Article Text

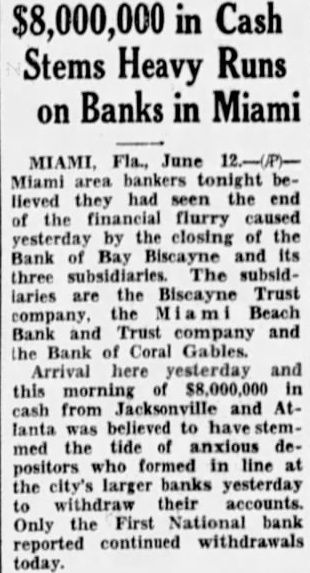

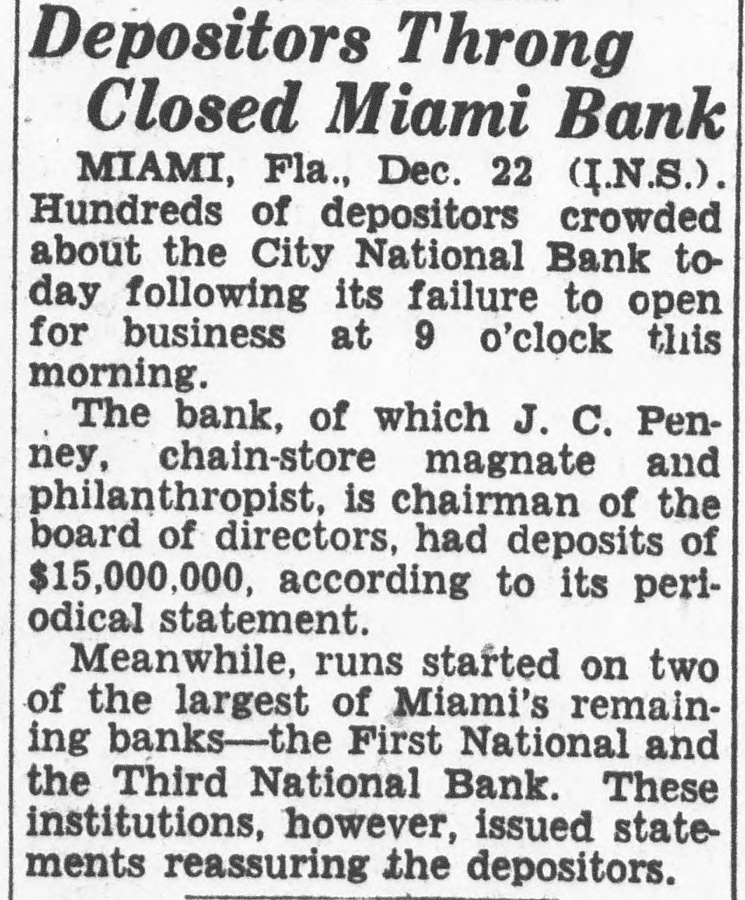

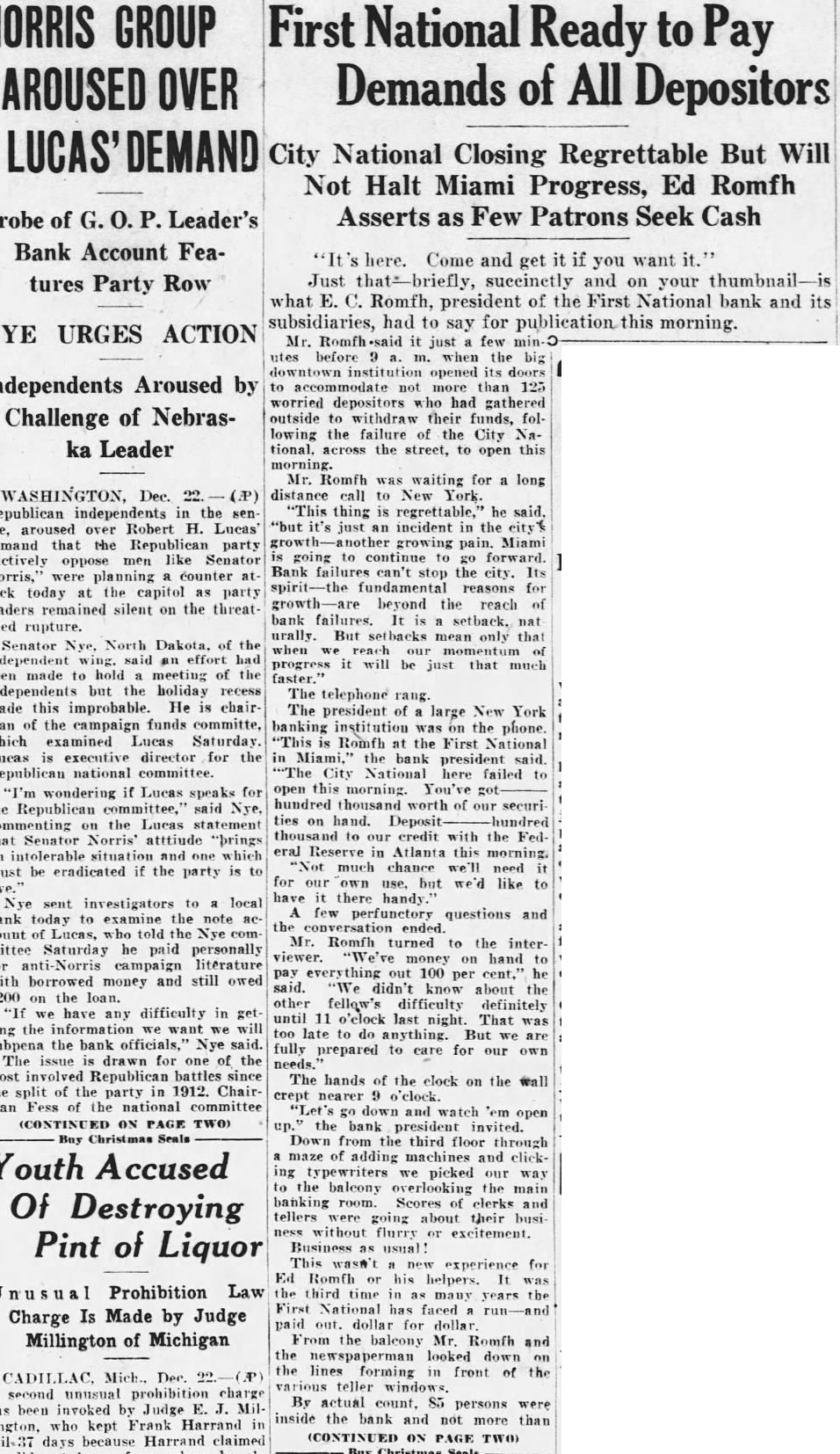

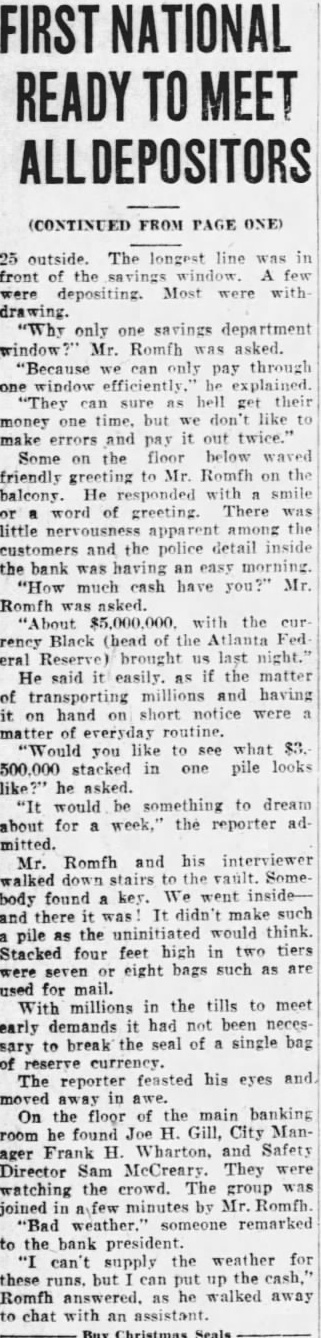

HEAVY ON Bay of Biscayne, Oldest pository in City, Fails to Open Forcing Affiliated Group Shut. $2,000,000 IN CASH SENT BY AIRPLANE Reserve Governor More Is Being Totals Announced. By the Associated Press. MIAMI, Fla., June The Bank of Bay Biscayne, with deposits of $15,037,198. as of March 27 statement, and three affiliated depositoories, failed to open for business today. statement by directors of the bank attributed closing to "recent substantial The affiliated banks the Biscayne Trust the Miami Beach Bank Trust and the Bank of Coral Gables. The Bank of Bay Biscayne in its quarterly statement showed posits and total sources man is president of the bank. The Bank of Bay Biscayne is Miami's oldest bank. It has one of the finest buildings in the structure. Resources of Other Banks. The Biscayne Trust Co. had deposits and The Miami Beach Bank Trust Co. had deposits of 943 and resources of The Bank of Coral Gables, the third of the affiliated had deposits of and sources of Romfh, president of the First National Bank, said that left by plane today from the Federal depository He said the First National Bank and its has on hand to pay all depositors, if necessary. Depositors were orderly as they made during the morning from other banks of the and suburbs. from other banks here up to the closing time were made orderly fashion. Bank of. ficials and available funds not by