Article Text

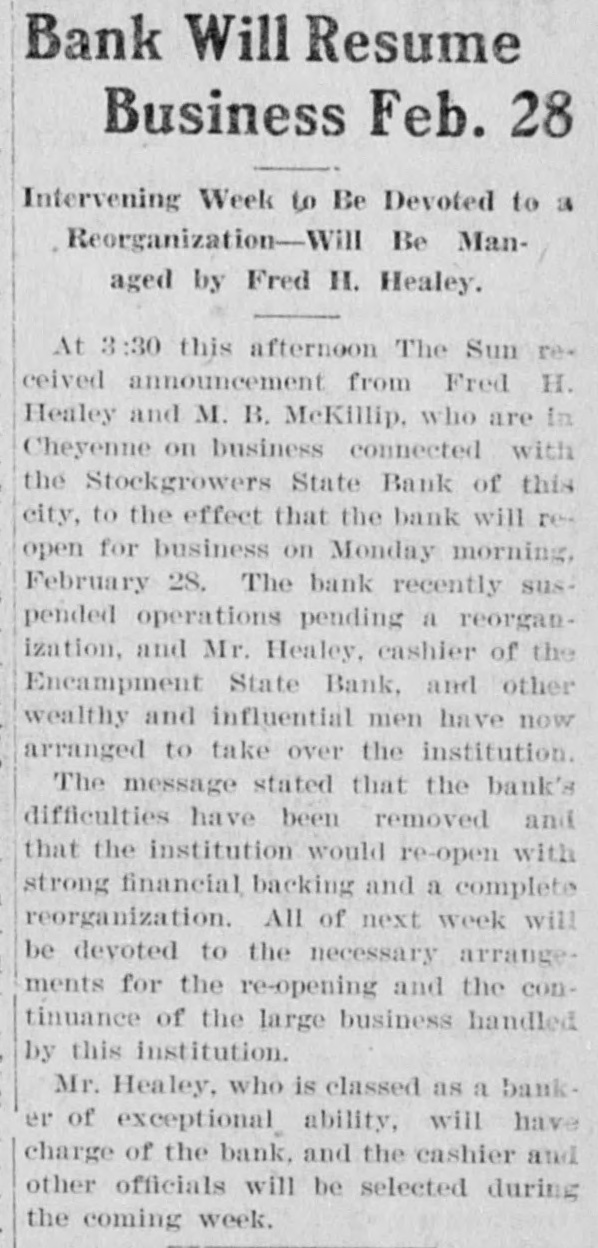

Bank Will Resume Business Feb. 28 Intervening Week to Be Devoted to a Reorganization-Will Be Managed by Fred H. Healey. At 3:30 this afternoon The Sun received announcement from Fred H. Healey and M. B. McKillip, who are in Cheyenne on business connected with the Stockgrowers State Bank of this city, to the effect that the bank will reopen for business on Monday morning, February 28. The bank recently suspended operations pending a reorganization, and Mr. Healey, cashier of the Encampment State Bank, and other wealthy and influential men have now arranged to take over the institution. The message stated that the bank's difficulties have been removed and that the institution would re-open with strong financial backing and a complete reorganization. All of next week will be devoted to the necessary arrangements for the re-opening and the continuance of the large business handled by this institution. Mr. Healey, who is classed as a bank er of exceptional ability, will have charge of the bank, and the cashier and other officials will be selected during the coming week.