Click image to open full size in new tab

Article Text

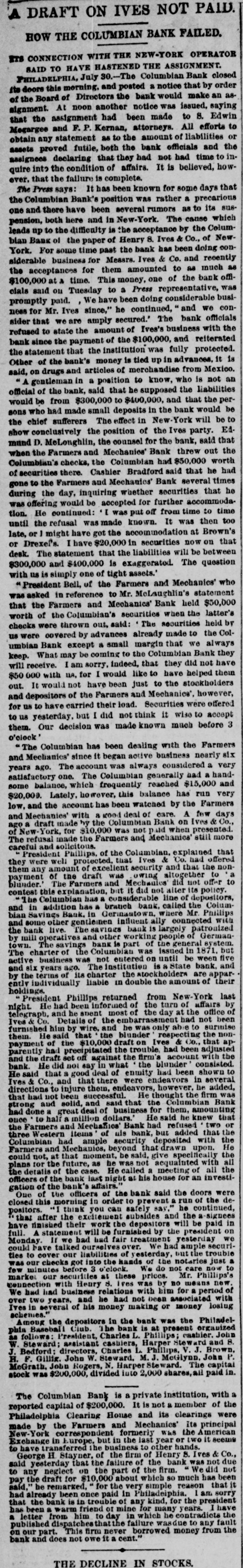

A DRAFT ON IVES NOT PAID. HOW THE COLUMBIAN BANK FAILED. HTS CONNECTION WITH THE NEW-YORK OPERATOR SAID TO HAVE HASTENED THE ASSIGNMENT. PHILADELPHIA, July 30.-The Columbian Bank closed its doors this merning, and posted a notice that by order of the Board of Directors the bank would make an assignment. At noon another notice was issued, saying that the assignment had been made to S. Edwin Megargee and F. P. Kernan, attorneys. All efforts to obtain any statement as to the amount of liabilities or the officials and bank the both futile, proved assignees declaring that they had not had time to inquire into the condition of affairs. It is believed, however. that the failure is complete. The Press says: It has been known for some days that the Columbian Bank's position was rather a precarious one and there have been several rumors as to its suspension, both here and in New-York. The cause which leads up to the difficulty is the acceptance by the Columbian Bank of the paper of Henry 8. Ives & Co., of NewYork. For some time past the bank has been doing considerable business for Messrs. Ives & Co. and recently the acceptances for them amounted to as much as $100,000 at time. This money, one of the bank officlais said on Tuesday to a Press representative, was promptly paid. We have been doing considerable business for Mr. Ives since," he continued, and we consider that we are amply secured.' The bank officials refused to state the amount of Ives's business with the bank since the payment of the $100,000, and reiterated the statement that the institution was fully protected. Other of the bank's money is tied up in advances, it 1s said, on drugs and articles of merchandise from Mexico. A gentleman in a position to know, who is not an official of the bank, said that he supposed the liabilities would be from $300,000 to $400,000, and that the persons who had made small deposits in the bank would be the chief sufferers The effect in York New-York will be to show conclusively the position of the Ives party. Ed. mund D. MeLonghlin, the counsel for the bank, said that when the Farmers and Mechanics' Bank threw out the Columbian's checks, the Columbian had $50,000 worth of securities there. Cashier Bradford said that he had gone to the Farmers and Mechanics' Bank several times during the day, inquiring whether securities that he was offering would be accepted for further accommodation. He continued: 'I was put off from time to time until the refusal was made known. It was then too late, or might have got the accommodation at Brown's or Drexel's. have $20,000 in securities now on that desk. The statement that the liabilities will be between $300,000 and $400,000 is exaggerated. The question with us is simply one of tight assets.' " President Bell, of the Farmers and Mechanics' who was asked in reference to Mr. McLaughlin's statement that the Farmers and Mechanics' Bank held $50,000 worth of the Columbian's securities when the latter's checks were thrown out, said: The securities held by us were covered by advances already made to the Columbian Bank except a small margin that we always keep. What may be coming to the Columbian Bank they will receive. am sorry, indeed, that they did not have $50 000 with na, for I would like to have helped them out. It would not have been just to the stockholders and depositors of the Farmers and Mechanics', however, for us to have carried their load. Securities were offered to us yesterday, but I did not think it wise to accept them. Our decision was made known much before 3 o'clock' Farmers the with been has dealing Columbian The and Mechanics' since it began active business nearly six years ago. The account was always considered a very satisfactory one. The Columbian generally had a handsome balance, which frequently reached $15,000 and $20,000. Lately, however, this balance has run very low, and the account has been watched by the Farmers and Mechanies' with a good deal of care. A few days ago a draft made by the Columbian Bank on Ives & Co., York, New-York, for $10,000 was not paid when presented. Mechanics' still more Farmers the made and refusal The solicitous. and careful President Phillips, of the Columbian, explained that they were well protected, that Ives had offered them any amount of excellent security and that the nonpayment of