Click image to open full size in new tab

Article Text

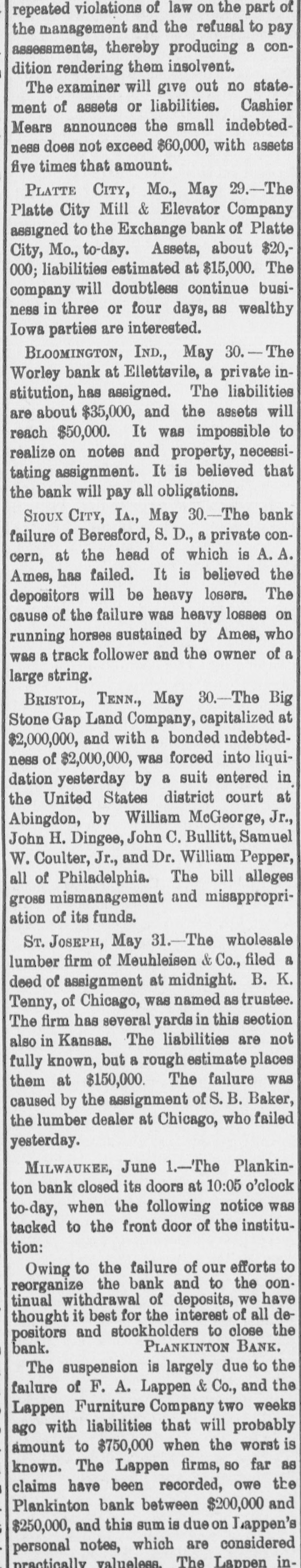

repeated violations of law on the part of the management and the refusal to pay assessments, thereby producing a condition rendering them insolvent. The examiner will give out no statement of assets or liabilities. Cashier Mears announces the small indebtedness does not exceed $60,000, with assets five times that amount. PLATTE CITY, Mo., May 29.-The Platte City Mill & Elevator Company assigned to the Exchange bank of Platte City, Mo., to-day. Assets, about $20,000; liabilities estimated at $15,000. The company will doubtless continue business in three or four days, as wealthy Iowa parties are interested. BLOOMINGTON, IND., May 30.-The Worley bank at Ellettevile, a private in stitution, has assigned. The liabilities are about $35,000, and the assets will reach $50,000. It was impossible to realize on notes and property, necessitating assignment. It is believed that the bank will pay all obligations. SIOUX CITY, IA., May 30.-The bank failure of Beresford, S. D., a private concorn, at the head of which is A. A. Ames, has failed. It is believed the depositors will be heavy losers. The cause of the failure was heavy losses on running horses sustained by Ames, who was a track follower and the owner of a large string. BRISTOL, TENN., May 30.-The Big Stone Gap Land Company, capitalized at $2,000,000, and with a bonded indebtedness of $2,000,000, was forced into liquidation yesterday by a suit entered in the United States district court at Abingdon, by William McGeorge, Jr., John H. Dingee, John C. Bullitt, Samuel W. Coulter, Jr., and Dr. William Pepper, all of Philadelphia. The bill alleges gross mismanagement and misappropriation of its funds. ST. JOSEPH, May 31.-The wholesale lumber firm of Meuhleisen & Co., filed a deed of assignment at midnight. B. K. Tenny, of Chicago, was named as trustee. The firm has several yards in this section also in Kansas. The liabilities are not fully known, but a rough estimate places them at $150,000. The failure was caused by the assignment of S.B. Baker, the lumber dealer at Chicago, who failed yesterday. MILWAUKEE, June 1.-The Plankinton bank closed its doors at 10:05 o'clock to-day, when the following notice was tacked to the front door of the institution: Owing to the failure of our efforts to reorganize the bank and to the oontinual withdrawal of deposits, we have thought it best for the interest of all depositors and stockholders to close the PLANKINTON BANK. bank. The suspension is largely due to the failure of F. A. Lappen & Co., and the Lappen Furniture Company two weeks ago with liabilities that will probably amount to $750,000 when the worst is known. The Lappen firms, so far as claims have been recorded, owe the Plankinton bank between $200,000 and $250,000, and this sum is due on Lappen's personal notes, which are considered practically valueless. The Lappen in-