1.

November 12, 1930

The Tennessean

Nashville, TN

Click image to open full size in new tab

Article Text

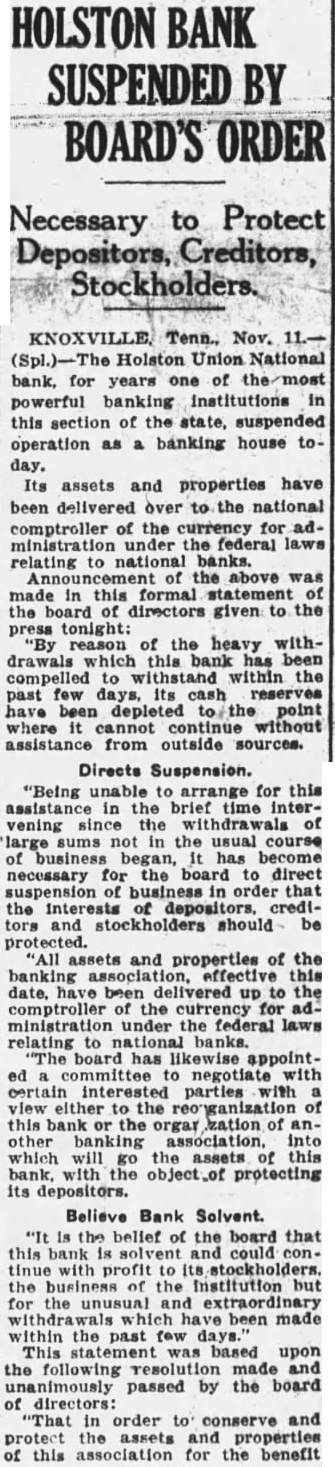

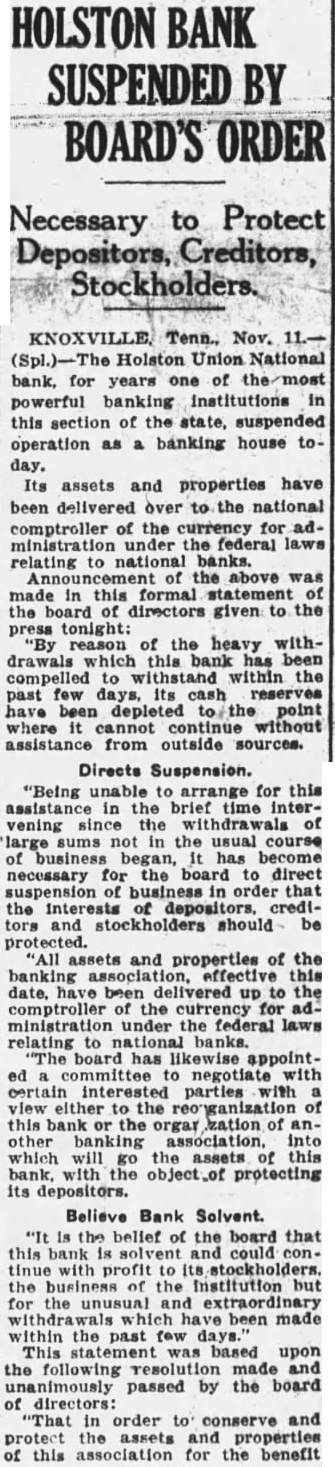

HOLSTON BANK BY BOARD'S ORDER

Necessary to Protect Depositors, Creditors, Stockholders.

KNOXVILLE Tenn., Nov. Holston Union National for years of powerful banking institutions in this section of the state, suspended operation as banking house today. Its assets and properties have been over to the national comptroller of the currency for administration under the federal laws relating to national banks. of the above was made in this formal statement the board directors given to the press tonight: reason of the heavy withdrawals has been compelled to withstand within the past few days, its cash reserves have depleted point where cannot without assistance from outside sources.

Directs Suspension. "Being unable arrange for this assistance the brief time intervening since the of large sums not the usual course business began, has become necessary for the board direct suspension in order that the credistockholders should be protected. "All and properties of the banking this date. have been delivered up to the comptroller the currency for ministration under the federal laws relating to national banks. board has likewise appointed committee with parties with either this the zation other association, which will the assets this bank, with object protecting its depositors.

Believe Bank Solvent. "It the belief of the board that this bank could tinue with profit its stockholders. the business the but for the unusual and extraordinary have been made within the past few This based upon the following and passed by the board of directors: "That in order conserve and protect assets and properties this for the benefit

2.

November 12, 1930

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

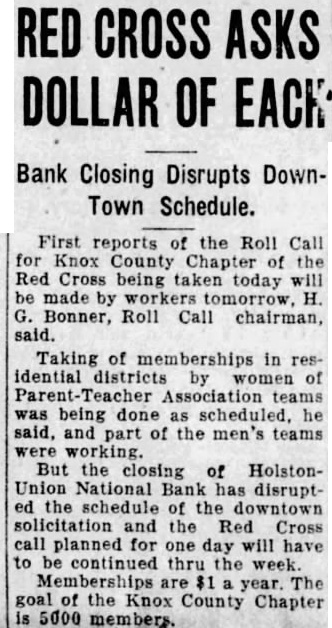

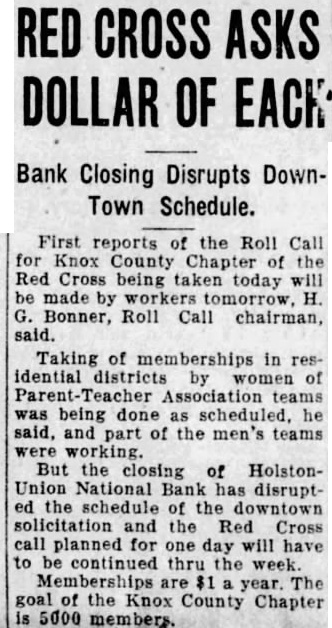

DOLLAR OF

Bank Closing Disrupts DownTown Schedule.

