Click image to open full size in new tab

Article Text

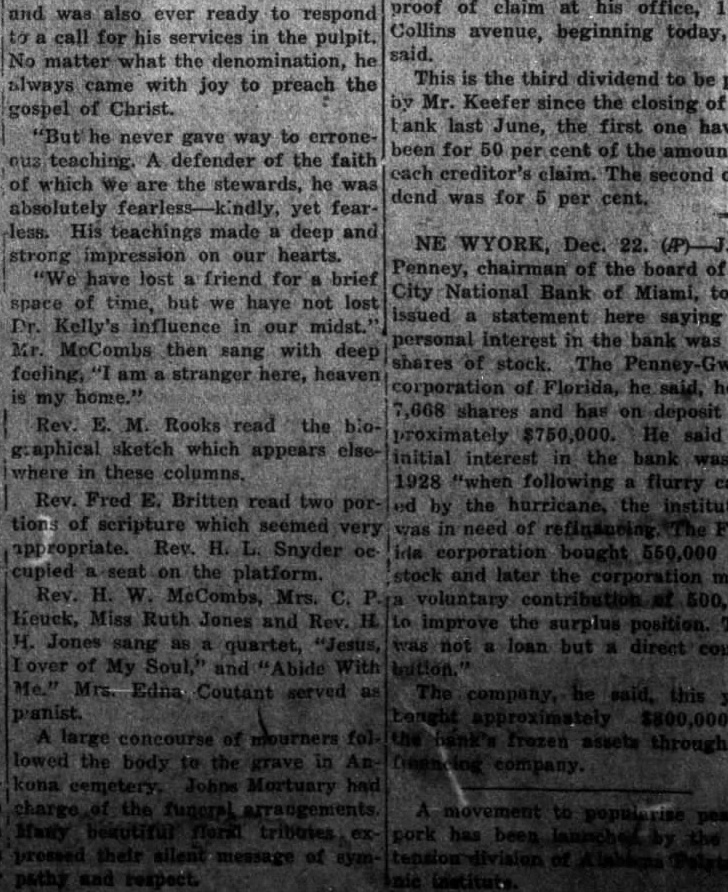

proof of claim at his office, 1035 and was also ever ready to respond Collins avenue, beginning today, he to a call for his services in the pulpit. said. No the denomination, he This is the third dividend to be paid always came with joy to preach the by Mr. Keefer since the closing of the gospel of Christ. tank last June, the first one having never gave way to erronebeen for 50 cent of the amount of ous teaching. A defender of the faith each creditor's claim. The second diviof which We are the stewards, he was dend was for per cent. absolutely yet fearless. His teachings made a deep and NE WYORK, Dec. 22. strong impression on our hearts. Penney, chairman of the board of the "We have lost a friend for a brief City National Bank of Miami, today space of time, but we have not lost issued statement here saying his Dr. Kelly's influence in our midst." personal interest in the bank was 244 Mr. McCombs then sang with deep shares of stock. The feeling, am stranger here, heaven corporation of Florida, he said, holds is my home." 7,668 shares and has deposit apRev. E. M. Rooks read the bioproximately $750,000. He said his graphical sketch which appears elseinitial interest in the bank in where in these columns. 1928 "when following flurry causRev. Fred E. Britten read two por the the by tion scripture which seemed very in need of Rev. Snyder corporation 550,000 in on the platform. stock and later the made Rev. McCombs, Mrs. voluntary Heuck, Miss Ruth Jones and Rev. improve the position. This H. Jones sang quartet, not loan but direct Lover of My Soul," and With Edna Coutant served company, said, this year $800,000 A large concourse of frozen assets through lowed the body to the grave kona Johns Mortuary the floral pork their message of respect.