Click image to open full size in new tab

Article Text

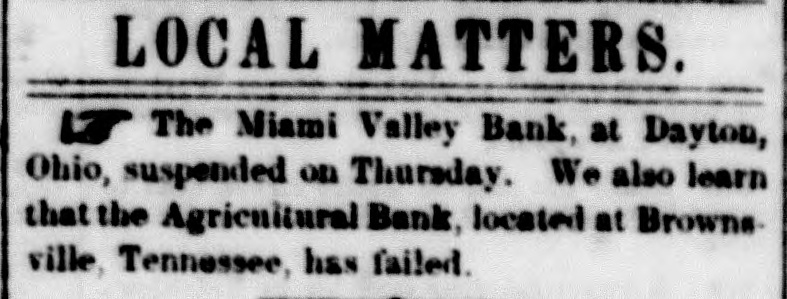

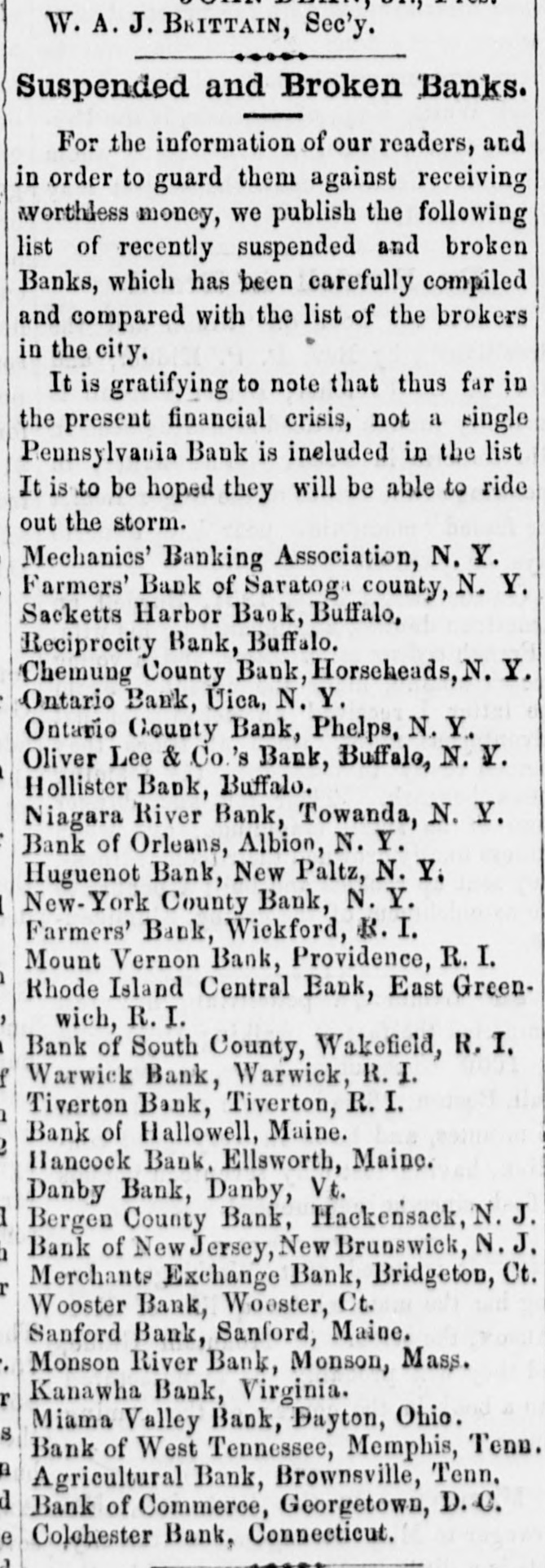

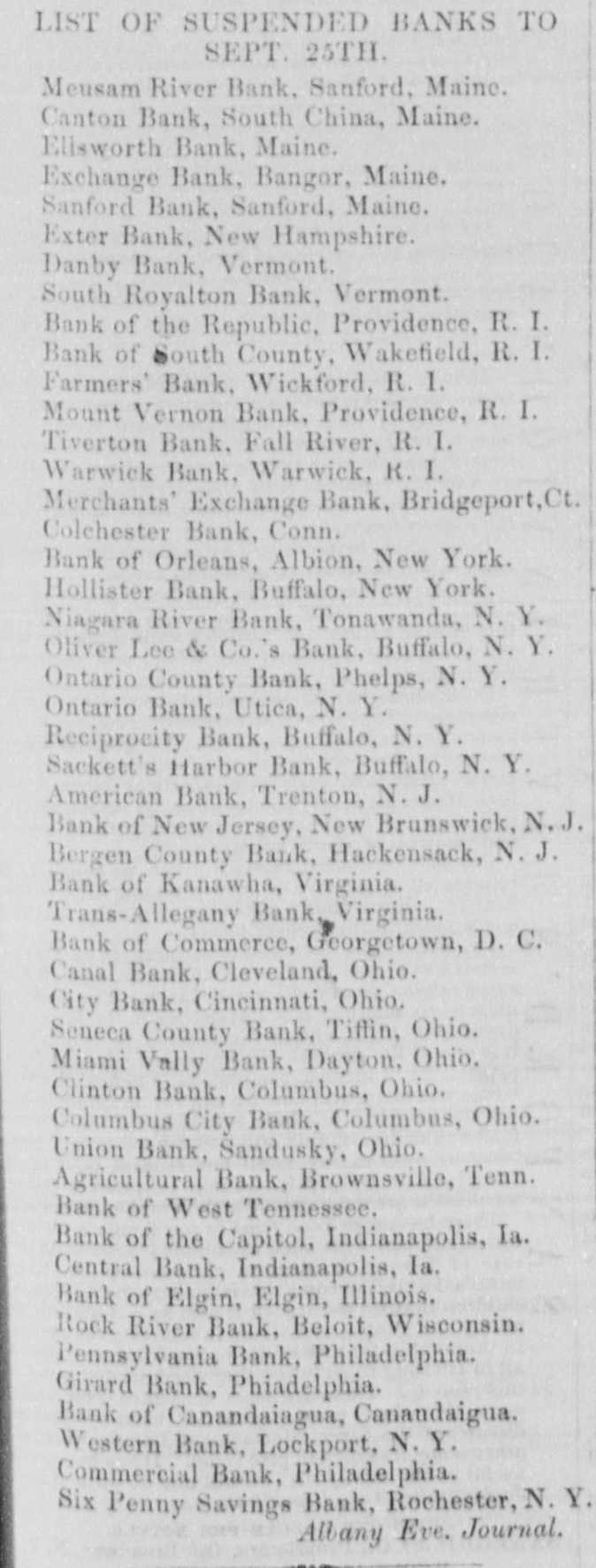

furnished by the banks. Experience driven out the better circulation is always valuable that more worthless- the more circulaby the And yet, sir, this paper not the cheaper. which is su ect to such fluctuation, the tion, drives specie from our country, but more peo- by ple of only the United States annually lose suspensions, depreciation of this currency by and the the total failures, and defalcations, of banking, thousand and other incidental abuses of our govlet us into came than would pay the entire expense the State of ernment. But and see something of what our much own Tennessee have lost by their banks. How Merchants' people lose by the Farmers' and worthbauk did they at Memphis, which now calculation, utterly half suppose, at the lowest lose million less? of dollars. How much did whose they charter by was remember the Central bank at stolen Nashville, through the Legislature? you At least quarter of million Agricultural did they lose by the How much at Brownsvill owned by set of thieving hundred bank From seventy-five to a Yankees? How much by the Miners' histo- and thousand more. bank at Knoxville, whose Manufacturers' believe is similar to that of the suppose Central bank? ry `wenty five thousand more much by the would be safe estimate. How which bank of East Tennessee at Knoxville, all? I supthe most stupendous windle of truth in putwas I would fall far short of the million of pose circulation at half ting down its impossible, in fact, to ascertain dollars. amount It is of circulation this mammoth learn what had out, but *from all I can "wild-cat" safe in setting down at half million. feel How much have they lost by being compelled paper of submit to discounts or shaves on the stock least hundred to the suspended free banks and thousand smaller dollars banks? Thus At we see, sir, that the people of their this more. have within the last few years lost hundred by banks State actual cash, one million, four low thousand dollars. This, think, sir, nothIn this estimate have said Kinestimate. of the losses by the shinplasters" that of ing Chaffin & Kirk, and other of Nor of an estimate cannon, have confined myself to recent the millins dates. of dolhave that made have been and will yet be lost in of con- her of