1.

November 14, 1930

The Pittsburgh Press

Pittsburgh, PA

Click image to open full size in new tab

Article Text

Call Money

Time Money Market unchanged 60-90 days 4-5-6 per cent Commercial Paper Market unchanged Prime names 2% per cent Other good names. 3½ per cent Prime Bankers' Acceptances

NATIONAL BISCUIT SEEKS WHEATSWORTH

Acquisition Would Increase Flour and Biscuit Output

B, The United Press NEW YORK The negotiations for the purchase Whea of and whole flour. by the National Biscuit Company were reported Acquisition of Wheatsworth Inc b Biscuit would the latter rease in output of both flour and biscuits and add to new companies that National absorbed The most important was the Pacific Coast Biscuit ompany which financed through 140,000 shares of National In the first six months of 1930 W Inc reported net in$184.205 compared with the period last year Since net income the com pany from $105,000 to a high level $410,000 in 1928 Last income $385,000 The compan has 121.000 outstanding shares of common and small issue o per cent cumulative preferred stock Common stock been paying quarterly dividends of 25

MONEY MARKET

Call money easy in tone toalthough demand loans were the outside market the official charge held at the renewal per cent Time money was dull and unchanged per cent for up to 90 and per cent for longer

New York per OZ. changed unchanged

FOREIGN EXCHANGE

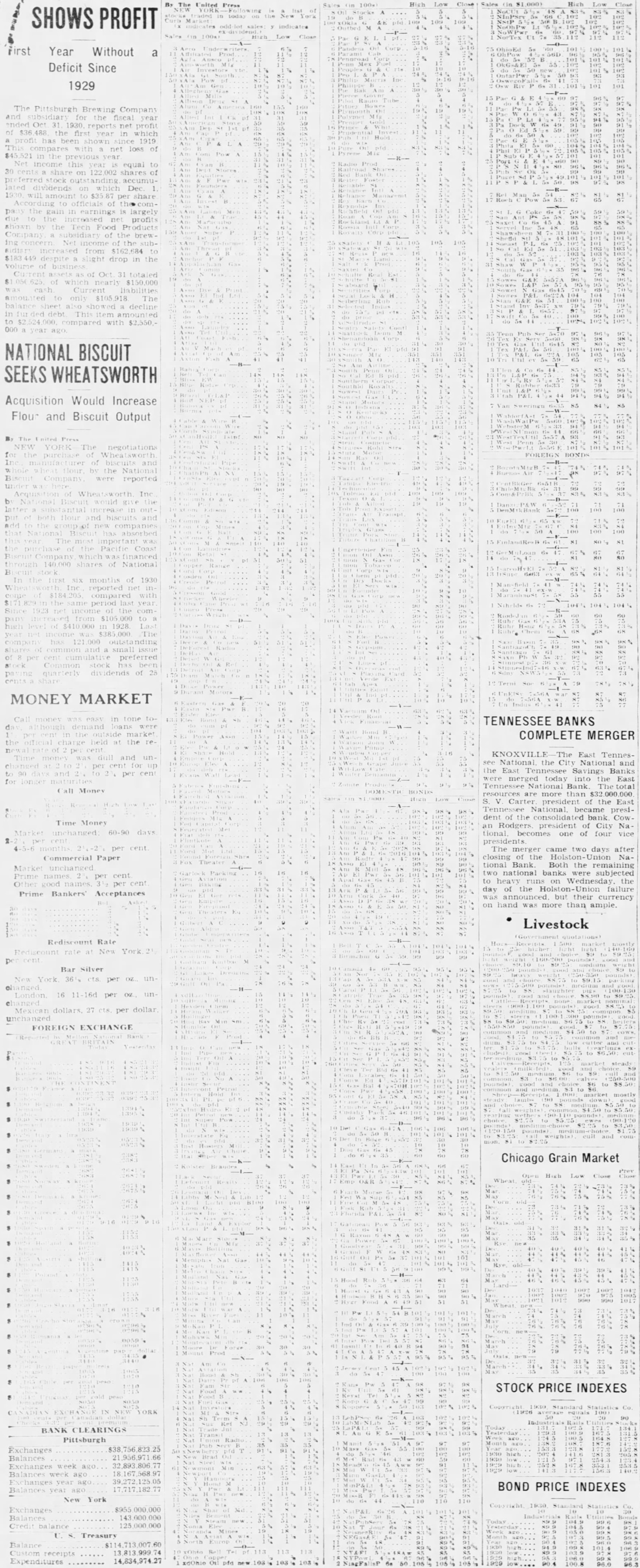

The United Press Sales High SHOWS PROFIT High First Year Without a Deficit Since 1929 The Pittsburgh Brewing Company and subsidiary for the fiscal year ended Oct 31 1930. reports net profit of $36 488 the first year in which a profit has been shown since 1919 This compares with net loss of $45,521 in previous year Net income this year IS equal to 30 cents share on 122,002 shares of ferred stock outstanding accumulated dividends on which Dec 1. 1930 will amount to $35.87 per share According to officials of the company the gain in earnings is largely due to the increased net profits shown by the Tech Food Products Company a subsidiary of the brewing Net income of the sub$183 449 despite slight drop in the volume of business Cu rent assets as of Oct 31 totaled 625 of which nearly $150,000 was cash Current liabilities amounted to only $105.918 The ba also showed decline in fur debt This amounted to 000. compared with $2,550.000 year ago BONDS TENNESSEE BANKS COMPLETE MERGER KNOXVILLE The East TennesNational the City National and