Article Text

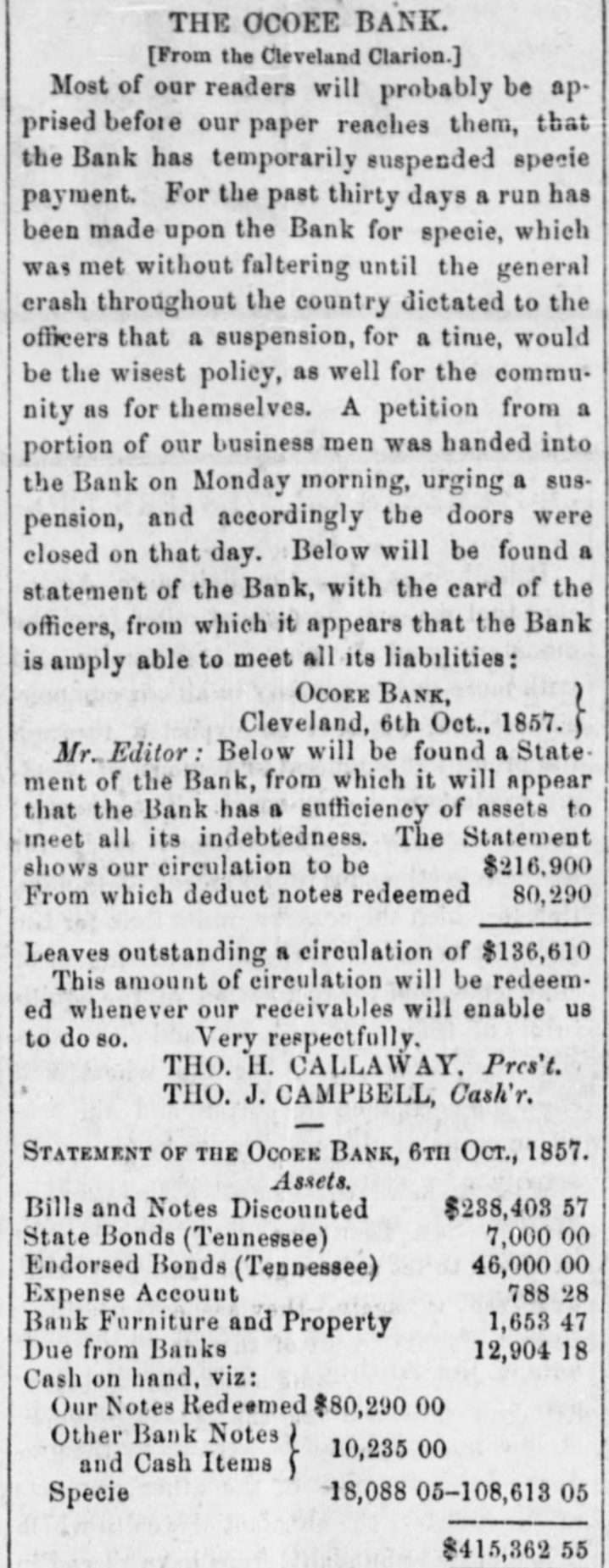

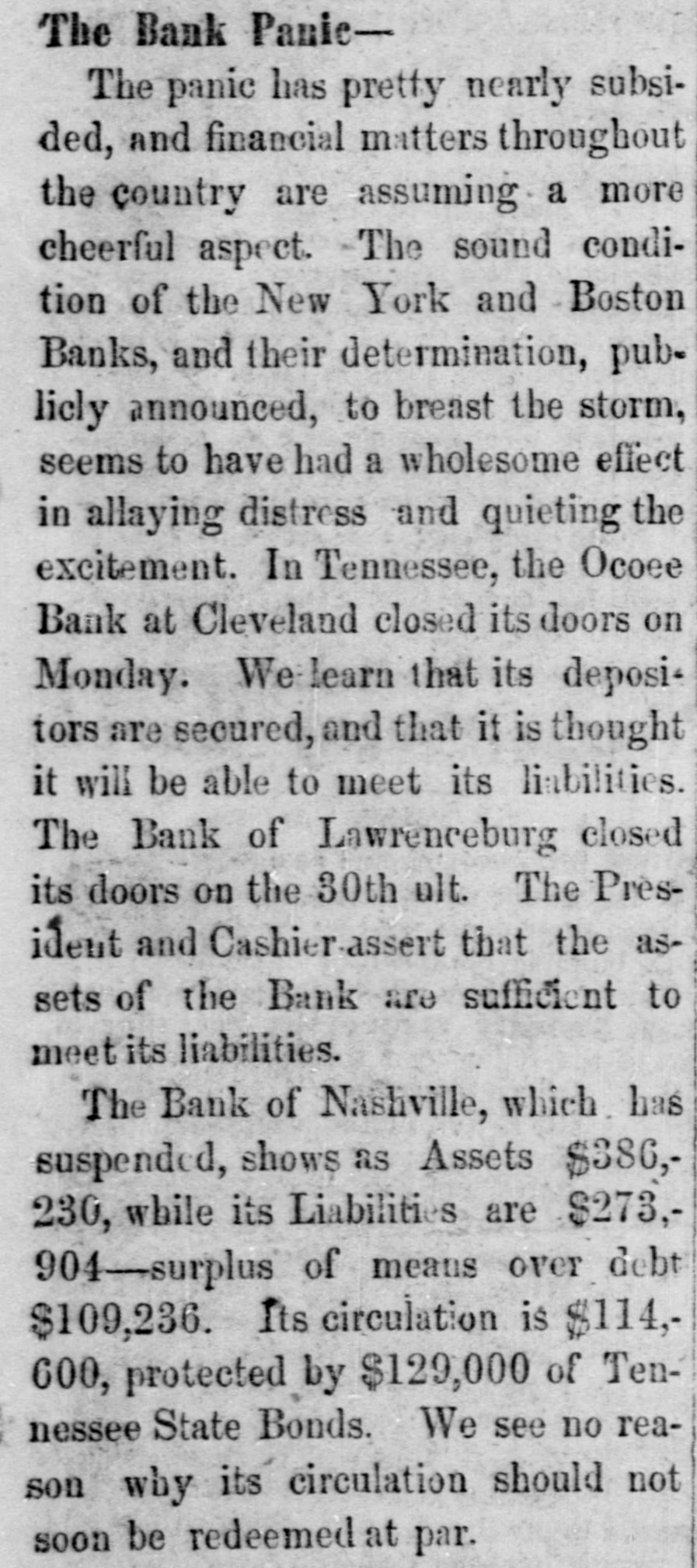

THE OCOEE BANK. [From the Cleveland Clarion.] Most of our readers will probably be apprised before our paper reaches them, that the Bank has temporarily suspended specie payment. For the past thirty days a run has been made upon the Bank for specie, which was met without faltering until the general erash throughout the country dictated to the officers that a suspension, for a time, would be the wisest policy, as well for the community as for themselves. A petition from a portion of our business men was handed into the Bank on Monday morning, urging a suspension, and accordingly the doors were closed on that day. Below will be found a statement of the Bank, with the card of the officers, from which it appears that the Bank is amply able to meet all its liabilities: OCOEE BANK, Cleveland, 6th Oct., 1857. Mr. Editor: Below will be found a Statement of the Bank, from which it will appear that the Bank has a sufficiency of assets to meet all its indebtedness. The Statement shows our circulation to be $216,900 From which deduct notes redeemed 80,290 Leaves outstanding a circulation of $136,610 This amount of circulation will be redeemed whenever our receivables will enable us to do so. Very respectfully, THO. H. CALLAWAY. Pres't. THO. J. CAMPBELL, Cash'r. STATEMENT OF THE OCOEE BANK, 6TH Oct., 1857. Assets. Bills and Notes Discounted $238,403.57 7,000.00 State Bonds (Tennessee) 46,000.00 Endorsed Bonds (Tennessee) 788 28 Expense Account 1,653 Bank Furniture and Property Due from Banks 12,904 18 Cash on hand, viz: Our Notes Redeemed $80,290.00 Other Bank Notes 10,235 00 and Cash Items 18,088 05-108,613 05 Specie $415,362.55