Article Text

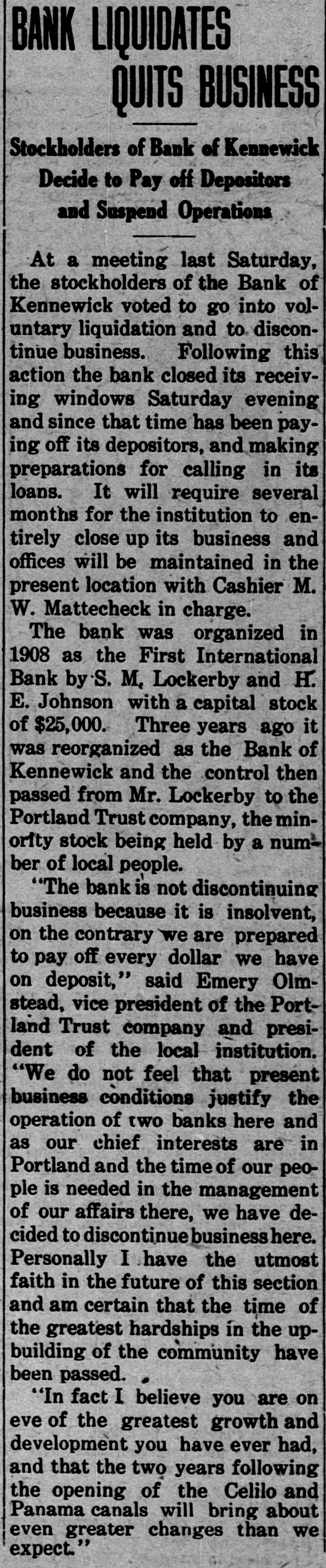

BANK LIQUIDATES QUITS BUSINESS Stockholders of Bank of Kennewick Decide to Pay off Depositors and Suspend Operations At a meeting last Saturday, the stockholders of the Bank of Kennewick voted to go into voluntary liquidation and to discontinue business. Following this action the bank closed its receiving windows Saturday evening and since that time has been paying off its depositors, and making preparations for calling in its loans. It will require several months for the institution to entirely close up its business and offices will be maintained in the present location with Cashier M. W. Mattecheck in charge. The bank was organized in 1908 as the First International Bank by S. M. Lockerby and H. E. Johnson with a capital stock of $25,000. Three years ago it was reorganized as the Bank of Kennewick and the control then passed from Mr. Lockerby to the Portland Trust company, the minority stock being held by a number of local people. "The bank is not discontinuing business because it is insolvent, on the contrary we are prepared to pay off every dollar we have on deposit," said Emery Olmstead, vice president of the Portland Trust company and president of the local institution. "We do not feel that present business conditions justify the operation of two banks here and as our chief interests are in Portland and the time of our people is needed in the management of our affairs there, we have decided to discontinue business Personally I have the utmost faith in the future of this section and am certain that the time of the greatest hardships in the upbuilding of the community have been passed. . "In fact I believe you are on eve of the greatest growth and development you have ever had, and that the two years following the opening of the Celilo and Panama canals will bring about even greater changes than we expect."