Article Text

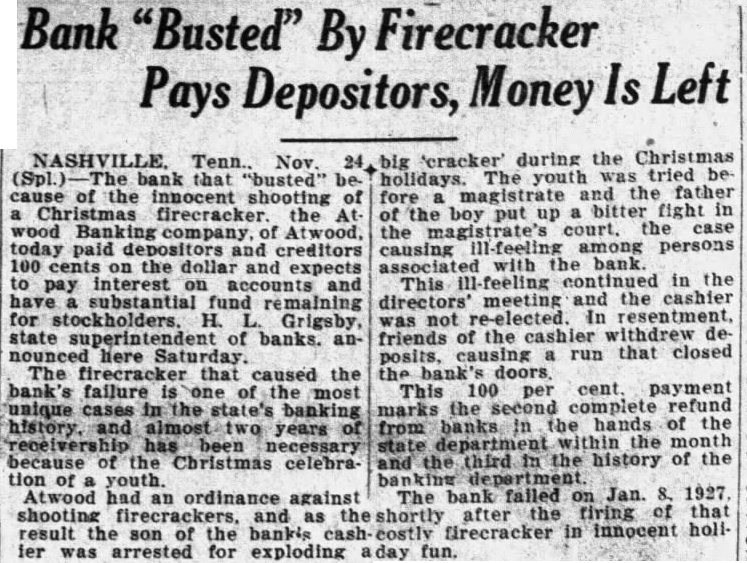

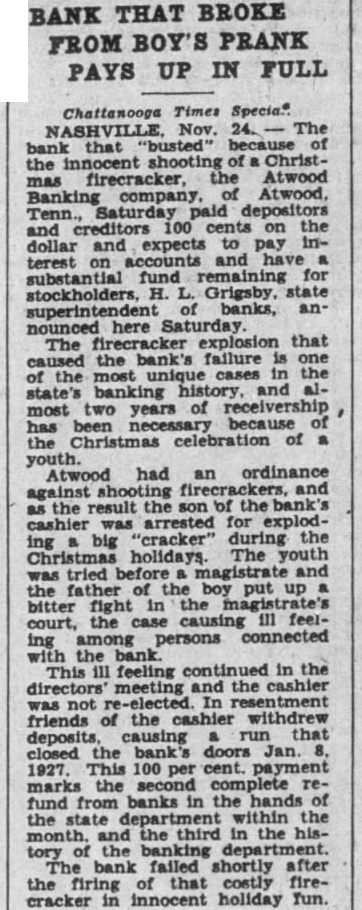

Bank "Busted" By Firecracker Pays Depositors, Money Is Left NASHVILLE. Tenn. Nov. (Spl.) The bank that "busted" because of the innocent shooting of a Christmas firecracker. the At wood Banking company, of Atwood, today paid depositors and creditors 100 cents on the dollar and expects to pay interest on accounts and have substantial fund remaining for stockholders. H. Grigsby, state superintendent of banks. announced here Saturday. The firecracker that caused the bank's failure is one of the most unique cases in the banking history. and almost two years or receivership has been because of the Christmas celebration of youth. Atwood had an ordinance against shooting firecrackers, and as the ier was arrested for exploding aday fun. 24, big 'cracker' during the Christmas holidays. The youth tried be fore magistrate and the father of the boy put up a bitter fight in the magistrate's court. the case causing ill-feeling among persons associated with the bank This ill-feeling continued in the directors' meeting and the cashier was not re-elected. In resentment. friends of the cashier withdrew deposits, causing a run that closed the bank This 100 per cent payment marks the second complete refund from banks in the hands of the state department within the month and the third in the history of the The bank failed on Jan. 8, 1927 after the firing of that shortly