the East Tennessee Savings Banks were merged today into the East Tennessee National Bank The total resources are more than $32,000,000 S. Carter president of the East Tennessee National became president of the consolidated bank Cow an Rodgers president of City Na. tional becomes one of four vice The merger came two days after closing of the Holston-Union National Bank Both the remaining two national banks were subjected to heavy runs on Wednesday the day of the Holston Union failure was announced. but their currency on hand was more than ample. Livestock Rediscount Rate Rediscount at New Bar Silver Bank Chicago Grain Market STOCK PRICE INDEXES 8050 YORK BANK CLEARINGS Pittsburgh Exchanges $38,756,823.25 Balances 21,956,971.66 Exchanges week ago 32,893,806.77 Balances week ago Exchanges year ago 39,272,125.05 BOND PRICE INDEXES Balances year ago 17,717,182.77 New York Exchanges Balances Credit balance Treasury Balance $114,713,007.60 Custom receipts Expenditures 14,834,974.27 103 90.4

2.

November 14, 1931

The Tennessean

Nashville, TN

Click image to open full size in new tab

Article Text

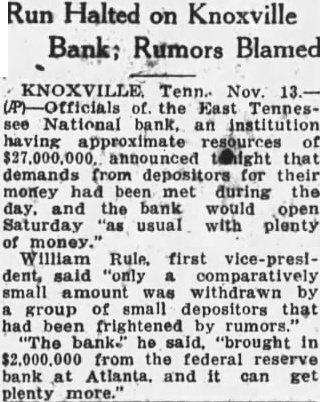

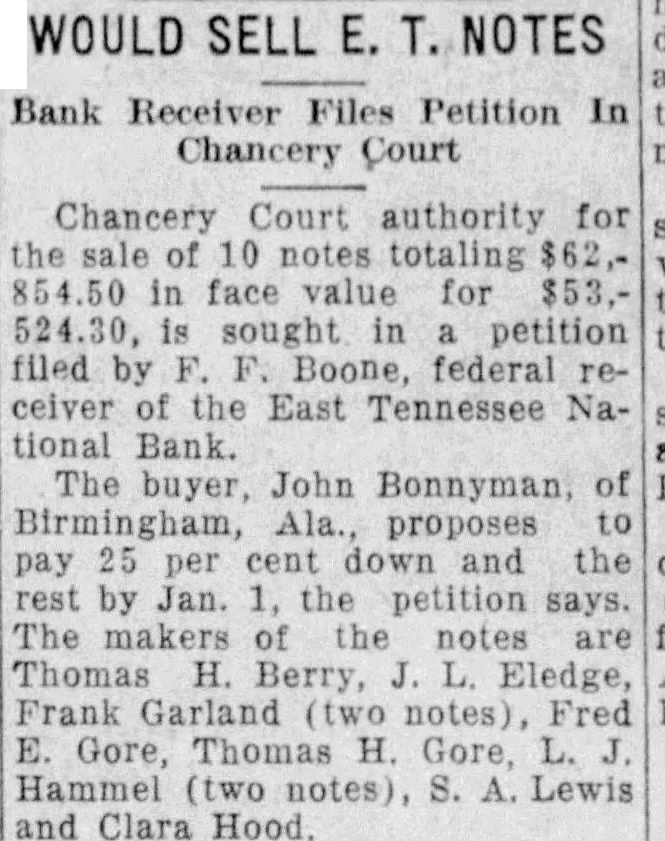

Run Halted on Knoxville Bank; Rumors Blamed

KNOXVILLE. Tenn. Nov. (P)-Officials of. the East Tennessee National bank, an institution having approximate resources of demands from depositors for their money had been met during the day. and the bank would open Saturday usual with plenty of money.' William Rule. first vice-president, "only comparatively small amount was withdrawn by group of small depositors that had been frightened by rumors. "The bank." he said, "brought in $2,000,000 from the federal reserve bank at Atlanta. and it can get plenty more."

3.

November 14, 1931

The Chattanooga News

Chattanooga, TN

Click image to open full size in new tab

Article Text

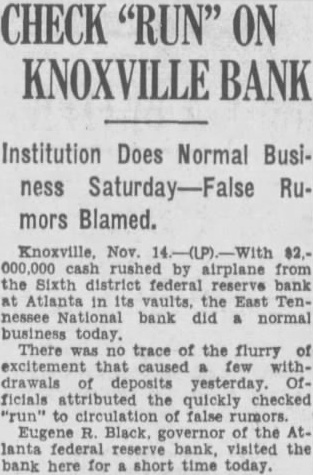

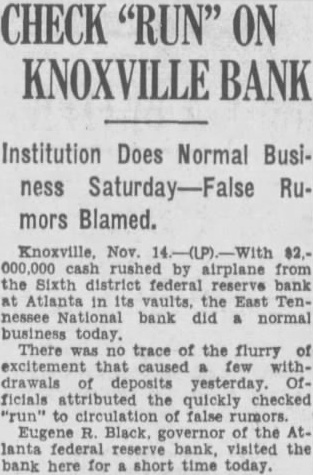

CHECK "RUN" ON KNOXVILLE BANK

Institution Does Normal Business Rumors Blamed.

000,000 cash rushed by airplane from the Sixth district federal reserve bank at Atlanta in its vaults, the East Tennessee National bank did a normal business today. There was no trace of the flurry of excitement that caused withdrawals of deposits yesterday. Officials attributed the quickly checked "run" to circulation of false rumors. Eugene R. Black, governor of the Atlanta federal reserve bank, visited the bank here for short time today.

