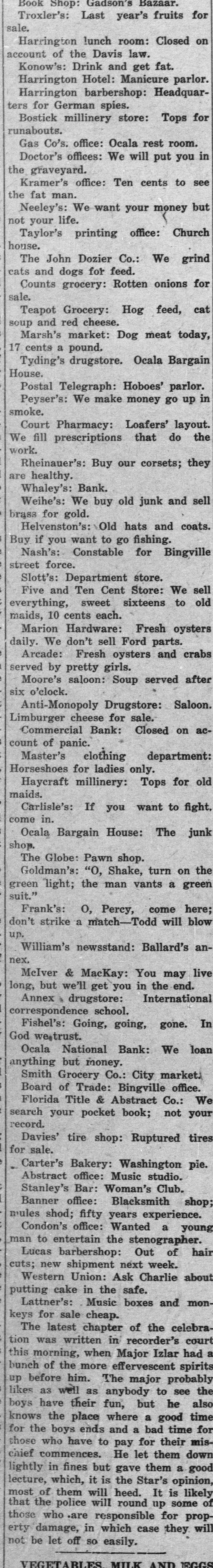

Article Text

ters for German spies. Bostick millinery store: Tops for runabouts. Gas Co's. office: Ocala rest room. Doctor's offices: We will put you in the graveyard. Kramer's office: Ten cents to see the fat man. Neeley's: We want your money but not your life. Taylor's printing office: Church house. The John Dozier Co.: We grind cats and dogs for feed. Counts grocery: Rotten onions for sale. Teapot Grocery: Hog feed, cat soup and red cheese. Marsh's market: Dog meat today, 17 cents a pound. Tyding's drugstore. Ocala Bargain House. Postal Telegraph: Hoboes' parlor. Peyser's: We make money go up in smoke. Court Pharmacy: Loafers' layout. We fill prescriptions that do the work. Rheinauer's: Buy our corsets; they are healthy. Whaley's: Bank. Weihe's: We buy old junk and sell brass for gold. Helvenston's: Old hats and coats. Buy if you want to go fishing. Nash's: Constable for Bingville street force. Slott's: Department store. Five and Ten Cent Store: We sell everything, sweet sixteens to old maids, 10 cents each. Marion Hardware: Fresh oysters daily. We don't sell Ford parts. Arcade: Fresh oysters and crabs served by pretty girls. Moore's saloon: Soup served after six o'clock. Anti-Monopoly Drugstore: Saloon. Limburger cheese for sale. Commercial Bank: Closed on account of panic. Master's clothing department: Horseshoes for ladies only. Haycraft millinery: Tops for old maids. Carlisle's: If you want to fight. come in. Ocala Bargain House: The junk shop. The Globe: Pawn shop. Goldman's: "0, Shake, turn on the green light; the man vants a green suit." Frank's: 0, Percy, come here; don't strike a match-Todd will blow up. William's newsstand: Ballard's annex. McIver & MacKay: You may live long, but we'll get you in the end. Annex drugstore: International correspondence school. Fishel's: Going, going, gone. In God weatrust. Ocala National Bank: We loan anything but money. Smith Grocery Co.: City market. Board of Trade: Bingville office. Florida Title & Abstract Co.: We search your pocket book; not your record. Davies' tire shop: Ruptured tires for sale. Carter's Bakery: Washington pie. Abstract office: Music studio. Stanley's Bar: Woman's Club. Banner office: Blacksmith shop; mules shod; fifty years experience. Condon's office: Wanted a young man to entertain the stenographer. Lucas barbershop: Out of hair cuts; new shipment next week. Western Union: Ask Charlie about putting cake in the safe. Lattner's: Music boxes and monkeys for sale cheap. The latest chapter of the celebration was written in recorder's court this morning, when Major Izlar had a bunch of the more effervescent spirits up before him. The major probably likes as well as anybody to see the boys have their fun, but he also knows the place where a good time for the boys ends and a bad time for those who have to pay for their mischief commences. He let them down lightly in fines but gave them a good lecture, which, it is the Star's opinion, most of them will heed. It is likely that the police will round un some of