1.

November 28, 1907

Albuquerque Morning Journal

Albuquerque, NM

Click image to open full size in new tab

Article Text

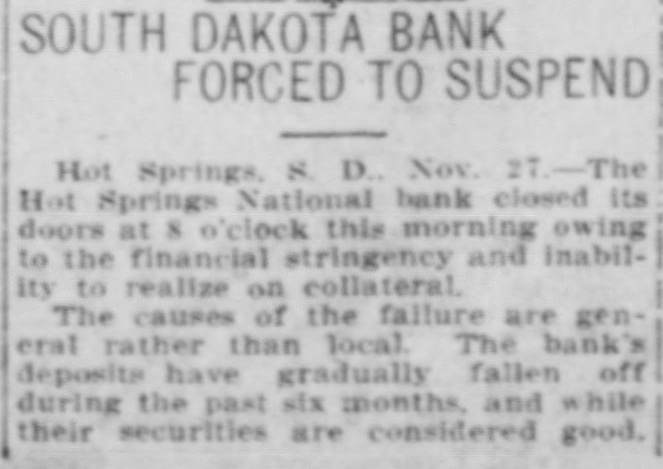

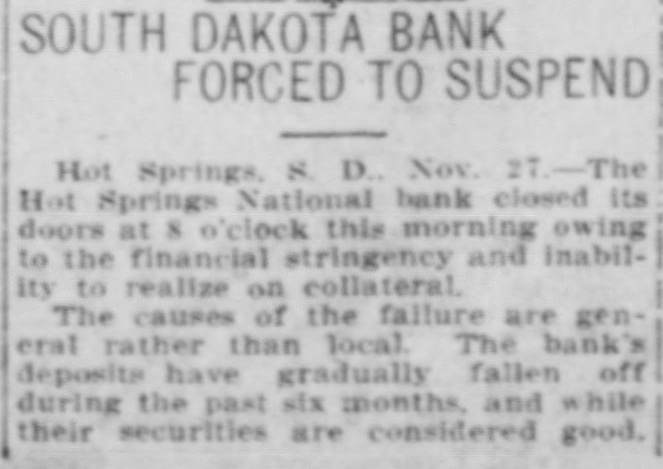

SOUTH DAKOTA BANK FORCED TO SUSPEND Hot Springs, 8. D., Nov. 27.-The Hot Springs National bank closed its doors at 8 o'clock this morning owing to the financial stringency and inability to realize on collateral. The causes of the failure are general rather than local. The bank's deposits have gradually fallen off during the past six months, and while their securities are considered good.

2.

November 28, 1907

Omaha Daily Bee

Omaha, NE

Click image to open full size in new tab

Article Text

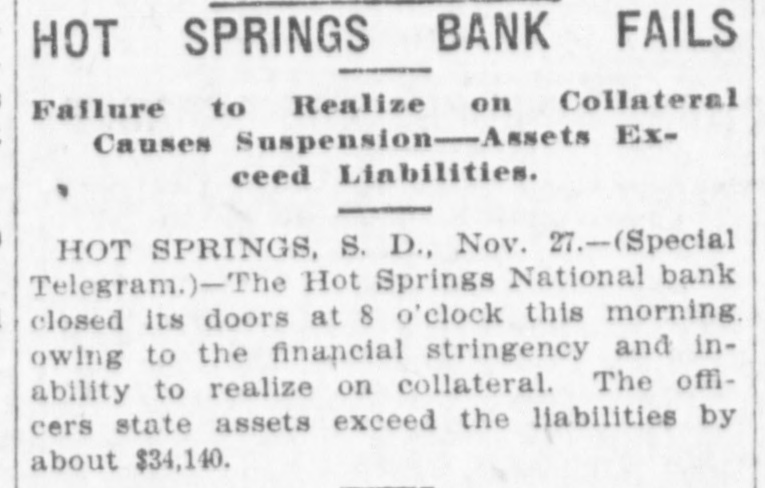

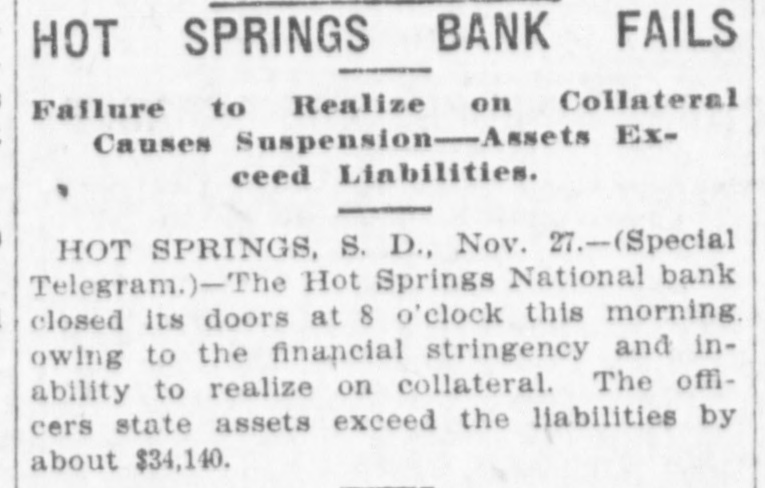

HOT SPRINGS BANK FAILS Failure to Realize on Collateral Causes Suspension- Assets Exceed Liabilities. HOT SPRINGS, S. D., Nov. 27.-(Special Telegram.)-The - Hot Springs National bank closed its doors at 8 o'clock this morning owing to the financial stringency and inability to realize on collateral. The officers state assets exceed the liabilities by about $34,140.

3.