First reports the Roll Call for Knox County Chapter of Red Cross being taken today will made Bonner, Roll Call chairman, said. Taking of memberships in residential districts women of Association teams being done scheduled, he said, and part of the men's teams working. But the closing of HolstonUnion National Bank has disruptthe schedule of the downtown solicitation the Red Cross call planned for one day will have continued thru the week. Memberships year. The goal the Knox County Chapter 5000 members.

3.

November 12, 1930

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

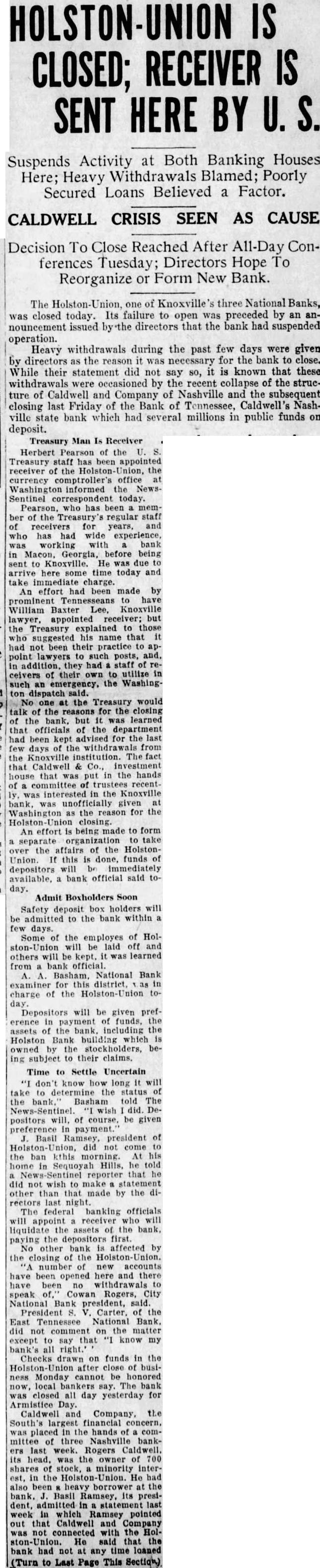

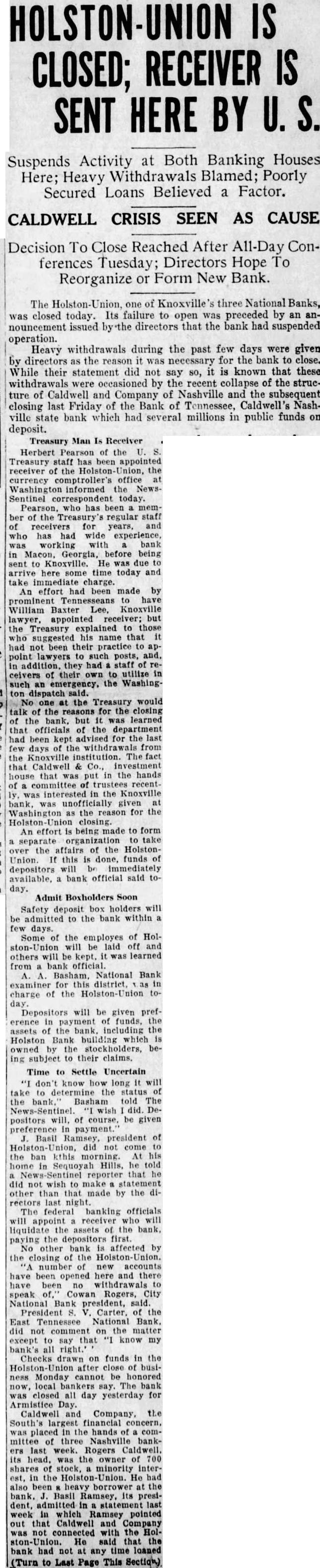

HOLSTON-UNION IS CLOSED; RECEIVER IS SENT HERE BY

Suspends Activity at Both Banking Houses Here; Heavy Withdrawals Blamed; Poorly Secured Loans Believed a Factor.

CALDWELL CRISIS SEEN AS CAUSE

Decision To Close Reached After Conferences Tuesday; Directors Hope To Reorganize or Form New Bank.

The one of Knoxville's three National Banks, closed today. Its failure to open was preceded by an nouncement issued directors that the bank had suspended operation. Heavy withdrawals during the past few days were given by directors as the reason it was necessary for the bank to close. While their statement did not say so, it is known that these were occasioned by the recent collapse of the strueture of Caldwell and Company of Nashville and the subsequent closing last Friday of the Bank of Tennessee, Caldwell's Nashville state bank which had several millions in public funds on deposit.

