of the old bank, were granted $300,000 stock in the reorganized institution, though it is declared the directors knew that this value was fictitious and that the stock was not actually worth this amount. He charges that despite this dividends have been declared continually on this fictitious stock. Mr. Pierson makes the allegation that the officers and directors have diverted funds to other objects than those named in the corporation declaring "these officials have been guilty of such fraud and willful mismanagement as to occasion loss to stockholders, whereby such officers and directors are personally liable for the amount of loss to creditors." He charges that between the assets given in the statement of December 11 and the one given December 24 there is a difference of/$287.554.89. and that the difference in liabilities amounts to only $158,415.82, leaving assets unaccounted for of $129,131.01. He charges there was a decrease of $59,999.65 in bills payable and gives other figures which bring the total alleged discrepancy to $378,083.65, made between December 11 and December 24.

17.

December 29, 1907

The Washington Herald

Washington, DC

Click image to open full size in new tab

Article Text

CHARGES BANK FRAUDS. Alleged Creditor Demands Removal of Memphis Receiver. Memphis, Tenn., Dec. 28.-Blair Pierson, representing himself as a creditor, and declaring he represents other creditors, filed suit in chancery court this afternoon asking the removal of E. B. McHenry as receiver of the Memphis Savings Bank. He charges fraud, committed with the full knowledge and consent of all the directors and officials. He also asked that the court order the cost pro rated among the creditors to provide for a thorough probe of all affairs of the bank, since it was reorganized in 1895, and the capital stock increased from $50,000 to $300,000. Pierson charges that daily meetings of the bank's directors were held for sixty days at least prior to the closing, and that the recapitalization was a fraud He asks that the officers and directors be declared personally liable.

18.

January 14, 1908

Pine Bluff Daily Graphic

Pine Bluff, AR

Click image to open full size in new tab

Article Text

MacRae, president of the suspended Memphis Savings Bank, has sold the property at 121 Union avenue, occupied by the Whittemore Buggy Company to Dr. J. F. Simmons of Pine Bruff, Ark., for $48,000. The lot is 26 1-2 by 200 feet, and the building is a four-story brick, on which the buggy company retains a lease. Last year Dr. Simmons purchased property in this city on Main, near Gayoso, for $100,000. A few months ago Doctor Simmons purchased a corner on Main street here, paying $96,000 cash for it.