November 29, 1907

Hot Springs Weekly Star

Hot Springs, SD

Click image to open full size in new tab

Article Text

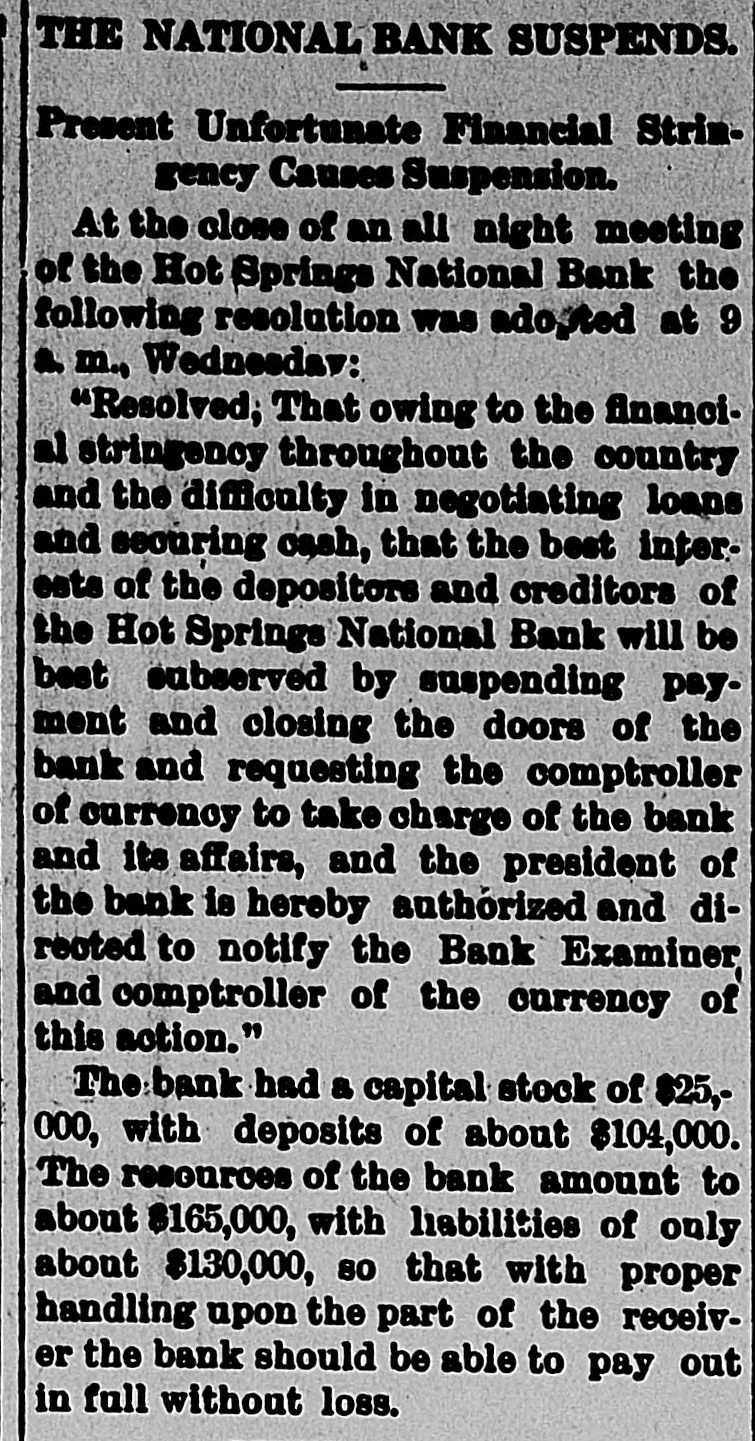

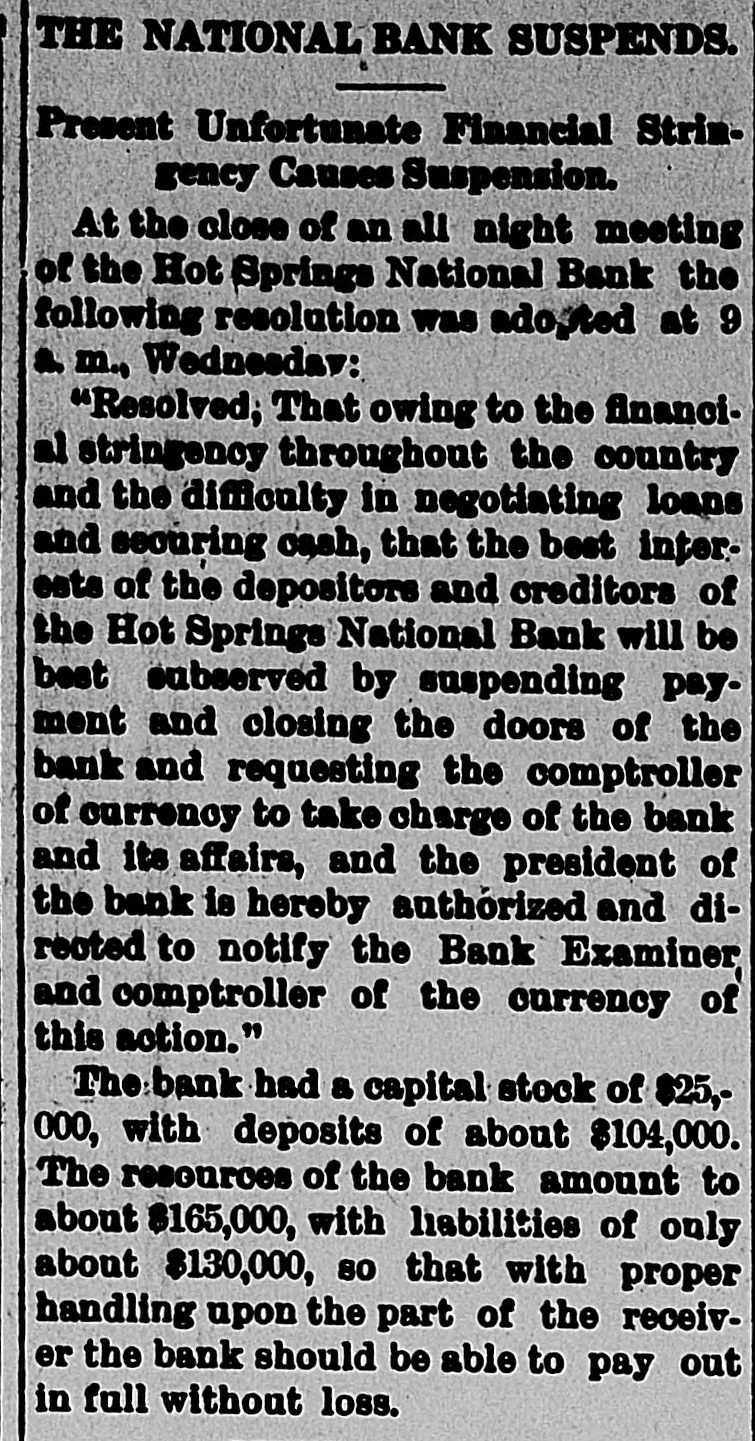

THE NATIONAL BANK SUSPENDS. Present Unfortunate Financial Stringency Causes Suspension. At the close of an all night meeting of the Hot Springs National Bank the following resolution was adopted at 9 a m., Wedneeday: "Resolved, That owing to the financial stringency throughout the country and the difficulty in negotiating loans and securing cash, that the best interests of the depositors and creditors of the Hot Springs National Bank will be best subserved by suspending pay. ment and closing the doors of the bank and requesting the comptroller of currency to take charge of the bank and its affairs, and the president of the bank is hereby authorized and dirooted to notify the Bank Examiner and comptroller of the currency of this action." The bank had a capital stock of $25,000, with deposits of about $104,000. The resources of the bank amount to about $165,000, with liabilities of only about $130,000, 80 that with proper handling upon the part of the receiver the bank should be able to pay out in full without loss.

4.

November 29, 1907

The Black Hills Union and Western Stock Review

Rapid City, SD

Click image to open full size in new tab

Article Text

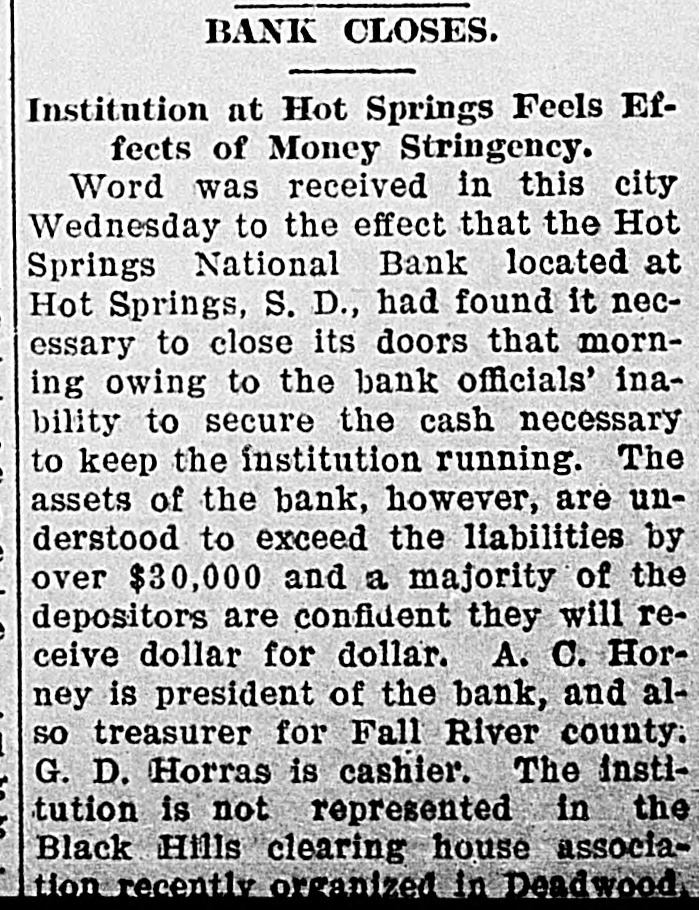

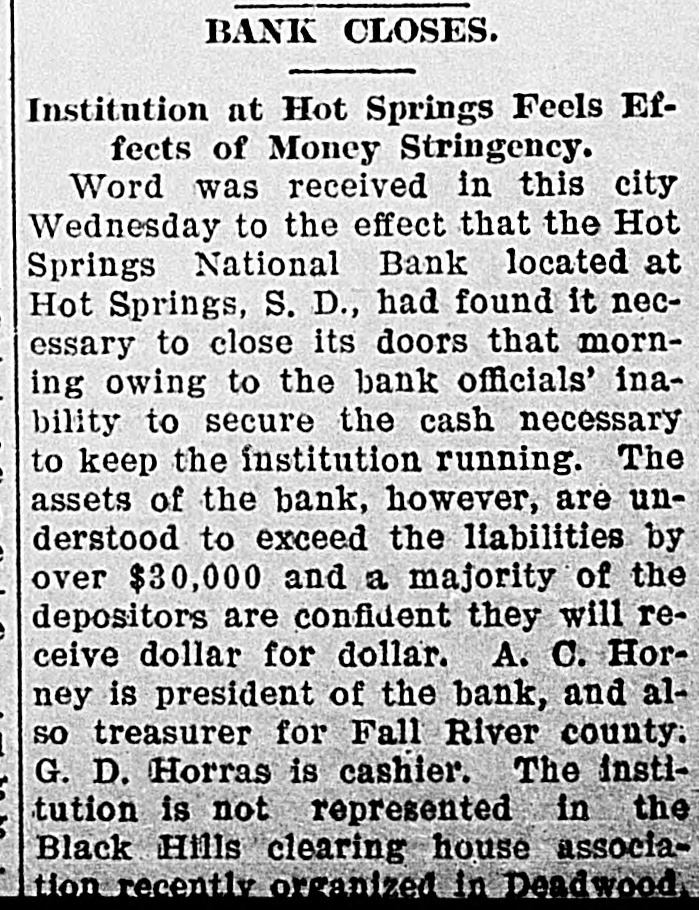

BANK CLOSES. / Institution at Hot Springs Feels Effects of Money Stringency. Word was received in this city Wednesday to the effect that the Hot Springs National Bank located at Hot Springs, S. D., had found it necessary to close its doors that morning owing to the bank officials' inability to secure the cash necessary to keep the institution running. The assets of the bank, however, are understood to exceed the liabilities by over $30,000 and a majority of the depositors are confident they will receive dollar for dollar. A. C. Horney is president of the bank, and also treasurer for Fall River county. G. D. Horras is cashier. The institution is not represented in the Black Hills clearing house association recently organized in Deadwood

5.

