Click image to open full size in new tab

Article Text

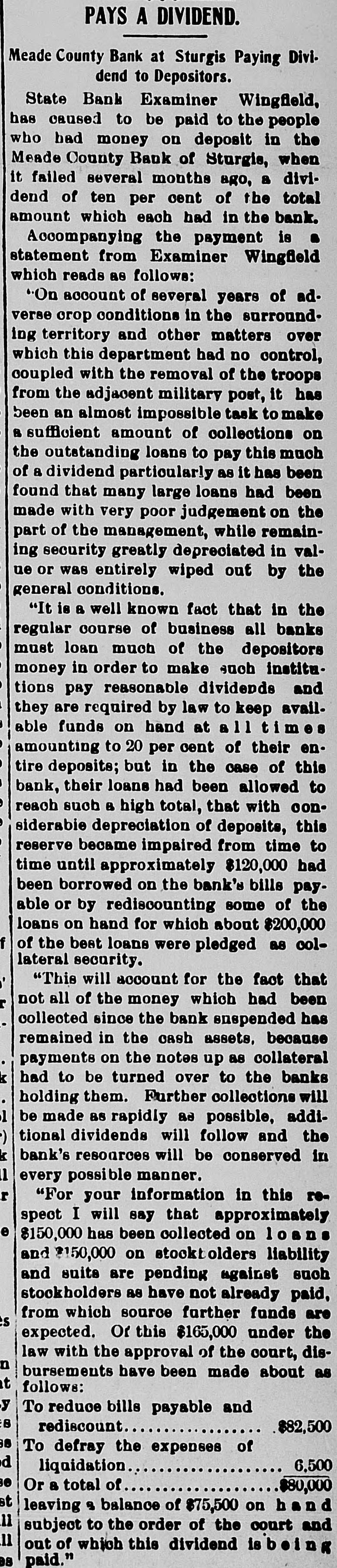

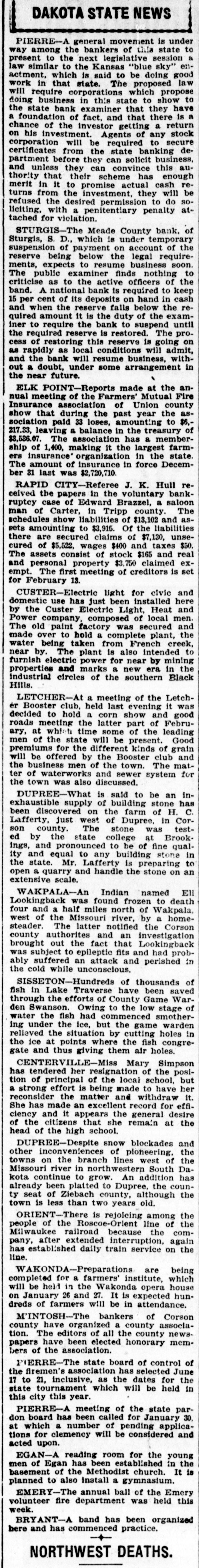

DAKOTA STATE NEWS PIERRE-A general movement is under way among the bankers of this state to present to the next legislative session a law similar to the Kansas "blue sky" enactment, which is said to be doing good work in that state. The proposed law will require corporations which propose doing business in this state to show to the state bank examiner that they have a foundation of fact, and that there is a chance of the investor getting a return on his investment. Agents of any stock corporation will be required to secure certificates from the state banking department before they can solicit business, and unless they can convince this authority that their scheme has enough merit in it to promise actual cash returns from the investment, they will be refused the desired permission to do soliciting, with a penitentiary penalty attached for violation. STURGIS-The Meade County bank. of Sturgis, S. D., which is under temporary suspension of payment on account of the reserve being below the legal requirements, expects to resume business soon. The public examiner finds nothing to criticise as to the active officers of the band. A national bank is required to keep 15 per cent of its deposits on hand in cash and when the reserve falls below the required amount it is the duty of the examiner to require the bank to suspend until the required reserve is restored. The process of restoring this reserve is going on as rapidly as local conditions will admit, and the bank will resume business, without a doubt, under some arrangement in the near future. ELK POINT-Reports made at the annual meeting of the Farmers' Mutual Fire Insurance association of Union county show that during the past year the association paid 33 loses, amounting to $6.217.33, leaving a balance in the treasury of $3,536.07. The association has a membership of 1,400, making it the largest farmers insurance organization in the state. The amount of insurance in force December 31 last was $2,720,710. RAPID CITY-Referee J. K. Hull received the papers in the voluntary bankruptcy case of Edward Brazzel, a saloon man of Carter, in Tripp county. The schedules show liabilities of $13,102 and assets amounting to $3,915. Of the liabilities there are secured claims of $7,130, unsecured of $5,522. wages $400 and taxes $50. The assets consist of stock $165 and real and personal property $3,750 claimed exempt. The first meeting of creditors is set for February 13. CUSTER-Electric light for civic and domestic use has just been installed here by the Custer Electric Light, Heat and Power company, composed of local men. The old paint factory was secured and made over to hold a complete plant, the water being taken from French creek, near by. The plant is also intended to furnish electric power for near by mining properties and marks a new era in the industrial circles of the southern Black Hills. LETCHER-At a meeting of the Letcher Booster club. held last evening it was decided to hold a corn show and good roads meeting the latter part of February, at which time some of the