Article Text

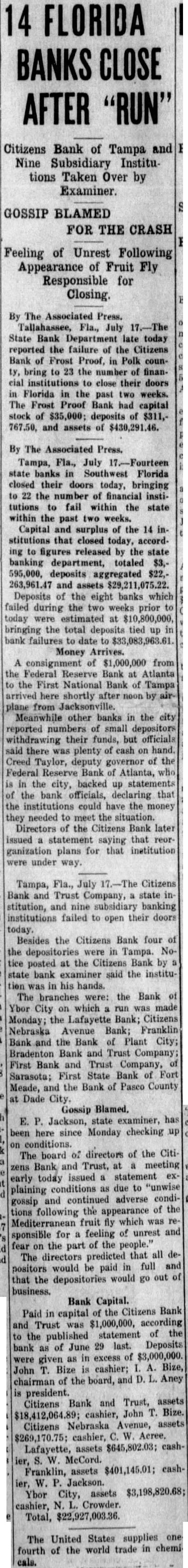

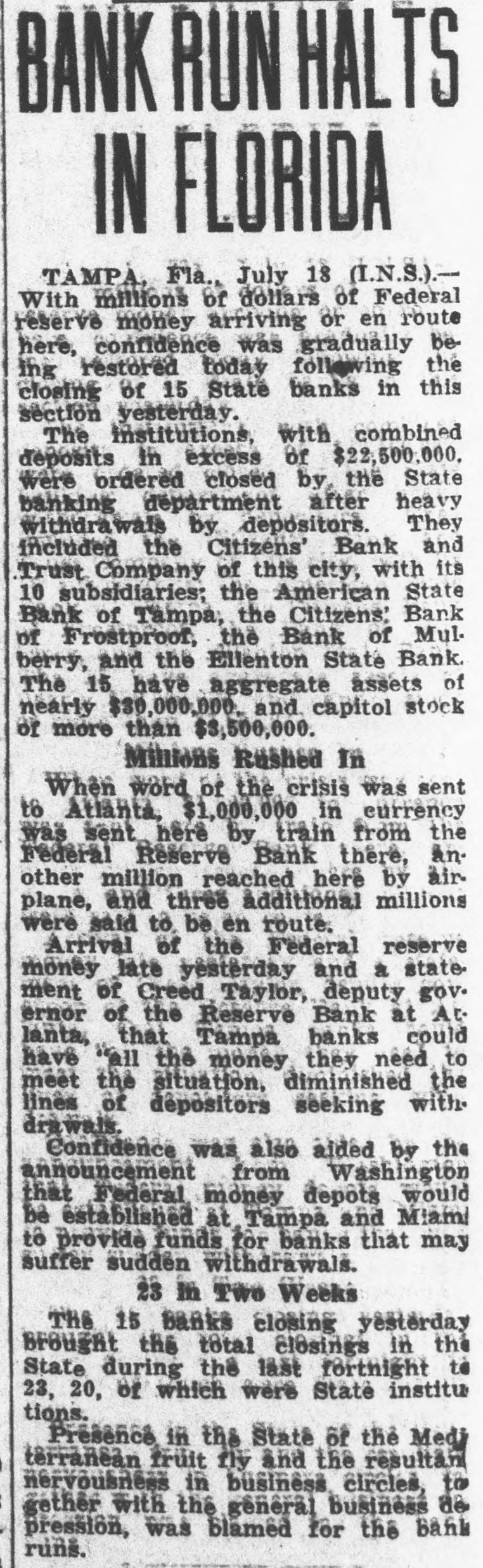

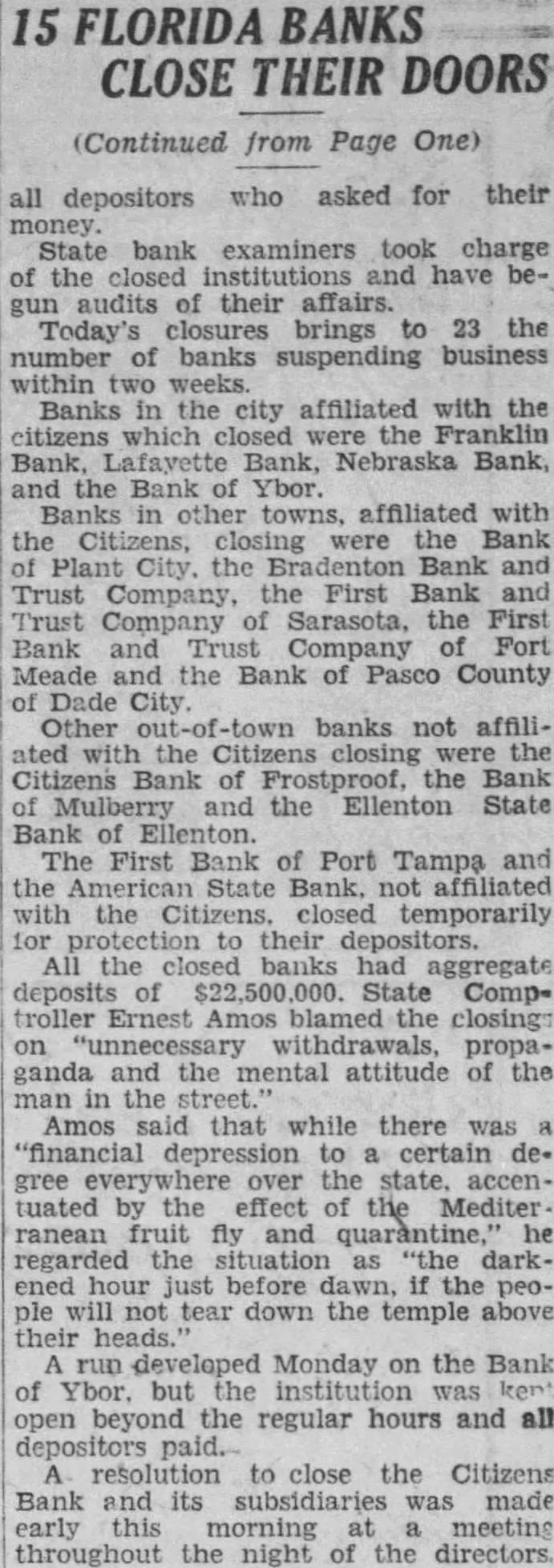

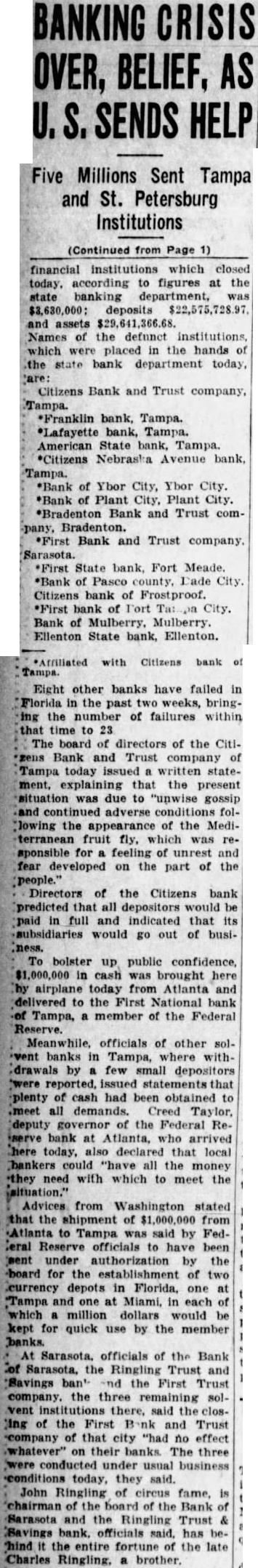

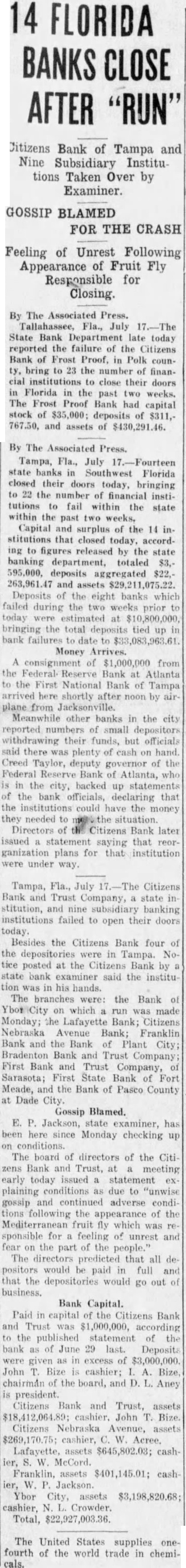

FLORIDA BANKS AFTER "RUN" Citizens Bank of Tampa and Nine Subsidiary Institutions Taken Over by Examiner. GOSSIP BLAMED FOR THE CRASH Feeling of Unrest Following Appearance of Fruit Fly Responsible for Closing. By The Associated Press. Tallahassee, Fla., July State Bank Department late today reported the failure of the Citizens Bank of Frost Proof, in Polk counbring to 23 the number of financial institutions to close their doors Florida in the past two weeks. The Frost Proof Bank had capital stock of $35,000; deposits of $311,and assets of By The Associated Press. Tampa, Fla., July 17.-Fourteen state banks in Southwest Florida closed their doors today, bringing to 22 the number of financial institutions to fail within the state within the past two weeks. Capital and surplus of the stitutions that closed today, according to figures released by the state banking department, totaled $3,595,000, deposits aggregated $22,263,961.47 and assets $29,211,075.22. Deposits of the eight banks which