Article Text

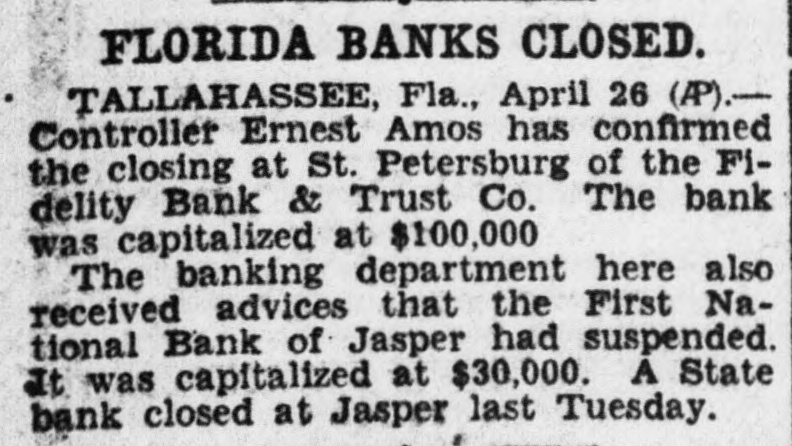

FLORIDA BANKS CLOSED. TALLAHASSEE, Fla., April 26 (P).Controller Ernest Amos has confirmed the closing at St. Petersburg of the Fidelity Bank & Trust Co. The bank was capitalized at $100,000 The banking department here also received advices that the First National Bank of Jasper had suspended. Tt was capitalized at $30,000. A State bank closed at Jasper last Tuesday.