November 30, 1907

Custer Weekly Chronicle

Custer, SD

Click image to open full size in new tab

Article Text

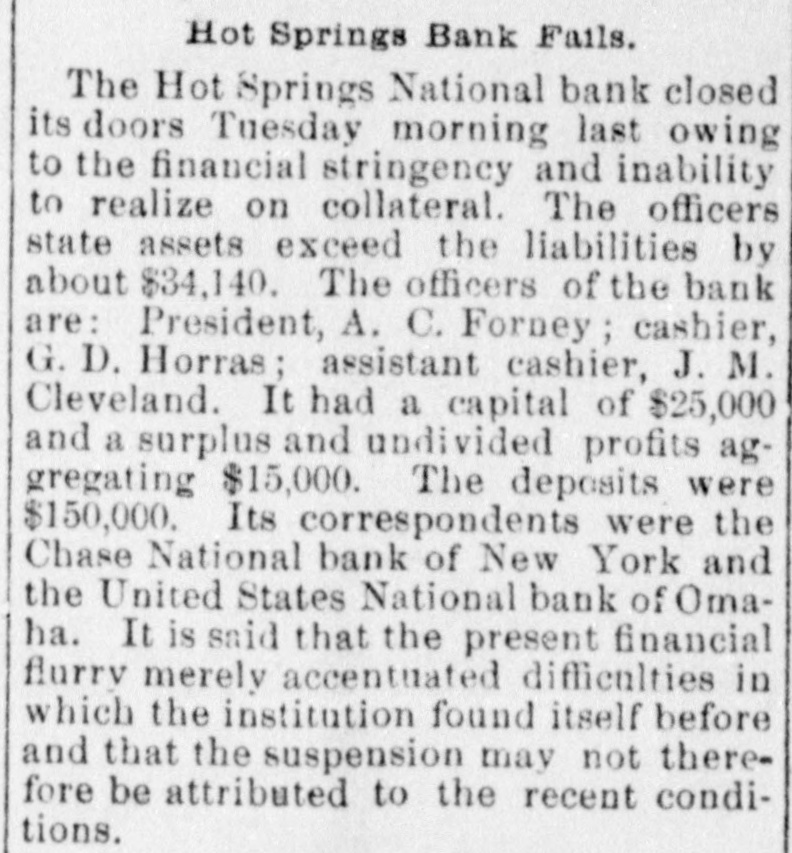

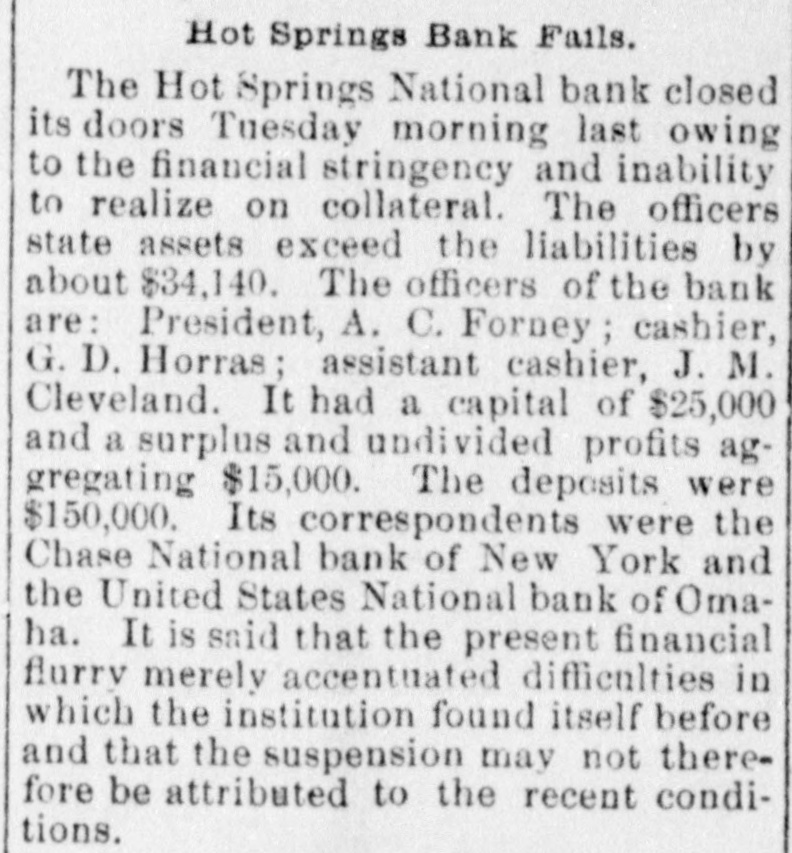

Hot Springs Bank Fails. The Hot Springs National bank closed its doors Tuesday morning last owing to the financial stringency and inability to realize on collateral. The officers state assets exceed the liabilities by about $34,140. The officers of the bank are: President, A. C. Forney; cashier, G. D. Horras; assistant cashier, J. M. Cleveland. It had a capital of $25,000 and a surplus and undivided profits aggregating $15,000. The deposits were $150,000. Its correspondents were the Chase National bank of New York and the United States National bank of Omaha. It is said that the present financial flurry merely accentuated difficulties in which the institution found itself before and that the suspension may not therefore be attributed to the recent conditions.

6.

December 12, 1907

The Dakota Chief

Gann Valley, SD

Click image to open full size in new tab

Article Text

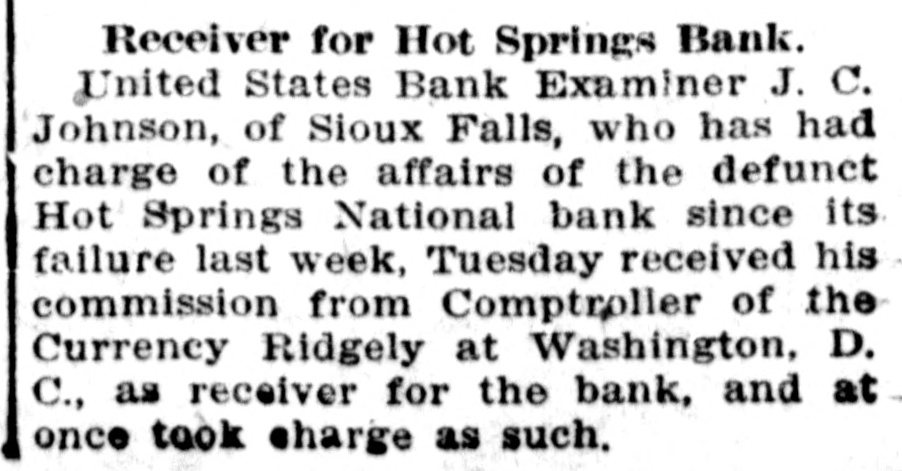

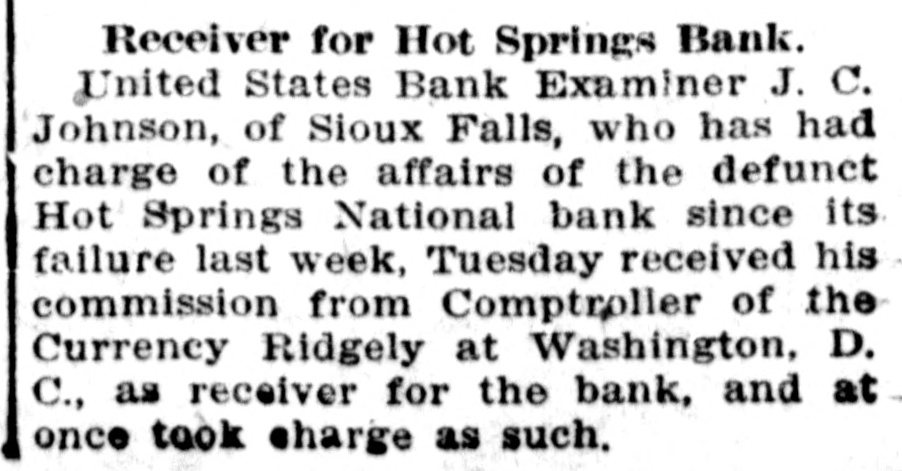

Receiver for Hot Springs Bank. United States Bank Examiner J. C. Johnson, of Sioux Falls, who has had charge of the affairs of the defunct Hot Springs National bank since its failure last week, Tuesday received his commission from Comptroller of the Currency Ridgely at Washington, D. C., as receiver for the bank, and at once took charge as such.

7.

