Article Text

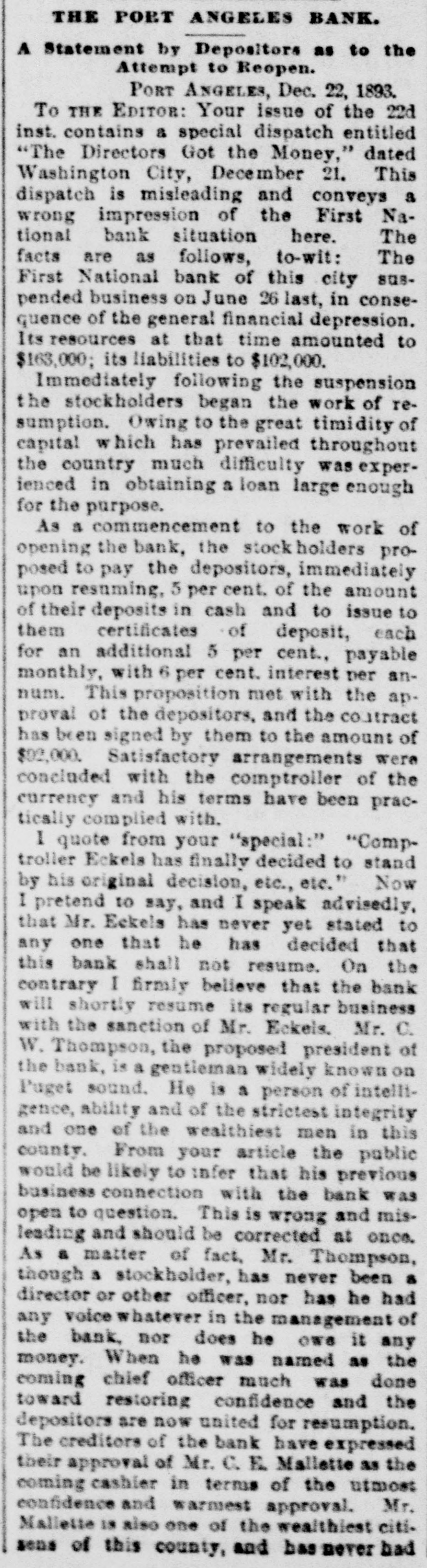

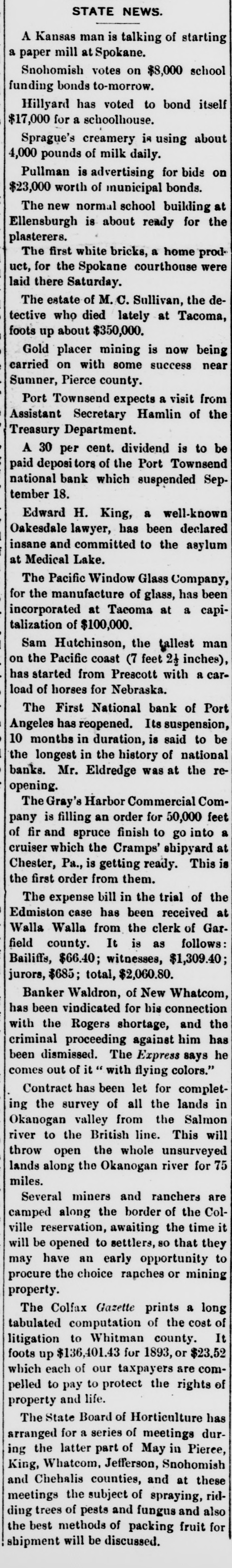

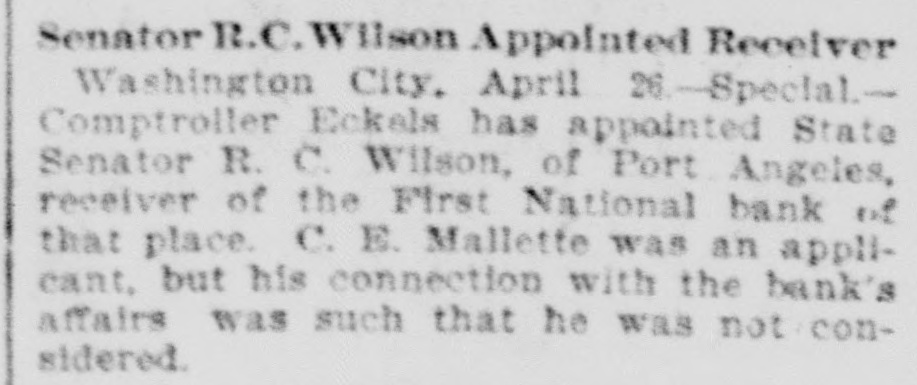

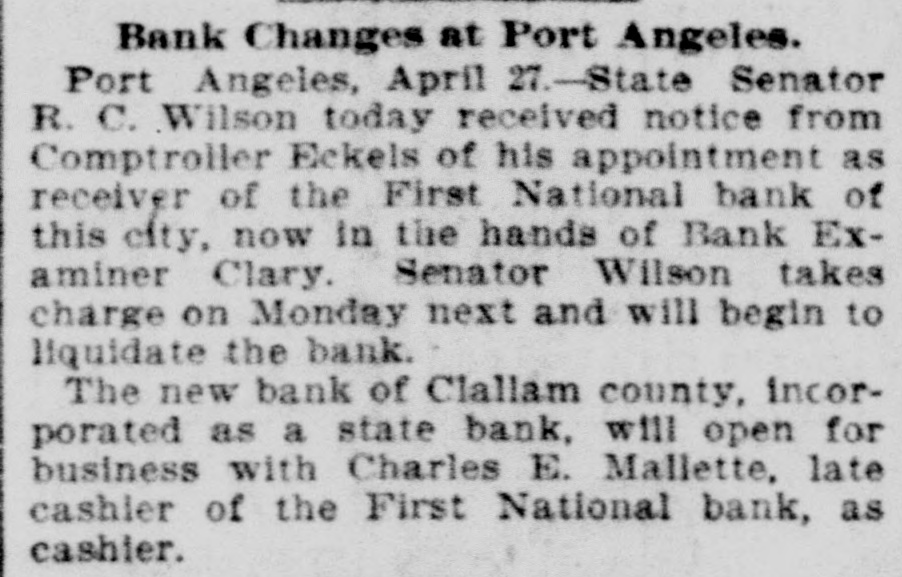

FAILURES. MINNEAPOLIS, Minn., June 26.-The Bank of New England suspended payment Since this morning, temporarily at least. the failure of the State bank on Thursday dethere has been a steady withdrawal of posits. A. J. Blethen, the president of the bank, says that it had considerable money tied up by the Chicago failures. Every depositor, be adds, will be paid in full, of the as the stockholders i suffer instead if the bank does had cash available to the last depositors The bank not of resume. amount the $64,000 on May 4, the time and of but its liabilities were $200,000 that report, somewhat in excess of The capital stock of the is surplus, the amount. $100,000; assets $12,000; undivided bank profits, $4,000; deposits unknown. NESS CITY, Kan., June 26,-The Bank of ComNess City has been closed by Bank missioner Breidenthal, after an unsuccess- its ful attempt to raise money among its eastern stockholders to tide it over bank, present embarrassment. This had $31,300 which had a capital of $40,000, in deposits. When the bank commissioner took charge of it the cash on hand amountd to just $83.55. Mr. Breidenthal says real that the bank was loaded down with estate and bad debts. BUFFALO, N. Y. June 26.-The Queen The City bank of this city has failed. suspension is due to a drain of money bank out the bank for several weeks. The offiof owes depositors over $1,400,000. The will cers are hopeful that the bank reThe liabilities of the bank. accord- The sume. ing to the June report, are $2,323,754. assets are not known. The bank paid out all the money it had, Mr. to dimes, nickels and pennies. even Englehart, one of the directors, said that but the bank had plenty of collateral, found it impossible to realize on it in New the present financial stringency. The York banks would not let them have any The depositors will be paid In money. The state superintendent of banking an examiner here. until when he full. dent, will send recently, resigned The presi- on H. account of ill health, was William Jackson. Since his resignation the bank has been in charge of a committee of its directors. ALBANY, N. Y., June 26.