Treasury Man Is Receiver Herbert Pearson of the Treasury staff has been appointed receiver the the currency comptroller's office informed the NewsSentinel correspondent today. Pearson, who has been member of the Treasury's regular staff receivers years, and who has had wide experience, working with bank Macon, Georgia, before being sent to Knoxville. He was due here time today and immediate charge. effort had been made by prominent Tennesseans have William Baxter Lee, Knoxville lawyer, appointed receiver; but the Treasury explained to those suggested his name that had not been their practice to point lawyers to such posts, and, addition, they had staff ceivers their own utilize such emergency, the dispatch the Treasury would talk of the reasons for the closing bank, but it learned that officials of the department had been kept the last days the withdrawals from the Knoxville institution. fact that Caldwell investment house that was put in the hands of committee trustees recentwas interested in the Knoxville bank, unofficially given Washington reason for the closing. An effort being made to form separate organization take the affairs of the HolstonUnion. this funds of depositors will immediately available, bank official said day.

Admit Boxholders Soon Safety deposit box holders will be admitted to the bank within few days. Some of employes of Holthe will be laid off and others will be kept. learned from bank official. National Bank examiner for charge the day. Depositors will be given preference in funds, assets of the including the Holston Bank building owned by the subject to their claims.

Time to Settle Uncertain don't know how long will determine the status bank. Basham told Depositors will, course, be given preference payment. Basil Ramsey, president not come kthis morning. At his the ban home Hills, told reporter that he did wish make statement other than that made by the rectors night. The federal banking officials will appoint receiver who will liquidate assets the the depositors first. other bank affected by the closing the number new accounts have been opened here and there have been speak Cowan Rogers, City National Bank president, said. President Carter, the East Tennessee National Bank. not comment the matter except to say that know my right.' Checks drawn on funds in the after close of busiMonday cannot be honored local bankers The bank closed all day yesterday for Armistice Day. Caldwell and the South's largest financial concern, placed the hands mittee three Nashville banklast week. Rogers was the owner of 700 shares stock, minority the He had also been heavy borrower the bank, Basil Ramsey, its presiadmitted statement last week which Ramsey pointed that Caldwell and Company not connected the He said that the bank had not time loaned any to Last This

4.

November 13, 1930

The Tampa Tribune

Tampa, FL

Click image to open full size in new tab

Article Text

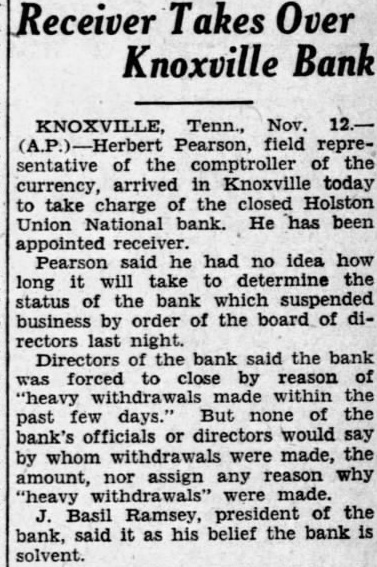

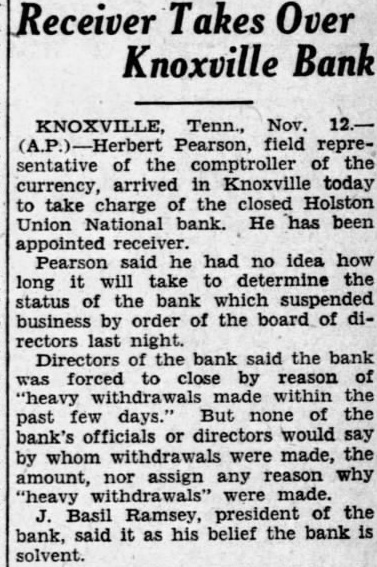

Receiver Takes Over Knoxville Bank

KNOXVILLE, Tenn., Nov. 12.-Herbert Pearson, field representative of the comptroller of the currency, in Knoxville today to take charge of the closed Holston Union National bank. He has been appointed Pearson said he had no idea how long it will take determine status of the bank which suspended business by order of the board of directors last night. Directors the bank said the bank was forced by reason of "heavy withdrawals made within the past few days." But none of the bank's officials or directors would say by whom withdrawals made, the amount, assign any reason why "heavy withdrawals" were made. J. Basil Ramsey, president of the bank, said it as his belief the bank is solvent.

5.

November 13, 1930

The Montgomery Advertiser

Montgomery, AL

Click image to open full size in new tab

Article Text

FEDERAL OFFICER TAKES OVER BANK Institution's Condition Is Still Unknown; Withdrawals Blamed

KNOXVILLE, TENN., Nov. Herbert Pearson, field of the comptroller of the currency, arrived in this to take charge the Holston Union National Bank. He has been appointed receiver. Mr. Pearson said he had no idea how long will take to determine the status the bank which business by order the board of directors Tuesday The receiver came from Macon, Ga., his headquarters. Directors of the bank said the bank was forced to close by reason "heavy withdrawals made within the past few days," but none of the banks officials or directors would say by whom withdrawals were made, the amount, assign any reason why "heavy withdrawals" Basil Ramsey president of the bank, said approximately $750,000 withdrawn from the Union on Monday. He added that was his belief the bank solvent, could have tinued if withdrawals had not depleted reserves." Edward McMilan, chairman on rethe Union, said today he had nothing to, announce regarding The Clearing House Association in statement this afternoon said that its members had availed themselves of the 30-day notice required for withdrawal of time deposits and savings The institution said in statement that "it feels there occasion for on the part of the depositing public. Constant and withdrawals from all of the Knoxville banks, if continued, would in all probability be very damaging all the banks of the city and to all depositors.