January 17, 1908

Kingsbury County Independent

Desmet, SD

Click image to open full size in new tab

Article Text

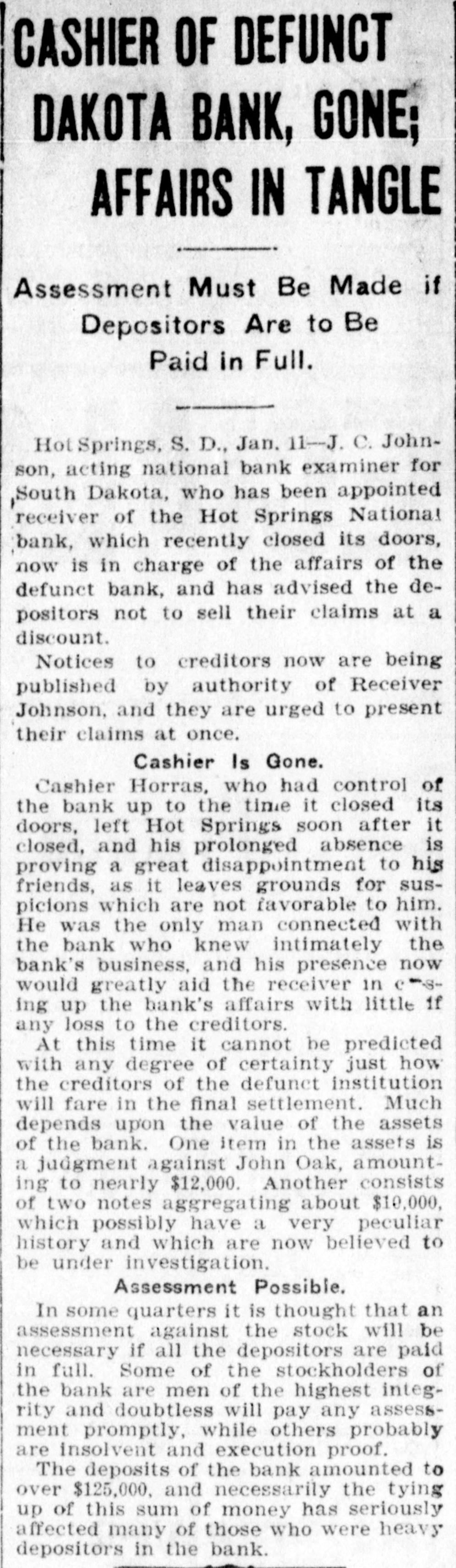

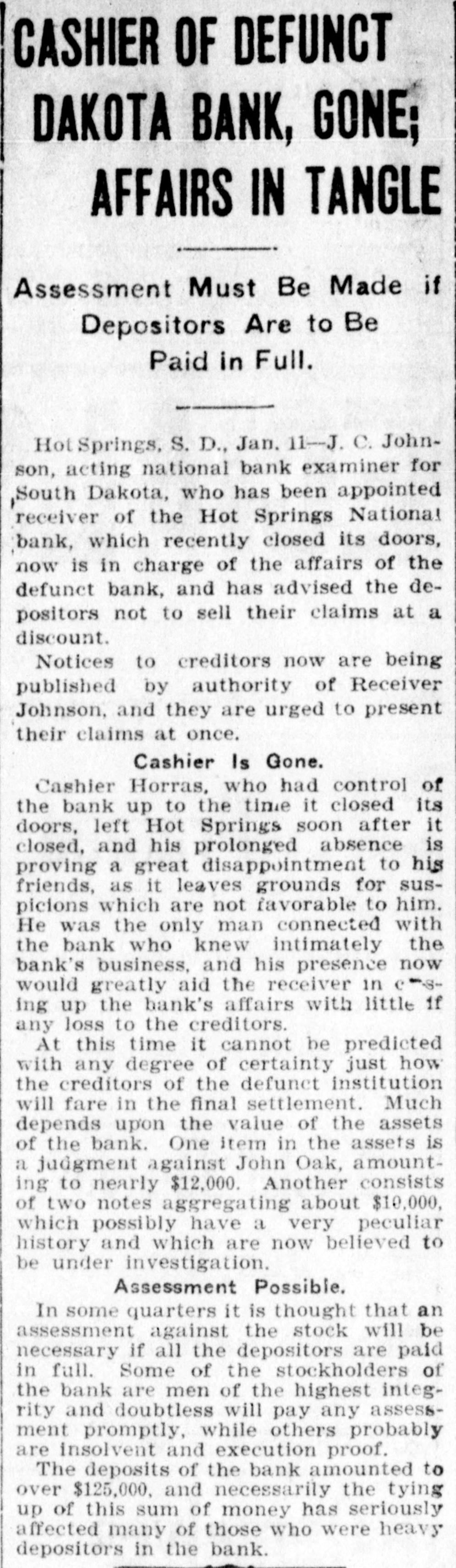

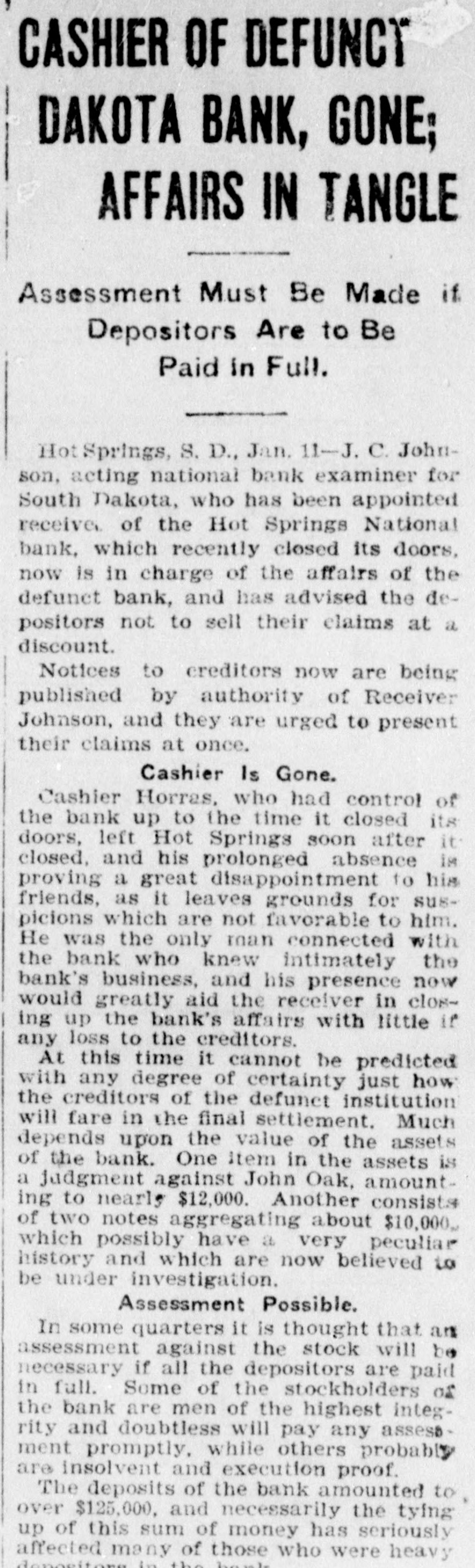

CASHIER OF DEFUNCT DAKOTA BANK, GONE; AFFAIRS IN TANGLE Assessment Must Be Made if Depositors Are to Be Paid in Full. Hot Springs, S. D., Jan. 11-J. C. Johnson, acting national bank examiner for South Dakota, who has been appointed receiver of the Hot Springs National bank, which recently closed its doors, now is in charge of the affairs of the defunct bank, and has advised the depositors not to sell their claims at a discount. Notices to creditors now are being published by authority of Receiver Johnson, and they are urged to present their claims at once. Cashier Is Gone. Cashier Horras, who had control of the bank up to the time it closed its doors, left Hot Springs soon after it closed, and his prolonged absence is proving a great disappointment to his friends, as it leaves grounds for suspicions which are not favorable to him. He was the only man connected with the bank who knew intimately the bank's business, and his presence now would greatly aid the receiver in e-sing up the bank's affairs with little if any loss to the creditors. At this time it cannot be predicted with any degree of certainty just how the creditors of the defunct institution will fare in the final settlement. Much depends upon the value of the assets of the bank. One item in the assets is a judgment against John Oak, amounting to nearly $12,000. Another consists of two notes aggregating about $10,000, which possibly have a very peculiar history and which are now believed to be under investigation. Assessment Possible. In some quarters it is thought that an assessment against the stock will be necessary if all the depositors are paid in full. Some of the stockholders of the bank are men of the highest integrity and doubtless will pay any assessment promptly, while others probably are insolvent and execution proof. The deposits of the bank amounted to over $125,000, and necessarily the tying up of this sum of money has seriously affected many of those who were heavy depositors in the bank.

8.

January 18, 1908

Custer Weekly Chronicle

Custer, SD

Click image to open full size in new tab

Article Text

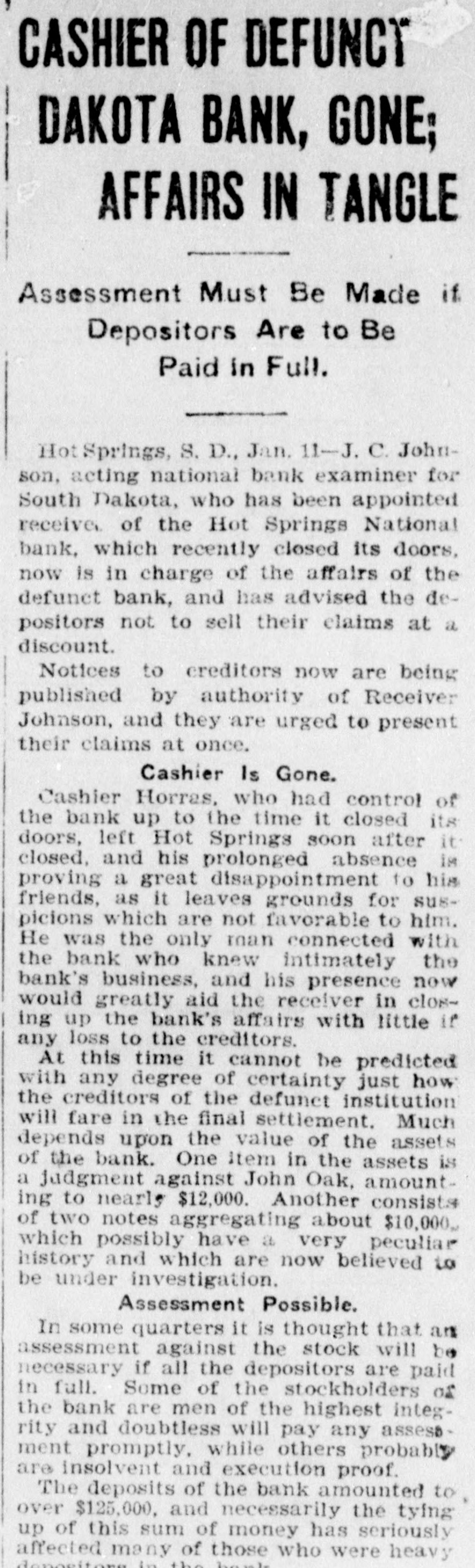

CASHIER OF DEFUNCT DAKOTA BANK, GONE; AFFAIRS IN TANGLE Assessment Must Be Made if Depositors Are to Be Paid in Full. Hot Springs, S. D., Jan. 11-J. C. Johnson, acting national bank examiner for South Dakota, who has been appointed receive. of the Hot Springs National bank, which recently closed its doors, now is in charge of the affairs of the defunct bank, and has advised the depositors not to sell their claims at a discount. Notices to creditors now are being published by authority of Receiver Johnson, and they are urged to present their claims at once. Cashier Is Gone. Cashier Horras, who had control of the bank up to the time it closed its doors, left Hot Springs soon after it' closed, and his prolonged absence is proving a great disappointment to his friends, as it leaves grounds for suspicions which are not favorable to him. He was the only man connected with the bank who knew intimately the bank's business, and his presence now would greatly aid the receiver in closing up the bank's affairs with little if any loss to the creditors. At this time it cannot be predicted with any degree of certainty just how the creditors of the defunct institution will fare in the final settlement. Much depends upon the value of the assets of the bank. One Item in the assets is a judgment against John Oak, amounting to nearly $12,000. Another consists of two notes aggregating about $10,000 which possibly have a very peculiar history and which are now believed to be under investigation. Assessment Possible. In some quarters it is thought that an assessment against the stock will be necessary if all the depositors are paid in full. Some of the stockholders of the bank are men of the highest integrity and doubtless will pay any assessment promptly, while others probably are insolvent and execution proof. The deposits of the bank amounted to over $125,000, and necessarily the tying up of this sum of money has seriously affected many of those who were heavy denositore the

9.

