Article Text

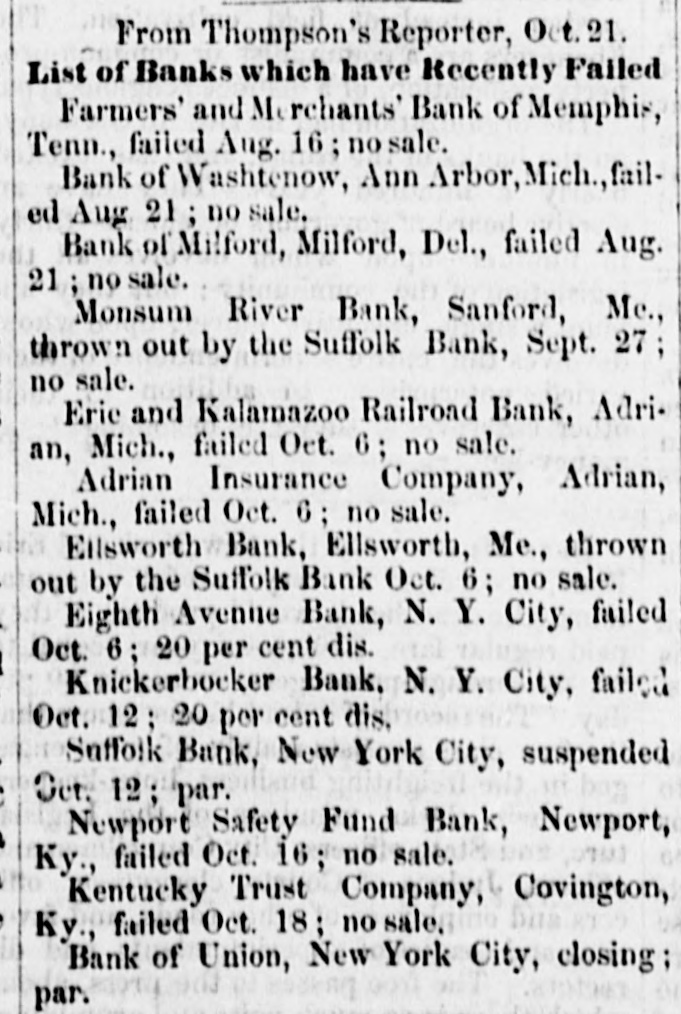

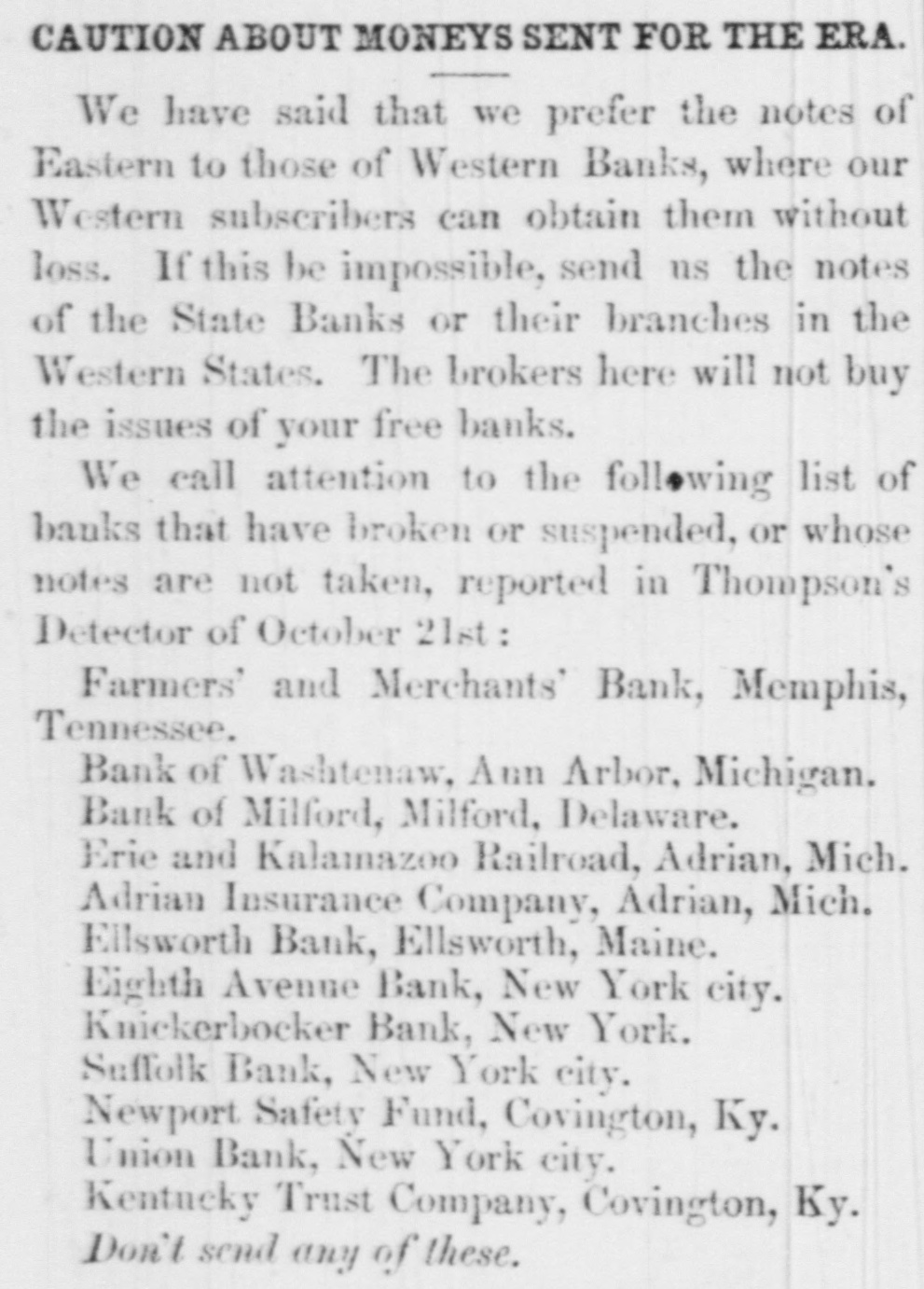

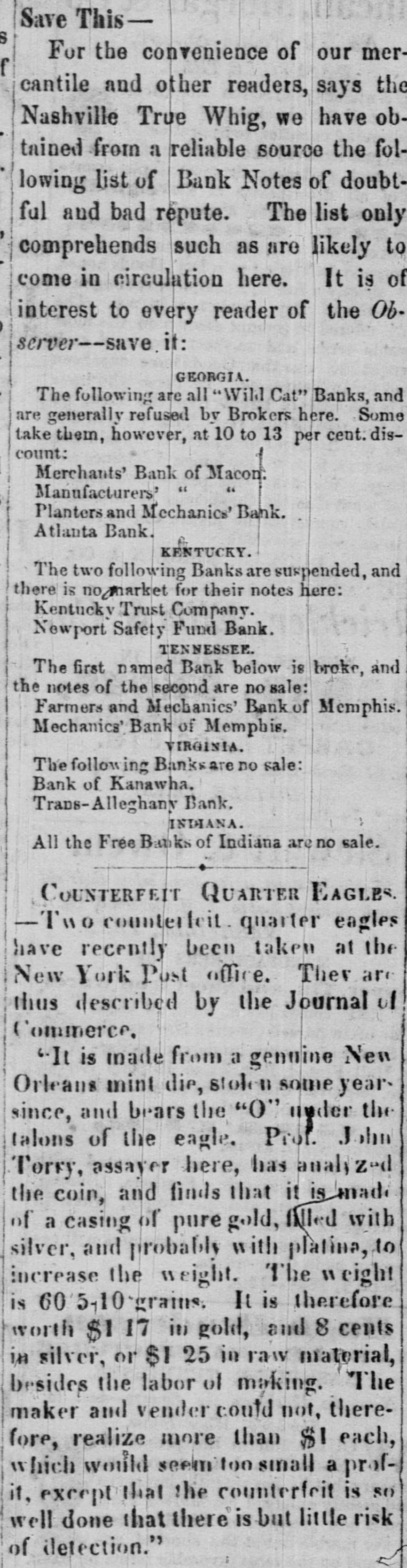

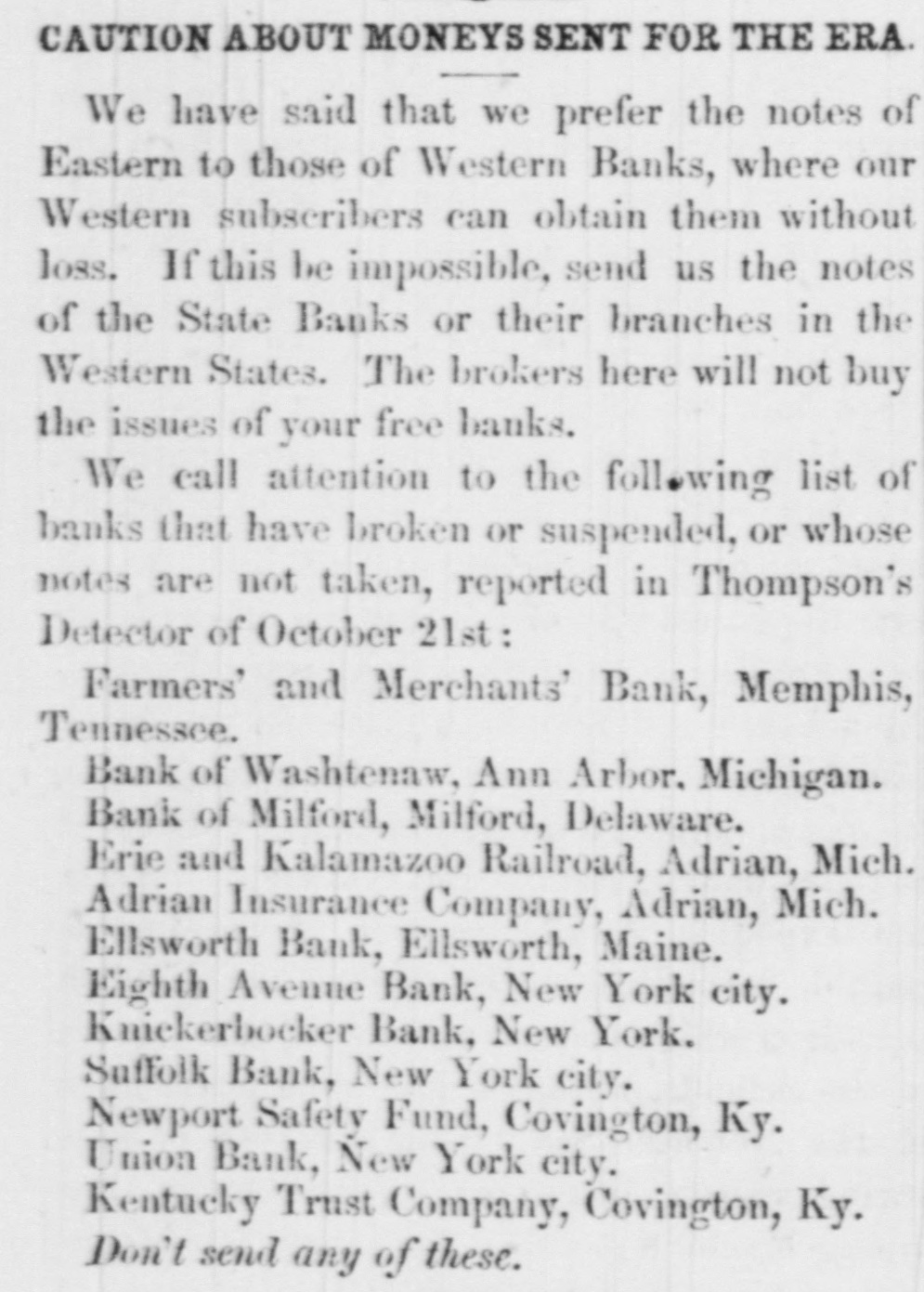

sufficient to complete the entire track between Wheeling and Cincinnati. The earnings of the Ontario Simcoe and Huron Railroad for June, 1854, were $14,553, against $5,791 in June, 1853. In 1853, 42 miles were in operation; in 1854, 63. The Western Railroad Record states that the work on the Maysville and Big Sandy Railroad has been suspended, not from any want of means for its completion, but rather to await some definite action for the completion of the Maysville and Lexington Road, without which the Big Sandy Road would be of comparatively little use. The Boston Journal of yesterday says: "The Vermont Central Railroad Company Directors have not yet held a meeting, although two appointments have already been made, and there is considerable excitement among shareholders in consequence of the apparent neglect. There are but four Directors remaining of the Board: two of these reside in Vermont and two in Boston. The whole number is required to constitute & quoram, and the difficulty seems to be in