6.

November 13, 1930

Bristol Herald Courier

Bristol, TN

Click image to open full size in new tab

Article Text

STATE FUNDS TENN. SUSPENDED

Holston Union-National, Largest Knoxville Bank, Closes Doors

$195,000 CARTER CO. FUNDS INVOLVED

Suspension of Knoxville Bank Follows Steady Withdrawal of Deposits, Depletion of Cash Fund

Nov. the National Bank Knoxville to open its doors this morning left the state Tennessee and night with approximately $5,813,777, and more, in two banks that have suspended operations Suspension of business by National was caused heavy during past few days, the the failure Friday the Bank of Tennessee Nashville of the Caldwell hands of committee three bankers. Rogers Caldwell, head of Caldwell and Company, minority stockholder in Holston Union National of Knoxville. An inventory filed today by Robertson, state bank superintendent, that approximately 400,000 state county deposit the closed Bank Tennessee Naghville, State Baker today that highway funds deposit State John Nolan $197,000 of the general fund and $168,000 the University of sinking fund deposit at the bank.

S. MAN AT KNOXVILLE Tenn., Nov. Pearson, field sentative of the comptroller currency, arrived today to charge the closed National receiver. Mr. he had no how long will take determine the status the bank which pended business by order board Tuesday night. The came here Macon, Ga, his headquarters. of the bank said forced to by reason withdrawals made within the past days.' Basil Ramsey, president of the bank said amounted to nearly $750,000. added that it was his belief the bank solvent. Edward McMillan chairman organization the said today he had nothing to nounce regarding his committee's work.

KNOXVILLE BANK CLOSES

Tenn., Nov. doors of the ion National Bank, which for years one the largest financial stitutions East Tennessee, closed today. Directors of the bank in last night announced that "necessary for board direct business order that interests deposistockholders should protected." The statement expressed the board's belief that the bank vent, would continued business, for the unusual and extraordinary withdrawals which been made within the past bank's published cial statement October second liabilities and assets $16,300.359.69 Under liabilities mand deposits given and time deposits at Capital was given at

(See Page Two Column

7.

November 13, 1930

The Commercial Appeal

Memphis, TN

Click image to open full size in new tab

Article Text

dent of that institution since the He is president of the Fourth and First Banks, Inc. KNOXVILLE BANK CLOSED Comptroller Takes Over Holston Union After Heavy Withdrawals. representative of the comptroller of ville this to take charge of the closed Holston Union National Bank. He has been appoint. ed Mr. Pearson said he had no idea how long take to the status of the which suspended business by order the board of directors Tuesday night. The receiver came from Macon. Ga. rectors of the bank said the was forced to close reason of with the past few days" but none of the bank's officials or directors would say by whom withdrawals were made the amount, nor as. sign any reason "heavy withBasil Ramsey president of the bank. said $750 000 were withdrawn from the Holston Union on Monday. He added that was his belief the bank have continued if withdrawals had not depleted its Edward McMillan chairman on reorganization of the Holston Union. said today had nothing to mittee's Closing of the Holston Union had its effects on other banks of the city today Crowds gathered in each of numerous withdrawals were made.

No Occasion for Alarm. The Knoxville Clearing House Association in statement early this afternoon announced that its members had availed themselves of the 30-day notice required for withdrawal time deposits and savings The association said in a statement that "feels there is no 00casion for alarm on the part of the depositing public. Constant and heavy from all the Knoxville banks would in all probability be very damaging to all of the banks of the city and to all depositors In the bank's last published on October liabilities and assets were $16,300,359.59 each. Under liabilities, demand deposits were given as $6,121,869 and time deposits at $5,795. $5. Capital was given as $750,000: surplus $750,000. and undivided profits $141,847.97 Among liabilities were bills payable and rediscounts "The board," the statement said. "has likewise appointed a committee to negotiate with certain interested parties with view either to the reorganization of this bank or organization of another banking association. into which will RO the assets of this bank, with the object of protecting its depositors. The Holston Trust Company, dealing in owned by the Holston Union National Bank also is closed. J. B. Ramsey. formerly of Kentucky. is president of the oank Directors in their statement said cash reserves were depreted to the point where the bank could not continue without "assistance from outside sources."

8.

November 13, 1930

The World-News

Roanoke, VA

Click image to open full size in new tab

Article Text

Receiver Takes Over Bank At Knoxville

Herbert Pearson, field representative of the comptroller of the currency, arrived yesterday to take charge of the closed Holston Union National Bank as receiver Mr. Pearson said he had no Idea how long will take to determine the status of the bank which suspended business by order at the board of directors Tuesday night The receiver came from Macon, Ga., his Directors of the bank said it was forced to close by reason "heavy withdrawals made within the past few days. Basil Ramsey president of the bank. said withdrawals Monday amounted to nearly $750,000. He added that it was his belief the bank is solvent. Edward J. McMillan chairman of reorganization of the Holston Union said today he had nothing to announce regarding his committees work.

9.

