Article Text

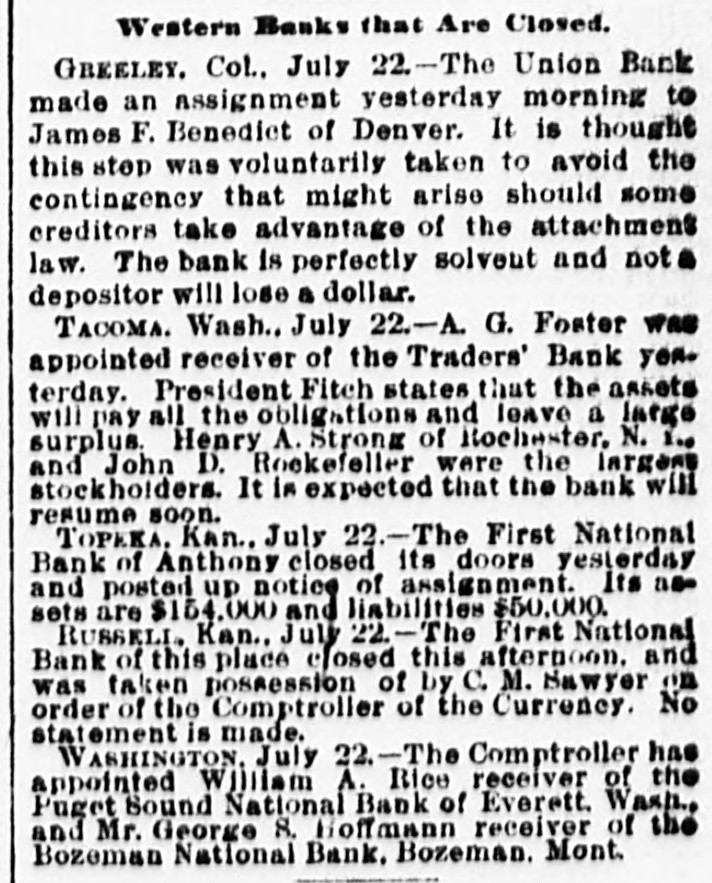

TELEGRAPHIC BREVITIES. Madame Demorest, of New York, was robbed of $3,000 worth of jewels Monday night at a Michigan avenue, Chicago, boarding house. No arrests have been made. Secretary Smith, of the Interior De- the partment, has issued an order to Choctow authorities to prevent the execution of the five Choctaws who were to be shot to-morrow. Vice-President Stevenson will leave Chicago for Buzzards Bay to-night to consult with the President over ques- the tions which may come up during special session of Congress. The refusal of the Treasury Depart- the ment to accept silver bullion at silprices offered yesterday weakened at the New York stock exchange to-day ver and a decline to 73 took place. FulThree negroes were arrested at of Ky., last night for the murder of the ton, Ray girls near Bardwell. One the men was found to have a bloody knife and there was blood on one arm. The oil town of McDonald, Pa., ou the Pan Handle road, narrowly escaped destruction by fire early this morning. the Ten buildings, one of which was esBaptist church, were burned. The timated loss is $90,000. Hundreds of the Texas cattle which have been driven into Oklahoma from the Cherokee strip by the soldiers are dying of the Spanish fever, and farmers along the line are greatly alarmed cattle over the prospects of their domestic have becoming infected. Armed forces gone to the line to shoot any cattlethat may be driven over. Rev. John T. James, of Virginia, who smashed the whisky exhibit at the World's fair on the Fourth of July acted so queerly that the justice allowed He the charge of disorderly conduct. As then fined the reverend vandal $25. Mr. James declared he would go to jail and pose as a martyr for demon drink, the judge remitted the fine. President Cleveland reached Gray Gables at 9:30 o'clock last night, a few minutes before the beginning of the most violent thunder, hail and wind storm that has swept over Buzzards' in Bay for years. The President was good health and had greatly enjoyed his fishing excursion. The President Lais confined to his room. Secretary mont says Mr. Cleveland has an attack of rheumatism in his foot and knee. Prominent parties were engaged in a shooting affair in Richmond, Ind., last night that has caused much excitement. Rev. John Beaver, a well-known divine and evangelist, who has been engaged in religious work for many years, shot One four times at Thomas G. Gray. ball took effect in Gray's thigh and pro- of duced a serious wound. The cause the trouble arose from jealousy of the preacher about his wife. Seymour, the mind- reader, is on his way alive to Chicago, where he is going to be buried after the manner of the Indian magicians, who say they can suspend animation for any period by swallowing their tongues and controlling their heart and mind. "I wont come Mr. back to earth until September 24," said it." Seymour, "and I am positive I can do Last night's thunder shower was very seat Elizabeth, N. J. Lightning struck dethe vere Park Methodist Episcopal Church, stroying the belfry and causing $10,000 damage. The members were holding prayer and meeting in the lecture room at the time they were greatly frightened. Among the failures to-day were the Ameri- Lock Savings Bank, at Omaha; L. C. & can Co., Alma, Ark.; Peter Traucht. Arlington, A.C Ohio; Bank of Sumas, Sumas, Wash.: Bank. Leighton, Ottumwa, Ia.; Nobles County NatWorthington, Minn; and Puget Sound ional Bank, Everett, Wash. After several attempts to agree on n gen- the reduction on World's Fair rates eral principal railroad lines of Cincinnati seem Penn- to have decided to act separately. The sylvania line has taken the initiative in announcing the first cheap excursion to Chicago