January 23, 1908

The Citizen-Republican

Scotland, Parkston, SD

Click image to open full size in new tab

Article Text

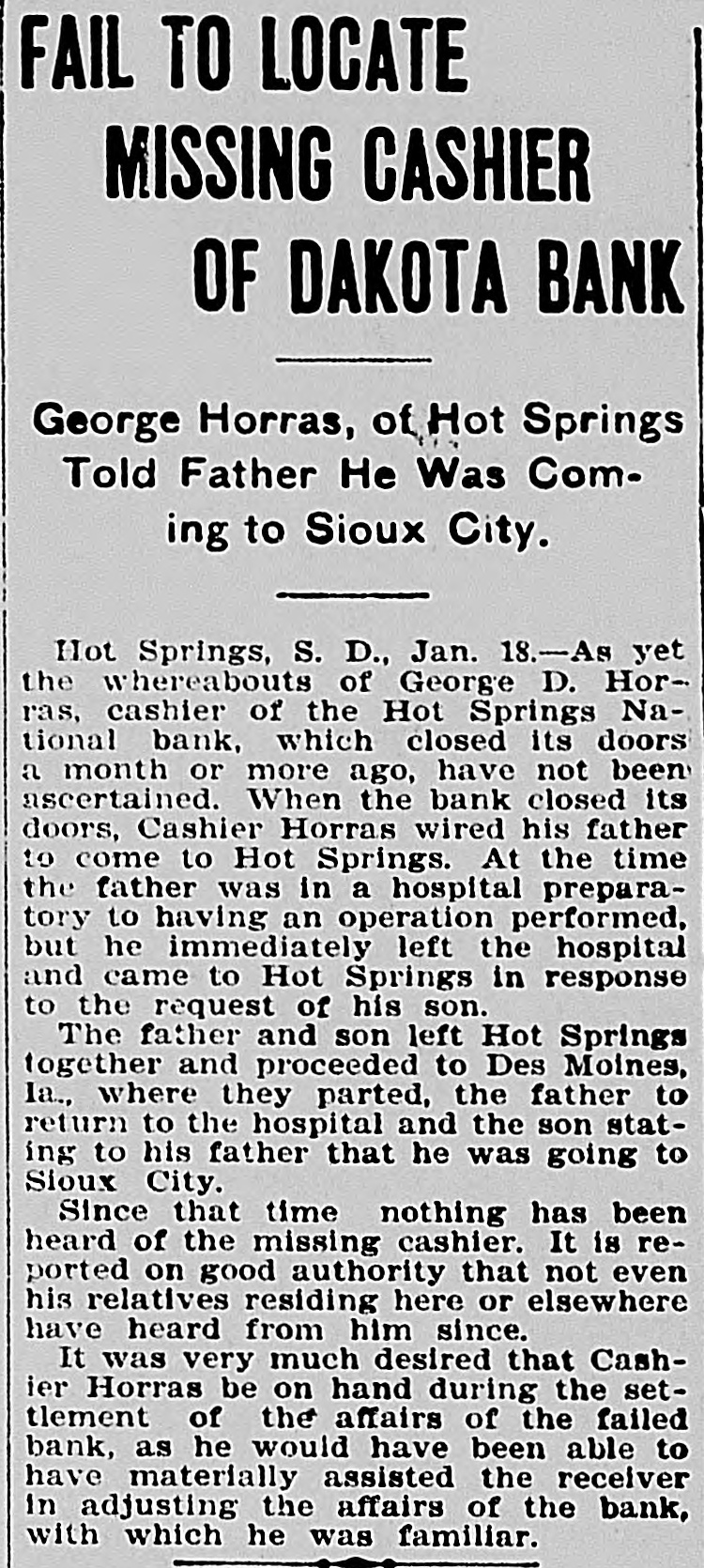

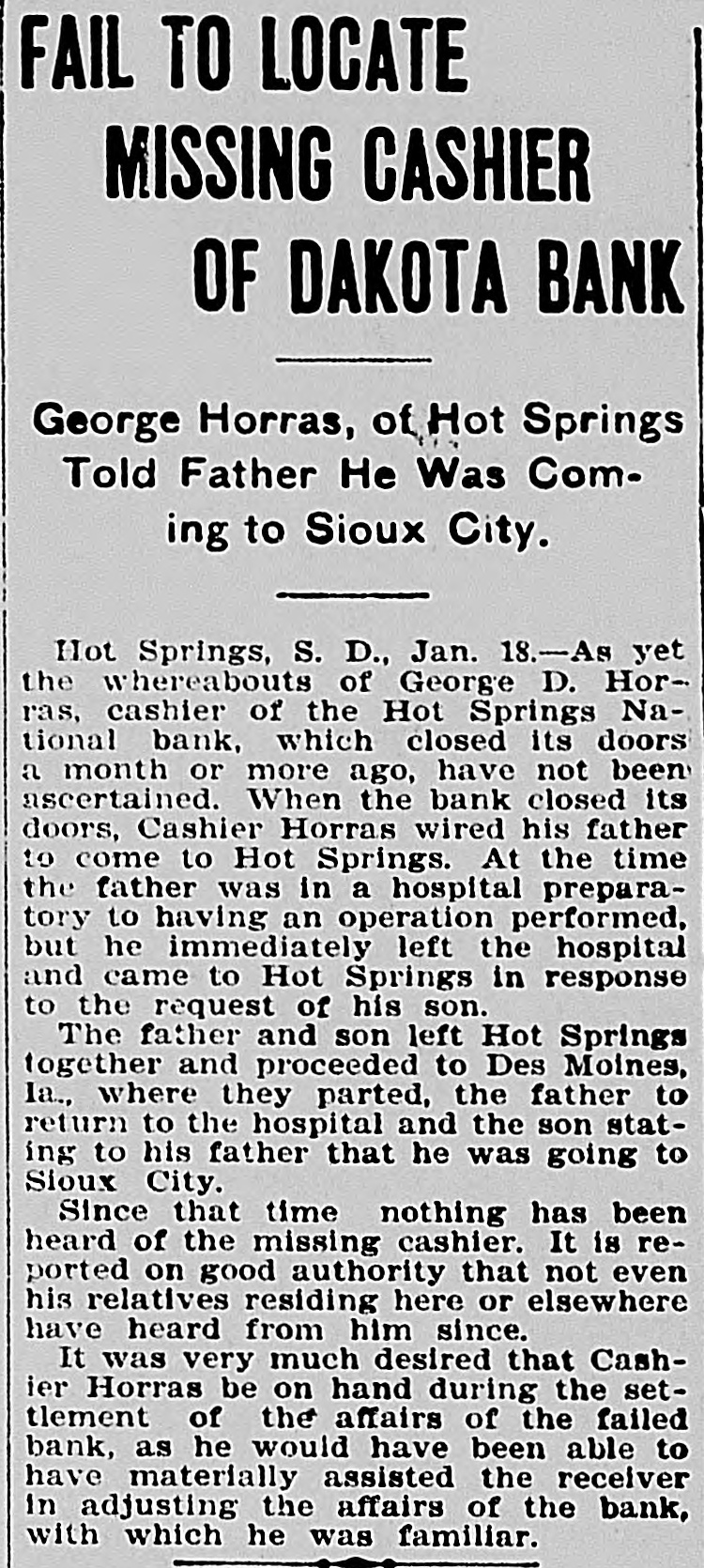

FAIL TO LOCATE MISSING CASHIER OF DAKOTA BANK George Horras, of Hot Springs. Told Father He Was Coming to Sioux City. Hot Springs, S. D., Jan. 18.-As yet the whereabouts of George D. Horras, cashier of the Hot Springs National bank, which closed its doors a month or more ago, have not been ascertained. When the bank closed its doors, Cashier Horras wired his father to come to Hot Springs. At the time the father was in a hospital preparatory to having an operation performed, but he immediately left the hospital. and came to Hot Springs in response to the request of his son. The father and son left Hot Springs. together and proceeded to Des Moines, la., where they parted, the father to return to the hospital and the son stating to his father that he was going to Sioux City. Since that time nothing has been heard of the missing cashier. It is reported on good authority that not even his relatives residing here or elsewhere have heard from him since. It was very much desired that Cashier Horras be on hand during the settlement of the affairs of the failed bank, as he would have been able to have materially assisted the receiver in adjusting the affairs of the bank, with which he was familiar.

10.

January 24, 1908

The Mitchell Capital

Mitchell, SD

Click image to open full size in new tab

Article Text

FAIL TO LOCATE MISSING CASHIER OF DAKOTA BANK George Horras, of Hot Springs Told Father He Was Coming to Sioux City. Hot Springs, S. D., Jan. 18.-As yet the whereabouts of George D. Horras, cashier of the Hot Springs National bank, which closed its doors a month or more ago, have not been ascertained. When the bank closed its doors, Cashier Horras wired his father to come to Hot Springs. At the time the father was in a hospital preparatory to having an operation performed, but he immediately left the hospital and came to Hot Springs in response to the request of his son. The father and son left Hot Springs together and proceeded to Des Moines, Ia., where they parted, the father to return to the hospital and the son stating to his father that he was going to Sioux City. Since that time nothing has been heard of the missing cashier. It is reported on good authority that not even his relatives residing here or elsewhere have heard from him since. It was very much desired that Cashier Horras be on hand during the settlement of the affairs of the failed bank, as he would have been able to have materially assisted the receiver in adjusting the affairs of the bank, with which he was familiar.

11.

