Click image to open full size in new tab

Article Text

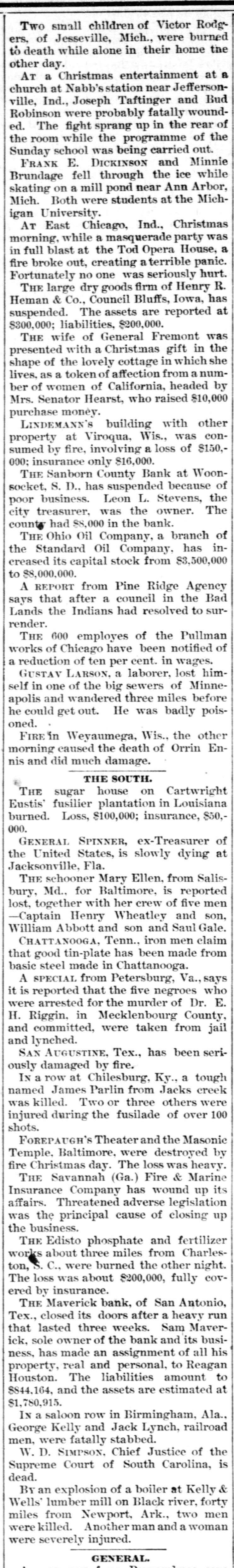

Two small children of Victor Rodgers. of Jesseville, Mich., were burned to death while alone in their home the other day. AT a Christmas entertainment at a church at Nabb'sstation near Jeffersonville, Ind., Joseph Taftinger and Bud Robinson were probably fatally wounded. The fight sprang up in the rear of the room while the programme of the Sunday school was being carried out. FRANK E. DICKINSON and Minnie Brundage fell through the ice while skating on a mill pond near Ann Arbor, Mich. Both were students at the Michigan University. AT East Chicago, Ind., Christmas morning, while a masquerade party was in full blast at the Tod Opera House, a fire broke out, creating a terrible panic. Fortunately no one was seriously hurt. THE large dry goods firm of Henry R. Heman & Co., Council Bluffs, Iowa, has suspended. The assets are reported at $300,000; liabilities, $200,000. THE wife of General Fremont was presented with a Christmas gift in the shape of the lovely cottage in which she lives, as a token of affection from a number of women of California, headed by Mrs. Senator Hearst, who raised $10,000 purchase money. LINDEMANN'S building with other property at Viroqua, Wis., was consumed by fire, involving a loss of $150,000; insurance only $16,000. THE Sanborn County Bank at Woonsocket, S. D., has suspended because of poor business. Leon L. Stevens, the city treasurer, was the owner. The county had $8,000 in the bank. THE Ohio Oil Company, a branch of the Standard Oil Company, has increased its capital stock from $3,500,000 to $8,000,000. A REPORT from Pine Ridge Agency says that after a council in the Bad Lands the Indians had resolved to surrender. THE 600 employes of the Pullman works of Chicago have been notified of a reduction of ten per cent. in wages. GUSTAV LARSON, a laborer, lost himself in one of the big sewers of Minneapolis and wandered three miles before he could get out. He was badly poisoned. FIRE in Weyaumega, Wis., the other morning caused the death of Orrin Ennis and did much damage. THE SOUTH. THE sugar house on Cartwright Eustis' fusilier plantation in Louisiana burned. Loss, $100,000; insurance, $50,000. GENERAL SPINNER, ex-Treasurer of the United States, is slowly dying at Jacksonville, Fla. THE schooner Mary Ellen, from Salisbury, Md., for Baltimore, is reported lost, together with her crew of five men -Captain Henry Wheatley and son, William Abbott and son and Saul Gale. CHATTANOOGA, Tenn., iron men claim that good tin-plate has been made from basic steel made in Chattanooga. A SPECIAL from Petersburg, Va., says it is reported that the five negroes who were arrested for the murder of Dr. E. H. Riggin, in Mecklenbourg County, and committed, were taken from jail and lynched. SAN AUGUSTINE, Tex., has been seriously damaged by fire. IN a row at Chilesburg, Ky., a tough named James Parlin from Jacks creek was killed. Two or three others were injured during the fusilade of over 100 shots. FOREPAUGH'S Theater and the Masonic Temple, Baltimore, were destroyed by fire Christmas day. The loss was heavy. THE Savannah (Ga.) Fire & Marine Insurance Company has wound up its affairs. Threatened adverse legislation was the principal cause of closing up the business. THE Edisto phosphate and fertilizer works about three miles from Charleston, C., were burned the other night. The loss was about $200,000, fully covered by insurance. THE Maverick bank, of San Antonio, Tex., closed its doors after a heavy run that lasted three weeks. Sam Maverick, sole owner of the bank and its business, has made an assignment of all his property, real and personal, to Reagan Houston. The liabilities amount to $844,164, and the assets are estimated at $1,780,915. IN a saloon row in Birmingham, Ala., George Kelly and Jack Lynch, railroad men, were fatally stabbed. W. D. SIMPSON. Chief Justice of the Supreme Court of South Carolina, is dead. By an explosion of a boiler at Kelly & Wells' lumber mill on Black river, forty miles from Newport, Ark., two men were killed. Another man and a woman were severely injured. GENERAL.