Article Text

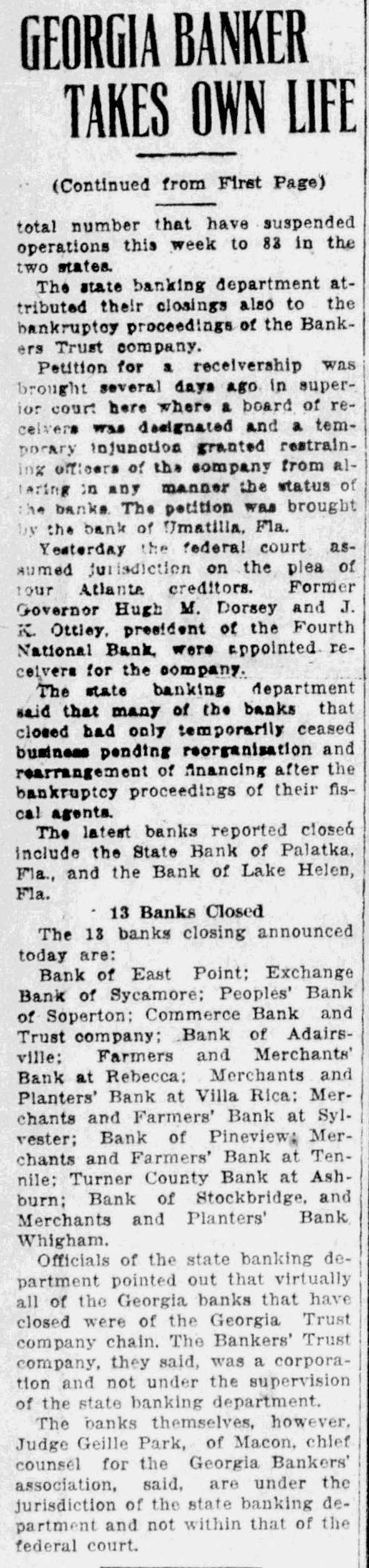

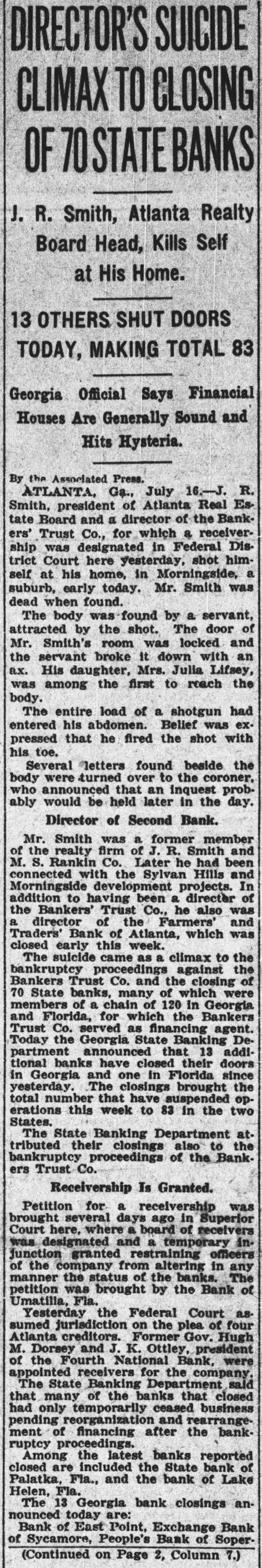

GEORGIA BANKER TAKES OWN LIFE (Continued from First Page) total number that have suspended operations this week to 83 in the two states. The state banking department attributed their closings also to the bankruptoy proceedings of the Bankers Trust company. Petition for a receivership was brought several days ago in superior court here where a board of recelvers was designated and a temporary injunction granted restraininz officers of the company from allaring in any manner the status of the banks The petition was brought by the bank of Umatilla. Fla. Yesterday the federal court assumed Jurisdiction on the plea of tour Atlante creditors. Former Governor Hugh M. Dorsey and J. K. Ottley, president of the Fourth National Bank were appointed recelvers for the company. The state banking department said that many of the banks that closed had only temporarily ceased business pending reorganisation and rearrangement of financing after the bankruptcy proceedings of their fiscal agents. The latest banks reported closed include the State Bank of Palatka, Fla., and the Bank of Lake Helen, Fla. 13 Banks Closed The 18 banks closing announced today are: Bank of East Point; Exchange Bank of Sycamore; Peoples' Bank of Soperton: Commerce Bank and Trust company; Bank of Adairsville; Farmers and Merchants' Bank at Rebecca: Merchants and Planters' Bank at Villa Rica: Merchants and Farmers' Bank at Sylvester; Bank of Pineview: Merchants and Farmers' Bank at Tennile; Turner County Bank at Ashburn; Bank of Stockbridge, and Merchants and Planters' Bank Whigham. Officials of the state banking department pointed out that virtually all of the Georgia banks that have closed were of the Georgia Trust company chain. The Bankers' Trust company, they said, was a corporation and not under the supervision of the state banking department. The banks themselves, however, Judge Geille Park, of Macon, chief counsel for the Georgia Bankers' association, said, are under the jurisdiction of the state banking department and not within that of the federal court.