Article Text

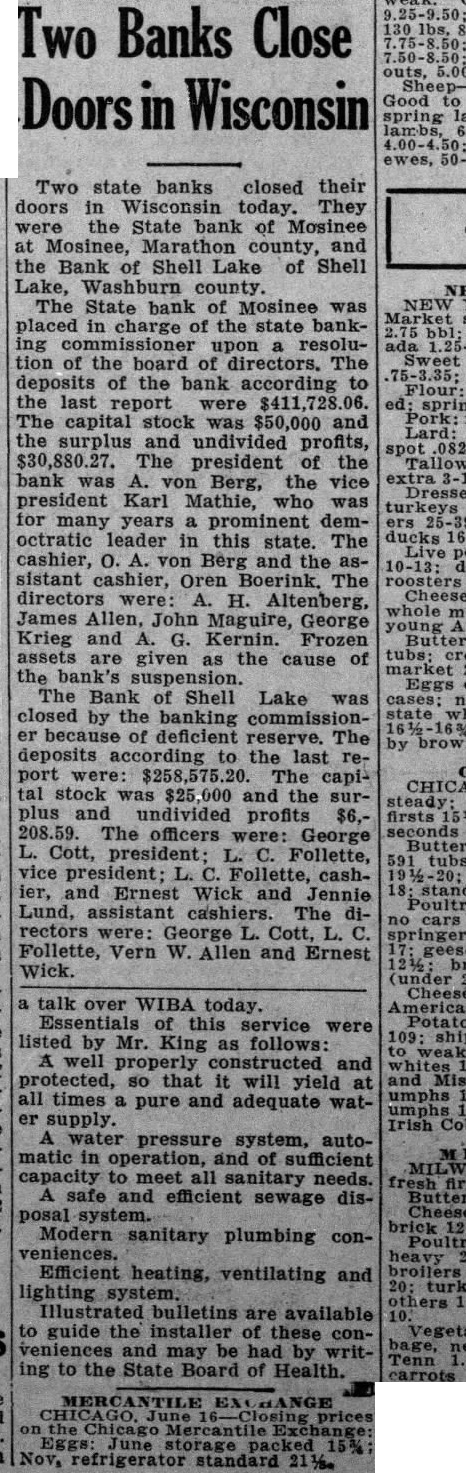

Two Banks Close Doors in Wisconsin Two state banks closed their doors in Wisconsin today. They were the State bank of Mosinee at Mosinee, Marathon county, and the Bank of Shell Lake of Shell Lake, Washburn county. The State bank of Mosinee was placed in charge of the state banking commissioner upon a resolution of the board of directors. The deposits of the bank according to the report capital was $50,000 and the surplus undivided profits, The president of the bank von Berg, vice president Karl Mathie, was for many years democtratic leader in this state. The cashier, von Berg and the assistant The directors Altenberg, James Allen, Maguire, George Krieg and G. Kernin. Frozen assets given as the cause of the bank's The Bank of Shell Lake was closed by the banking commissioner because of deficient reserve. The deposits according to the last report were: $258,575.20 capital stock was 000 and the surplus undivided profits $6, 208.59. The officers were: George Cott, president Follette, vice president; Follette, cashier, and Ernest Wick and Jennie Lund, assistant cashiers. The directors George Cott, Follette, Vern W. Allen and Ernest Wick. a talk over WIBA today. Americas Essentials this service 109: listed by Mr. King as follows: well properly and protected, so that it will yield at umphs all times pure and adequate water supply. Irish water pressure system, automatic in operation, and of sufficient capacity to meet all sanitary needs. A safe efficient sewage disCheese: Modern sanitary plumbing conveniences. Efficient heating, ventilating and broilers lighting Illustrated bulletins are available to guide the installer of conmay be had by writTenn ing to the State Board of Health. Eggs: June storage packed 15% refrigerator standard