Click image to open full size in new tab

Article Text

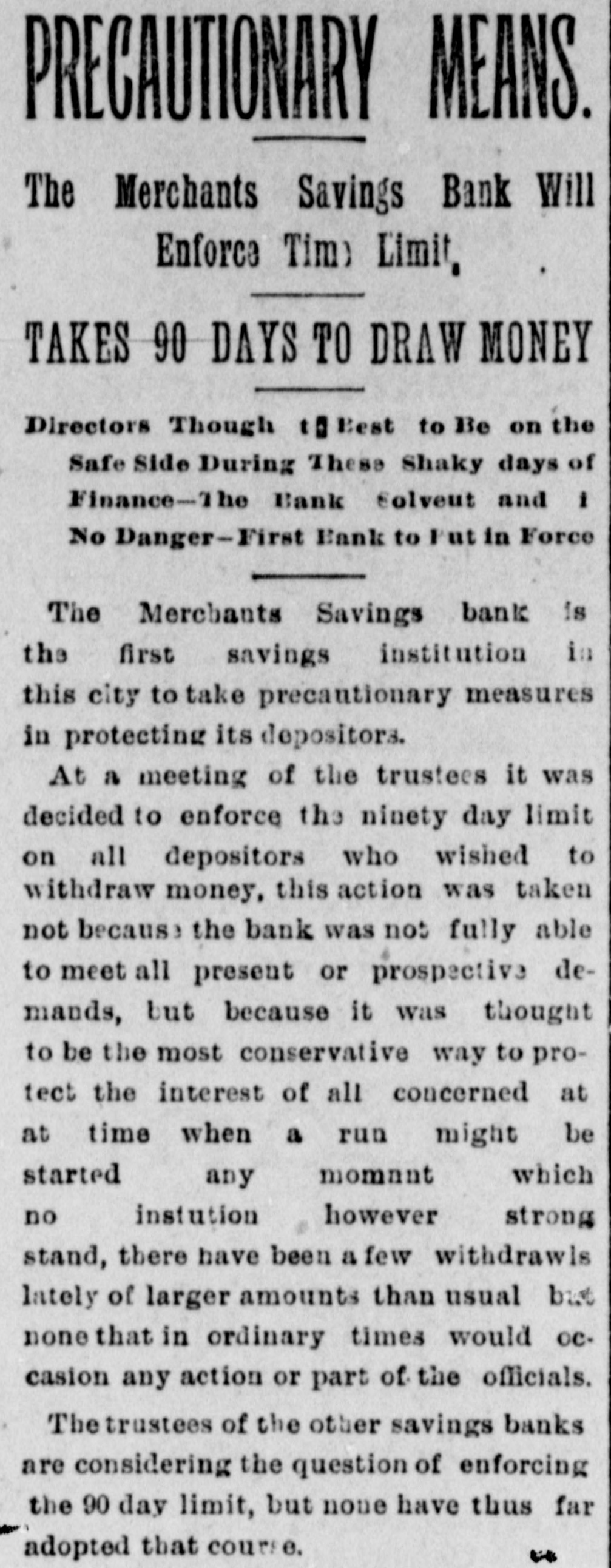

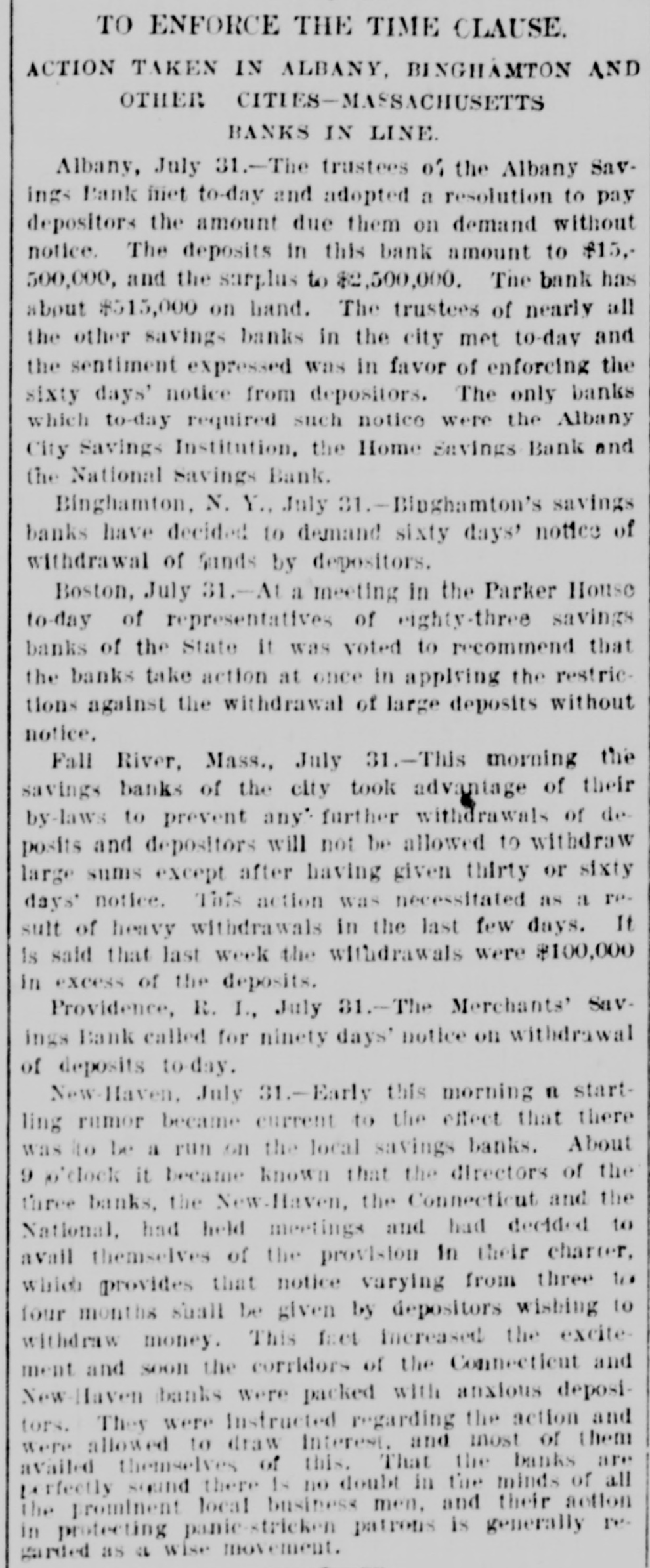

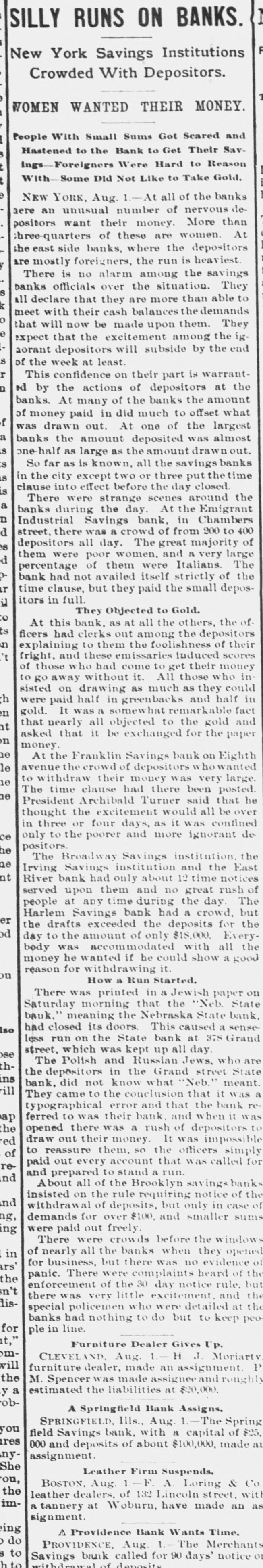

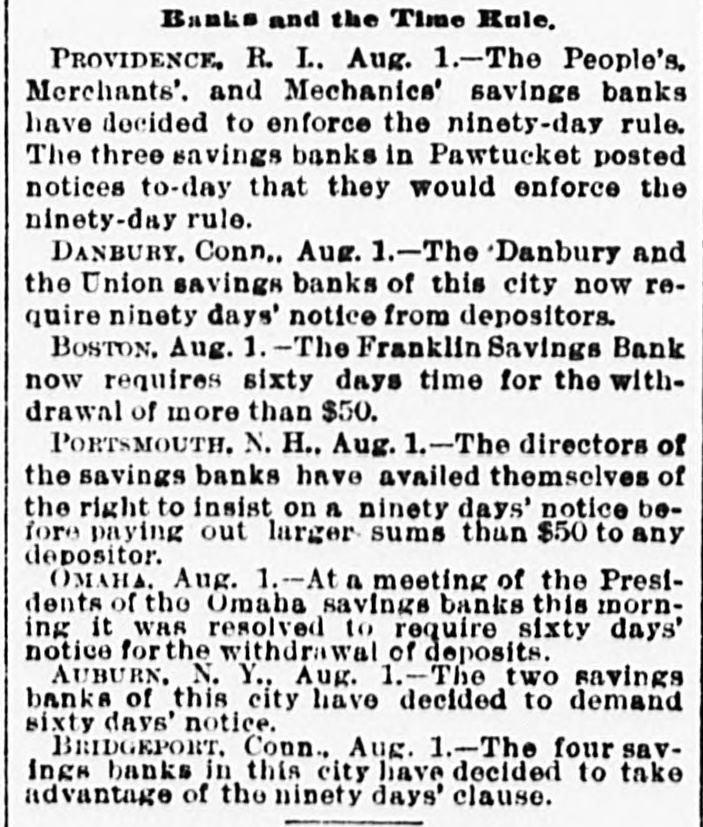

THE NEWS. to reported The Reading Receiver an amicable were tinderstand.ng the with Joan. have come Speyer to syn icate for Electric the extension wires of the £2,500,000 a $300,000 fire in Allentown, at Atcrossing caused the United States Court, issued an lanta, Pa. Ga., In Judge date Newmati of sale for has the Marietta of order fix ng Georgia the Railroad for the in 20th Georand North road has 100 miles and 110 fof the Georgia an roof November. gia $750,00 miles Th's in Tennesses. The The 8800,- price fixed for is the Tennessee division. Buffalo was blown off 000 of a raiiroad station killing in three boys and the inand the walls fell, Philadelphia Catholic $2),000 juring seven Church men.- of the Nativity The was storm partially new destroyed. Loss and Hillsboro tivers were In along the was Indian unusually severe. unroofed. Towns The Florida, flooded and many badly Houses damaged:- John Ed: motive orange Schrecker crop was was murdered in was Pittsburg robbery. by The ward Merchant's Sloan. The Savings voluntary Bank, of liquidation, Providence for R.I., has goue into the supreme court and has its permission petitioned to wind by the depreciation affairs. his action of which of precipitated OD some securities, bank was interest was unWestern been defaulted, and the cash to meet the had to turn its assets into of the demands able Action was depositors. begun Railway against Company, Duluth, in and Northern that the road in unable to pay .conMesaba Duluth, insolvent, which and it was alleged Shipley & its debts. is plaintiffs are Mortis, Mathaus F. BoBtractors, The of Fungarian Faribault. physician, Conn., who a month was Inch, an in Bridgeport, taken