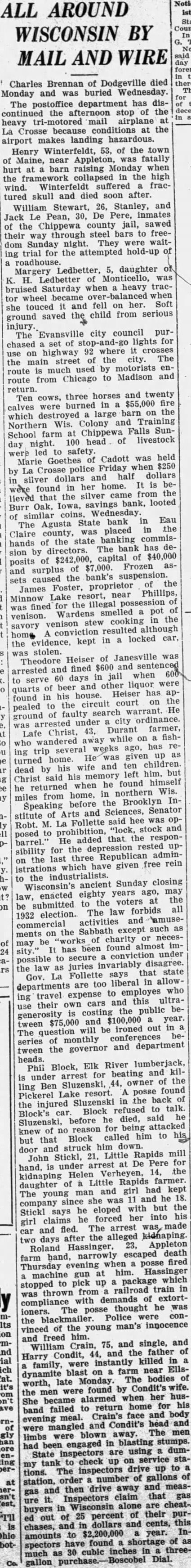

Article Text

ALL AROUND WISCONSIN BY MAIL WIRE Charles Brennan of Dodgeville died there Monday and was buried Wednesday. The postoffice department has disthe stop of the heavy tri-motored mail airplane at La Crosse because conditions at the airport landing hazardous. Henry Winterfeldt, 53, of the town of Maine, near Appleton, fatally hurt at barn raising Monday when the collapsed in the high wind. Winterfeldt fractured skull and died soon after. William Stewart, 26, Stanley, and Jack Pean, De Pere, inmates of the Chippewa county jail, sawed their way through steel bars to freeThey were waitdom Sunday night. ing trial the attempted hold-up of roadhouse. Margery Ledbetter, daughter K. H. Ledbetter Monticello, was bruised Saturday when heavy tractor wheel became when she touced and fell her. Soft ground saved child from serious injury. The Evansville city council purchased set of lights for highway 92 where it crosses the main street the city. The route much used by motorists enroute from Chicago to Madison and return. Ten cows, three horses and twenty calves were burned in $55,000 fire which destroyed large barn on the Northern Wis. Colony Training School farm at Chippewa Falls Sunof livestock 100 head day night. to safety. were Marie Cadott was held by Crosse police Friday when $250 silver dollars and half dollars bein her home. found from the the silver came lieved that Burr Oak, Iowa, savings bank, looted Wednesday. similar in Eau State bank The Agusta placed the Claire county, was hands the state banking commisbank has dedirectors. The sion by of $40,000 $242,000, capital posits of Frozen asof $7,000. surplus and sets caused the bank's suspension. James Foster, proprietor the near Phillips, Lake resort, Minnow the illegal fined was venison. Wardens smelled pot the of cooking venison savory resulted although conviction home in locked kept the stolen. was of Janesville Theodore Heiser arrested and fined $600 and when sentenced 60 days in jail to serve other liquor beer and of quarts found in his house. Heiser has apon the circuit court to the pealed search warrant. of faulty ground was arrested under city ordinance. Lafe Christ, 43, Durant farmer, wandered away while on fishing trip several weeks ago, has given up as turned home. children. wife and ten dead by his left him, but said his memory Christ found himself returned when he he northern Wis. from home. miles Speaking before the Brooklyn Senator Inand Sciences, stitute of Arts said hee was opM. La Follette posed Robt. to prohibition, "lock, stock barrel.' He added that the responsibility for the depression rested on the last three Republican adminwhich have given free rein the ancient Sunday closing law, enacted eighty years ago, may the the voters be submitted forbids all The law 1932 election. activities and ments commercial the Sabbath except such as charity necesbe "works may imbeen found has under possible secure the law as juries that state says La departments Gov. are too liberal in allowing travel expense to employes who their own cars and this ultragenerosity is costing the public between $75,000 and $100,000 year. The question will be ironed out beconferences series monthly tween the governor and department heads. Phil Block, Elk River lumberjack, under arrest for beating and killing Ben Sluzenski, 44, owner of found the Lake resort. posse Pickerel the injured Sluzenski the to back talk. of Block refused Block's Sluzenski, before he died, said he knew of no reason for being attacked but that Block called him to struck him down. door John Stickl, 21, Little Rapids mill hand, under arrest De Pere for the kidnaping daughter Little Rapids farmer. and girl had kept The young company since she was and he 18. Stickl says he eloped with but the girl claims forced her into his car and fled. The arrest was, made days after the alleged kidnaping. Hassinger which in was of Ellsof wife. body men stumps. to measgas this Inof three-