Click image to open full size in new tab

Article Text

GREAT BRITAIN NATIONAL IS 3 MAKE 8-STORY 4TH AND AGAINST WITH 1ST LIFE MERGED LEAP TO CRAFT UNDERSEA MONTGOMERY IN IN NET CHICAGO

Two Floors of Gunther Building, Near "Loop" Swept By Blaze Last Night

THOUSANDS THRILLED BY SENSATIONAL ESCAPES

Young Woman Suffers Broken Leg and Skull Fracture From Fall; May Die

Feb. for life from eighth story windows into neta, and precarious descents on sealing ladders were thriller that sands saw last night when fire swept two floory of the Gunther Building just south of the "Loop." Miss Margaret Paine, one the three who sought escap from the flames by leaping into net jured seriously she may She struck the feet first and her body rebounded several feet into the A flying cut deep in the cheek one of the men hlding the net. the rebound struck other holder, Ralph De Butch, cab driver, and his shoulder was broken

The young woman's leg was broken and her skull fractured. Miss Paine was the second of three persons to leap the eighth floor. the first jumper was Joseph Sandman. He struck squarely in the center of one of the five spread be. low and suffered only slight wrench to his left Cecil McDonough, 32, who weighs 195 pounds, jumped last and came from the net, as he put it, "without bruise or scratch. The blowing of a fuse on an electric machine in the factory of the compainy on the seventh floor started the fire. spark igniting a bin of cotton and silk shreds. Three hundred girls employed the Thorne company escap. ed by of elevators which were running even until flames were leaping across the shafts.

Several kirls, unable to reach the elevat in tim ran to the window Three of them were hanging to win dew ledges of the seventh floor when firemen arrived. Extension ladders rached only to the fifth floor. Fire men used scaling ladders, consisting only of single hook nosed upright with cross bars, and carried these girls to safety. Battalion Chief Michael Kerwin said that in his 39 year, experience he never before had seen ful leap life from floor any higher than the fourth