November 14, 1930

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

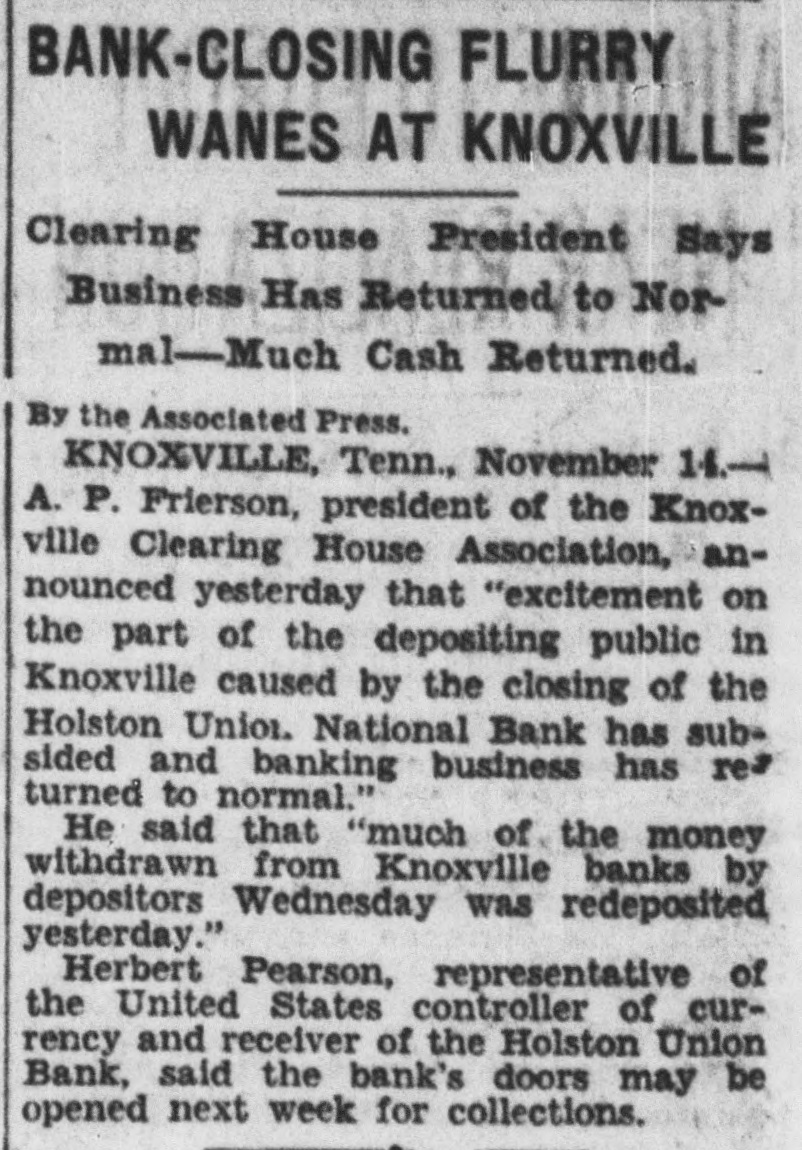

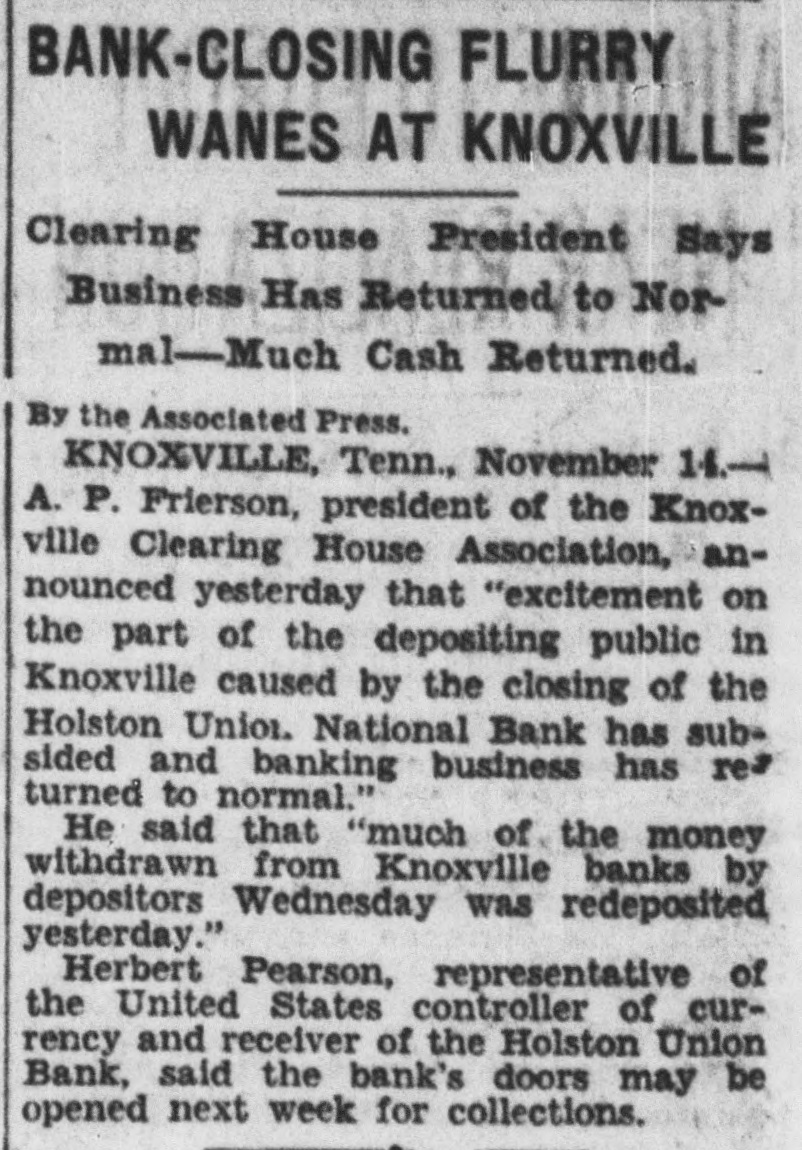

BANK-CLOSING FLURRY WANES AT KNOXVILLE Clearing House President Says Business Has Returned to Normal-Much Cash Returned. By the Associated Press. KNOXVILLE, Tenn., November 14.-1 A. P. Frierson, president of the Knoxville Clearing House Association, announced yesterday that "excitement on the part of the depositing public in Knoxville caused by the closing of the Holston Union. National Bank has subsided and banking business has res turned to normal." He said that "much of the money withdrawn from Knoxville banks by depositors Wednesday was redeposited yesterday." Herbert Pearson, representative of the United States controller of currency and receiver of the Holston Union Bank, said the bank's doors may be opened next week for collections.

10.

November 14, 1930

The Times

Hammond, IN

Click image to open full size in new tab

Article Text

BIG BANKS IN MERGER

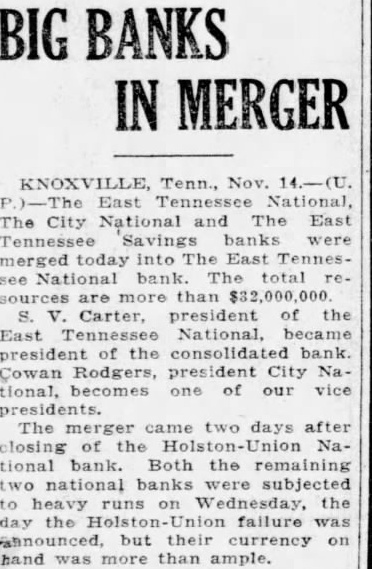

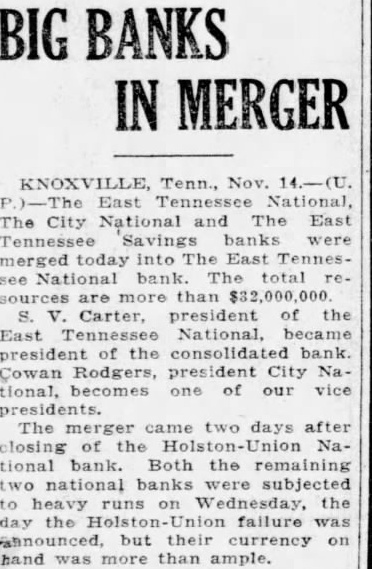