4.

November 14, 1931

Chattanooga Daily Times

Chattanooga, TN

Click image to open full size in new tab

Article Text

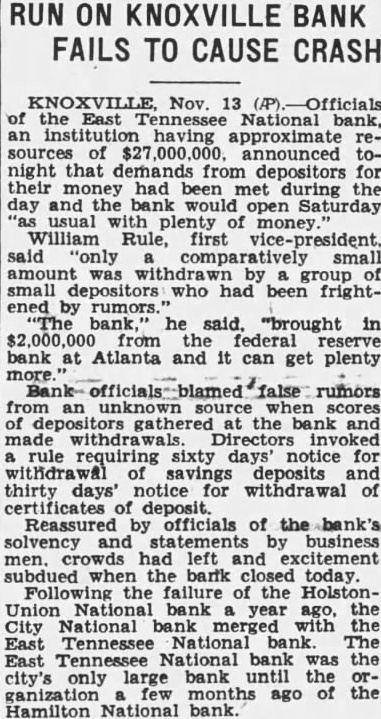

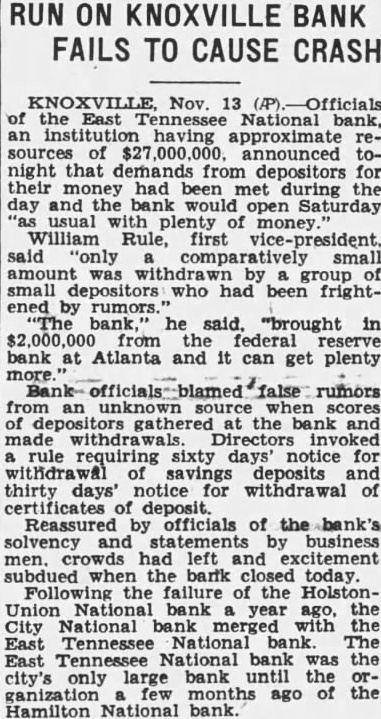

RUN ON KNOXVILLE BANK FAILS TO CAUSE CRASH

KNOXVILLE, Nov. 13 (P).-Officials of the East Tennessee National bank, an having approximate resources of $27,000,000. announced tonight that demands from depositors for their money had been met during the day and the bank would open Saturday "as usual with plenty of money William Rule, first vice-president. said "only comparatively small amount was withdraw by group small depositors who had been frightened by rumors. "The bank,' he said, "brought in $2,000,000 from federal reserve bank at Atlanta and it can get plenty more. Bank- officials blamed false rumors from when scores of depositors at the bank and made withdrawals Directors invoked rule requiring sixty days' notice for withdrawal of savings deposits and thirty days' notice for withdrawal of certificates of deposit. Reassured by officials of the bank's solvency and by business men. crowds had left and excitement subdued when the bartk closed today. Following the failure of the HolstonUnion National bank a year ago, the City National bank merged with the East Tennessee National bank. The East Tennessee National bank was the city's only large bank until the organization months ago of the Hamilton National bank.

5.

November 15, 1931

The Knoxville Journal

Knoxville, TN

Click image to open full size in new tab

Article Text

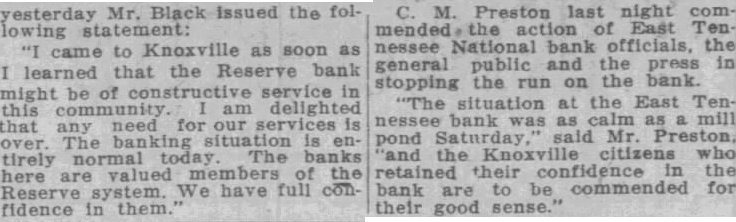

yesterday Mr. Black issued the following statement: "I came to Knoxville as soon as learned that the Reserve bank might be of service in this community am delighted that any need for our services is over. The banking situation is entirely normal today The banks here are valued members of the Reserve system. We have full confidence in them.

C. M. Preston last night commended the action of East Tennessee National bank officials, the general public and the press in stopping the run on the bank. "The situation at the East Tennessee bank was as as mill pond Saturday, said Mr. Preston, 'and the Knoxville citizens who retained their confidence in the bank are to be commended for their good sense."

6.