ago, lodged was in released. jail $10,000, Bozinch's brought body physician by was Joseph inin a suit for who Alleged the criminally nsKyrszanski, jured him to that extent A by courier from the at saulting his town wife. of Ilan, Mexico, conflict arrived between mountain with news of police authorGuadalajara men and the eight mob of lawless in the death of outa which resulted The were ities, of the mob and police. wounded members were not killed or -The failures driven into the and cKim were laws who mountains. Jr., an- in H. Sisson, Exchange, nounced of E. on the Consolidated Lumber ComThe New York. The Ketebum in Chicago. pany are assets voluntarily assigned estimated at 45 Gottscbalk, took Edward sheriff 000, while of the the company liabilities amount a New York to $250,00 possess- pawnbroker, Liabilities of his failed, place. and the Welluhn about and $100,000. Bertha lon of Franz of The trial the murder of the husband June, in Eschert, latter, for William Eschert, The last jury found Sheboygan, the Wis., ended. murderi in the second Franz Welluhn guilty of acquitted. and Bertha was of Brockton, James by legree, Hayes, a resident footpads while out Mass., was attacked beaten and robbed. riding, and terribly a church choir leader, Mrs. Cranford. of Hollidaysburg Leslie Lots, Pa., eloped Two with a freight trains Rail- 01 Both are married. Lorain and Wheeling of Bridgeport, road the Cleveland, collided LWO miles engines west and several damaging both The amount of No one Jacob Arnold, cars Ohio, defalcation badly. of Cashier injured. Lockport, N. Y., of Bank, of trouble between the will Merchants' reach $100,000. Company The and its machinists,at backBig Four the company the Indianapolis, settled, every down and did not was agreeing to reinstate actually parrecent discharged ing man who riots. Frederick him Vogel, ticipate aged in forty-one, the whose suicide wife left at