KNOXVILLE, Nov. East National, The City National and The East Tennessee Savings banks merged today into The East Tennessee National bank. The total sources are more than V. Carter, president of the East Tennessee National, president of the consolidated bank. Cowan Rodgers, president City tional, becomes one of our presidents. The merger came two days after closing of the Holston-Union National bank. Both the remaining two national banks were subjected heavy runs Wednesday, the day the Union failure but their currency hand was more than ample.

11.

November 14, 1930

The Springfield Press

Springfield, MO

Click image to open full size in new tab

Article Text

2 NATIONAL BANKS IN SOUTH MERGED

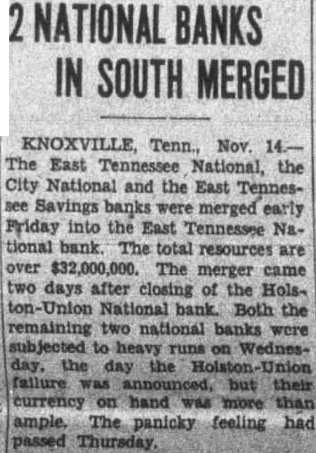

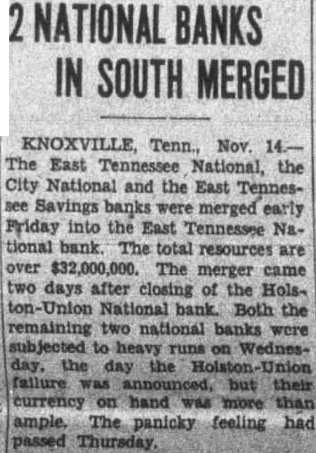

KNOXVILLE, Tenn., Nov. 14.The East Tennessee National, the City National and the East Tennessee Savings banks were merged early Friday into the East Tennessee National bank The total resources are over $32,000,000. The merger came two days after closing of the Holsn-Union National bank. Both the remaining two national banks were subjected to heavy runs on Wednesday. the day the Holston Union failure was but their currency on hand was more than ample. The panicky feeling had passed Thursday.

12.