January 20, 1933

The Salisbury Post

Salisbury, NC

Click image to open full size in new tab

Article Text

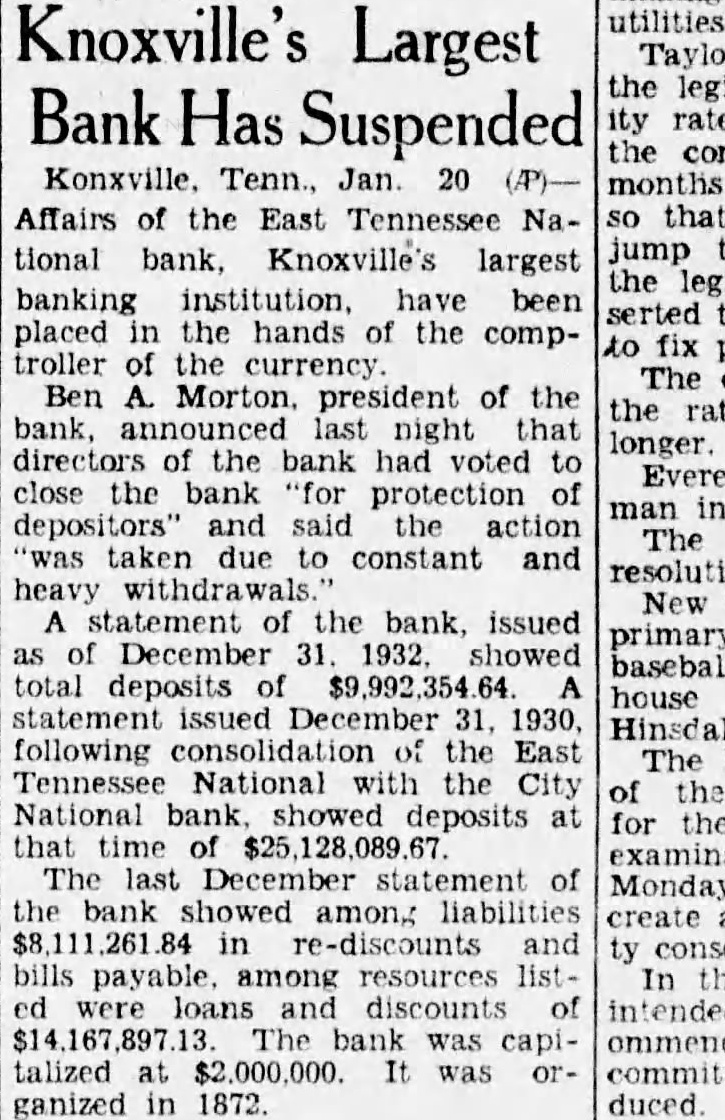

utilities Knoxville's Largest Bank Suspended

Jan. 20 Affairs of the East Tennessee Na- that tional bank, Knoxville's largest banking have been placed the hands of the comptroller the currency Ben Morton. president of the bank, announced night longer. directors of the bank had voted close the bank protection depositors" and action taken to constant and resolution. heavy statement of the bank, issued primary December 1932. showed baseball total deposits house statement issued December following the East The Tennessee National the National showed deposits for that time last December statement Monday the bank showed among liabilities payable, resources loans discounts bank was capitalized was ganized 1872.

7.

January 20, 1933

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

E. TENNESSEE BANK SHUT BY DIRECTORS; RECEIVER IS NAMED

Board Decides to Close Knoxville's Largest Bank After Efforts Fail to Halt Steady

Withdrawal of Deposits.

COMPTROLLER TAKES CHARGE

R. C. Loans Total $8,500,000; Deposits Have Shrunk From $25,000,000 to $8,000,000 in Two Years.

East Tennessee National Bank, oldest and largest bank in Knoxville, did not open today. Its control had passed into U. S. Comptroller of Currency. the hands of the Jay Riley, attached to the Comptroller's office at Washing- the here noon today to take over due to arrive at ton was affairs of the bank. correspondent Washington The News-Sentinel's Mr. left last office that Riley informed at the Comptroller's night from some unannounced point in Arkansas by airplane for After six-hour meeting of the board of directors, which close, the decision was made to began and the at following m. yesterday, notice soon appeared on the front door of the bank: "Following constant and heavy withdrawals of deposits, this bank closed by order of the board of directors in session on Thursand its affairs were day, Jan. placed in the hands of the Comptroller of the Currency at Wash-

R. Aid Offered

President Ben Morton of the bank had been in Washington since Tuesday attempting to arrange an additional loan from the Reconstruction Finance Corp. The R. was ready to give the bank additional credit, President Morton revealed today. Returning to Knoxville Thursday, found that drawals of deposits were so heavy that the loan could meet them, causing the decision to close.

Deposits Had Melted

The bank's deposits had dwindled from high of around $25,to about Withdrawals had been gradual but steady for the last year or more but apparently had finally ceased only month. The bank not only made headway in December but actually picked up some This continued during the early part of this month but last Monday morning heavy withdrawal began, and developed into silent run on the bank. There were crowds at the bank, the usual sign of run, but nevertheless withdrawals Monday, Tuesday and Wednesday totaled over The bank had around accounts, the an number of them were dead accounts. The bank had in cured deposits, and these deposiState Tennessee, the United States and the Philippine not cent. owed the Reconstruction Finance Corporation around was learned today that few weeks ago some of the stockholders formed holding company, apparently escape double sessment case the bank crashed. None of the group participated in this, said. An attorney, when asked about said today that those who put their stock in holding company would be assessed the same; that the receiver so ruled in the National Bank Kentucky (Louisville) case; and that there was way for (Please Turn to Last Page)

8.

January 22, 1933

The Knoxville Journal

Knoxville, TN

Click image to open full size in new tab

Article Text

CLEMENTS ASKS BANK MEETING

Says Depositors in Closed Banks Need Protection. mass meeting depositors of the closed East Tennessee Na tional and National banks in being circulated by H. Clements, Knoxville attorney and internal commissioner for Tennessee. The date for meeting not specified. said he was circulat interest been that these bank failures there been seemed pecially interested in saving the small Among signers he reported were Perry Long. Walker, Jenkins, Painter, HarKing, Bros. Lloyd Sterchi, Foyonskey, Hal Clements. reads depositors meeting banks held hall published meeting of orderly cussion affairs funct the look closed banks that shall large their will the further purpose said the depositors and them that winding funct might be the further purpose furnish (especially after their status furnish their further defunct might way violated the duty and banking

9.