Plane. E. president of the First National Bank, said Laurie Yonce, Jacksonville pilot, had landhere shortly after with in cash which he brought from the Federal depository in Hugh H. Gordon president the City Bank, said that approximately $350,000 had been withdrawn from his bank up m. and that the doors of the depository would be kept open as long depositors Romfh said 000 had been withdrawn from the First National Bank today. telegram signed by Black, governor of the Federal District in was postin the window of the Third National Bank which shid was route to Miami banks. 10,000 Depositors Affected. depositors in Miami, Miami Beach and Coral Gables were affected by the bank closings. President Gilman of the Bank of Bay Biscayne said: of the directors this after consultation with the State Comptroller, decided not open this bank and tions, the Biscayne Trust Co., Beach Bank Trust Co. and the Bank Coral order to protect all of our depositors to the fullest extent. decision was made after due consideration was due to substantial Arthur Saarinen, bank iner, charge the bank. The bank's include loans and discounts amounting to and securities and commercial and bonds valued at June The Bank of Homestead closed doors this morning today after opening short time. AssistCashier H. Grady Smith said the bank was in condition good and that of business suspension but temporary, avoid account of bank failures today Miami. He said the bank pects to open few days. Reserve Governor Is Being Sent Miami. June Black, of district the Bank, said today that being Continued on Column