the depreciation in the price induced sequence property and products of the country This-al by the present monetary pressure banking systhis-is but part of the cost of our told that tems to the people. along without And yet banks- we are they cannot commercial get luxury with which no luxury civilized people can dispense. Well, sir, if would say they are rather an LegisOh! sir, wish could prevail upon this laxury our consider the cost of lators woul my to voice could be heard by State-by every man the within the limits of our proud land-that people--the sovereigns of the and could induce them to stop and think, and that sider the cost of this system to them. they might be persuaded never to send who is this hall to make laws for them, man to against banks and bank influe not pledged miracle, Mr. Speaker, that with this Is it not : burthen, this onerous tax upon us, we grievous ever attained unto the degree of prosperity been have now enjoy And oh! sir, had we but free we from this burthen, what people would have been? But, Mr. Speaker, the gentlema from Shelby objected to that provision in the Senate's and which prohibits banks from selling gold silver at any price, and from selling exchange Why, greater premium than two per cent. these banks debts- -they refused to pay sir, them-have suspended, and why Because, as they allege they have not sufficient specie this redeem their And when --when they tell us they have not now specie to redeem their circulation, shall authorise cient them sell or dispose of what specie they have on hand? Would that be guarding, should, the interests of our constituents as who hold their notes? No. sir, no! to They have issued their notes promising demand, and yet when the honest holder presents them and demands payment them they refuse, have the power to compel do so? or at least to see that they do to squander their effects until by legal proceeding what are forced into liquidation? If not, they is our boasted liberty worth? Where cacy of our free institutions? And exchange, the of gold--they ship their gold and check on it, and shall we allow them to refuse to pay their gold to the holder who is justly entiteld to it, and ship New York or Philadelphia and check from five to ten per cent. premium as they are now doing? Why, sir, in times of suspension, these banks fatten and grow rich, and we low them suspended and sell exchange at exorbiant prices they never will