Article Text

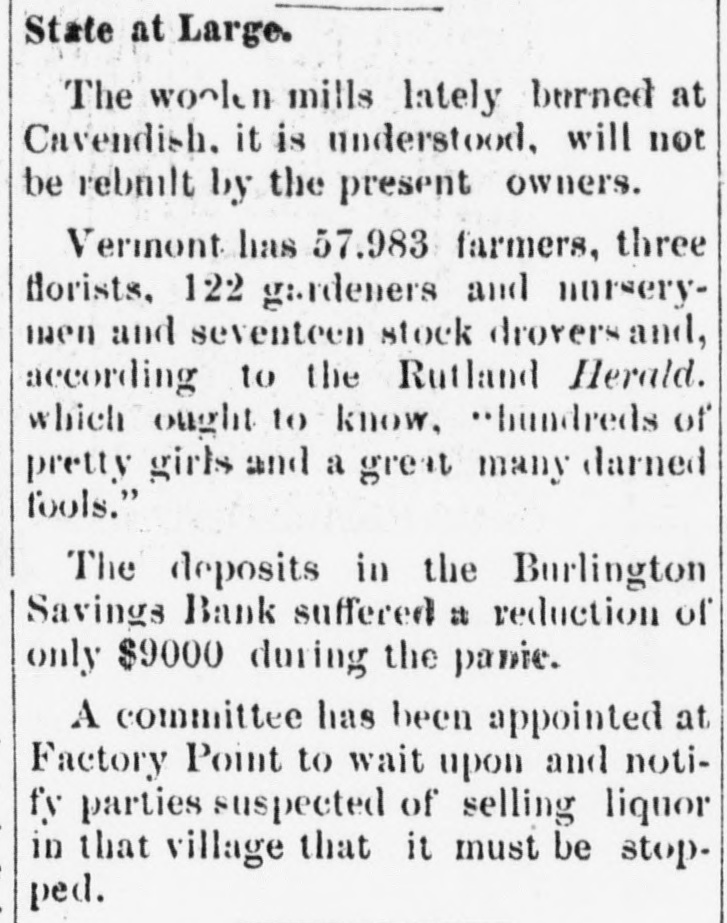

State at Large. The wookn mills lately burned at Cavendish. it is understood, will not be rebmit by the present owners. Vermont has 57.983 farmers, three florists, 122 gardeners and nurserymen and seventeen stock drovers and, according to the Rutland Herald. which ought to know, "hundreds of pretty girls and a great many darned fools." The deposits in the Burlington Savings Bank suffered a reduction of only $9000 during the panie. A committee has been appointed at Factory Point to wait upon and notify parties suspected of selling liquor in that village that it must be stopped.