failed during the two weeks prior today were estimated at bringing the total deposits tied bank failures to date to Money Arrives. A consignment of $1,000,000 from the Federal Reserve Bank at Atlanta to the First National Bank of Tampa arrived here shortly noon plane from Jacksonville. Meanwhile other banks in the city reported numbers of small depositors withdrawing their funds, but officials said there was plenty of cash on hand. Creed Taylor, deputy governor of the Federal Reserve Bank of Atlanta, who in the city, backed up statements of the bank officials, declaring that the institutions could have the money needed to meet the situation. Directors of the Citizens Bank later issued statement saying that reorganization plans for that institution under way. Tampa, Fla., July Citizens Bank and Trust Company, state institution, nine subsidiary banking institutions failed to open their doors today. Besides the Citizens Bank four the depositories were in Tampa. Notice posted at the Citizens Bank by state bank examiner said the institution in his hands. The branches were: the Bank Ybor City on which run was made the Lafayette Bank; Citizens Monday; Nebraska Avenue Bank; Franklin Bank and the Bank of Plant City; Bradenton Bank and Trust Company; First Bank and Trust Company, First State Bank of Fort Sarasota; Meade, and the Bank of Pasco County Dade Gossip Blamed. Jackson, state examiner, has been here since Monday checking up conditions. The board of directors of the Citiand at meeting zens Bank early today issued statement conditions as due to "unwise plaining gossip and continued adverse conditions following the appearance of the Mediterranean fruit fly which sponsible for feeling of unrest and fear on the part of the people." that all deThe directors predicted positors would be paid in full and that the depositories would go out of business. Bank Capital. Paid in capital of the Citizens Bank Trust $1,000,000, according and was to the published statement of the of June 29 last. Deposits bank as in excess of $3,000,000. were given as cashier; Bize, John Bize is of the board, and Aney chairman president. Bank and Trust, assets Citizens John Bize. $18,412,064.89; cashier, Avenue, assets Citizens Nebraska cashier, $645,802.03; cashLafayette, assets McCord. ier, Franklin, assets ier, W. Jackson. Ybor City, assets cashier, Crowder. Total, The United States supplies onethe world trade in chemifourth of cals.