Article Text

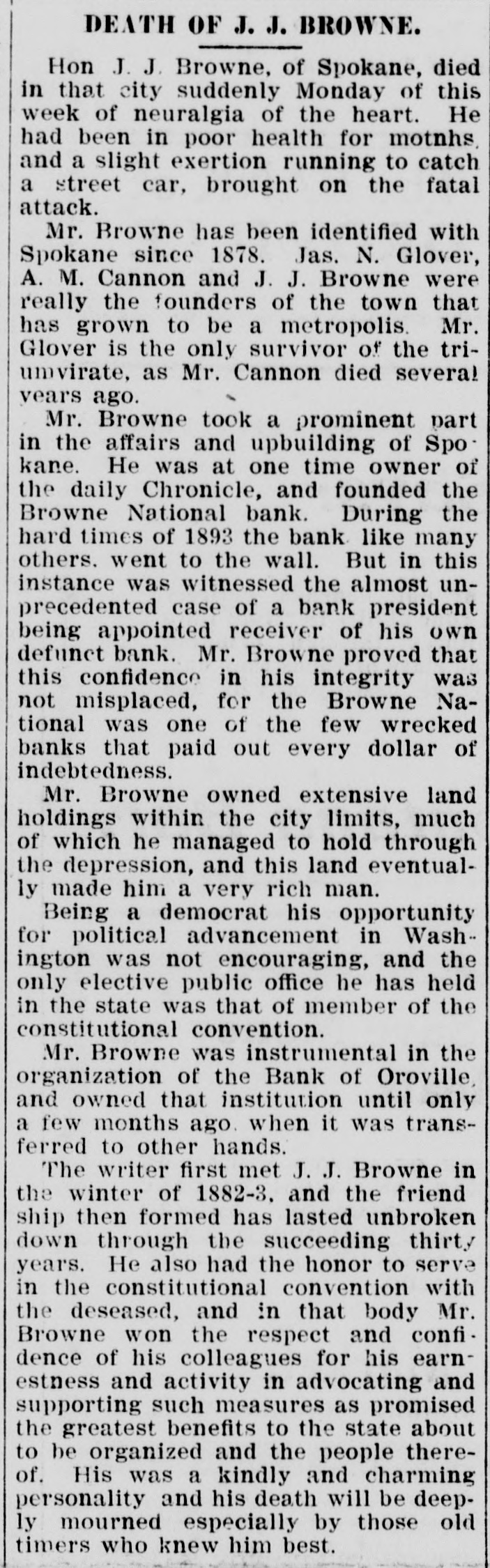

DEATH OF J. J. BROWNE. Hon J. J. Browne, of Spokane, died in that city suddenly Monday of this week of neuralgia of the heart. He had been in poor health for motnhs and a slight exertion running to catch a street car, brought on the fatal attack. Mr. Browne has been identified with Spokane since 1878. Jas. N. Glover, A. M. Cannon and J. J. Browne were really the founders of the town that has grown to be a metropolis. Mr. Glover is the only survivor of the triunvirate, as Mr. Cannon died several vears ago. Mr. Browne took a prominent part in the affairs and upbuilding of Spo kane. He was at one time owner of the daily Chronicle, and founded the Browne National bank. During the hard times of 1893 the bank. like many others. went to the wall. But in this instance was witnessed the almost unprecedented case of a bank president being appointed receiver of his own defunct bank. Mr. Browne proved that this confidence in his integrity was not misplaced, for the Browne National was one of the few wrecked banks that paid out every dollar of indebtedness. Mr. Browne owned extensive land holdings within the city limits, much of which he managed to hold through the depression, and this land eventually made him a very rich man. Being a democrat his opportunity for political advancement in Washington was not encouraging, and the only elective public office he has held in the state was that of member of the constitutional convention. Mr. Browne was instrumental in the organization of the Bank of Oroville, and owned that institution until only a few months ago. when it was transferred to other hands. The writer first met J. J. Browne in the winter of 1882-3, and the friend ship then formed has lasted unbroken down through the succeeding thirty years. He also had the honor to serve in the constitutional convention with the deseased, and in that body Mr. Browne won the respect and confidence of his colleagues for his earnestness and activity in advocating and supporting such measures as promised the greatest benefits to the state about to be organized and the people thereof. His was a kindly and charming personality and his death will be deeply mourned especially by those old timers who knew him best.