his months ago, committed The grand jury in Paterson, New Haven, H. some home of the Superior Court N. of Dr. William Ct., retrue bill against him with the of Ansonia, malpractice. Pulford, ported murder a of Nellie Nesbitt appropriately charging by celebrated Connecticut Day was George H. Knight, deat the World's Fair, of Mrs. Lady Managers, State Board Address. runWAS of the interesting train an livering While a an Northern Pacific hour, two miles ning at twenty New Rockford, miles N. D., hunters, the rear car, left loaded south of with a party of broken thirty rail, and turned on its side. to New the track, owing to Twenty a men were Rockford. injured, over all of whom were taken at Lewiston, Peter Pearson, postmaster of Blount, S. D., shot the miles then himself on thirty killed his northwest wife and Jealously was the prairie and near that place. They leave six ebilcause of shooting. destroyed $500,000 worth Are City, Ia.-Mrs. business dren.- property in Sioux suicide in Paterson, Maltera committed dwelling, in Provid- and Kate fire in the Joseph Daly family, ence, N. R. resulted I., occupied in the by death and serious oi Harry another injuries Daly, years old, and seventeen from,the Joe. flames At a to meeting Mrs. Federation, Daly of the in Cincinna- Innesfail were son, Branch of the Irish adopted protesting and ti, resolutions the actions, of John to Redmond the policy of against their adherence Trust ComThe stock of has asserting Gladstone. Louis, with Mercantile a capital its affairs The reasons pany of St. decided to wind up given the $1,000,00 and go out of business. financial depression the and comare the present rates of risks, which high in at extremely pany did not feel justified Hardwood assuming. Company, liabilities The Hyndman has failed. The princiHyndman, Pa., assets $21,000. The pal are stockholders $60,000, and reside in Brooklyn. THE MAFIA AT WORK.