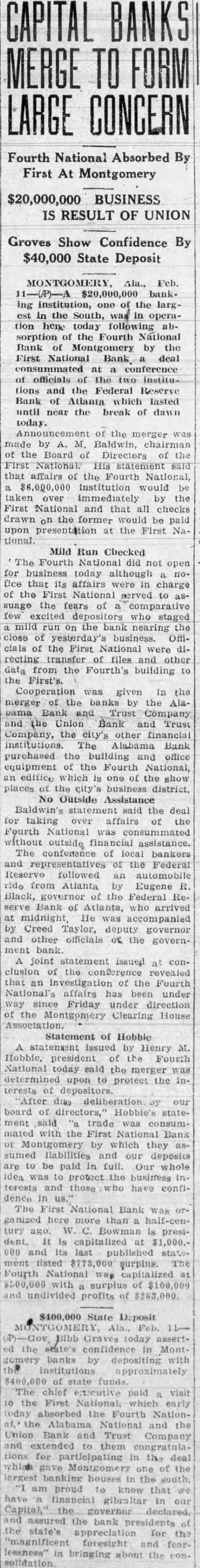

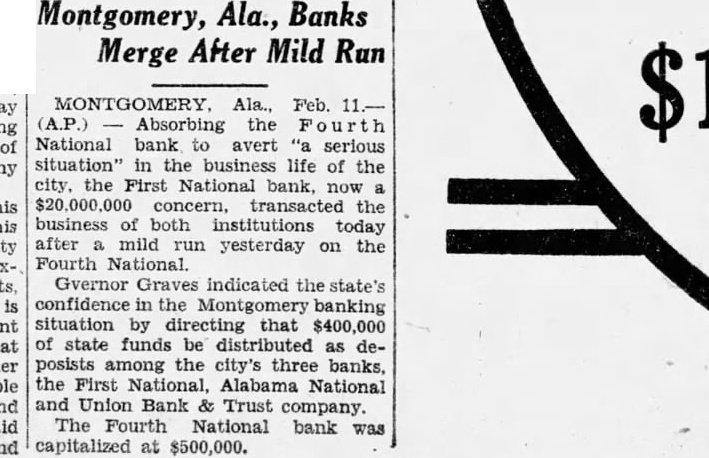

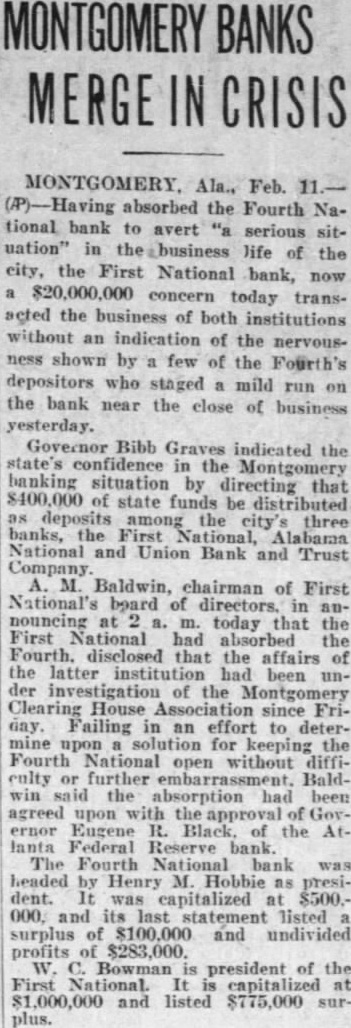

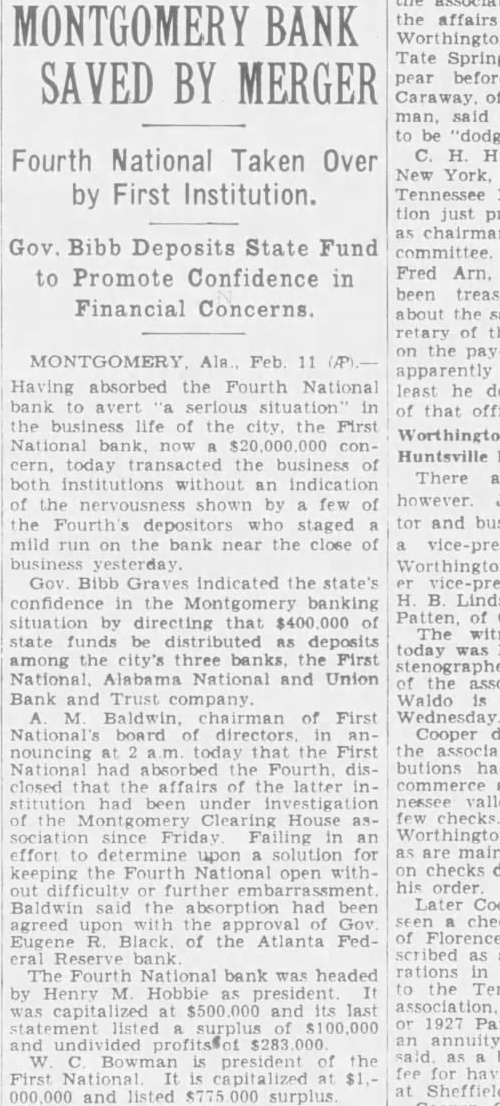

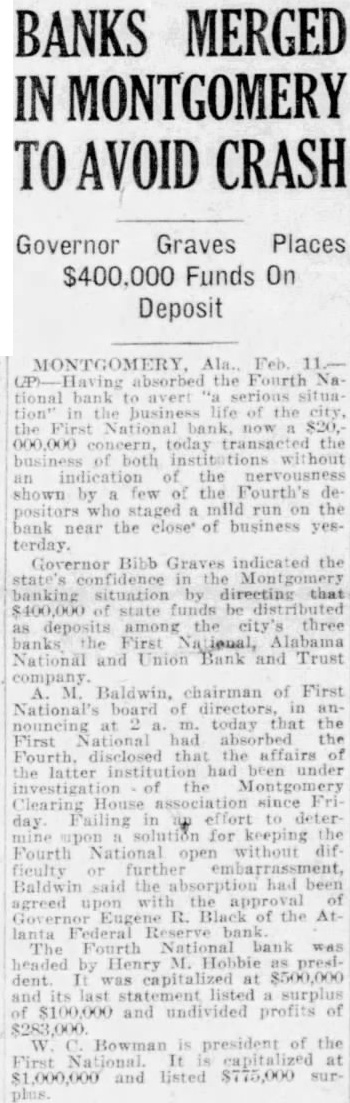

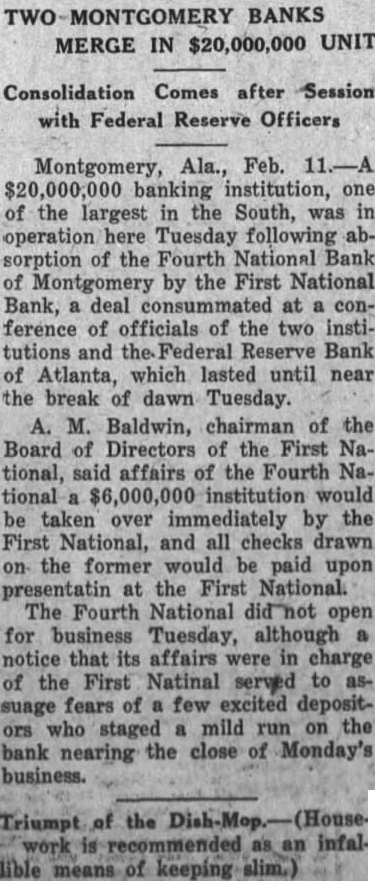

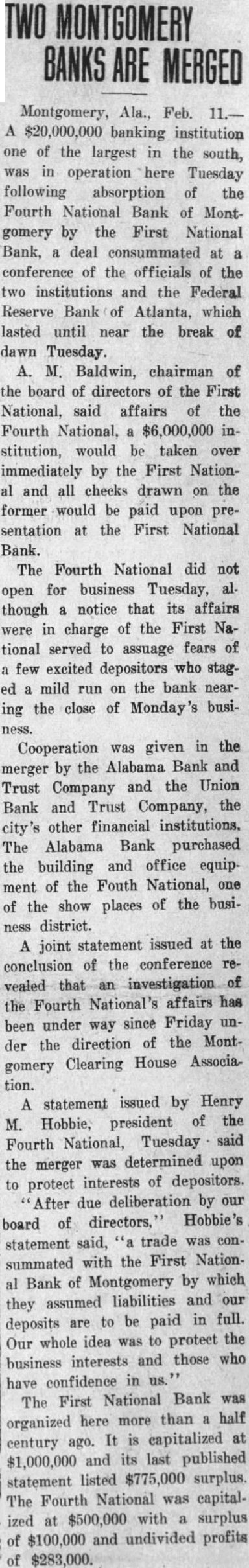

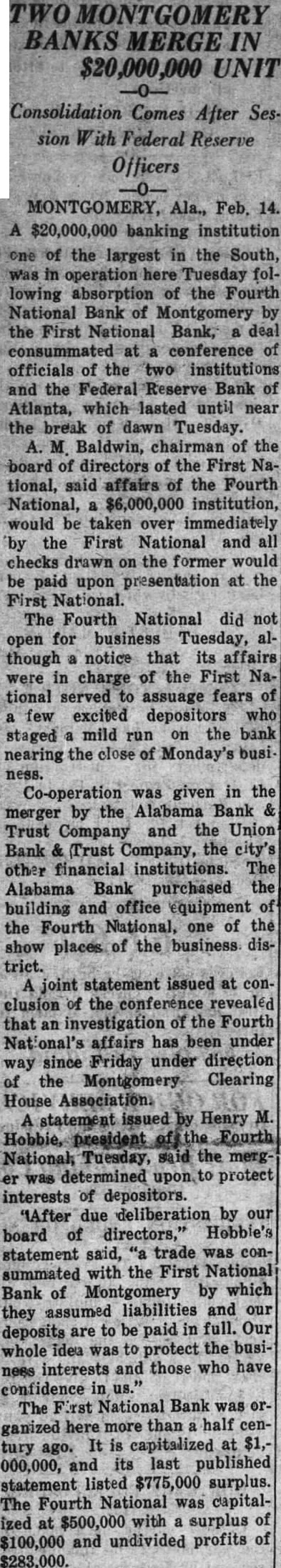

Effected Today Consolidation After Light Run and AllNight Conference

MONTGOMERY in the South of the today operation Bank the Fourth sorption of Montgome by Bank, deal consummated of officials of the ference federal bank tions and the which lasted near Atlanta break of dawn today of the made by Na the heard aff $6,000.000 institution would diately by the First