the draft was owing altogether to offer to not PIP Mechanics pur Farmers The blunder. contest this explanation, but it did not alter its policy. of line depositors, considerable has Columbian the and in addition has a branch bank, called the ColumMr. where Phillips Germantown, in Bank. bian Savings and some other gentlemen influent ally connected with the bank live. savings bank is largely patronized by mill operatives and other working people of Germanthe of general system. bank part The The savings town. but 1871, in Was issued Columbian the charter of The active business was not entered on until be ween five and six years ago. The institution is State bank, and by the terms of its charter the stockholders are apparently individually liable in double the amount of their holdings. President Phillips returned from New York last night. He had been informed of the turn of affairs by telegraph, and he spent most of the day at the office of Co. Details of the embarrassment had not been furnished him by wire, and he was only able to surmise them. He said He said that the blunder respecting the nonCo., draft that à on Ives the of $10,000 parently payment had precipitated the trouble, had been adjusted and the draft set off against the firm's account with the bank. He did not say in what the blunder consisted. said that a good deal of enmity had been shown to Ives & Co., and that there were endeavors in several directions to injure them, endeav however, he added, that had not been successful. He thought the firm was strong and solid, and said that the Columbian Bank had done great deal of business for them, amounting said knew that he He million half dollars. to at once the Farmers and Mechanics' Bank had refused two or three Western items of uls bank, but added that the Columbian had ample security deposited with the Farmers and Mechanics, beyond that drawn upon. He could not, at that moment, be said, give specifically the all with not he was as acquainted the future, for plans details of the case. He called a meeting of all the officers of the bank last night at his house for an investigation of the bank's affairs. One of the officers of the bank said the doors were closed this morning order to prevent a run of the depositors. "I think you can safely say he continued, at and the signees subsides excitement the after that have rinished their work the depositors will be paid in full. A statement will be furnished by the president on Monday If we had had fair treatment yesterday we securihad We ample ourselves talked over. have prinoo ties to cover our liabilities of resterday, but the trouble . of the notaries the just hands into got checks our i few minutes before o'clock. We do not care now to Mr. Phillips's = these securities prices. our market connection with Henry S. Ives was by no means new. of of for him with relations period had had We business over two years. and he had not been associated with or losing his of money in money several making Ives schemes." Philadelwas the bank the the in depositors Amoug organized he Club. bank present Baseball phia follows: President, Charles L. Phillips; cashier. John Steward assistant cashiers, Harper Steward and S. Bedford: directors, Charles L. Phillips, J. Brown, F. Gillig. John W. Steward, M. J. McGlynn. John P. B. The Ste capital Steward. N. John Harper Rogers, McGrath. stock was $200,000, divided into 2,000 shares, all paid in. The Columbian Bank is a private institution, with a reported capital of $200,000. It is not a member of the Philadelphia Clearing House and its clearings were made by the Farmers and Mechanics' Its principal York New-York correspondent formerly Was the American Exchange in Europe, but in the last year or two it seems hands. other 8 business the have transferred to George H. Stayner, of the firm of Henry S. Ives & Co., said yesterday that the failure of the bank was not due to any neglect on the part of the firm. We did not pay the draft for $10,000 about which so much has been said, he remarked, for the very simple reason that it had already been once paid in Philadeiphia. am sorry that the bank is in trouble of any kind, for the president has been warm friend of mine for many years. have a letter from him to day in which he contradicts the published that failure wasdue to any fault our part. This firm never borrowed money from the bank and does not owe it a cent." THE DECLINE IN STOCKS.