January 24, 1908

Hot Springs Weekly Star

Hot Springs, SD

Click image to open full size in new tab

Article Text

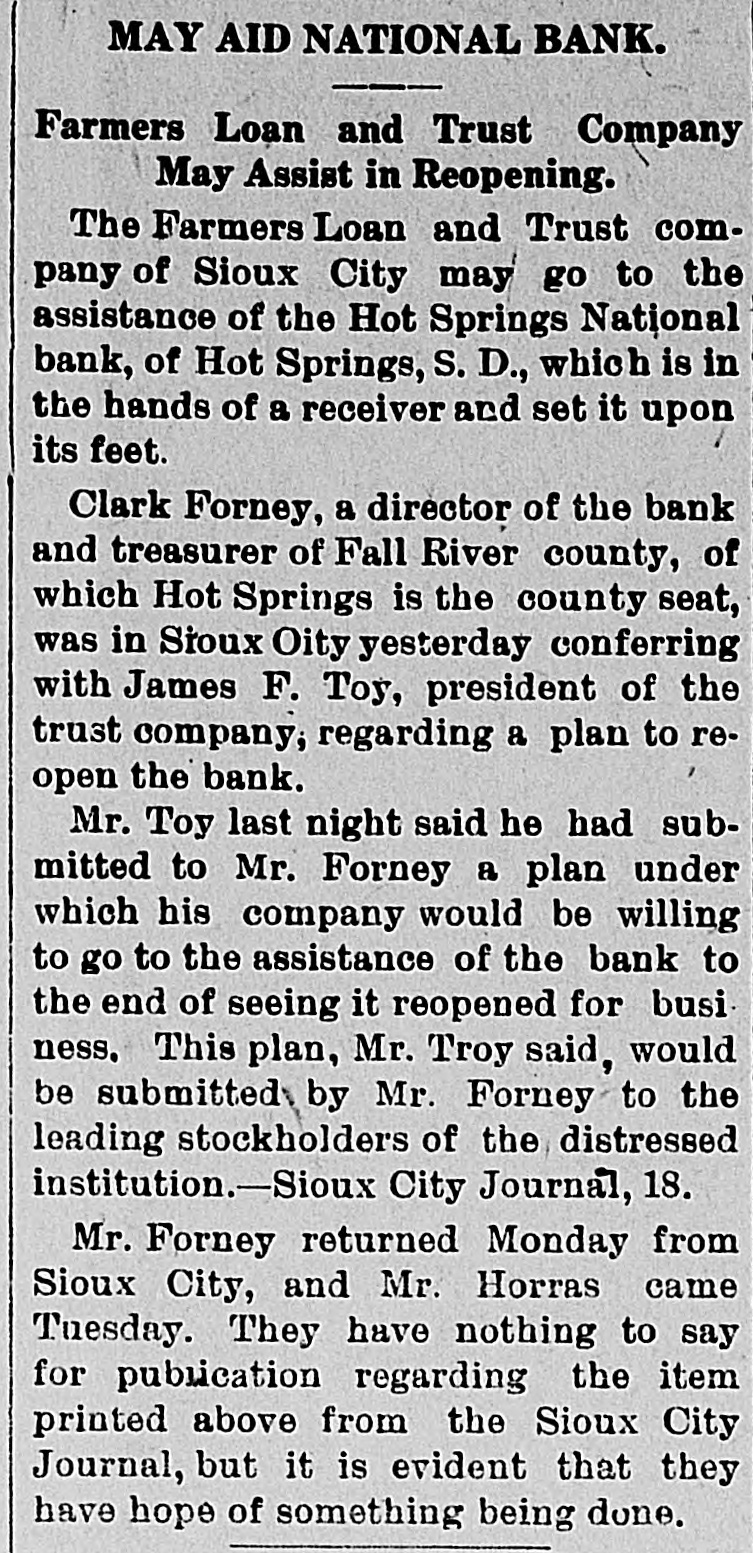

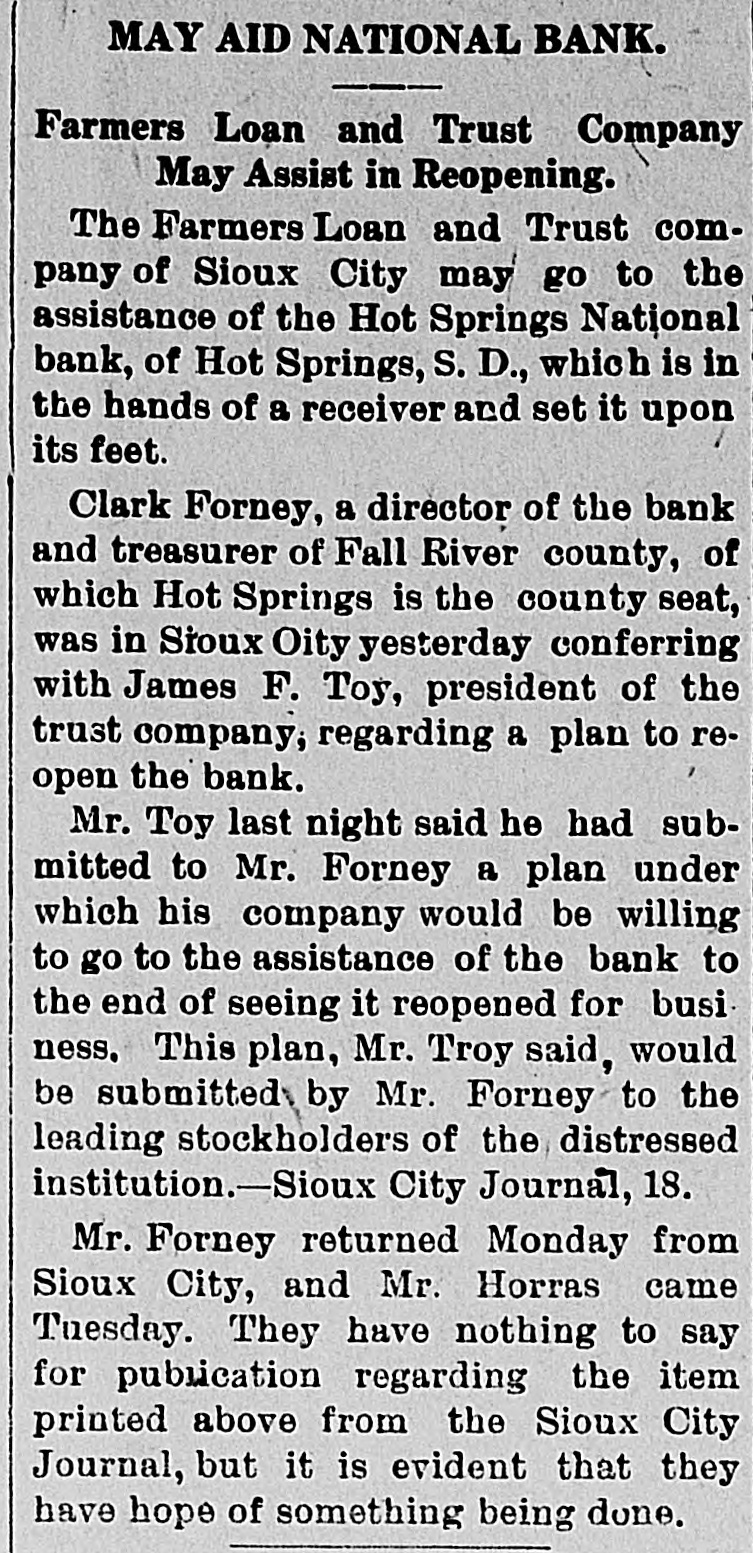

MAY AID NATIONAL BANK. Farmers Loan and Trust Company May Assist in Reopening. The Farmers Loan and Trust company of Sioux City may go to the assistance of the Hot Springs National bank, of Hot Springs, S. D., which is in the hands of a receiver and set it upon its feet. Clark Forney, a director of the bank and treasurer of Fall River county, of which Hot Springs is the county seat, was in Sioux Oity yesterday conferring with James F. Toy, president of the trust company, regarding a plan to reopen the bank. Mr. Toy last night said he had submitted to Mr. Forney a plan under which his company would be willing to go to the assistance of the bank to the end of seeing it reopened for business. This plan, Mr. Troy said, would be submitted by Mr. Forney to the leading stockholders of the distressed institution.-Sioux City Journal, 18. Mr. Forney returned Monday from Sioux City, and Mr. Horras came Tuesday. They have nothing to say for publication regarding the item printed above from the Sioux City Journal, but it is evident that they have hope of something being done.

12.

January 31, 1908

The Black Hills Union and Western Stock Review

Rapid City, SD

Click image to open full size in new tab

Article Text

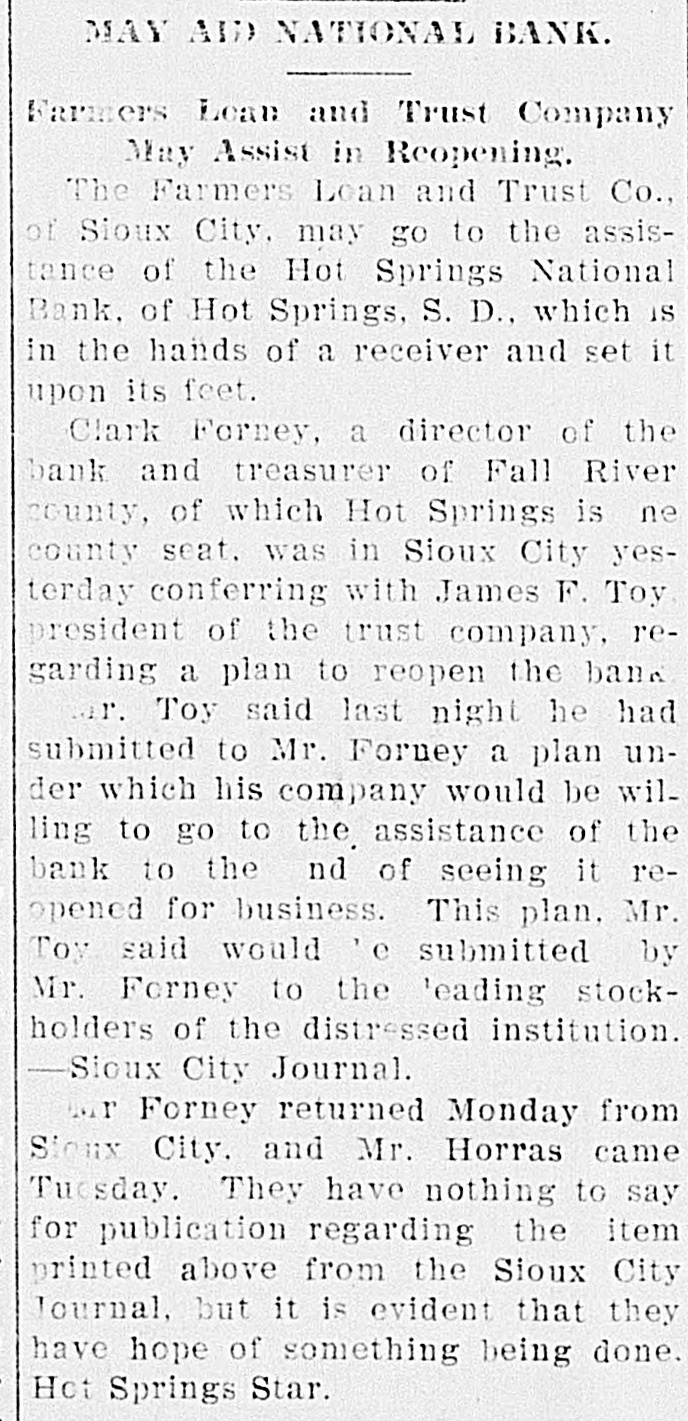

MAY Alix NATIONAL BANK. Farmers Loan and Trust Company May Assist in Reopening. The Farmers Loan and Trust Co., of Sioux City. may go to the assistance of the Hot Springs National Bank. of Hot Springs, S. D., which IS in the hands of a receiver and set it upon its feet. Clark Forney, a director of the bank and treasurer of Fall River county, of which Hot Springs is ne county seat. was in Sioux City yesterday conferring with James F. Toy president of the trust company, regarding a plan to reopen the bank il Toy said last night he had submitted to Mr. Forney a plan under which his company would be willing to go to the assistance of the bank to the nd of seeing it reopened for business. This plan. Mr. Toy said would ' e submitted by Mr. Forney to the 'eading stockholders of the distressed institution. Sioux City Journal. mr Forney returned Monday from Sieux City, and Mr. Horras came Tuesday, They have nothing to say for publication regarding the item printed above from the Sioux City Journal, but it is evident that they have hope of something being done. Hot Springs Star.

13.