March 6, 1931

The News-Star

Monroe, LA

Click image to open full size in new tab

Article Text

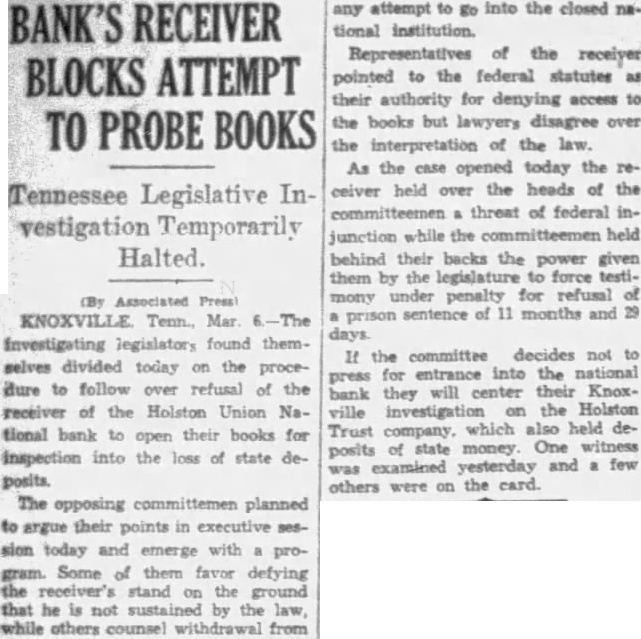

BANK'S RECEIVER BLOCKS ATTEMPT TO PROBE BOOKS

Tennessee Legislative Investigation Temporarily Halted.

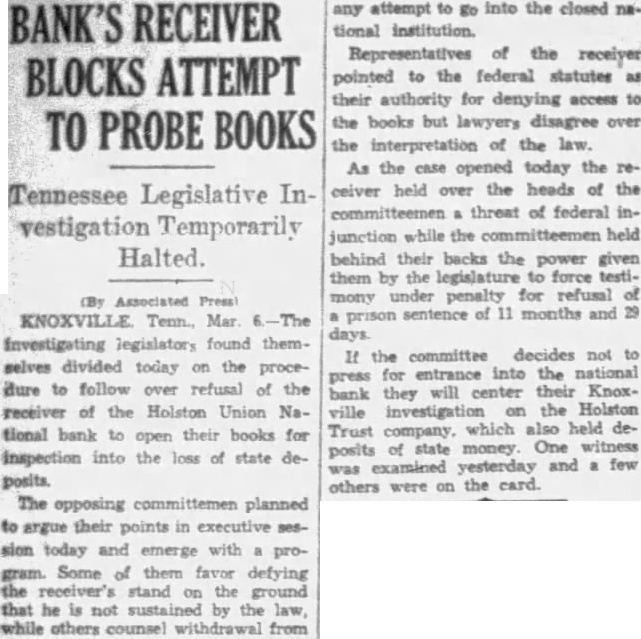

Associated Investigating legislators found themselves divided today the procedure to follow over refusal of the receiver of the Holston Union National bank to their books for into the of state deposits. The opposing committemen planned to argue their points in executive session today and emerge with program. Some of them defying the receiver's stand on the ground that he not sustained by the law, while others counsel withdrawal from any attempt to go into the closed national institution. Representatives of the receiver pointed to the federal statutes as their authority for access to the books but lawyers disagree over the interpretation of the As the case opened today the ceiver held over the heads of the committeemen threat of federal injunction while the committeemen held behind their backs the power given them by the legislature to force testimony under penalty for refusal of sentence of 11 months and 29 prison days. If the committee decides not to press for entrance into the national bank they will center their Knoxville investigation on the Holston Trust company. which also held deposits of state money One witness was examined yesterday and a few others were on the card.

13.

March 6, 1931

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

POLE DENIES BANNING PROBE

U. Comptroller Contradicts Letter Read to Committee.

John W. Pole, U. Comptroller of the Currency, flatly contradicted testimony before State vestigating committee that ordered bar against federal spection Holston-Union tional Bank records, according to Associated Press dispatch from Washington. The dispatch said: "John W. Pole, Comptroller of the Currency, said today he not familiar with the action the federal receiver had taken in gard. requests that the records the Holston-Union National Bank be made available to the Tennessee Legislative Investigating committee investigating bank failures. said the matter was being handled the federal receiver and his and reports had not been made to Washing- letter signed by Receiver Herbert Pearson, read to the mittee this morning by Attorney Harley Fowler, Pearson said: reply to your request that (the committee) permitto examine into the affairs the National Bank. respectfully advise you have been instructed by the Comptroller the Currency to not agree that this be

SCREAM KILLS LISTENER

LYNN, woman's two weeks ago scream, the course of radio mystery realistic that Mrs. Cecile Dane suffered shock. She died yesterday.

14.

July 21, 1931

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

MORE ABOUT

U-T Trustees

STARTS ON PAGE ONE earned for us about which will nearly offset the estimated loss on our deposit in the bank. That loss is figured the basis of total dividend of 70 per cent expected from the bank The trustees approved the installation of new tem for the university following report by W B. Franke, New York auditor The system went into effect July Under the new system, President H. Morgan said, the reports are made uniform and available to prompt for details than heretofore. The legislative committee last spring investigating U-T. more accounting system of the sytem, however has been under way since last and follows lines of special national committee which worked out the first uniform system for accounting in institutions of higher learning Franke was a member of this To Handle Law Review The trustees authorized the ganization of corporation for handling the Law Review, publication of the U-T College of Law, in relation to the State Bar Association. The Bar Association recently adopted the publication as its official organ and the new corporation will make this effective. The name of Henson Hall for the new girls' dormitory was approved. The name honors the late Martha Henson, who left bequest for building dormitory. The meeting to have started but the hour was 10 before Governor Horton, last to appear, arrived and the trustees closeted themselves. Budget Is Lower

Dr. H. Morgan, U-T president, said the budget would be around $936,000. or about $100,000 less than last year's. It was to be the finance committee's job to spread this reduced fund over each department of the University without crippling operations. The finance committee, headed by Paul Kreusi of Chattanooga, was also to report the collection of the 40 per cent dividend from the Holston-Union National Bank receirevrship. When the bank closed last November U-T had about on deposit including in building funds. Those on hand were the following trustees: Stokely of Newport Gen. Spence Kreusi Major Memphis. Wassell Martin. Col. Shields of Knoxville and Will White of Memphis did not appear Ex-officio members present: President Morgan. culture. Fitts, commissioner of agri. cation. Harned, commissioner of edu. Dean Hoskins was also present to report on administrative affairs.

