Click image to open full size in new tab

Article Text

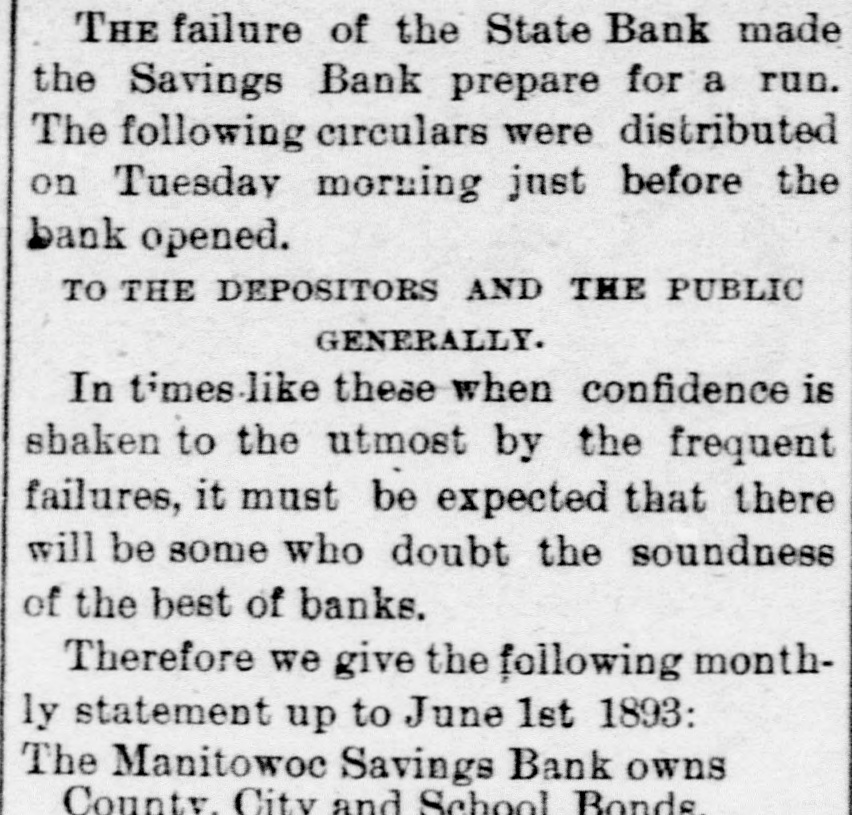

SO that we feel and consider them as investments. We have our Bank reserves in the strongest considered Banks, and distributed in such a manner so that even by the failure of a few banks, could not sustain any perceptible loss. We have as yet not sustained a single loss in any Bank. JOHN SCHUETTE, Pres. LOUIS SCHUETTE, Cashier. In addition to the Bank assets the depositors have the double liability of the Stockholders. That is:-I own $42,000 Stock in the Manitowoc Savings Bank so that my other property is liable to the depositors for $42,000 more in case of necessity. My other property consists of the Oriental Mills plant which does not owe a cent to the Bank nor anyone else, but has besides $19,000 of working capital. Although the value of the mill plant may at present be nominal yet the working capital of $19,000 can be turned into cash at a moments notice. The Electric Light Plant owes nothing to the Bank, is free from debt, and has a balance due in its favor. The Bank and adjoining building owned by me are also free from debt. Besides, I own lots, good stocks, etc. all unincumbered. All my above mentioLed individual properties outside of Bank Interests are practicably liable to all the depositors of the Manitowoc Savings Bank, in the amount of $42,000. The balance of the stock is owned by Henry Schuette, $7,000. and Louis Schuette, $1,000, for which they are doubly liable and adequately responsible. It may not be necessary to state that Schuette Bros. owe nothing to the Bank, but have a credit there. Any one scrutinizing the above statement and having faith in their truthfulness. which I certify to be correct, must feel that all depositors are abundantly secured. JOHN SCHUETTE. On the advice of business men who who were perfectly satisfied the bank could meet its obligations at once unless subjected to a mad rush, Mr. Schuettede cided to cash only such certificates as were due. All who desired were given security, the bonds of which there are over $83,000 worth in bank and the real estate mortgages of which the bank holds over $114,000 being used for this purpose. The city bonds were bought by the bank at 103 per cent. and before the run, would have sold at a higher figure. A large majority took the security. The certificates due and the smaller certificates were cashed. The rush in the morning was caused by the feverish anxiety of the preceding night when the news of the failure of the State Bank spread. By o'clock there was no one in the bank to withdraw his money. had down stampede seeking ten quieted for the time. The The abundance of security which the bank had to offerseemed to have a soothing effect. I While Mr. Schuette stated openly that he blamed no one because of the panic that he it to was utterly is everywhere, impossible for insisted the bank that fail so that it could not pay dollar for dollar. It was difficult to raise money on the splendid securities he had to offer because every bank in the country either had a run or feared one and would not part with any considerable portion of their currency on the very best collateral. The bonds held by the bank are county bonds, Manitowoc city bonds and school bonds on the north side district of this city and of the 3rd ward. These n bonds can not be purchased for less than 104 per cent. The mortgages are on Manitowoc county real estate and would of sell at a premium. The bank has always in turned in its surplus as its officers have an income more than sufficient to meet all their wants without drawing one cent h from the earnings of the bank. Outside of thebank John Schuette is worth about $100,000 and the property is wholly unencumbered. Schuette Bros. offer their guaranty that depositors shall be paid. The credit of their store is at the disposal of the bank should it be needed. The business men of the city are acting very fairly with the bank, so that take it all in all the cause for alarm seems to be utterly groundless. The only trouble is difficulty to get money a difficulty which a few days will remedy as the fever has practically died down in Milwaukee. People have come to their senses there and in a day or two the banks of that city will feel safe in giving money for good secur ities. The bank expected a heavy run yesterday but was quite well prepared. The excitement 10 Milwaukee had died out and banks are willing to make advances on securities. Offers of assistance came for 20 times the amount that was asked and refused the day preceding. The farmers were on hand early in the morning but only a few drew their money out Many of these returned it before 12 At half ten run come totally o'clock, collapsed. past Farmers the who had had with their certificates talked among