Article Text

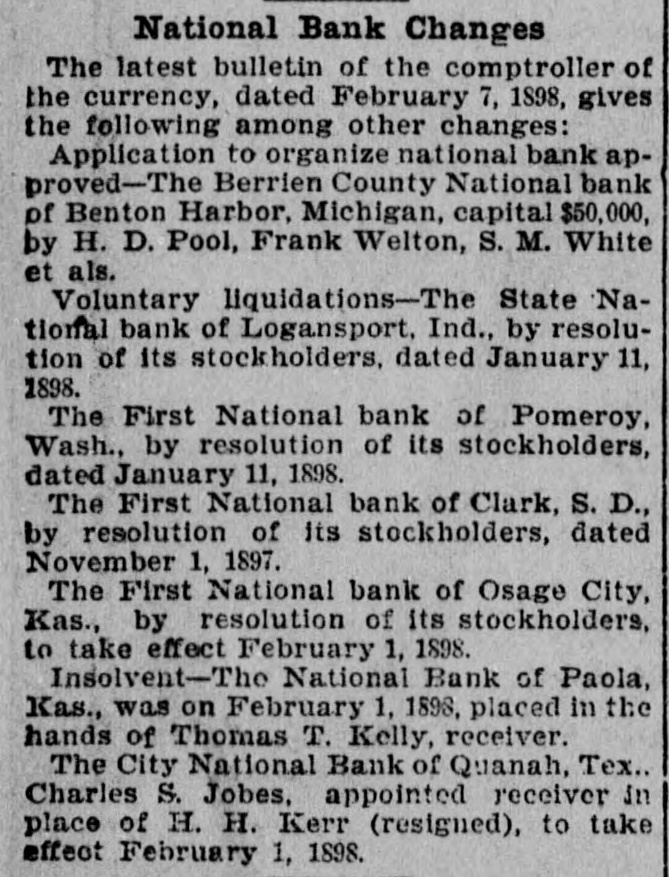

National Bank Changes The latest bulletin of the comptroller of the currency, dated February 7, 1898, gives the following among other changes: Application to organize national bank approved-The Berrien County National bank of Benton Harbor, Michigan, capital $50,000, by H. D. Pool, Frank Welton, S. M. White et als. Voluntary liquidations-The State National bank of Logansport, Ind., by resolution of its stockholders, dated January 11, 1898. The First National bank of Pomeroy, Wash., by resolution of its stockholders, dated January 11, 1898. The First National bank of Clark, S. D., by resolution of its stockholders, dated November 1, 1897. The First National bank of Osage City, Kas., by resolution of its stockholders, to take effect February 1, 1898. Insolvent-The National Bank of Paola, Kas., was on February 1, 1898, placed in the hands of Thomas T. Kelly, receiver. The City National Bank of Quanah, Tex., Charles S. Jobes, appointed receiver in place of H. H. Kerr (resigned), to take effect February 1, 1898.