January 27, 1933

The Daily News-Journal

Murfreesboro, TN

Click image to open full size in new tab

Article Text

Maynardsville Bank Open for Business

"aynardsville. Tenn., Jan. 27-(U.P)Mounardsville State Bank was open ngain todav. week after it was susmended. following the closing of the East Tennessee National Bank And depositors came in to deposit more

"This bank had suspended to avoid any hysteria that might follow the closing of the East Tennessee National at Knoxville," said R. V. Beeler, vice-president.

10.

January 31, 1933

The Knoxville Journal

Knoxville, TN

Click image to open full size in new tab

Article Text

BASS REQUESTS FURTHER SLASH IN SCHOOL COST

Manager Pleads for City Savings Additional to

RECEIVER BELIEVED HOLDING CITY 'KEY'

Cockrum Says Normal Payments on Loans Will Not Hurt Service.

City Manager Nell Bass has the school slash the hudget for more than the he asked to budget mitted the first council at an adjourned meeting. believe they will cooperate Bass told council. made no specific request this time. merely told them that changed conditions made necessary cut greater than suggested days The submitted budget $1,065,000. based on 45-cent by the charter. then the has expressed to effect further Closing East Tennessee National bank make much difference Knoxville the receiver allow repayment loans the same schedule the bank would have required had remained open, Councilman Cockrum told council. TO RECEIVER "Doubtless large portion of the deposits were accounts, did good except that the money again. The more than the had been loaned receiver lenient such hard time. But presses loans Knoxville suffer. We should go slow the budget and find out what receiver going be to cut the out our government. "Cutting salaries again would make change in the budget" Bass extra of cent. from salaries month. The will through come Bass relief that refunding would debt is not out of declared. "and can paid, the city of such pay those bonds refunding goes through reports that will go through proposed the interest rate reduced. The bonds under the plan cent. borrow money now for less than six per Councilman Cary Spence offered the opinion that taxpayers would reduction and high tax found lot of sentiment favoring low and

11.

January 31, 1933

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

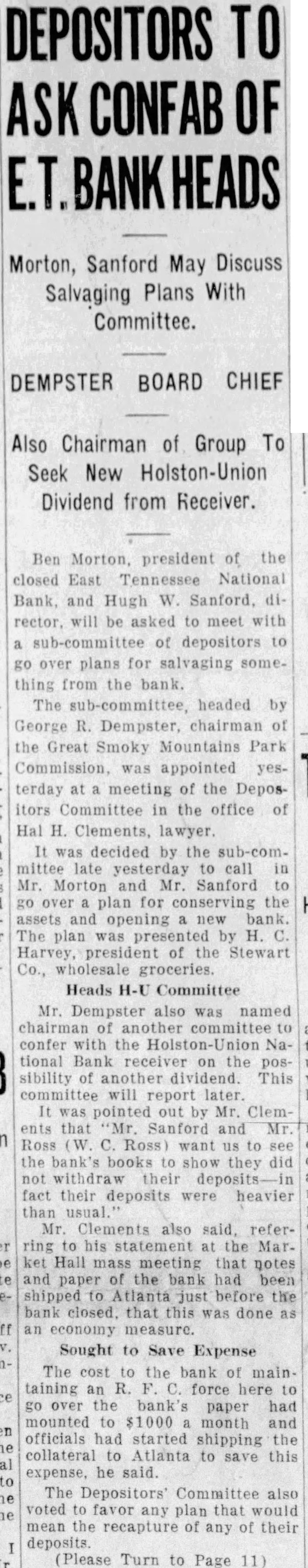

DEPOSITORS TO CONFAB OF

Morton, Sanford May Discuss Salvaging Plans With Committee.

DEMPSTER BOARD CHIEF

Also Chairman of Group To Seek New Holston-Union Dividend from Receiver.

Ben Morton, president the closed East Tennessee National Bank, and Hugh W. Sanford. rector. will be asked to meet with sub-committee of depositors to go over plans for salvaging thing from the bank. The headed by George R. Dempster, chairman of the Great Smoky Mountains Park Commission. was appointed yesterday at meeting of the Depositors Committee in the office of Hal H. Clements, lawyer. decided by the mittee late yesterday to call Mr. Morton and Mr. Sanford go over plan for the and opening bank. The plan by president of the Stewart Co., groceries.

Heads H-U Committee

Mr. Dempster also was named chairman another committee confer with the National Bank receiver on the sibility of another dividend. This committee will report later It pointed out Mr. Clements that Sanford and Mr Ross (W. Ross) want to the books show they did withdraw their fact their deposits were heavier than usual Mr. Clements also said, referring to his statement at the Mar. Hall mass meeting that paper of the bank had been shipped to Atlanta before the bank that this was done economy

Sought to Save Expense

The cost to the bank of maintaining an R. force here to over the bank's paper had mounted to month and officials had started shipping the collateral to Atlanta to save this expense, he The Depositors' Committee also voted to favor any plan that would mean the recapture of any of their deposits (Please Turn to Page 11)

12.

