Article Text

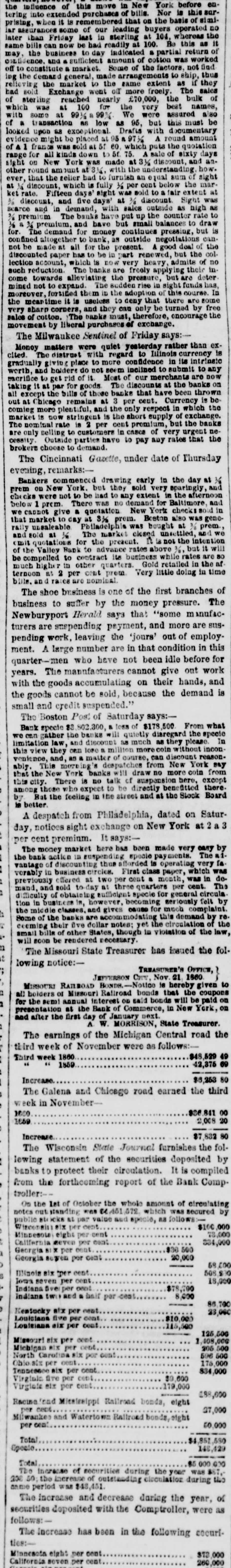

the influence of this move in New York before entering into extended purchases of bills. Nor is this surprising, when it is remembered that on the basis of similar assurances some of our leading buyers operated no later than Friday last in sterling at 104, whereas the same bills can now be had readily at 100. Be this as it may, the business to day indicated a partial return of confidence, and a sufficient amount of cotton was worked off to constitute a market. Some of the factors, not finding the demand general, made arrangements to ship, thus relieving the market to the same extent as if they had sold Exchange went off more freely. The sales of sterling reached nearly £70,000, the bulk of which was at 100 for the very best names, with some at 99% 99%. We were assured also of a transaction as low as 95, but this must be looked upon as exceptional. Drafts with documentary evidence might be placed at 95 a 97½. A round amount of a 1 francs was sold at 5f 60, which puts the quotation range for all kinds down to 5f. 75. A sale of sixty days sight on New York was made at 3% discount, and another round amount at 3¼, with the understanding, however, that the relier had to furnish an equal sum of sight at discount, which is fully ½ per cent below the market rate. Fifteen days' sight was sold to a fair extent at discount, and five days' at ¼ discount. Sight was scarce and in demand, with sales outside as high as ½ premium The banks have put up the counter rate to a premium, and have but small balances to draw for. The demand for money continues pressing, but is confined altogether to bank, as outside negotiations cannot be made at all for the present. A good deal of the discounted paper has to be in part renewed, but the collection account, which is now very heavy, admits of no such reduction. The banks are freely applying their income towards alleviating the pressure, but are determined not to expand. The sudden rise in sight funds has, moreover, fortified them in the adoption of this course. In the meantime it is useless to deny that there are some very sharp corners, and they can only be turned by free sales of cotton. The banke must, therefore, encourage the movement by liberal purchases of exchange. The Milwaukee Sentinel of Friday says:- Money matters were quiet yesterday rather than excited. The distrust with regard to Illinois currency is gradually giving place to more confidence in its intrinsic worth, and holders do not seem inclined to submit to any sacrifice to get rid of it. Most of our merchants are now taking it at par for goods. The discounts at the banks on all except the bills of those banks that have been thrown out at Chicago remains at 3 per cent. Currency is becoming more plentiful, and the only respect in which the market is now stringent is the short supply of exchange. The nominal rate is 2 per cent premium, but the banks are only selling to customers in cases of very urgent necessity. Outside parties have to pay any rates that the brokers choose to demand. The Cincinnati Gazette, under date of Thursday evening, remarks:- Bankers commenced drawing early in the day at prem on New York, but they sold very sparingly, and checks were not to be had to any extent in the afternoon below 1 prem. There was no demand for Baltimore, and we cannot give a quotation New York checks sold in that market to day at 3% prem. Boston also was generally unsaleable. Philadelphis was bought at prem., and sold at The market closed unsettled, and we omit quotations for the present. It is not the intention of the Valley Rank to advance rates above 3%, but it will be compelled to contract its business while rates are so much higher in other quarters. Gold retailed in the afternoon at 2 per cent prem. Very little doing in time bills, and rates are nominal. The shoe business is one of the first branches of business to suffer by the money pressure. The Newburyport Herald says that "some