-SuperintendPreston of the state banking department, ent speaking of the Queen City bank failure, said that the report of the condi- re-tion of the bank on June 1st showed sources of $2,351,600 and liabilities of $2,Reference to the amount of cash 351,600. on hand shows that it does not equal the amount of the 10 per cent legal reserve required by law. The report of the examiner for Feburary showed a nominal sur- had plus of $35,600. Poor investments considerable to do with the collapse. CHESTER, Pa., June 26. - The Crum Creek Iron and Steel company has assigned. The liabilities are estimated at $120,000 and the assets at $119,000. The sum of $40,000.is due the company from a former agent. Dullness in trade and threatened suits caused the failure. NEW YORK, June 26.Mann Bros., clothing dealers, today confessed judgment for $55,000. The attorneys for the say that the liabilities are about $300,000, half of which istor borrowed money and the other half for merchandise, The value of the assets is not known. The failure is attributed to several causes, the stringency in the money market being the principal one, as they were unable to meet notes as they mature. NEW YORK, June 26.-The supreme court this morning appointed a receiver for the Mutual Brewing company of College Point. GALLIPOLIS, O., June 26.-The Carl coal works, at Carlton, have assigned. The liabilities are $50,000, and the assets £7,000. HAMILTON, O., June 26.-Louis Snyder's Sons tonight assigned their four great paper mills at Hamilton, and their real estate and paper warehouses, with contents, in Cincinnati. The assets are over $1,000,000. The liabilities are less than $300,000. The assignment is due to the fact that they were unable to borrow $7, 000 from the banks. It is an old and well established firm. PORT ANGIERS, Wash., June 26.-The First National bank has suspended temporarily. The assets are $142,000, and the liabilities $85,000. SAN FRANCISCO, June 26.-Sands & Gump. extensive dealers in rt goods, have assigned. The liabilities are $14,000 and in the assets $100,000. The stringency money caused the failure. WILMINGTON, O., June -The Sabina bank, a private banking institution in this is county, has suspended. The capital $12,000. No statement was made. BOSTON, June xi-Forty-three banks, represented at the clearing house meeting this morning, voted unanimously in favor of clearing house certificates for payment at the clearing house.