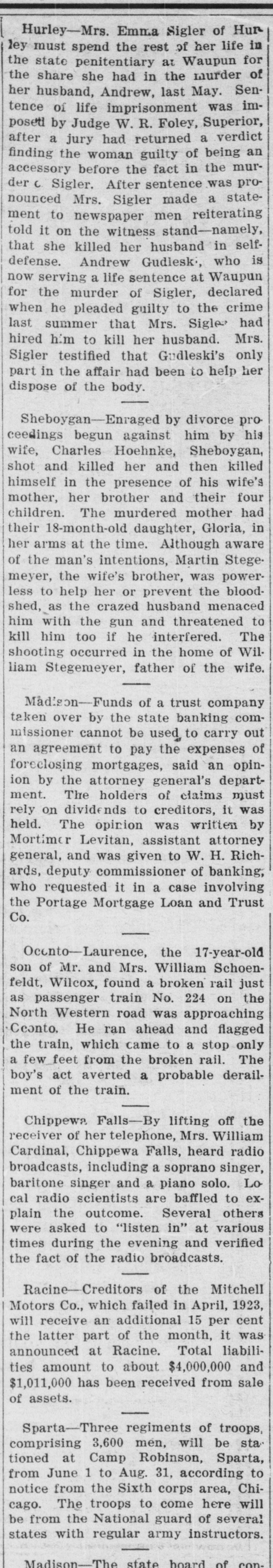

Article Text

Hurley-Mrs. Emma Sigler of Hurley must spend the rest of her life in the state penitentiary at Waupun for the share she had in the murder of her husband, Andrew, last May. Sentence of life imprisonment was imposed by Judge W. R. Foley, Superior, after a jury had returned a verdict finding the woman guilty of being an accessory before the fact in the murder c. Sigler. After sentence was pronounced Mrs. Sigler made a statement to newspaper men reiterating told it on the witness stand-namely, that she killed her husband in self-defense. Andrew Gudlesk, who is now serving a life sentence at Waupun for the murder of Sigler, declared when he pleaded guilty to the crime last summer that Mrs. Sigle had hired him to kill her husband. Mrs. Sigler testified that Gudleski's only part in the affair had been to help her dispose of the body. Sheboygan-Enraged by divorce proceedings begun against him by his wife, Charles Hoehnke, Sheboygan, shot and killed her and then killed himself in the presence of his wife's mother, her brother and their four children. The murdered mother had their 18-month-old daughter, Gloria, in her arms at the time. Although aware of the man's intentions, Martin Stegemeyer, the wife's brother, was powerless to help her or prevent the bloodshed, as the crazed husband menaced him with the gun and threatened to kill him too if he interfered. The shooting occurred in the home of William Stegemeyer, father of the wife. Madison-Funds of a trust company taken over by the state banking commissioner cannot be used to carry out an agreement to pay the expenses of foreclosing mortgages, said an opinion by the attorney general's department. The holders of claims must rely on dividends to creditors, it was held. The opinion was written by Mortimer Levitan, assistant attorney general, and was given to W. H. Richards, deputy commissioner of banking, who requested it in a case involving the Portage Mortgage Loan and Trust Co. Ocento-Laurence, the 17-year-old son of Mr. and Mrs. William Schoenfeldt, Wilcox, found a broken rail just as passenger train No. 224 on the North Western road was approaching Cconto. He ran ahead and flagged the train, which came to a stop only a few feet from the broken rail. The boy's act averted a probable derailment of the train. Chippewa Falls-By lifting off the receiver of her telephone, Mrs. William Cardinal, Chippewa Falls, heard radio broadcasts, including a soprano singer, baritone singer and a piano solo. Local radio scientists are baffled to explain the outcome. Several others were asked to "listen in" at various times during the evening and verified the fact of the radio broadcasts. Racine Creditors of the Mitchell Motors Co., which failed in April, 1923, will receive an additional 15 per cent the latter part of the month, it was announced at Racine. Total liabilities amount to about $4,000,000 and $1,011,000 has been received from sale of assets. Sparta-Three regiments of troops, comprising 3,600 men, will be stationed at Camp Robinson, Sparta, from June 1 to Aug. 31, according to notice from the Sixth corps area, Chicago. The troops to come here will be from the National guard of several states with regular army instructors. Madison-The state board of con-