getting this number together. Another meeting, we understand, has been appointed for this evening, and if this is not attended there will be a "moving of the waters" among the shareholders, who will no longer censent to such needless precrastination. The plan will be to call a special meeting of the shareholders, in accordance with the by-laws." The Alton Telegraph of July 27, says: "We are reliably informed that orders have been received from Col. Brough, for & total suspension of all work upon the Brough road. Not only have the laborers been discharged, but even the engineers who were running the lines. The cause of the suspension, we understand, is the tightness of the money market, and the utter impossibility of raising means for its presecution." The Legislature of New-Hampshire has passed the following law relative to over-issues of stocks: "Any president, cashier, treasurer or secretary, or any other officer or stockholder of any bank, railroad, manufacturing or other corporation in this State, who shall knowingly, falsely and willfully sign, issue, or cause to be issued, any shares, in the capital stock of their respective corperations, other than those authorized in their charter, or by some amendment thereto, shall be deemed and adjudged guilty of felony; and when duly convicted thereof, shall be punished by a fine not exceeding $1,000 and imprisoned in the State prison for not less than one nor more than seven years, at the discretion of the Court." It was reported at Louisville, on Monday, that the Commercial Bank of Tennessee, at Memphis, had stopped payment. Some of the Louisville brokers, en the strength of the rumor, refused the notes of the Commercial Bank of Memphis, the Tazewell Bank, the Citizens' Bank of Memphis, and the Farmers' and Merchants' Bank of Memphis. At Boston Money is abundant enough at from 10 to 12 per cent. outside of the Banks, on such paper and securities as will undergo close scrutiny, but very hard to obtain on any thing which does not come up to the required standard. There is less alarm and distrust in Money circles, but the return of confidence is necessarily slow, and it is not yet sufficiently diffused to remove the unnatural stringency of the market. A correspondent of The Boston Atlas gives the following as the two greatest years of commerce of the United States since the year 1789: Fenertato Imports from