February 2, 1933

The Knoxville Journal

Knoxville, TN

Click image to open full size in new tab

Article Text

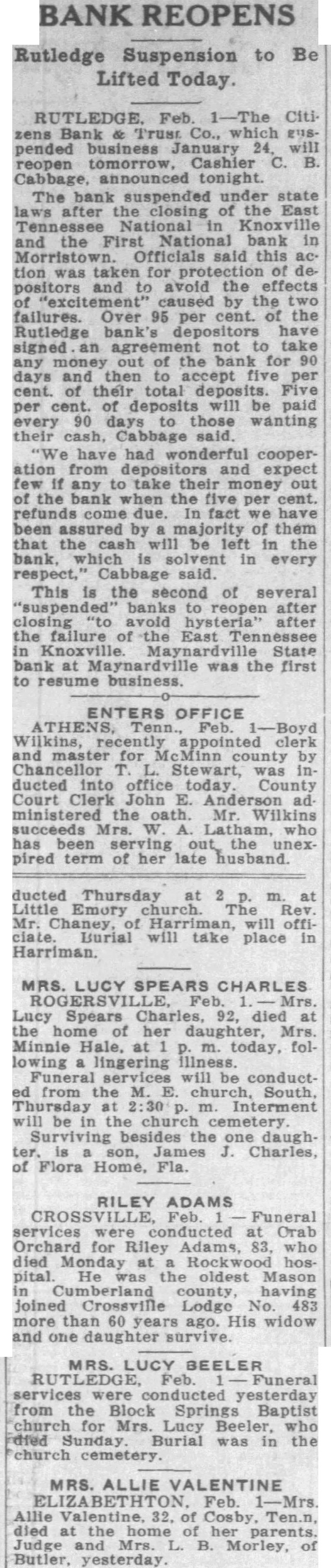

BANK REOPENS

Rutledge Suspension to Be Lifted Today.

RUTLEDGE. Feb. 1-The Citizens Bank Trust Co., which gus. pended business January 24, will reopen tomorrow, Cashier C. B. Cabbage, announced tonight. The bank suspended under state laws after closing the East Tennessee National Knoxville and the First National bank in Morristown. Officials said this action was of deand to avoid the effects of caused by the failures. Over 95 per cent. of the Rutledge bank's depositors have signed an agreement not to take any of the bank for 90 days and then to accept five per cent. of their total deposits. Five per cent. of deposits will be paid every 90 days those wanting their cash, Cabbage said. "We have had wonderful cooperation from depositors expect few if any to take their money of the bank when the five per cent. refunds come due. In fact we have been by majority of them that the cash will be left in the bank, which is in every respect,' said. This is the second of several banks to reopen after closing avoid hysteria' after the failure of the East Tennessee in Knoxville. Maynardville State bank at Maynardville was the first to resume business.

ENTERS OFFICE ATHENS, Tenn. Feb. Boyd Wilkins, recently appointed clerk and master for IcMinn county by Chancellor T. Stewart, was inducted into office today. County Court Clerk John E. administered the oath. Mr. Wilkins succeeds Latham, who has been serving the pired term of her late husband. ducted Thursday at 2 m. at Little Emory church. The Rev Mr. Chaney, Harriman, will officlate. Burial will take place in Harriman.

MRS. LUCY SPEARS CHARLES Lucy Spears Charles, died at the home of her daughter, Mrs. Minnie Hale, at p. m. today, following a lingering illness. Funeral services will be conductfrom the M. church, South, Thursday at m. Interment will be in the cemetery. Surviving besides the one daugh ter J. Charles, of Flora Home, Fla,

RILEY ADAMS CROSSV Feb. Funeral services were at Orab Orchard for Riley Adams, 83. who died Rockwood hospital He the oldest Mason Cumberland county, having joined Crossville Lodge No. 483 more than 60 years ago. His widow and one daughter survive.

MRS. LUCY BEELER services conducted yesterday from the Block Springs Baptist church for Mrs. Lucy Beeler, who died Sunday Burial was in the church cemetery.

MRS. ALLIE VALENTINE ELIZABETHTON. Feb. Mrs. Allie Valentine, 32. of Cosby, Ten.n. died at the home of her parents. Judge Mrs. L. B. Morley, of

13.

February 4, 1933

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

Rail Employes Call Bank Mass Meeting

Railroad members of the Four" brotherhood, will hold mass meeting Labor Temple m. Tuesday "what can be done East Tennessee National Bank closing. The meeting is sponsored by the Central Labor Union.

14.

