Article Text

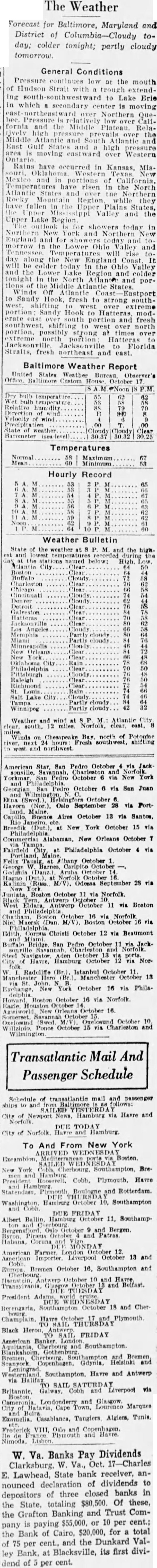

The Weather Forecast for Baltimore, Maryland and District of Columbia-Cloudy today; colder tonight; partly cloudy tomorrow General Conditions Pressure low at the mouth Hudson Strat with extending to Lake Erie in which secondary center is moving east Pressure northeast Northern Quefornia and the Middle Plateau. over the Middle and Atlantic and East Gul high pressure area is moving over Western Rains have occurred in Kansas, MisTempers and in of tures risen in the North States the Mountain Region fallen the Upper Plains pper Valley and the Upper Lake today in Norther York and Northern England and to: morrow Lower Valley and will today in the Ohio Valley and the Lower Lake Region and colder tonight and porddle west, to Sandy fresh to strong Eastport Hook to modeast portion and fresh over north strong times over Hatteras to Jacksonville Florida Straits, fresh northeast and east Weather Bulletin Weather north of American October October via October via Havorn September via Buenos Aires October 13 via New York October 15 via New Orleans October Philadelphia October 4 via October 28 via October Norfolk West via Boston and via Christi October 12 Beaumont San 12 (Br.) Istanbul October October 16 via Boston October via Norfolk 16 Savanna October Ponce October 15 via Charleston Schedule of transatlantic mail and passenger ships Norfolk News. Hamburg via Havre and DUE City of Norfolk To And From New York York Havre and Rotterdam Hamburg 10, Southampton DUE FRIDAY Albert Ballin October 11, and Habana MONDAY American 13 and Europa, Bremen October 16, Southampton and October 10 and Belfast. President October and Cher Black Heron FRIDAY American Banker, and thamptor Scanyork Southampton. Havre and Antwerp Halifax SATURD via Londonderry Marques VIII W. Va. Banks Pay Dividends Clarksburg. W. Va., Oct. 17-Charles E. Lawhead, State bank receiver, announced declaration dividends to depositors of three closed banks in the State, totaling $80,500. Of these, the Grafton Banking and Trust Company paying $55,000. or 10 per cent.; the Bank of Cairo, $20,000, for total of 75 per cent., and the Dunkard Valley Bank, at Blacksville, its first dividend of cent. per Baltimore Weather Report United States Weather Bureau Observer's Dry temperature Relative humidity Velocity weather Temperatures Normal Maximum Minimum Hourly Record named below: York