Click image to open full size in new tab

Article Text

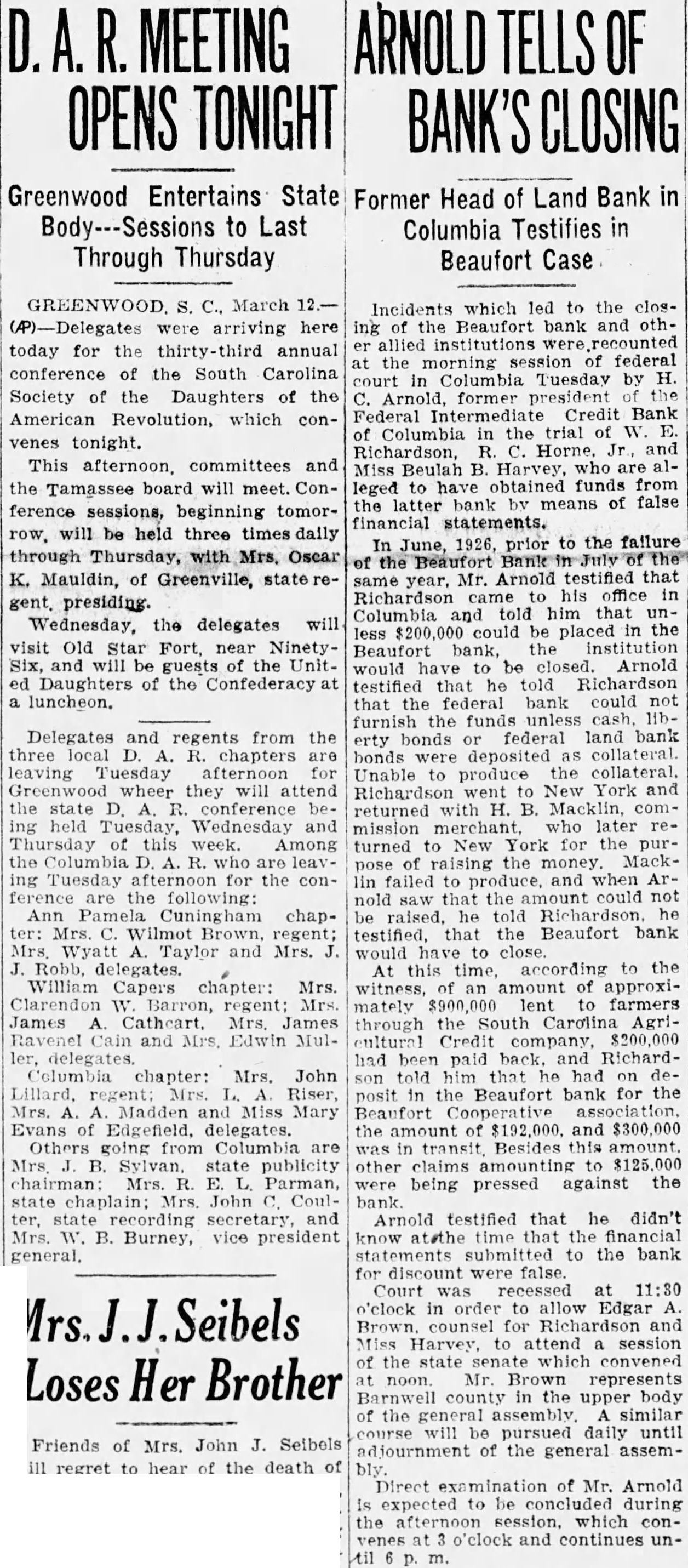

MEETING OPENS TONIGHT

Greenwood Entertains State Former Head of Land Bank in to Last Columbia Testifies in Through Thursday Beaufort Case

GREENWOOD S. March arriving here today for the thirty-third annual conference of the South Carolina Society of the Daughters of the American Revolution, which convenes tonight. This afternoon, committees and the Tamassee board will meet. Conference sessions, beginning tomorrow, will be held three times daily through Thursday, with Oscar K. Mauldin, of Greenville, state gent. presiding. Wednesday, the delegates will visit Old Star Fort, near NinetySix, will guests UnitDaughters of the Confederacy at a

Delegates and regents from the three local chapters are leaving Tuesday wheer they will attend the state conference held Tuesday, Wednesday Thursday this week. Among the Columbia R. ing Tuesday afternoon for the conference the Ann Pamela Cuningham chapMrs. Wilmot regent; Mrs. Wyatt Taylor and Mrs. Robb, delegates. William Capers chapter: Mrs. Clarendon regent: Mrs James Mrs. James Ravenel and Mrs. Edwin Muller, Columbia chapter: Mrs. John Lillard, regent; Mrs. Riser, Mrs. Madden and Miss Mary Evans of Edgefield, delegates Others going from Columbia are Mrs. B. Sylvan, state publicity chairman: Mrs. Parman, John ter, secretary Mrs. B. Burney, vice president general.