February 24, 1933

The Chattanooga News

Chattanooga, TN

Click image to open full size in new tab

Article Text

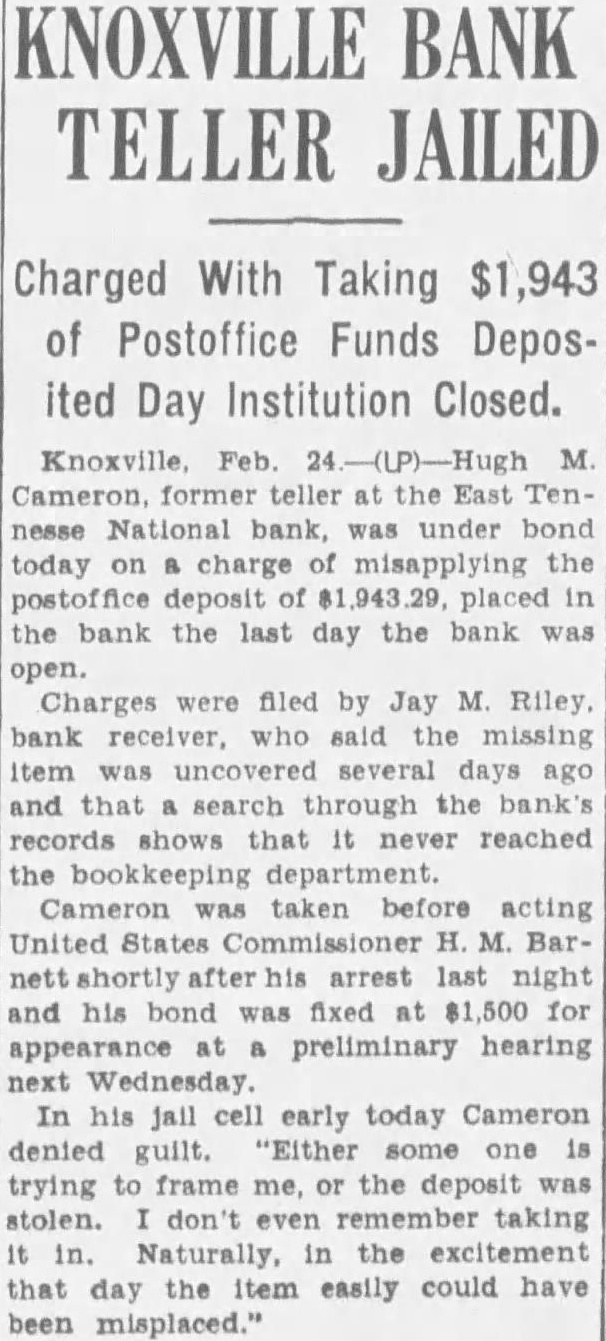

KNOXVILLE BANK TELLER JAILED

Charged With Taking $1,943 of Postoffice Funds Deposited Day Institution Closed.

Cameron, former teller East Tennesse National bank, was under bond today on charge misapplying the postoffice deposit of placed in the bank the last day the bank was Charges filed by Jay M. Riley. receiver, said the missing Item was and that search through the bank's records shows that never reached department. Cameron taken before acting United Bararrest last night and his bond was fixed at for appearance preliminary hearing Wednesday. In his jail cell early today Cameron denied "Either trying frame the deposit was stolen. don't taking the excitement that day the easily could have misplaced."

15.

February 25, 1933

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

LOAN TO PAY BANK DIVIDEND

Labor Committee To Leave for Washington Tomorrow. committee representing ganized labor of Knoxville, headby will leave tomorrow Washington pear before the Reconstruction Finance Corporation Monday and ask for collateral of the closed East TenNational Bank with which immediate dividend to positors. Dr. John R. Neal, who is ing his legal the group, leave by automobile for Washington today with his nephJohn Wheelock The Labor committee is ning its hopes for the loan statement Ben Morton. president the closed bank, that the would have loaned the bank more that not accepted Morton realized that the additional would benefit only those withdrew their money from the bank rather than all the depositors. Dr. Neal said he planned to main Washington for the auguration March

16.

March 3, 1933

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

SANFORD CONFERS ON BANK REOPENING

To See Bernard Baruch on Refinancing Closed Houses.

Hugh W Sanford Knoxville capitalist has gone from Washington to New York to confer with Bernard M. Baruch, financier and Demperatic leader, about plan that Mr Sanford has worked out for re-financing not only the East Tennessee National Bank of Knoxville but other closed banks thruout the country Ben Morton who was with Mr Sanford at Washington but who has returned to Knoxville, said Mr Sanford did not want the plan given out until it has been approved. Several versions of the plan have been on the street for the last week but none of them is said to be correct Mr. Sanford also is seeking an amendment to the Glass banking reform bill which would permit holders of 85 per cent of the depositors in closed bank to agree to plan for re-opening bank. At present the law requires the consent of every depositor. which is considered next to impossible to obtain.

17.

March 28, 1933

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

Seek Preliminary Approval of Reopening Plan; Want Loan, Anyway.

By MARSHALL McNEIL Staff Correspondent

WASHINGTON, March 28. round of conferences cials the Treasury and the Reconstruction Finance Corp. was started here today the committee from Knoxville that hopes reopen East Tennessee National Theirs. best, is slow business; and there was no of telling today just when they would reach showdown: yes, or First, according to Ben Morton former president the closed bank. delegation intends to see officials the C. The idea to preliminary approval of the reopening plan, and to termine the status of the proposed two-million loan. The two go hand in hand, but if the reopening plan rejected the loan will still be sought, so that the depositors may receive at least small dividend After the R. C. conference. the endeavor the Comptroller the Currency or of his deputies, and, if necessary, the Knoxvillians will make an attempt to lay their plan before Secretary of the Treasury Yesterday. in preliminary parley. the plan was discussed with George James Memphis, South ern member of the Federal ReBoard. Besides Morton and Hugh Sanford, delegation includes John Neal, Frank Torlay, Joseph P. Gaut, and M. W. Eger-

18.

June 27, 1933

Morristown Gazette Mail

Morristown, TN

Click image to open full size in new tab

Article Text

Bank Receiver Dead

Knoxville, Tenn., June apoplectic stroke suffered Saturday has proven fatal to Jay M. Riley, receiver for the East Tennessee National Bank. He died at Sunday night. Riley called Lineoln, Neb., home. He came here from Pine Bluff, Ark.

19.

June 27, 1933

The Miami Herald

Miami, FL

Click image to open full size in new tab

Article Text

PIONEER OF TALKING

MACHINE FIRM DIES WENONAH. N. June 26. (P)-Belford G. Royal, former vice president and general manager of the Victor Talking Machine Company and one of the pioneers of the firm, died yesterday at his home. He was 68.

Other deaths: NEW Herbert Venner, president Securities Company: H. Venner Company, General Investment Company and New York Central Securities Company,

ST. STEPHEN, N. C.-G. Horne Russell, noted Canadian landscape painter.

SYRACUSE, N. Y.-Albert Leverett Brockway, 68, architect, leader in civic and agricultural affairs here.

KNOXVILLE Tenn-Jay Morton Riley. 55, receiver for East Tennessee National Bank since its closing.