resume, and ruin the merchants of the county they need and must have this exchange If will redeem their notes and furnish the mercial with gold, they can perhaps either us them pay the at est debts able They premium it profitable of per infavor limiting furnishing Why, furnish price. banks these of notes thing to-day, allow them to ling soon the their for they will have disposed of all their redeem their Sir, without this provision, the bill would be materially defective us protect the of the -holder, by prohibiting the banks from making way with their and thus postponing indefinitely the period of resumption Again, sir, this Senate bill provides that if any bank shall refuse to accept of its provisions as amendments to charter, the Attorney General shall proceed against it to forfeiture of of charter. This the only means we have compelling them to obey our law af have made it. Why, the law already requires that they shall be paying out specie, and vet they are every day violating and disregarding it. If they disregard laws made by previous to Legislatures, what more respect will they pay those we may enact? We must retain this provision in order to force obedience to our enactments. And, indeed, so well am satisfied of the wisdom of this provision, that if this Legislature refuses to pass it, am then prepared to vote for a resolution directing the Attorney Geberal to have every one of them wound up. But bank advocates here say: If you oppress the banks, the banks will oppress the people," or in other words Mr. Speaker, their position is this: Let the Legislature take care of the banks, and the banks will take care of their constituents. Indeed, sir, when logically considered, the position of bank advocates every where is: Let the Legislature take care of the rich, and the rich will take care of the poor, or the the poor may take care of themselves. poor man, sir, that gets bank accommodations? Are the great mass of the people accommodated by them? By no means. If a poor man gets note discounted at is thought the influence of some rich friend, or perhaps in order to enable him to pay debt he owes some rich man, and then he had as matter of course to be indorsed by men of property. No. sir: the fact of the is, that the poor are always the sufferers by the defaulting, non paying banks and while the banks are solvent they receive no accommodations whatever. Sir, to am not in favor of returning at once