Article Text

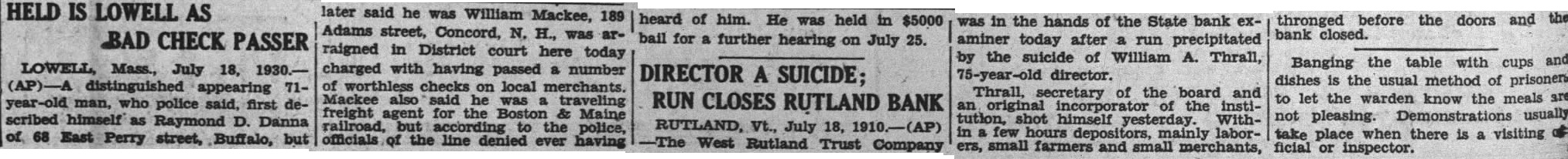

HELD IS LOWELL AS BAD CHECK PASSER LOWELL Mass., July 18, 1930.(AP)-A distinguished appearing 71year-old man, who police said, first described himself as Raymond D. Danna of 68 East Perry street, Buffalo, but later said he was William Mackee, 189 Adams street, Concord, N. H., was arraigned in District court here today charged with having passed a number of worthless checks on local merchants. Mackee also said he was a traveling freight agent for the Boston & Maine railroad, but according to the police, officials of the line denied ever having heard of him. He was held in $5000 bail for a further hearing on July 25. DIRECTOR A SUICIDE; RUN CLOSES RUTLAND BANK RUTLAND, Vt., July 18, 1910.-(AP) -The West Rutland Trust Company was in the hands of the State bank examiner today after a run precipitated by the suicide of William A. Thrall, 75-year-old director. Thrall, secretary of the board and an original incorpora of the institution, shot himself yesterday. Within few hours depositors, mainly laborers, small farmers and small merchants, thronged before the doors and the bank closed. Banging the table with cups and dishes is the usual method of prisoners to let the warden know the meals are not pleasing. Demonstrations usually take place when there is a visiting of ficial or inspector.