April 3, 1908

The Mitchell Capital

Mitchell, SD

Click image to open full size in new tab

Article Text

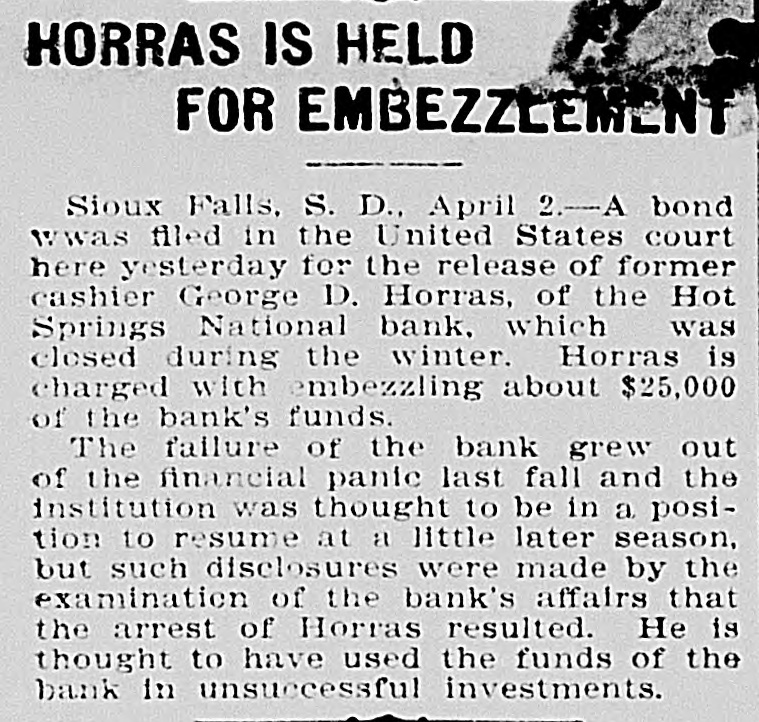

HORRAS IS HELD FOR EMBEZZLEMENT Sioux Falls, S. D., April 2.-A bond wwas filed in the United States court here yesterday for the release of former cashier George D. Horras, of the Hot Springs National bank. which was closed during the winter. Horras is charged with embezzling about $25,000 of the bank's funds. The failure of the bank grew out of the financial panic last fall and the institution was thought to be in a position to resume at a little later season, but such disclosures were made by the examination of the bank's affairs that is the arrest of Horras resulted. He thought to have used the funds of the bank in unsuccessful investments.

14.

May 23, 1908

Custer Weekly Chronicle

Custer, SD

Click image to open full size in new tab

Article Text

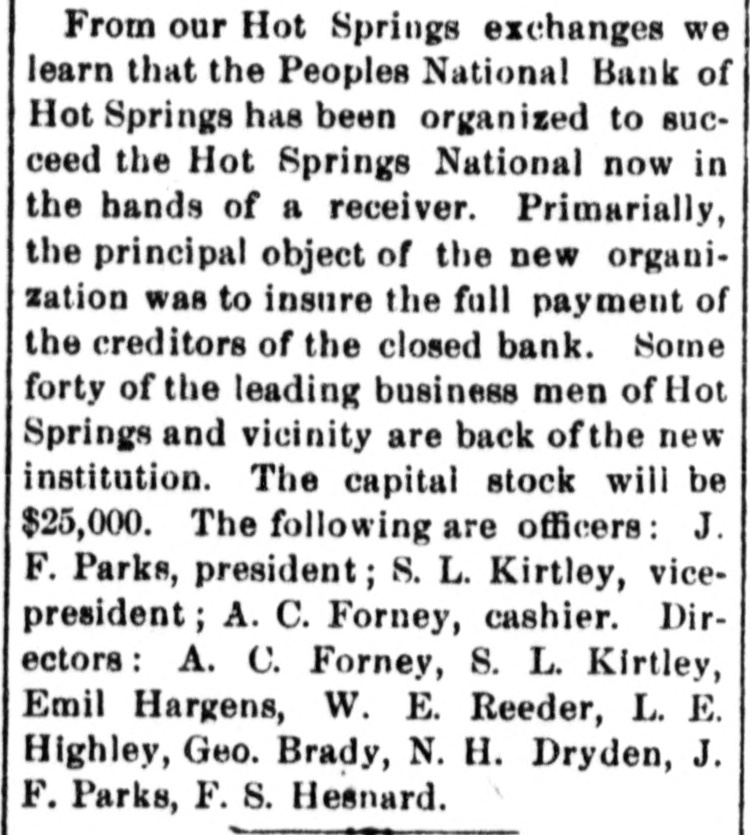

From our Hot Springs exchanges we learn that the Peoples National Bank of Hot Springs has been organized to succeed the Hot Springs National now in the hands of a receiver. Primarially, the principal object of the new organization was to insure the full payment of the creditors of the closed bank. Some forty of the leading business men of Hot Springs and vicinity are back ofthe new institution. The capital stock will be $25,000. The following are officers: J. F. Parks, president; S. L. Kirtley, vicepresident; A. C. Forney, cashier. Directors : A. C. Forney, S. L. Kirtley, Emil Hargens, W. E. Reeder, L. E. Highley, Geo. Brady, N. H. Dryden, J. F. Parks, F. S. Hesnard.

15.

August 10, 1908

Omaha Daily Bee

Omaha, NE

Click image to open full size in new tab

Article Text

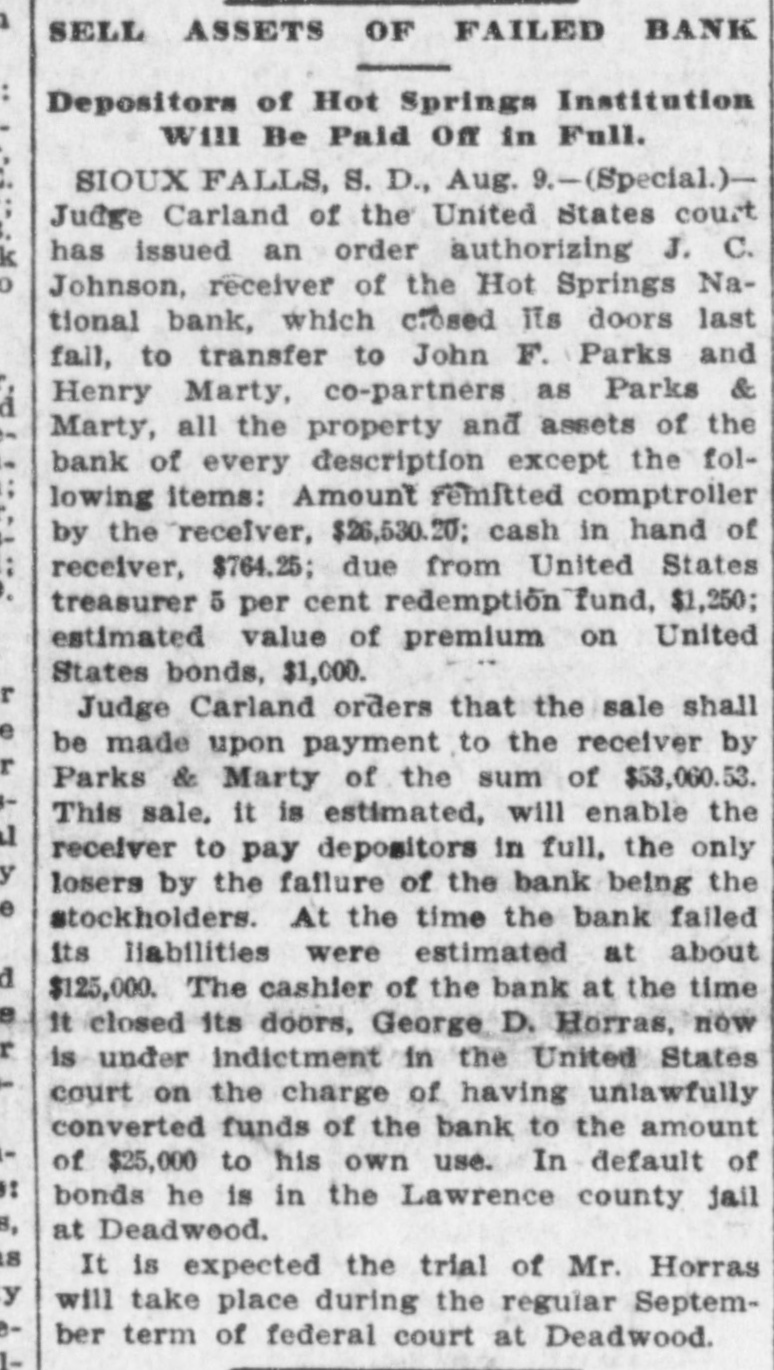

1 SELL ASSETS OF FAILED BANK Depositors of Hot Springs Institution will Be Paid Off in Full. SIOUX FALLS, S. D., Aug. 9.-(Special.)Judge Carland of the United States court has issued an order authorizing J. C. Johnson, receiver of the Hot Springs National bank, which closed its doors last fall, to transfer to John F. Parks and Henry Marty, co-partners as Parks & Marty, all the property and assets of the bank of every description except the following items: Amount remitted comptroller by the receiver, $26,530.20; cash in hand of receiver, $764.25; due from United States treasurer 5 per cent redemption fund, $1,250; estimated value of premium on United States bonds, $1,000. Judge Carland orders that the sale shall be made upon payment to the receiver by Parks & Marty of the sum of $53,060.53. This sale. it is estimated, will enable the receiver to pay depositors in full, the only losers by the failure of the bank being the stockholders. At the time the bank failed its liabilities were estimated at about $125,000. The cashier of the bank at the time it closed its doors, George D. Horras, now is under Indictment in the United States court on the charge of having unlawfully converted funds of the bank to the amount of $25,000 to his own use. In - default of bonds he is in the Lawrence county jail 8, at Deadwood. is It is expected the trial of Mr. Horras y will take place during the regular September term of federal court at Deadwood.

16.