manufacturers are suspending payment, and more are suspending work, leaving the 'jours' out of employment. A large number are in that condition in this quarter-men who have not been idle before for years. The manufacturers cannot give out work with the goods accumulating on their hands, and the goods cannot be sold, because the demand is small and credit suspended." The Boston Post of Saturday says:- Bank specie $3,802,300, a loss of $178,500. From what we can gather the banks will quietly disregard the specie limitation law, and discount as much as they please. In this view they can lose a million more coin without inconvenience, and, as a matter of course, can discount reasonably. This morning's despatches from New York say that the New York banks will draw no more coin from this city. There is no talk of suspension here, except among those who expect to be directly benefitted there. by Bat the feeling in the street and at the Stock Board is better. A despatch from Philadelphia, dated on Saturday, notices sight exchange on New York at 2 a 3 per cent premium. It says:- The money market here has been made very easy by the bank action in suspending specie payments. The ai-vantage of discounting thus afforded is operating very favorably in business circles. First class paper, which was previously offered at two per cent a month, was in demand, and sold to-day at three quarters per cent. The difficulty of obtaining sufficient specie for general circulation in business is, however, becoming seriously felt by the middle classes, and gives cause for much complaint. Some of the banks are accommodating this demand by re-ceeming their five dollar notes; yet the circulation of the small bills of other States, though in violation of the law, will soon be rendered recessary. The Missouri State Treasurer has issued the following notice:- TREASURER'S OFFICE, JEFFERSON CHEY, Nov. 21, 1660. MISSOURI RAILROAD HONDS.-Notice is hereby given to all holders of Missouri Rafiroad bonds that the coupons for the semi annual interest on said bonds will be paid on presentation at the Bank of Commerce, in New York, on and after the first day of January next. A. W. MORRISON, State Treasurer. The earnings of the Michigan Central road the third week of November were as follows:- Third week 1860. $48,529 49 " " 1859. 42,376 69 Increase. $6,253 80 The Galena and Chicago road earned the third week in November- 1000. $36.841 00 1659 2,008 20 Increase. $7,832 80 The Wisconsin State Journal furnishes the following statement of the securities deposited by banks to protect their circulation. It is compiled from the forthcoming report of the Bank Comptroller:-- On the 1st of October the whole amount of circulating notes outstanding was 451,072, which was secured by public sticks at par value and specie, as follows:- Wisconsin six per cent. $100,000 Minnesota eight per cent 78,000 California zeven per cent. 334,000 Georgia six per cent. $36 500 Georgia seven por cent 20,000 59,000 Illinois six per cent. 508,800 Jowa seven per cent. 18,000 Indiana five per cent. $78,700 indiana two and a anif per cent. 8,000 86,700 Kentucky six per cent. 23,060 -Louisiana five per cent. $10,000 Louleiana six per cont. 115,500 125,500 Missouri six per cont. 1,408,000 Michigan six per cent. 206 500 North Carolina six por cor 596 600 Ohio six per cent. 176,000 Tennessee six per cent. 834,000 Virginic five per cent. $0,600 Virgiale siz per cent. 179,000 188,600 Racine'end Mitsissippi Railroad bonda, eight per cent. 27,000 Milwankes and Watertown Ballroad bonds, eight per cen: 50,000 Total. $4,851,580 Specie. 148,429 Total. $5.000.000 The increase of securities during the your was $57,-200 50, the increase of outstanding circulation during tho anme period was $48,451. The increase and decrease during the year, of securities deposited with the Comptroller, were as follows:- The increase has been in the following securities: Minnesota eight per cent. 373,000 California seven per cent. 260,000