Click image to open full size in new tab

Article Text

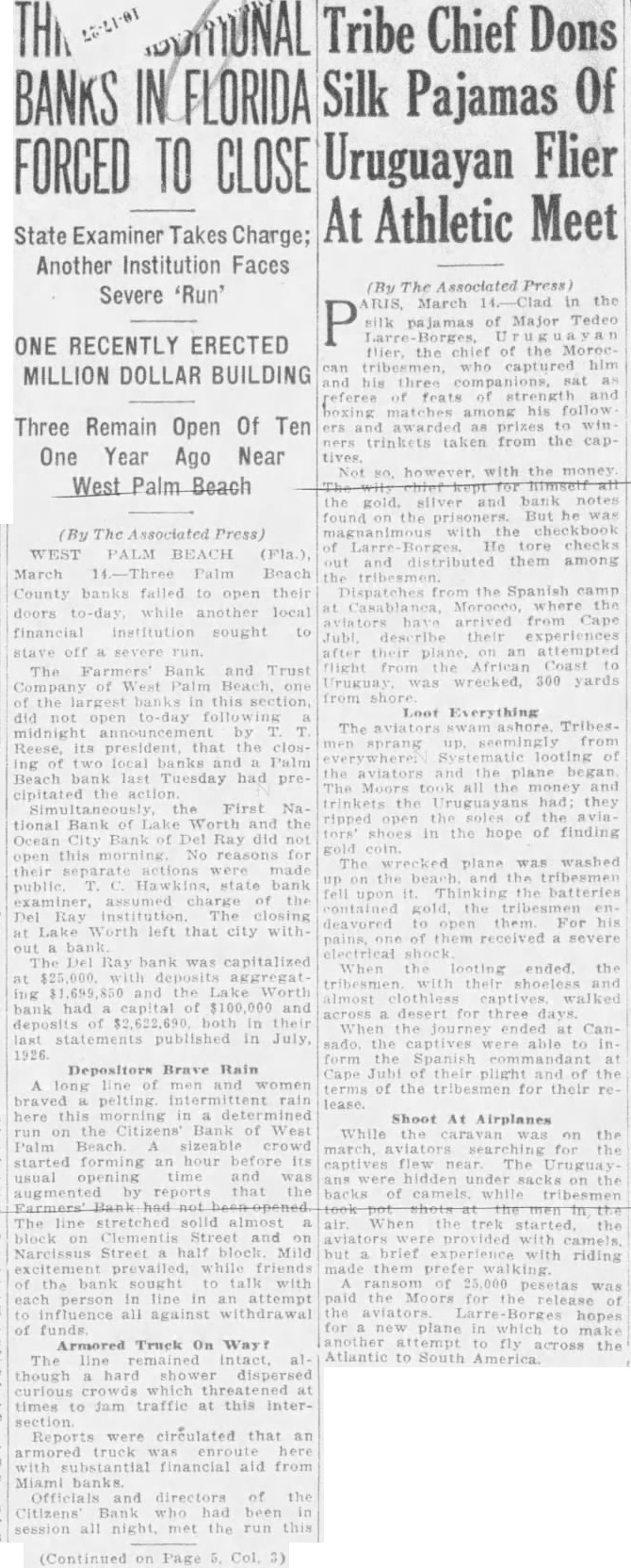

Tribe Chief Dons BANKS Uruguayan Flier FORCED TO CLOSE At Athletic Meet State Examiner Takes Charge;

Another Institution Faces Severe 'Run'

ONE RECENTLY ERECTED MILLION DOLLAR BUILDING

Three Remain Open Of Ten One Year Ago Near West Palm Beach

(By The Associated Press) WEST PALM BEACH (Fla.) March 14-Three Palm Beach County banks failed to open their doors to-day, while another local financial institution sought to stave off run. The Farmers' Bank and Trust West Palm Beach, one the in this section did to-day midnight by Reese, its president that the closBeach bank last Tuesday had precipitated the First Na tional Bank of Worth and the Bank of Del Ray did open this morning. No reasons their separate actions were made public Hawkins, state bank examiner, assumed of the Del institution Lake Worth left that city with bank The Del Ray bank was capitalized deposits aggregat ing and the Lake bank had capital of $100,000 and in published in July,

Depositors Brave Rain and braved pelting. rain here this morning in determined on the Citizens' Bank of West Palm Beach sizeable crowd started forming an hour usual opening time and was by reports that the Farmers' had The line stretched solld almost block on Clementis Street and Narcissus Street half block Mild excitement prevailed, while friends sought each person line attempt influence all against withdrawal of funds

Armored Truck On Way! The though hard shower dispersed which threatened at times to Jam traffic at this InterReports circulated that truck here substantial aid from Miami Officials and directors of the Citizens Bank had been in session all night met the run this

(Continued on Page Col 3)

(By The Associated Press) ARIS, March in the P silk pajamas of Major Tedeo flier, the chief of the Moroc. tribesmen, captured him and his three companions, sat referee feats boxing his follow awarded as prizes to win trinkets taken from the cap Not NO. however. with the money the gold. silver and bank But he was the checkbook Larre Borges. He tore checks and distributed them among Dispatches from the Spanish camp arrived from Cape Jubl their experiences their plane attempted flight from African Coast wrecked, 300 yards

Loot Everything The sprang looting the and the plane began The all the money and trinkets the Uruguayans had they ripped open the shoes in hope of finding The plane was washed the tribesmen fell upon the batteries contained the tribesmen deavored to open them. For his pains, received severe electrical When looting ended. the and almost captives walked desert for three days When journey ended at Can sado, the captives able in the Spanish commandant the terms of the tribesmen for their re lease.

Shoot At Airplanes While on the march, searching for captives The Uruguay on the backs of camels. When trek started, the aviators brief experience with riding them prefer walking. of pesetas was paid the Moors for the the hopes for new plane in which to make another attempt fly across the Atlantic to South America.