August 14, 1908

The Mitchell Capital

Mitchell, SD

Click image to open full size in new tab

Article Text

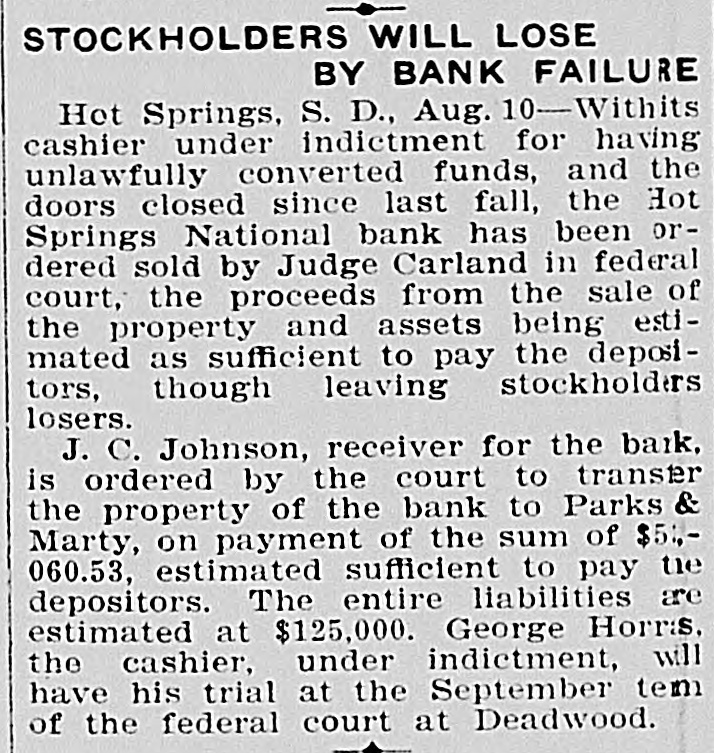

STOCKHOLDERS WILL LOSE BY BANK FAILURE Hot Springs, S. D., Aug. 10-Withits cashier under indictment for having unlawfully converted funds, and the doors closed since last fall, the Hot Springs National bank has been ordered sold by Judge Carland in federal court, the proceeds from the sale of the property and assets being estimated as sufficient to pay the depositors, though leaving stockholders losers. J. C. Johnson, receiver for the bark. is ordered by the court to transfer the property of the bank to Parks & Marty, on payment of the sum of $54.060.53, estimated sufficient to pay tie depositors. The entire liabilities are estimated at $125,000. George Horris. the cashier, under indictment, will have his trial at the September tem of the federal court at Deadwood.

17.

October 9, 1908

The Bemidji Daily Pioneer

Bemidji, MN

Click image to open full size in new tab

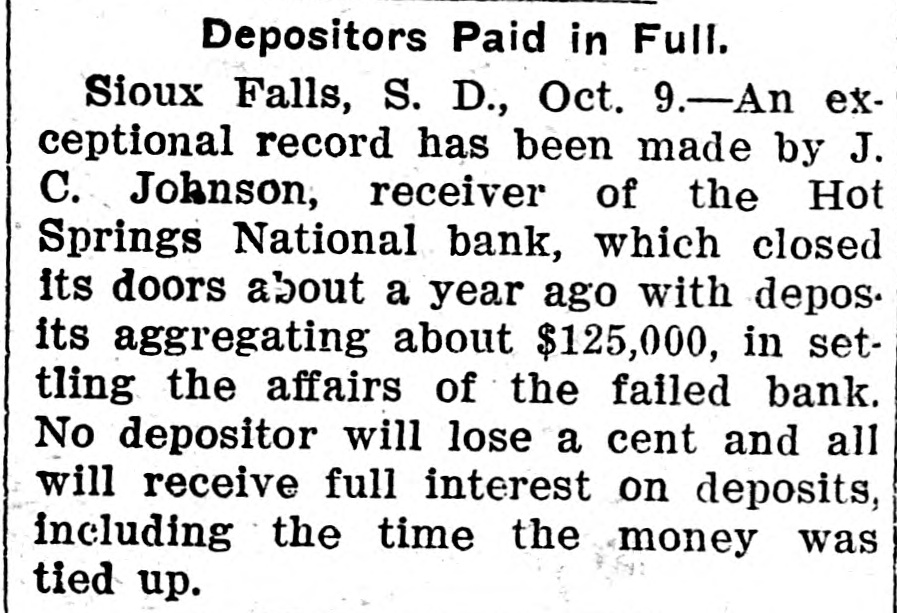

Article Text

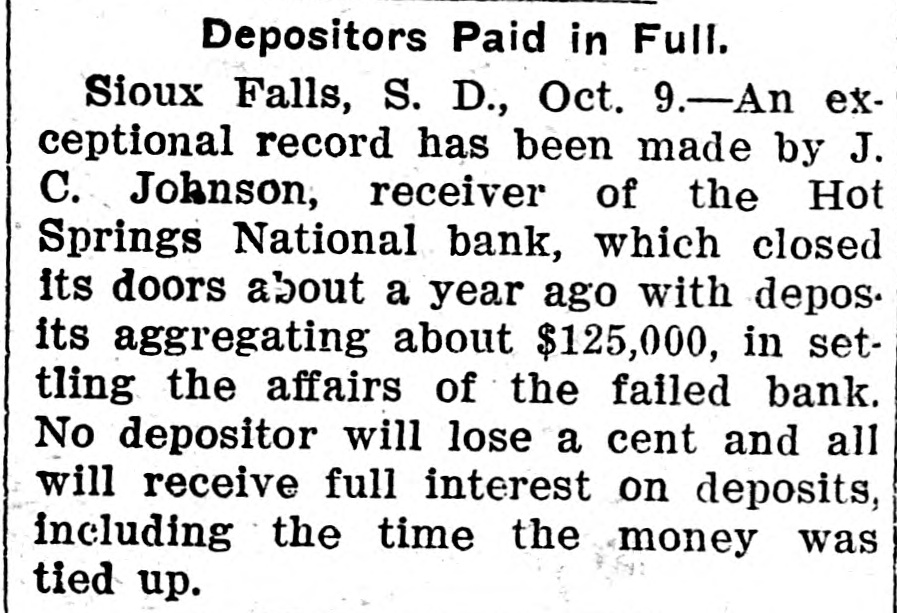

Depositors Paid in Full. Sioux Falls, S. D., Oct. 9.-An exceptional record has been made by J. C. Johnson, receiver of the Hot Springs National bank, which closed its doors about a year ago with depos. its aggregating about $125,000, in settling the affairs of the failed bank. No depositor will lose a cent and all will receive full interest on deposits, including the time the money was tied up.

18.

October 15, 1908

The Bon Homme County Independent

Tabor, SD

Click image to open full size in new tab

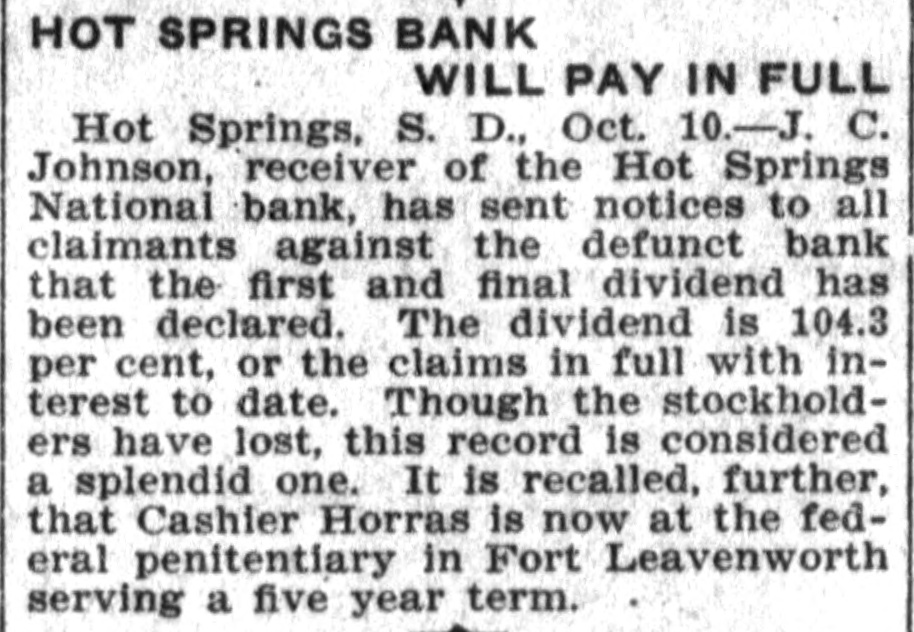

Article Text

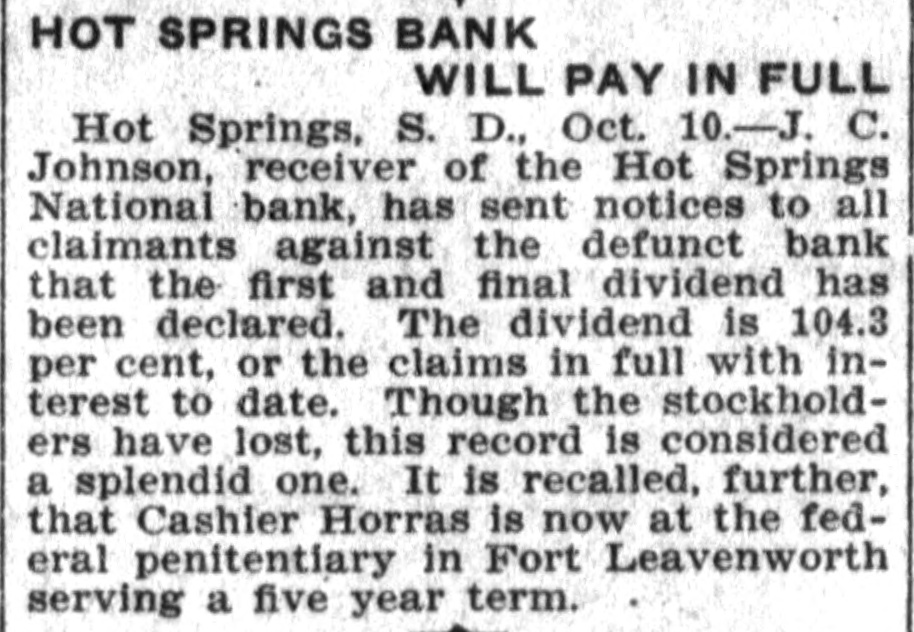

HOT SPRINGS BANK WILL PAY IN FULL Hot Springs, S. D., Oct. 10.-J. C. Johnson, receiver of the Hot Springs National bank, has sent notices to all claimants against the defunct bank that the first and final dividend has been declared. The dividend is 104.3 per cent, or the claims in full with interest to date. Though the stockholders have lost, this record is considered a splendid one. It is recalled, further, that Cashier Horras is now at the federal penitentiary in Fort Leavenworth serving a five year term.