Article Text

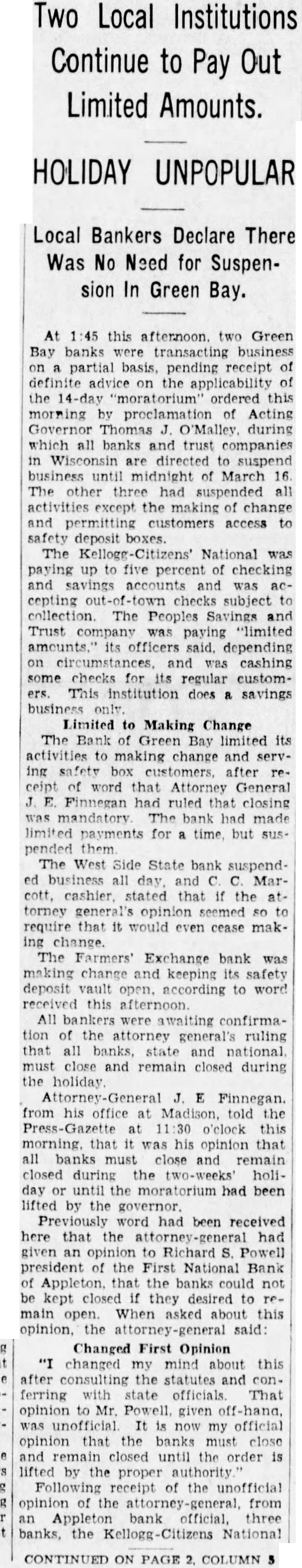

Two Local Institutions Continue to Pay Out Limited Amounts. HOLIDAY UNPOPULAR Local Bankers Declare There Was No Need for Suspension In Green Bay. At this afternoon. two Green Bay banks transacting business partial basis, pending receipt definite advice the ordered morning proclamation Acting Governor Thomas during which all banks and trust companies Wisconsin directed to suspend business midnight March 16 other three had suspended all activities except the making of change and permitting customers access deposit The National was paying up five percent of checking and was cepting subject The Peoples and Trust paying "limited its officers depending and cashing checks for regular customThis does savings business Limited to Making Change The Bank Bay limited its activities making and servsafety customers, after of word that Attorney General Finnegan ruled that closing The bank had limited payments for but them The West Side State bank suspendbusiness all Marstated that the torney general's opinion seemed require that it would even cease making change. The Farmers' Exchange bank was making change keeping safety deposit vault according to word this afternoon. All confirmaof the attorney general's ruling all state and must and remain closed during the holiday from his office told the o'clock this morning. that his opinion that all banks remain closed during the two-weeks' holiuntil the moratorium had been lifted by the governor. word had been received here that the had given an opinion Richard Powell president of the First National that the banks could not kept closed they desired to open. When asked about this opinion. the said: Changed First Opinion changed my mind about this after consulting the statutes and conferring state officials That opinion to Mr. Powell, given unofficial my official opinion the banks must close and closed until the order is lifted by the proper receipt the unofficial opinion the from three banks, the National CONTINUED ON PAGE COLUMN