Article Text

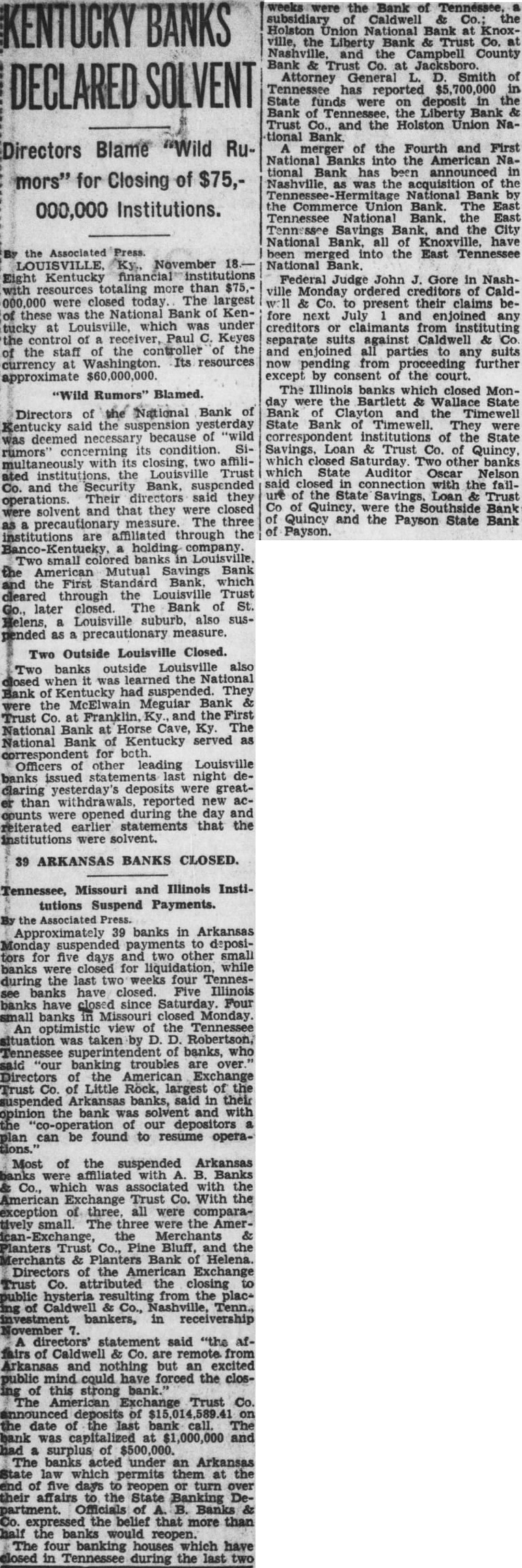

KENTUCKY BANKS DECLARED SOLVENT Directors Blame "Wild Rumors" for Closing of $75,000,000 Institutions. By the Associated Press. Eight Kentucky financial institutions with resources totaling more than $75,000,000 were closed today. The largest of these was the National Bank of Kentucky at Louisville, which was under the of Paul C. Keyes of the staff of the controller of the currency at Washington. Its resources approximate $60,000,000. "Wild Rumors" Blamed. Directors of the National Bank of Kentucky said the suspension yesterday was deemed necessary because of "wild rumors' concerning its condition. Simultaneously with its closing. two affiliated institutions. the Louisville Trust Co. and the Security Bank, operations. Their directors said they were solvent and that they were closed as precautionary measure. The three institutions are affiliated through the a holding company. Two small banks in Louisville, the American Mutual Savings Bank and the First Standard Bank. which cleared through the Louisville Trust Go., later closed. The Bank of St. Helens, Louisville suburb. also suspended as precautionary measure. Two Outside Louisville Closed. Two banks outside Louisville also closed when it was learned the National Bank of Kentucky had suspended. They were the McElwain Meguiar Bank & Trust at Franklin. Ky. and the First National Bank at Horse Cave, Ky. The National Bank of Kentucky served as correspondent for both. Officers of other leading Louisville banks issued statements last night declaring yesterday's deposits were greater than withdrawals reported new accounts were opened during the day and reiterated earlier statements that the institutions were solvent. 39 ARKANSAS BANKS CLOSED. Tennessee, Missouri and Illinois Institutions Suspend Payments. By the Associated Press. Approximately 39 banks in Arkansas Monday suspended payments to depositors for five days and two other small banks were closed for liquidation, while during the last two weeks four Tennessee banks have closed. Five Illinois banks have closed since Saturday. Four small banks in Missouri closed Monday An optimistic view of the Tennessee situation was taken by D. D. Robertson, Tennessee superintendent of banks, who said "our banking troubles are over Directors of the American Exchange Trust Co. of Little Rock, largest of the suspended Arkansas banks, said in their opinion the bank was solvent and with the of our depositors a plan can be found to resume opera- Most of the suspended Arkansas banks affiliated with A. B. Banks & Co., which was associated with the American Exchange Trust Co. With the exception of three, all were comparatively small The three were the American- Exchange, the Merchants & Planters Trust Co., Pine Bluff, and the Merchants & Planters Bank of Helena. Directors of the American Exchange Trust Co. attributed the closing to public hysteria resulting from the placing of Caldwell & Co., Nashville, Tenn., investment bankers, in receivership November A directors' statement said "the Affairs of Caldwell & Co. are from Arkansas and nothing but an excited public mind could have forced the closof this strong bank.' The American Exchange Trust Co. announced of the date of the last bank call. The bank was at $1,000,000 and had surplus of $500,000. The banks acted under an Arkansas State law which permits them at the end of five days to reopen or turn their affairs to the State Banking Department. of A. B. Banks & Co. expressed the belief that more than half the banks would reopen. The four banking houses which have closed in Tennessee during the last two weeks were the Bank of Tennessee, subsidiary of Caldwell Co.; the Holston Union National Bank at Knoxville, the Liberty Bank & Trust Co. at Nashville, and the Campbell County Bank & Trust Co. at Jacksboro. Attorney General D. Smith of Tennessee has reported $5,700,000 State funds were deposit in the Bank of Tennessee, the Liberty Bank Trust Co., and the Holston Union National Bank A merger of the Fourth and First National Banks into the American National Bank has been announced in Nashville, as was the acquisition of the National Bank by the Commerce Union Bank. The East Tennessee National Bank. the East Tennessee Savings Bank, and the City National Bank, all of Knoxville, have been into the East Tennessee National Bank. Federal Judge John J. Gore in Nashville Monday ordered creditors Cald& Co. to present their claims before next July and enjoined any creditors or claimants from separate suits against Caldwell & Co and enjoined all parties to any suits now pending from proceeding further except by consent of the court. The Illinois banks which closed Monday were the Bartlett & Wallace State Bank of Clayton and the Timewell State Bank of Timewell. They were correspondent institutions of the State Savings. Loan & Trust Co. of Quincy, which closed Saturday. Two other banks which State Auditor Oscar Nelson said closed in connection with the failure of the State Savings, Loan & Trust Co Quincy. were the Southside Bank of Quincy and the Payson State Bank of Payson.