leading men of the state will be present. Good premiums for the different kinds of grain will be offered by the Booster club and the business men of the town. The matter of waterworks and sewer system for the town was also discussed. DUPREE-What is said to be an inexhaustible supply of building stone has been discovered on the farm of H. C. Lafferty, just west of Dupree, in Corson county. The stone was tested by the state college at Brookings, and pronounced to be of fine quality and equal to any building stone in the state. Mr. Lafferty is preparing to open a quarry and handle the stone on an extensive scale. WAKPALA-An Indian named Ell Lookingback was found frozen to death four and a half miles north of Wakpala, west of the Missouri river, by a homesteader. The latter notified the Corson county authorites and an investigation brought out the fact that Lookingback was subject to epileptic fits and had probably suffered an attack and perished in the cold while unconscious. SISSETON-Hundreds of thousands of fish in Lake Traverse have been saved through the efforts of County Game Warden Swanson. Owing to the low stage of water the fish had commenced smothering under the ice, but the game warden relieved the situation by cutting holes in the ice at points where the fish congregate and thus giving them air holes. CENTERVILLE-Miss Mary Simpson has tendered her resignation of the position of principal of the local school, but a strong effort is being made to have her reconsider the matter and withdraw it. She has made an excellent record for efficiency and it appears the general desire of the citizens that she remain at the head of the high school. DUPREE-Despite snow blockades and other inconveniences of pioneering, the towns on the branch lines west of the Missouri river in northwestern South Dakota continue to grow. An addition has already been platted to Dupree, the county seat of Ziebach county, although the town is less than two years old. ORIENT-There is rejoicing among the people of the Roscoe-Orient line of the Milwaukee railroad because the company, after extended interruption, again has established daily train service on the line. WAKONDA-Preparations are being completed for a farmers' institute, which will be held in the Wakonda opera house on January 26 and 27. It is expected hundreds of farmers will be in attendance. MINTOSH-The bankers of Corson county have organized a county association. The editors of all the county newspapers have been elected honorary members of the association. PIERRE-The state board of control of the firemen's association has selected June 17 to 21, inclusive, as the dates for the state tournament which will be held in this city this year. PIERRE-A meeting of the state pardon board has been called for January 30, at which a number of pending applications for clemency will be considered and acted upon. EGAN-A reading room for the young men of Egan has been established in the basement of the Methodist church. It is planned to also Install a gymnasium. EMERY-The annual ball of the Emery volunteer fire department was held this week. BRYANT-A band has been organized here and has commenced practice. NORTHWEST DEATHS.