Article Text

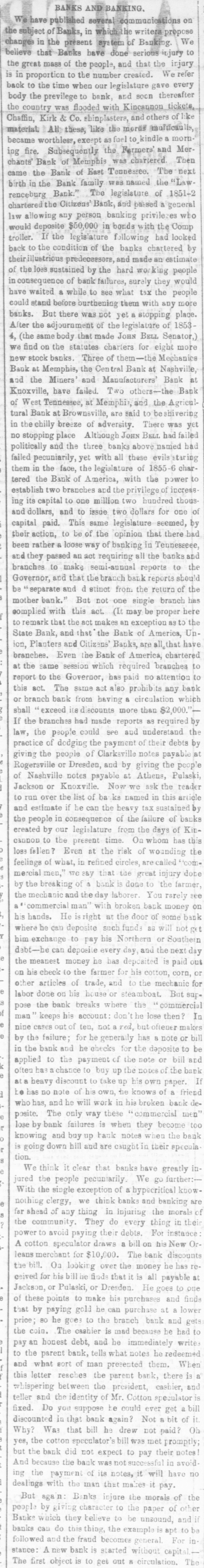

# BANKS AND BANKING. We have published several communications on the subject of Banks, in which the writers propose changes in the present system of Banking. We believe that Barks have done serious injury to the great mass of the people, and that the injury is in proportion to the number created. We refer back to the time when our legislature gave every body the previlege to bank, and soon thereafter the country was flooded with Kincannon tickets, Chaffin, Kirk & Co. shinplasters, and others of like material. All these, like the moras multicaulis, became worthless, except as fuel to kindle a morning fire. Subsequently the Fermers' and Merchants Bank of Memphis was chartered. Then came the Bank of East Tennessee. The next birth in the Bank family was named the "Lawrenceburg Bank." The legislature of 1851-2 chartered the Citizens' Bank, and passed a general law allowing any person banking privilezes who would deposite $50,000 in bonds with the Comptroller. If the legislature following had looked back to the condition of the banks chartered by their illustrious predecessors, and made an estimate of the loss sustained by the hard working people in consequence of bank failures, surely they would have waited a while to see what tax the people could stand before burthening them with any more banks. But there was not yet a stopping place. After the adjournment of the legislature of 1853-4, (the same body that made JOHN BELL Senator,) we find on the statutes charters for eight more new stock banks. Three of them the Mechanics Bauk at Memphis, the Central Bank at Nashville, and the Miners' and Manufacturers' Bank at Knoxville, have failed. Two others the Bank of West Tennessee, at Memphis, and the Agricultural Bank at Brownsville, are said to be shivering in the chilly breeze of adversity. There was yet no stopping place Although JOHN BELL had failed politically and the three banks above named had failed pecuniarily, yet with all these evils staring them in the face, the legislature of 1855-6 chartered the Bank of America, with the power to establish two branches and the privilege of incressing its capital to one million two hundred thousand dollars, and to issue two dollars for one of capital paid. This same legislature seemed, by their action, to be of the opinion that there had been rather a loose way of banking in Tennesseee, and they passed an act requiring all the banks and branches to make semi-annual reports to the Governor, and that the branch bark reports should be "separate and d stinct from the return of the mother bank." But not one single branch has complied with this act. (It may be proper here to remark that the act makes an exception as to the State Bank, and that the Bank of America, Union, Planters and Citizens' Banks, are all that have branches. Even the Bank of America, chartered at the same session which required branches to report to the Governor, has paid no attention to this act. The same act also prohibits any bank or branch bank from having a circulation which shall "exceed its discounts more than $2,000." If the branches had made reports as required by law, the people could see and understand the practice of dodging the payment of their debts by giving the people of Clarksville notes payable at Rogersville or Dresden, and by giving the people of Nashville notes payable at Athens, Pulaski, Jackson or Knoxville. Now we ask the reader to run over the list of baks named in this article and estimate if he can the heavy tax sustained by the people in consequence of the failure of banks ereated by our legislature from the days of Kincannon to the present time. On whom has this loss fallen? Even at the risk of wounding the feelings of what, in refined circles, are called "commercial men," we say that the great injury dote by the breaking of a bank is done to the farmer, the mechanic and the day laborer. You rarely see a "commercial man" with broken bank money on his hands. He is right at the door of some bank where he can deposite such funds as will not get him exchange to pay his Northern or Southern debt he can deposite every day, and the next day the meanest money he has deposited is paid out on his check to the farmer for his cotton, corn, or other articles of trade, and to the mechanic for labor done on his house or steamboat. But suppose the bank breaks where the "commercial man" keeps his account: don't he lose then? In nine cases out of ten, not a red, but oftener makes by the failure; for he generally has a note or bill in the bank and he checks for the deposite to be applied to the payment of the note or bill ard often has a chance to buy up the notes of the bank at a heavy discount to take up his own paper. If he has no note of his own, he knows of a friend who has, and he will work in his broken bank deposite. The only way these "commercial men" lose by bank failures is when they become too knowing and buy up tank notes when the bank is going down hill and are caught in their speculation. We think it clear that banks have greatly injured the people pecuniarily. We go further:- With the single exception of a hypocritical know-nothing clergy, we think banks and banking are far shead of any thing in injuring the morals of the community. They do every thing in their power to avoid paying their debts. For instance: A cotton speculator draws a bill on his New Orleans merchant for $10,000. The bank discounts the bill. On looking over the money he has received for his bill he finds that it is all payable at Jackson, or Pulaski, or Dresden. He goes to one of these points to make his purchases and finds that by paying gold he can purchase at a lower price; so he goes to the branch bank and gets the coin. The cashier is mad because he had to pay an honest debt, and he immediately writes to the parent bank, tells what notes he redeemed fand what sort of man presented them. When this letter reaches the parent bank, there is a whispering between the president, cashier, and teller and the identity of Mr. Cotton speculator is fixed. Do you suppose he could ever get a bill discounted in that bank again? Not a bit of it. Why? Was that bill he drew not paid? Oh yes, the cotton speculator's bill was met promptly; but the bank did not expect to pay their notes! And because the bank was not successful in avoiding the payment of its notes, it will have no dealings with the man that makes it pay. But again: Banks injure the morals of the people by giving character to the paper of other Banke which they believe to be unsound, and if banks can do this thing, the example is apt to be followed and the fraud becomes general. For instance: A new bank is started without capital- The first object is to get out a circulation. The