15.

July 23, 1931

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

# PROSECUTOR SAYS LEA

# MUST PRESENT PLEA

Tennessee Indictment Abatement

Arguments to Be Heard at

Knoxville August 1.

By the Associated Press.

KNOXVILLE, Tenn., July 23.-William Carter, United States district attorney, announced yesterday that Col. Luke Lea, Tennessee published, indicted in Federal Court here on charges of violating national banking laws, must be present or represented by counsel in event his plea for abatement of the indictment is argued in Knoxville August 1.

Rogers Caldwell, president of Caldwell & Co., investment banking house now in receivership, and J. Basil Ramsey, president of the defunct Holston Union National Bank here, are indicted jointly with Lea, and they have joined in making the abatement plea.

Carter said their counsel have asked him to continue the abatement plea hearing, since Lea is scheduled to go on trial in the State Court of North Carolina at Asheville July 27 on charges arising from the failure of the Central Bank & Trust Co. there.

"When the North Carolina case against Lea was originally set for July 13, I agreed to pass the hearing to August 1 to accommodate them," Carter said. "If they don't show up, I'll call for a bond forfeiture."

16.

October 13, 1931

The Commercial Appeal

Memphis, TN

Click image to open full size in new tab

Article Text

SUES DAVIS FOR $274,272

Holston Bank Receiver Says Asheville Man's Notes Unpaid.

ASHEVILLE N. C., Oct. Herbert receiver of the closed Holston Union National Bank of has filed suit here against Wallace B. Davis, president of the Central Bank Trust of Asheville for $264 and $10,000 interest, unpaid the Knoxy bank bought from the bank which were endorsed by the latter's president. Mr. Pearson alleged that on June 30, 1930, the Central Securities Company of Asheville, a subsidiary of the bank, executed $125,000 note which was secured by 2,050 shares of stock of the Mortgage Company, 192 shares Central Bank Trust Company stock and 100 shares of Federal Mortgage Company stock. In addition, Pearson alleged, Davis endorsed the note as part the consideration. The Holston Union National Bank also purchased of from the Asheville bank which Davis IS alleged to guaranteed This series originally totalled $15,716.60 but has been reduced to $139,272.67 Pearson said. This series consists of obligations of many Asheville companies individuals, the complainant concludes.

17.

January 20, 1932

The Messenger

Madisonville, KY

Click image to open full size in new tab

Article Text

J. Basil Ramsey Trial To Begin Next Monday

KNOXVILLE Tenn., Jan. 20. Trial of J. Basil Ramsey, former president of the Hopkins County Bank, Madisonville, and president of the Holston Union National Bank here when it suspended operation, is scheduled to begin Monday. Ramsey is facing trial on indictments which followed the bank's suspension. Attorney Gener Bibb said that he will a trial this court term. Judge J. D. G. side.

18.

January 22, 1932

The Hustler

Madisonville, KY

Click image to open full size in new tab

Article Text

J. Basil Ramsey Trial To Begin Next Monday

KNOXVILLE Tenn., Jan. 20. Trial of J. Basil Ramsey, former president of the Hopkins County Bank, Madisonville, and president of the Holston Union National Bank here when it suspended operation, is scheduled to begin Monday. Ramsey is facing trial on indictments which followed the bank's suspension. Attorney General Fred Bibb said that he will insist on a trial this court term. Judge J. D. G. Morton will preside.

19.

May 26, 1932

Chattanooga Daily Times

Chattanooga, TN

Click image to open full size in new tab

Article Text

INDICTMENTS DISMISSED FOR LEA AND ASSOCIATES

KNOXVILLE, May 25 (P).-Indictments returned at Greeneville more than year ago charging Col. Luke Lea and Rogers Caldwell, of Nashville, and B. Ramsay, of Knoxville, with violation of the national banking laws, were formally dismissed in federal court today. Application of United States District Attorney W. J. Carter for an order nolle prosequi was granted by Judge George Taylor without The indictments followed the failure here in November, 1930, of the Holston Union National bank of which Ramsay was president and Lea and Caldwell stockholders. Lea and still face charges out of the bank's failure. have been postponed until the next term of the Knoxville federal court. A trial date will be set next Tuesday. Carter said the Greeneville cases against Lea, Caldwell and Ramsey were nolle because he was forced either to "try or dismiss' them and he wanted to try the Knoxville indictments first.

Truck licenses in Michigan for 1932 are expected exceed 1931 in state revenue by $100,000.

20.

August 22, 1932

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

BASIL RAMSEY IS WITNESS

Appears In Court Here In Bank Note

J. Basil Ramsey former president the failed Holston Union National Bank, was back in Federal Court This time he was witness. in case brought by H. Dulin against Carpenter, the bank's receiver. Dulin is suing for $6100, which he says is due on agreement he had with Ramsey His allegation is that note he held was sold the bank with the understanding that he would not draw the money of the bank until the note due. On the date the note was renewed by the and Dulin alleges his responsibility ended and was due him. The bank failed