Article Text

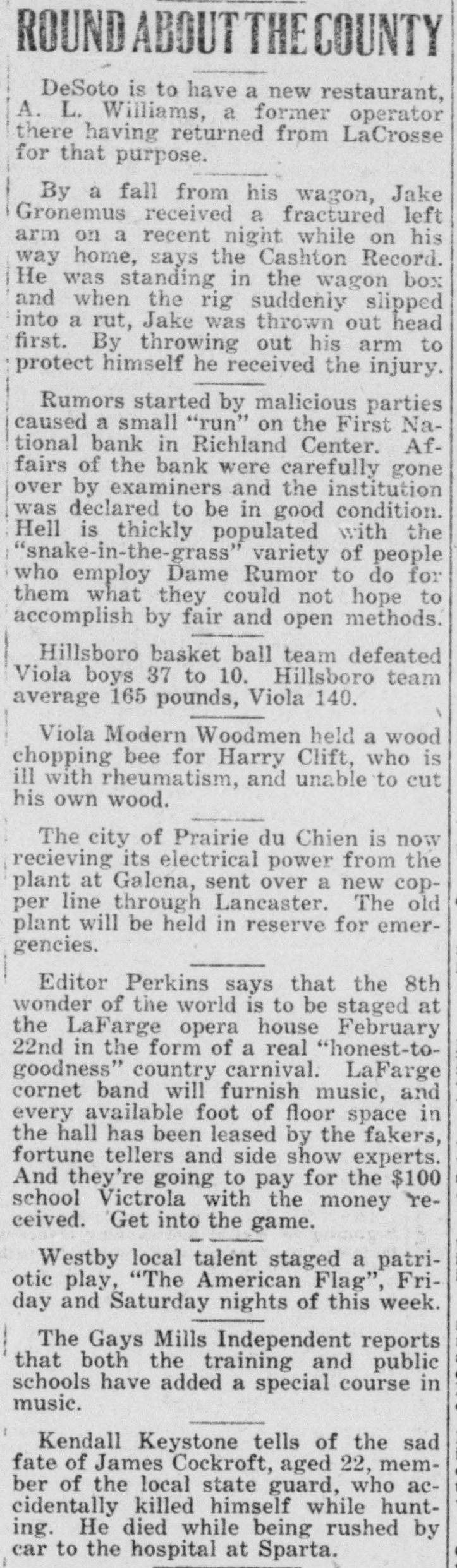

ROUND ABOUT THE COUNTY DeSoto is to have a new restaurant, A. L. Williams, a former operator there having returned from LaCrosse for that purpose. By a fall from his wagon, Jake Gronemus received a fractured left arm on a recent night while on his way home, says the Cashton Record. He was standing in the wagon box and when the rig suddenly slipped into a rut, Jake was thrown out head first. By throwing out his arm to protect himself he received the injury. Rumors started by malicious parties caused a small "run" on the First National bank in Richland Center. Affairs of the bank were carefully gone over by examiners and the institution was declared to be in good condition. Hell is thickly populated with the "snake-in-the-grass" variety of people who employ Dame Rumor to do for them what they could not hope to accomplish by fair and open methods. Hillsboro basket ball team defeated Viola boys 37 to 10. Hillsboro team average 165 pounds, Viola 140. Viola Modern Woodmen held a wood chopping bee for Harry Clift, who is ill with rheumatism, and unable to cut his own wood. The city of Prairie du Chien is now recieving its electrical power from the plant at Galena, sent over a new copper line through Lancaster. The old plant will be held in reserve for emergencies. Editor Perkins says that the 8th wonder of the world is to be staged at the LaFarge opera house February 22nd in the form of a real "honest-togoodness" country carnival. LaFarge cornet band will furnish music, and every available foot of floor space in the hall has been leased by the fakers, fortune tellers and side show experts. And they're going to pay for the $100 school Victrola with the money received. Get into the game. Westby local talent staged a patriotic play, "The American Flag", Friday and Saturday nights of this week. The Gays Mills Independent reports that both the training and public schools have added a special course in music. Kendall Keystone tells of the sad fate of James Cockroft, aged 22, member of the local state guard, who accidentally killed himself while hunting. He died while being rushed by car to the hospital at Sparta.