Article Text

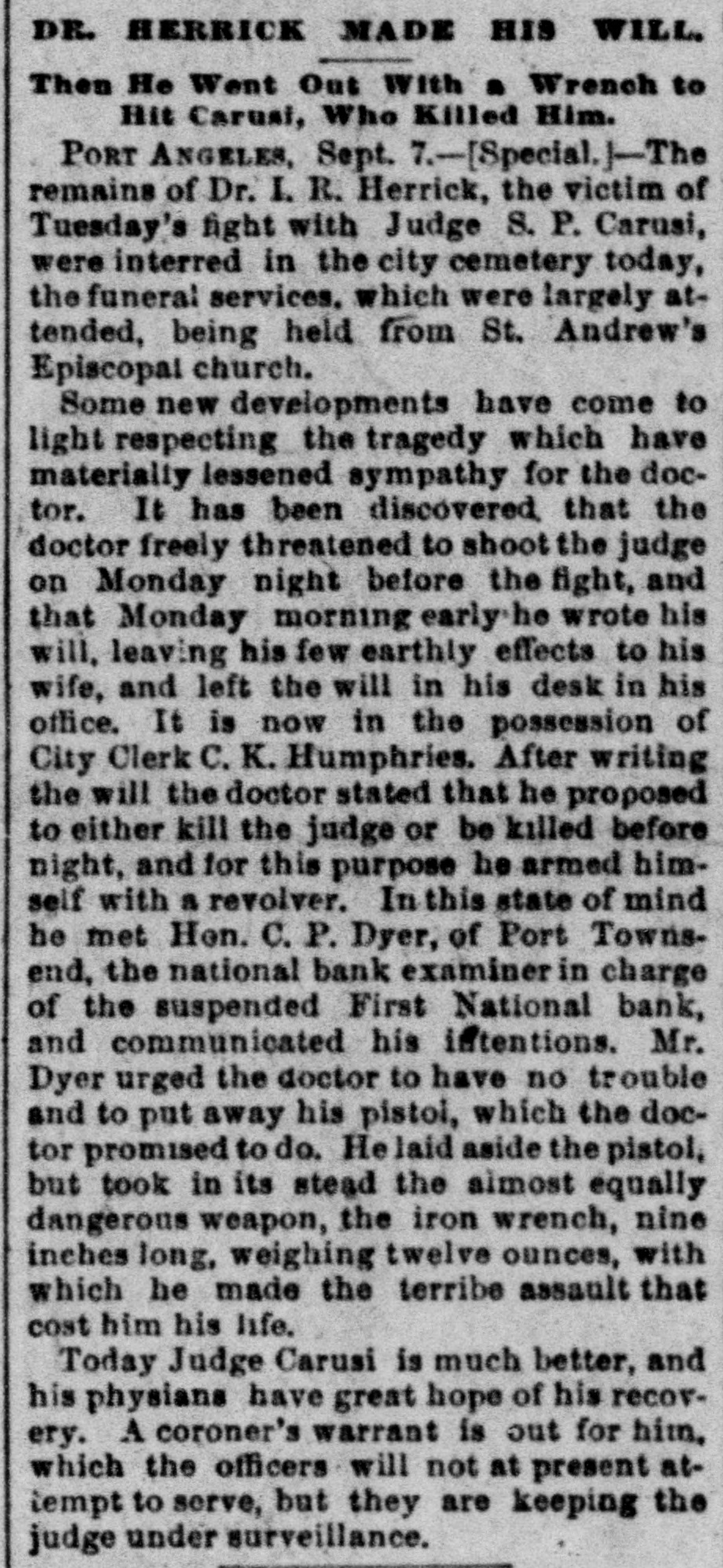

DR. HERRICK MADE HIS WILL. Then He Went Out With a Wrench to Hit Carusi, Who Killed Him. PORT ANGELES, Sept. 7.-[Special.|-The remains of Dr. I. R. Herrick, the victim of Tuesday's fight with Judge S. P. Carusi, were interred in the city cemetery today, the funeral services. which were largely attended, being held from St. Andrew's Episcopal church. Some new developments have come to light respecting the tragedy which have materially lessened sympathy for the doctor. It has been discovered that the doctor freely threatened to shoot the judge on Monday night before the fight, and that Monday morning early he wrote his will, leaving his few earthly effects to his wife, and left the will in his desk in his office. It is now in the possession of City Clerk C. K. Humphries. After writing the will the doctor stated that he proposed to either kill the judge or be killed before night, and for this purpose he armed himself with a revolver. In this state of mind he met Hon. C.P. Dyer, of Port Townsend, the national bank examiner in charge of the suspended First National bank, and communicated his intentions. Mr. Dyer urged the doctor to have no trouble and to put away his pistoi, which the doctor promised to do. Helaid aside the pistol, but took in its stead the almost equally dangerous weapon, the iron wrench, nine inches long, weighing twelve ounces, with which he made the terribe assault that cost him his life. Today Judge Carusi is much better, and his physians have great hope of his recovery. A coroner's warrant is out for him. which the officers will not at present attempt to serve, but they are keeping the judge under surveillance.