ST. LOUIS-Rev. Dr. Baxter P. Fullerton. 82, long leader in religious affairs, former the Presbyterian Church of the United States.

H. Moore, 41, assoclate justice the Colorado Supreme court since 1929.

20.

July 17, 1933

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

WOULD OFFSET CLAIM BY DEPOSIT

Anderson, Dulin, Varnell Co. posit the East Tennessee National Bank time of closing, against claim the bank receiver has filed against the comThis offer is an answer to the suit Federal Court. The answer was for return of the withdrawn by the Varnell Co. just

21.

September 13, 1933

The Knoxville Journal

Knoxville, TN

Click image to open full size in new tab

Article Text

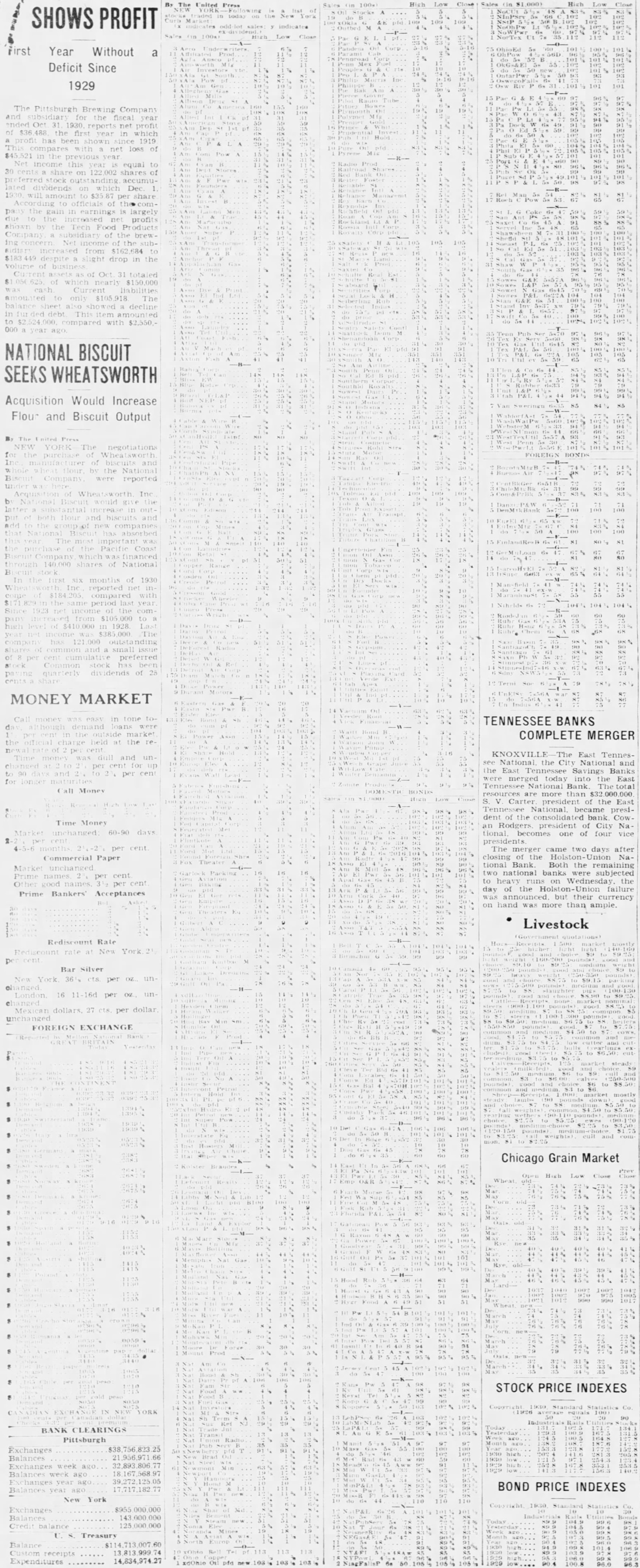

BANK MAY AT EARLY DATE

Park Stockholders Continue Daily Sessions.

The stockholders' meeting of the old East Tennessee National bank scheduled for yesterday journed to will from day open the new Park bank In explained, they will avoid meeting of the stockholders while awaiting final action from ington the plans. The bank expected to ready open trustees, Cecil Baker. Cowan and Charlton Karns, under the reopening plan doing all the voting of stock Joseph Gaut temporary chairman and Joe McAfee secretary

22.

December 7, 1933

The Knoxville News-Sentinel

Knoxville, TN

Click image to open full size in new tab

Article Text

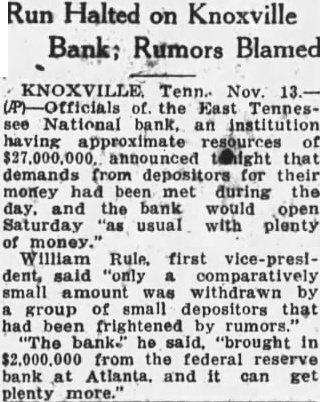

WOULD SELL NOTES

Bank Receiver Files Petition In Chancery Court

Chancery Court authority for the sale 10 notes totaling $62,in face value for $53.is sought petition filed Boone, federal receiver of the East Tennessee National Bank. The buyer, John Bonnyman, of Birmingham, proposes to pay 25 per cent down and the rest by Jan. 1, the petition says. The makers the notes are Thomas Berry, Eledge, Frank Garland notes), Fred Gore, Thomas H. Gore, Hammel (two notes), S. Lewis and Clara Hood