Article Text

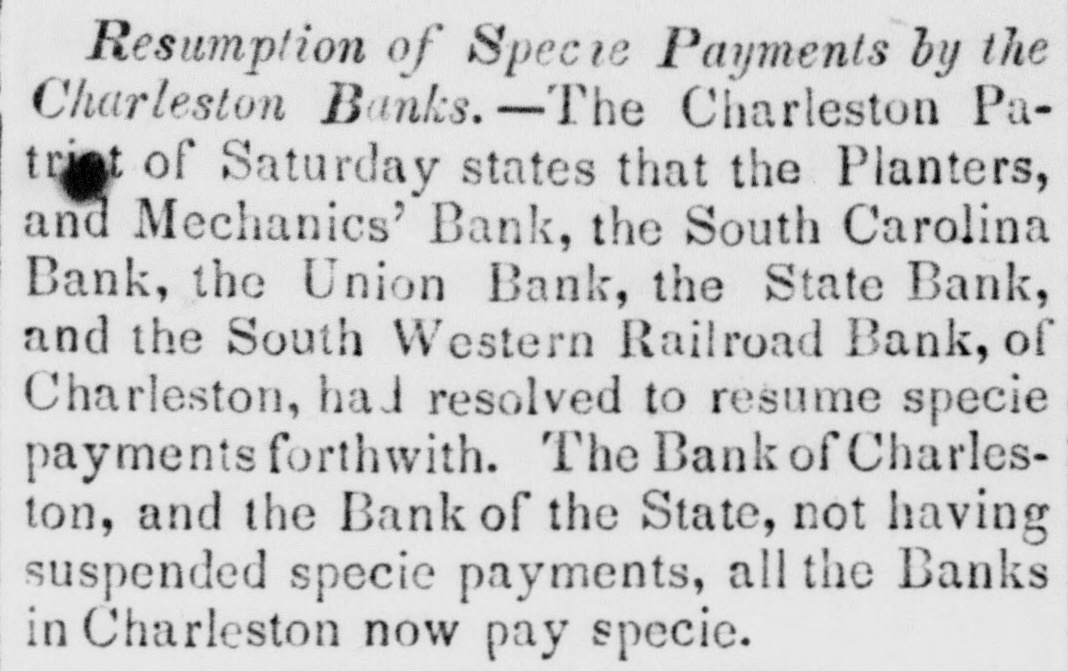

# MONEY MARKET. ## Friday, October 18-6 P.M. Wall street remains exceedingly quiet, and all idea of a sus- pension of our banks has vanished; at the Stock Exchange prices again fell; United States Bank opened at 78į and closed at 72, which is a decline of 10 per cent since the board yesterdy morn- ing-Delaware & Hudson declined 1 per cent-Kentucky 4 per cent-Harlem 1 per cent. In sterling exchange there is as much doing as the scarcity of money will permit. The bills selling by the banks at 9 per cent or $4 86 the £ sterling are taken freely and fully meet the object in drawing, viz: to stop the export of specie. We know of an eminent firm who had previously insured $14,000 to ship, but withdrew it and deposited the amount with the Bank of Commerce, taking bills in preference. There is there- fore, not the slightest call for specie, while the amounts in the banks are daily increasing; $200,000 arrived at New Orleans on the 9th instant, from St. Louis, and destined for this port. Exchange on the South is merely nominal and may be put at 16 to 20 for all south of Philadelphia; on that city sales have been made at 87, on Mobile 87į, Baltimore 89. Uncurrent money stands as follows: U. S. Bk. bills, 16 to 20 dis. Rhode Island, 10 to 12 dis. Eastern, 1 to 2 " Safety Fund, to 1 " Bills of new bks, 3 to 5 " Southern, 20 to 25 " The directors of the Yates County and the two Oswego Banks are now in the city endeavoring to make some arrange- ment for the redemption of the bills of those Banks. The bills of the Dutchess County Bank are received at par by the New York Banking Company, 14 Wall street. It is stated in a Buffalo paper that articles of association were filed last week for the Union Bank of Buffalo, which will com- mence operations immediately. J. Salter, President; S. J. Powers, Cashier. The bills of the Washington County Bank, at Calais, (Maine,) are not received at the Suffolk Bank. The Attorney General of Pennsylvania has sent a circular to each of the Philadelphia Banks, wherein he states that pro- ceedings wil be instituted against any Bank issuing bills of a less denomination than $5. It is stated that an Injunction has been issued by the Vice Chancellor, by which the discounts maturing in the United States Bank in New York are held for the benefit of the holders of post notes of the United States Bank, made payable in New-York. The specie which was recently drawn from the east in favor of our banks, has, it is stated, been returned in many instances. The eastern banks are perfectly quiet, although the mercantile classes are severely pressed. The merchants of Boston held a meeting on Tuesday evening, when it was resolved to call upon the banks to step forward and furnish some relief. We under- stand by letter, that the banks have, in consequence of the meet- ing and the encouragement afforded by the firm position of New York, resolved to discount to the extent of 8 per cent. on their capital, which will be to the extent of $500,000. The effect of the Philadelphia suspension is progressing south; each mail brings accounts of banks that have suspended. The following is a list of the bank suspensions so far as heard from: Banks of Philadelphia Baltimore, Harrisburg, Frederick, Maryland, York, Wilmington, Del. Chahambersburg, Washington, Gettysburg, Georgetown, Norfolk, Richmond, Charleston, S. C. Rhode