The Fourth National although for today that affairs were First to fear of bank the Officials files tional and data from the bu other ing to the operation WAS given in of the bank by the Alabama Ban Trust Company and the Union Ban' and Trust Company, the city's other financial institutions. The Alabam Bank purchased the buil ng of fic equipment the Fourth National an edifice which is one of the show place of district Baldwin's statement the deal for taking over affairs of the Fourt National was consummated outside financial assistance

The conference local representative of the der followed automobile ride om A lanta by Engene R Black the federal reserve A'lanta who arrived at midnight. He was companied by Cired Tay governor and other officials government bank A joint statement lon of the to investigation of the with uffair has been under way since Fri day under direction of clearing statement issued by M Hobbie of th Fourth Na tional the merger termined to protect the up of depositors. by out born of director H bbie's statement trade was with the First National Bank of M which assumed liabilities an by they full our deposits are whole idea the busi protect interests

The Frist National Bank ganized ago W Bowman at $1,000,000 and last published listed $775,000 Fourth National at $500,000 surplu $100.000 and undivided profits $283,000

Graves Deposits With First National

Gov ibb Graves today asserted the confidence Nontgomery by depositing with the $400,000 of state approximately funds The Chief Executive paid visit to the First National which early today absorbed the Fourth National the Alabama National and the Union Bank and Trust Company and extend to them congratulations for partic ipating in the deal which gave Mont one of the largest baking the south am proud to know that have financial gibraltar in our capita," the declared. and assure bank presidents of the preciation for the "magnificent fore. and fearlessness in bringin sight about the consolidation

France and Japan Will Not Aban don Submersibles, But Will "Humanize" Activities

MARKED WITH AIR SESSION OF INTENSITY OVER DEBATE

Alexander, of Great Britain, Declares Subs Should Be Wiped From Navies of World

By DEWITT 11 virtually marines of lease of war during historic debate the conference today in the course of which the five great nava ers of the world present views to the abolition of "terrors of the deep." Out of the wealth of elocent pleas for against the retention formal and that be made to restrict number There was an air of tensity which other plenary session HAS the of the each other in the Anne St James' Palace make their regarding the larations sunk all aboard. the United States and tritain for the abolition of France and Japan for their ntion holding to their her would not surreder this arm of Italy agreed Britain but America and with with reservations which would guard her interests as compared with those of other

After opened the session, had formally Alexander, first Lord of the Ad miralty, rose amidst great silence measured tones sclared belief that Britain's should be wiped from the the world The French and Japan listened with delegations declared with intentness he that submersibles tion but inhuman offensive

Great Britain, he said, lition, but if this could not be stood for ed then she of submarine warfare and the tation of size and numbers. The chief American delegate, retury of State Stimson, who follow of address one ed began his which have statements crisp to naval familiar "The American delegation or of the abolition of the submarine Briefly he amplified this declara handed in tion and later the committee calling for three questions Abolition of the submarine 2. Regulation of use in way time Regulation of unit and undersea like Mr In other words he, the road for ander, opened mise with France who, it would agree to humanizing marine but would flatly to cept abolition Georges Then came French minister of marine, shifting in the was to get other France's spokesman. In rapid tones that France declined to She considered defensive weapons. sary that country doubt at this stand but he tendered branch proposing study the proposition izing not only of all clas the activities ships of Dino Grand The speech foreign minister, of the Italian reiteration of the beginning which bee nfor naval ference has France Admiral in rine, contention reiterated Japan's need of ended today's plenary So feeling general had siscussed that it had come on Page (Continued