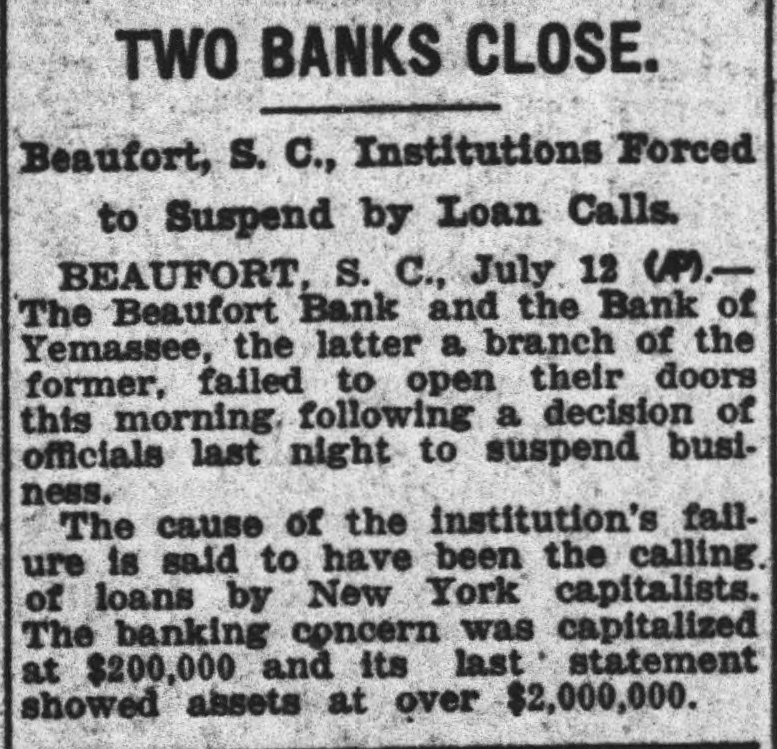

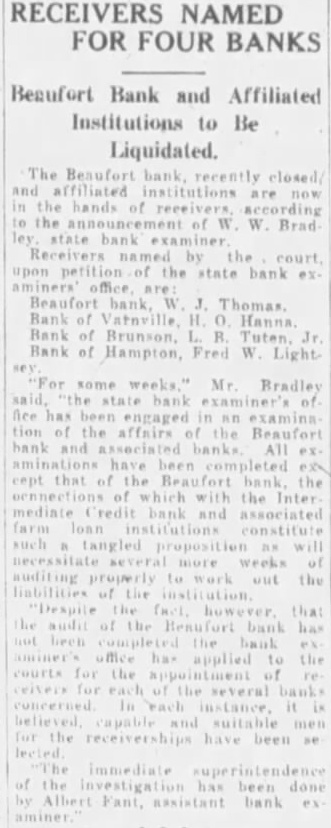

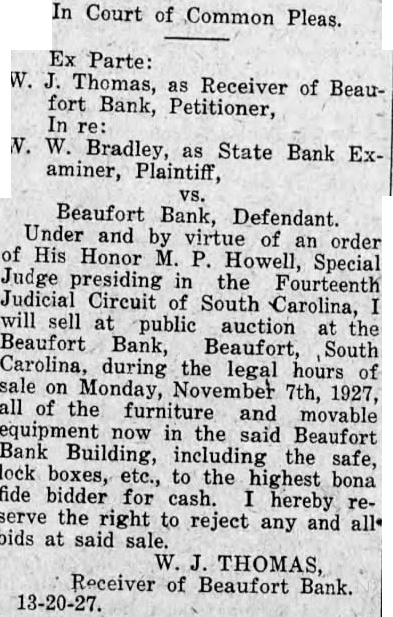

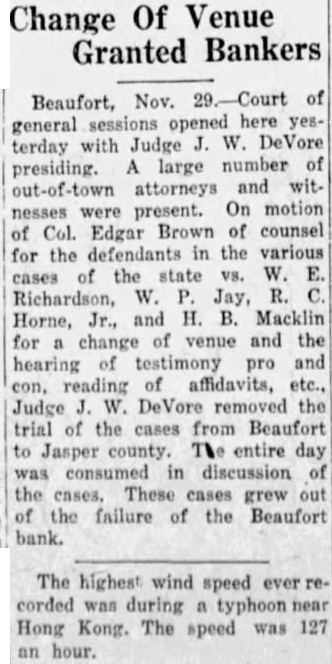

Incidents which led the closing the Beaufort bank and othallied institutions the morning session of federal court Columbia Tuesday by H. Arnold, former president Federal Intermediate Credit Bank of Columbia in the trial of W. Richardson, Horne, and Miss Beulah B. Harvey, who are leged to have obtained funds from means of false financial statements. June, 1926, prior to the failure the same year, Mr. Arnold testified that Richardson his office in Columbia and told him that could placed in the Beaufort bank, institution would have be closed. Arnold testified that he told Richardson that the federal bank could not furnish the funds unless federal land bank bonds collateral Unable produce the collateral. Richardson to New York and returned with B. Macklin, commission merchant, who later returned to New York for the purof raising the Mackpose lin failed produce, and when Arnold saw that the could not raised, he told Richardson, testified, that the Beaufort bank would close. this time to the At witness, amount of approximately lent to farmers through the South Carolina Agricultural Credit company, $200,000 had been paid back. and Richardtold him that he had on posit the Beaufort bank for the Beaufort Cooperative the amount of $192,000. and transit Besides this amount other being pressed against the bank Arnold testified that he didn't the statements submitted the bank for discount were false Court recessed 11:30 o'clock in order to allow Edgar counsel for Richardson and Harvey, to attend session the state senate which convened noon. Mr. Brown represents Barnwell county the upper body of the assembly similar will be pursued daily adjournment of the general assembly.

Direct examination of Mr. Arnold expected to during the afternoon session. which venes o'clock and continues until