Article Text

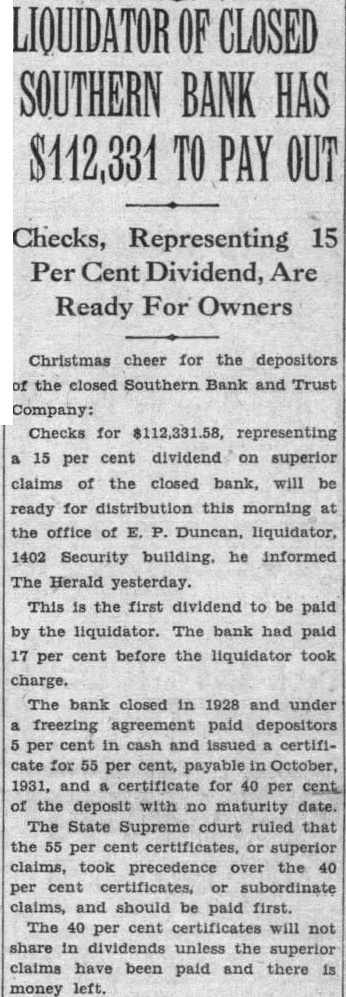

Checks, Representing 15 Per Dividend, Are Ready For Owners Christmas cheer for the depositors the closed Southern Bank and Trust Company: Checks for $112,331.58, representing 15 per cent dividend superior claims of the closed bank, will ready for distribution this morning the office Duncan, liquidator, 1402 Security building, he informed The Herald yesterday. This the first dividend to be paid the liquidator. The bank had paid per cent before the liquidator took charge. The bank closed in 1928 and under freezing agreement paid depositors per cent in cash issued certififor cent, payable October, 1931, and certificate for 40 per the deposit with no The State ruled that 55 per certificates, superior claims, took precedence over the per cent certificates, subordinate claims, and should be paid first. The per cent certificates will not share dividends unless the superior claims have been paid and there money left.