Article Text

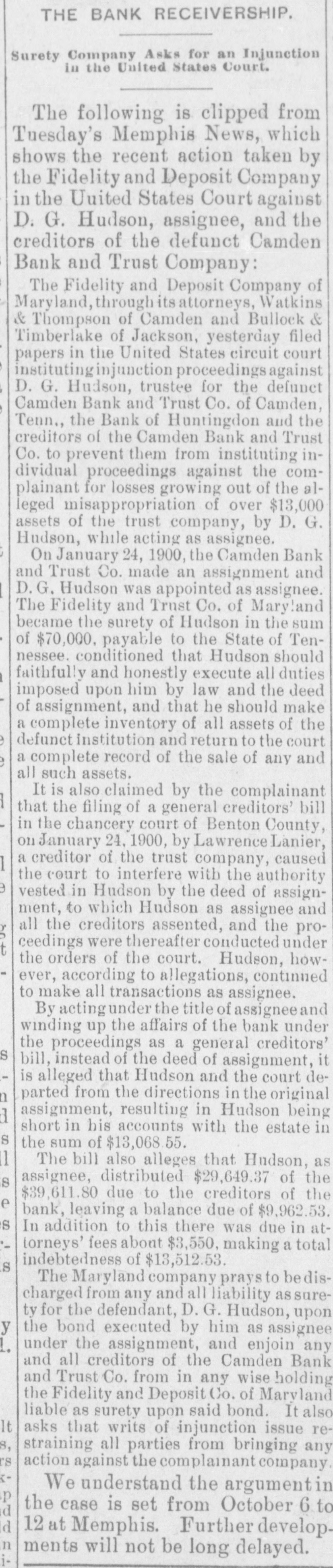

ITS DOORS CLOSED. 'The bank has busted!" Shorn of all details, the above statement, which passed from one to another on the streets of Camden last Friday is a plain statement of a fact. The Camden Bank and Trust Co. has closed it doors, and nearly every business man in town and scores of others were "caught" for various amounts, not a few for large sums, aggregating up in the thousands. The first intimation the public had that anything was wrong was when the bank failed to open its doors as usual last Friday morning. But it seems that Nashville parties, headed by F. O. Watts, were here Thursday night figuring on a deal in which they proposed to purchase a controlling interest and continue the business. Their proposition was .to take $15,000 of the stock at 20 cents on the dollar. This, we understand, was raised to 25 cents by Brownsville and Huntingdon parties, but the stockholders were not willing to accept it, only a few agreeing to make the sacrifice. Capable and influential citizens here offered to buy a controlling interest and assumes the liabilities, but for some reason the bank officials declined this proposition, and SO far all negotiations for a transfer of stock and reopening of the bank have failed. Many reasons have been advanced as the cause for failure, and many rumors have went the rounds, some of them positiveiy startling, but it would be useless to attempt to give details, and we feel safe in saying that it was mainly due to the fact that the concern was short on cash. It has been asserted by those who claim to know, that the available cash at the close of business on Thursday evening, January 18, was less than $500. Be that as it may it is known that a run aggregating $3,000 was made on the bank the day before it closed. In a published interview in the Nashville Banner last Friday the president of the bank, W. E. Mc Rae, states that he knew that the bank was rather hard up, its depos its having fallen away from $70,000 to $40,000 within the year. To bad management may be at tributed some of the present troub les of the bank. It is alleged tha the bank holds paper now that ha passed maturity from one to ever four years. We have endeavored to obtain tangible statement of the actua condition of the bank, but withou success. We are informed, howey or, that the liabilities are abou $41,000. As to the assets, they ar difficult to estimate, but are said be about $50,000 in notes, etc., no including real estate. We are tol