Article Text

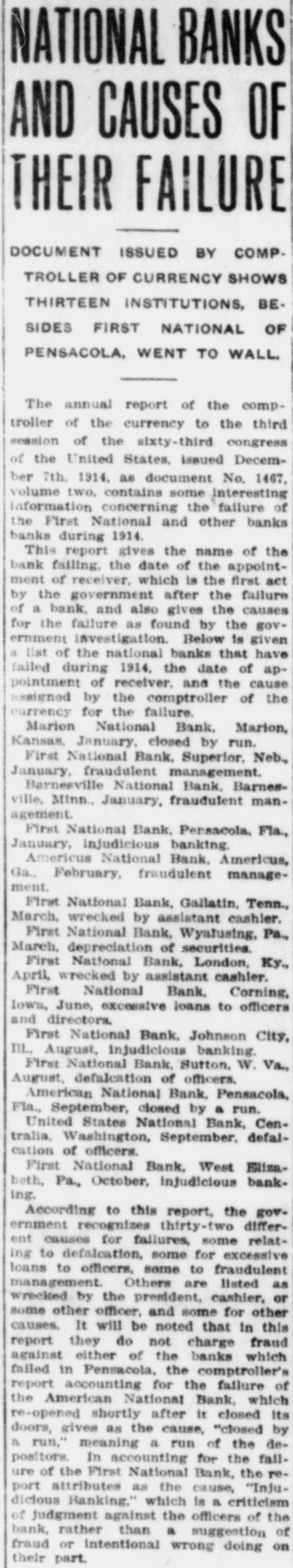

STOCK MARKET AGAIN RECEDES President's Victory Over the House Has Brought About Confident Feeling. LOCAL MEN HONORED Washington Chapter Men Placed in American Banking Institute Fellowship Class. By W. STEALEY. The New York stock market yesterday closed lower. Steel, Reading and Union were Union off fractionally. Copper and Western its exceptions, the former holding 1-4. IItown were while Western Union quiet gained and but The market opened There was of show tle changed strength from Thursday. in the copper stocks, to 561-2. a Utah, which ran up openespecially Pacific on the other hand the ed Canadian down and ruled trading. heavy The during reports two of heavy hours retrenchment of the system on caused the Pennsyl- some vania Railroad Eastern trunk lines, traders to sell the slightly. About prices yielded very in Westbut sudden activity developed large ern noon Union which on comparatively transactions American Tobacco rose to 63 1-4. on the other weak. hand was also comparatively again active almost and entirely professional Operations were and the trading element than is it now more divided in its opinion has been for some time past. the late trading the market losses was heavy In with most stocks showing as a result of the day's trading. The President's Victory. Local brokerage firms yesterday men received many inquiries from business New York relating to the progress House. in of the canal tolls bill fight President in the should felt that if the loss of It was defeated it would indicate a excontrol be over Congress which would tend to other legislation. The news of the defeat of the House The leadership was highly gratifying. to confidence in Congress appears it only in the President's ability to keep rest from ruining the country and incidentally the Democratic party. Local Stock Market. Trading in the Washington Stock Exchange vesterday showed improvement. 106 Bond sales amounted to $5,000 and of stock were sold. shares Two $1,000 Washington Gas 5's sold 82; 107 1-4a107 1-2; one $1,000 Railway and 4, one Capital Traction 5. 107 1-4; Metropolitan one Railroad 5, 105 1-2. The principal trading in the stock selling list was in Mergenthaler, 28 shares 214 5-8a.215. Thirteen shares of National Bank shares of Washington brought 240, and two 294. of American Security and Trust, Twenty-four shares of Capital Traction brought 107 1-2; 25 shares of Washington Railway Gas 82 1-2; and six shares of preferred, 87 1-2. Decision on Rates. Brokers are looking ahead to the Com- decision of the Interstate rates Commerce as to an oasis mission on freight deferred business in sein a desert Some of of them hold that scale they curities comfortable will profit on a win or lose the whether the railroads They will fill buying freight if rate the case. increase is allowed, Nat- and selling orders orders if it that is not the permitted. ruling. when urally they hope favorable to the roads, it comes, it may will be be easily argued that a would buyfor movement under this stimulant selling ing more lively and lasting than a movement be prompted by disappointment. governing committee of the favor- local stock The exchange yesterday passed Washupon the application of the Electric ably Baltimore and Annapolis ington, Railroad Company to list its preferred and bonds. stock are issued $1,455,450 of the 6 and per There noncumulative preferred stock, $7,500,cent $5,079,000 of an authorized issue of 000 5 per cent bonds due in 1941. E. Allen, educational director has George American Institute of Banking, Washadvised of the President Devereux, of the memchapter, that the following electington of the local chapter have been by the pers the "Fellowship Class" W. ed to W. W. Spaid, of B executive Hibbs council: & Co.; H. T. V. Love, Haynes, American Riggs Natonal National Bank; Bank; F. E. V. Grayson, Farmers Merchants Bank: F. B. Devereux, National and Savings and Trust Company. Stockholders of the Seaboard National 21 to of Norfolk will meet April Bank on the proposal to increase the addi- capirote stock from $200,000 to $300,000, the stocktal tional $100,000 to be sold to the holders of the Bank of Norfolk, Inc., two as part of a plan to consolidate the W. T. It is understood that Did, companies. president of the Seaboard bank, will head the merged company. The Wayland Oil and Gas Company has elected Clarence W. Watson, Nusbaum, of West Virginia: Alfred Dryer, A. E. and Edward Cornell, of New York, and Albert Hughes, of Baltimore, as diI. rectors. The board will be enlarged later. Organization was effected by the election of Mr. Watson, president; Mr. Dryer, secrice president, and John T. Caulfield, retary and treasurer. The First National Bank of Wyalusing, yesterday closed its doors by action of Pa., its directors according to a message reeived by Comptroller of the Currency Williams The action was necessitated depreciation in its bonds and securiy ies. The bank has a capital of $25,000, 10 surplus, and deposits aggregating $179, 10. Bank Examiner Charles Smith is in harge of the institution, and his report the Comptroller states that the bank :o held a great deal of industrial securities which had been depreciated far below par value.