Article Text

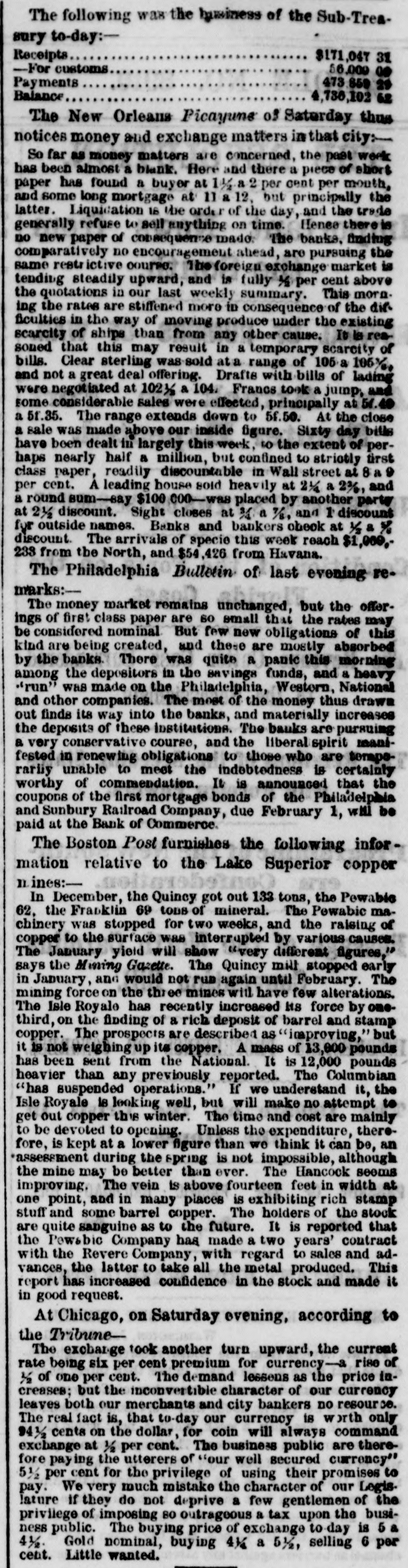

The following was the business of the Sub-Treasury to-day:Receipts $171,047 31 -For customs 56,009 00 Payments 473 859 29 Balance 4,736,102 62 The New Orleans Picayuns of Saturday thus notices money and exchange matters that city:So far as money matters are concerned, the past week has been almost a blank. Here and there a piece of short paper has found a buyer at 1/2.a.2 per cent per month, and some long mortgage at 11 a 12, but principally the latter. Liquidation 18 the order of the day, and the trade generally refuse to sell anything on time. Henee there is no new paper of consequence made. The banks. finding comparatively no encouragement ahead, are pursuing the same restr ictive course. The foreign exchange market is tending steadily upward, and is fully X per cent above the quotations in our last weekly summary. This morn. ing the rates are stiffened more in consequence of the dieficulties in the way of moving produce under the existing scarcity of ships than from any other cause. It is reasoned that this may result in a temporary scarcity of bills. Clear sterling was sold ata range of 105 106% and not a great deal offering. Drafts with bills of lading were negotiated at 102½ a 104. Francs took a jump, and some considerable sales were effected, principally at 51.40 a 5f.35. The range extends down to 5f.50. At the close a sale was made above our inside figure. Sixty day bills have been dealt in largely this week, to the extent of perhaps nearly half a million, but confined to strictly first class paper, readily discountable in Wall street at 8 a 9 per cent. À leading house sold heavily at 2½ a 2%, and a round sum-say $100 000-was placed by another party at 2½ discount. Sight closes at M a 7/8, and 1 discount for outside names. Banks and bankers check at ½ a % discount. The arrivals of specie this week reach $1,000,233 from the North, and $54 ,426 from Havana. The Philadelphia Bullotin of last evening remarks:-The money market remains unchanged, but the offerings of first class paper are 60 small that the rates may be considered nominal But few new obligations of this kind are being created, and these are mostly absorbed by the banks. There was quite a panic this morning among the depositors in the savings funds, and a heavy "run" was made on the Philadelphia, Western, National and other companies. The most of the money thus drawn out finds its way into the banks, and materially increases the deposits of these institutions. The banks are pursuing a very conservative course, and the liberal spirit manifested in renewing obligations to those who are temporariiy unable to meet the indebtedness is certainly worthy of commendation. It is announced that the coupons of the first mortgage bonds of the Philadelphia and Sunbury Railroad Company, due February 1, will be paid at the Bank of Commerce. The Boston Post furnishes the following information relative to the Lake Superior copper n. ines:In December, the Quincy got out 133 tons, the Pewable 62, the Franklin 69 tons of mineral. The Pewabic machinery was stopped for two weeks, and the raising of copper to the surface was interrupted by various causes. The January yield will show "very different figures,' says the Mining Gazette. The Quincy mill stopped early in January, and would not run again until February. The mining force on the the mines will have few alterations. The Isle Royale has recently increased its force by onethird, on the finding of a rich deposit of barrel and stamp copper. The prospects are described as "improving," but it is not weighing up its copper, A mass of 13,000 pounds has been sent from the National. It is 12,000 pounds heavier than any previously reported. The Columbian "has suspended operations." If we understand it, the Isle Royale is looking well, but will make no attempt to get out copper this winter. The time and cost are mainly to be devoted to opening. Unless the expenditure, therefore, is kept at a lower figure than we think it can be, an assessment during the spring is not impossible, although the mine may be better than ever. The Hancock seems improving. The vein is above fourteen feet in width at one point, and in many places is exhibiting rich stamp stuff and some barrel copper. The holders of the stock are quite sanguine as to the future. It is reported that the Pewsbic Company has made a two years' contract with the Revere Company, with regard to sales and advances, the latter to take all the metal produced. This report has increased confidence in the stock and made it in good request. At Chicago, on Saturday ovening, according to the TribuneThe exchange took another turn upward, the current rate being six per cent premium for currency-a rise of ½ of one per cebt. The demand lessens as the price increases; but the inconvertible character of our currency leaves both our merchants and city bankers no resour The real fact is, that to-day our currency is orth only 943/2 cents on the dollar, for coin will always command exchange at ½ per cent. The business public are therefore paying the utterers of "our well secured currency" 5½ per cent for the privilege of using their promises to pay. We very much mistake the character of our Legis. lature If they do not deprive a few gentlemen of the privilege of imposing 80 outrageous a tax upon the business public. The buying price of exchange to day is 5 a wanted. 4½. cent. Gold Little nominal, buying 41/4 a 5½, selling 6 per