Article Text

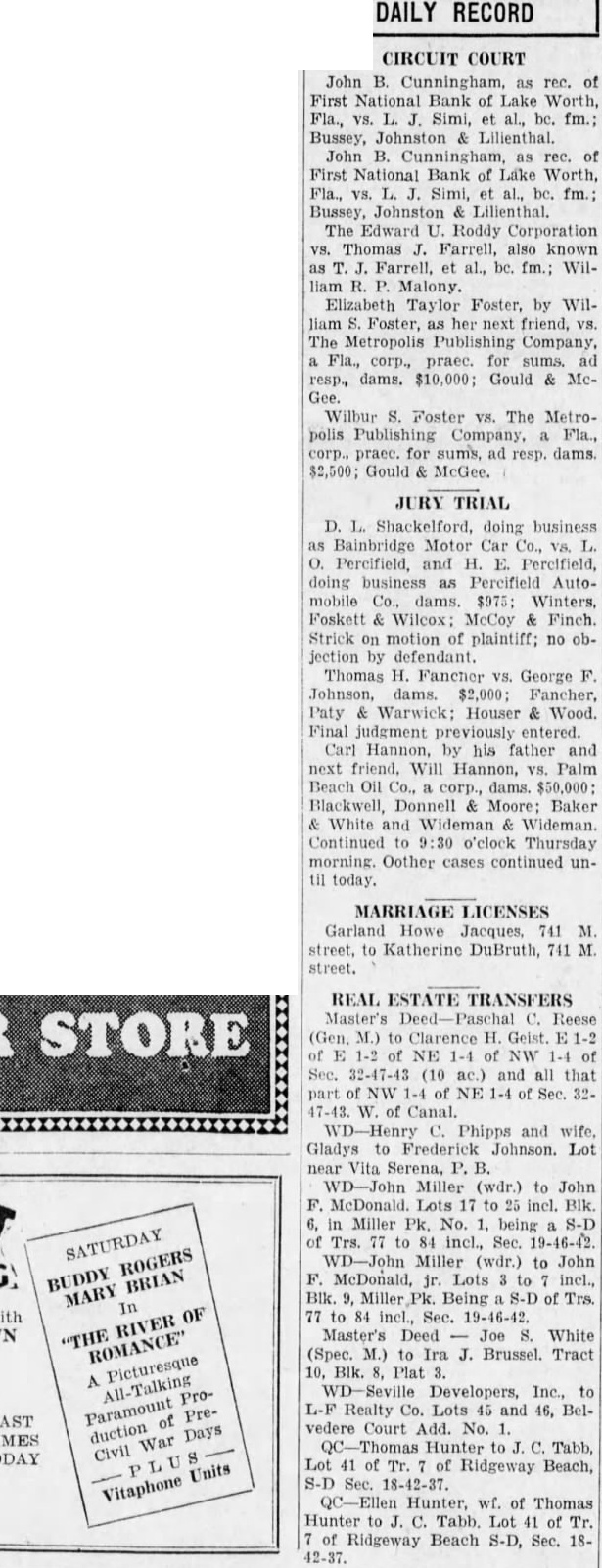

DAILY RECORD CIRCUIT COURT John B. Cunningham, as rec. of First National Bank of Lake Worth, Fla., vs. Simi, al., bc. fm.; John B. Cunningham, as rec. of Bank of Lake Worth, Fla., vs. Simi, al., bc. fm.; The Edward Roddy Corporation Thomas Farrell, also known Farrell, al., be. fm.; WilMalony. Elizabeth Taylor Foster, by William Foster, next friend, vs. The Publishing Company, corp., praec. sums. ad resp, dams. $10,000; Gould & McWilbur S. Foster VS. The Metropolis Publishing Company, Fla., corp., prace. for sums, ad resp. dams. $2,500; Gould McGee. TRIAL D. L. Shackelford, doing business Bainbridge Motor Car Co., Percifield, and H. E. Percifield, doing business as Percifield Automobile Co., dams. $975: Winters, Foskett Wilcox: McCoy & Finch. Strick on motion of plaintiff; no objection by defendant. Thomas H. Fancher VS. George Johnson, dams. Fancher, Paty Warwick: Houser Wood. Final judgment entered. Carl Hannon, his father and next Will Palm Beach Oil dams. $50,000: Blackwell, Moore: Baker White and Wideman. Continued o'clock Thursday morning. Oother cases continued until today. MARRIAGE LICENSES Garland Howe Jacques, M. street, Katherine DuBruth, 741 street. REAL Master's Clarence Geist. 1-2 NE of NW Sec. 32-47-43 (10 and all that part NE 1-4 of Sec. 32of WD-Henry Phipps and wife. Gladys Frederick Johnson. Lot Vita Serena, Miller to John McDonald Lots to incl. Blk. in Miller being Trs. to Sec. WD-John Miller (wdr.) to John BUDDY BRIAN McDonald, Lots incl., MARY Blk. Miller Being Trs. In OF 77 incl., Sec. 19-46-42. "THE Master's Deed White (Spec. M.) Ira J. Brussel. Tract Picturesque Blk. Plat Developers, Inc., to L-F Realty Co. Lots and 46, Belvedere Court Add. No. Days Hunter to Tabb. Civil 41 of Ridgeway Beach, Units Vitaphone 18-42-37. Hunter, wf. of Thomas Hunter to Tabb. Lot Ridgeway Beach S-D, Sec. 18-