Island, The news of the Philadelphia suspension reached Charleston on the 14th, and a meeting was held immediately, consisting of delegates from the Union Bank, State Bank, Bank of South Carolina, Louisville, and Charleston Rail Road Bank, and the Planters and Mechanics' Bank, when it was resolved to sus- pend forthwith. This will, probably, be the case throughout the south and west. We observe in the proceedings of the meetings of the southern banks a greater degree of unanimity and decision in suspending than in the more northerly institu- tions. At Charleston they were unanimous-at Richmond one or two of the banks voted against it-at Washington the Patriotic bank did not concur with the others in suspending.- Several of the Baltimore banks did not feel the necessity of the measure, and in Philadelphia nine of the banks, the names of which we gave yesterday, voted decidedly against it. The New York and eastern banks do not recognise the neces- sity or the convenience of the measure, with the ex- ception of Rhode Island, where the banks have shown a most unworthy subserviency to southern opinions, but even there six out of 20 banks voted against it. Rhode Island is pe- cularly situated; most of the bank loans amounting to $12,000,- 000, are directly or indirectly payable at the south. She has, therefore pursued the mistaken policy of depreciating her currency, in order to save the difference. From the west we have not not heard the effects of the explosion; but as it is the season when their greatest wealth is most available, it is pos- sible they may go through safely. All the banks south of Philadelphia to New Orleans, will doubtless stop. New Orleans is, however, strong, and her position, like New York, is such, that she will form a rallying point for the trade and healthy currency of that section, and the three points of New Orleans, New York and Boston will form the skeleton of the healthy trade which will rise out of the ruins of the unlimited credit system which reached its zenith in 1836, and has finally perished with the wasted energies of the United States bank, that thought to sustain and regene- rate it. Up to 1836 there was a regular increase of credit and busi- ness throughout the United States, fostered by a rapid increase of paper credits. This business far outrun the natural busi- ness of the country; that is, the soil and manufactures did not furnish produce and actual wealth so fast as the representatives of wealth increased. The consequence was that every class of dealers could command more money than their business required. That money was not allowed to remain idle, but sought new ob- jects of traffic. The most general object fixed upon was real estate, stocks, &c.; almost every class of society invested more or less in real estate, of a description which was actually worth nothing. The means to make these investments constitute the great mass of the increase of bank loans which took place in two years, from 1835 to 1837, amounting to $200,000,000. If a miller at the west drew on the city factor for $8,000, $6,000 of that was to buy corn, and $2,000 to invest in water lots. In the south, cotton was made the basis of similar operations. Large amounts of bills were drawn on England by banks having no funds there, and sold to dealers who gave their notes and raised the money on the bills, which money was spent in real estate.