Article Text

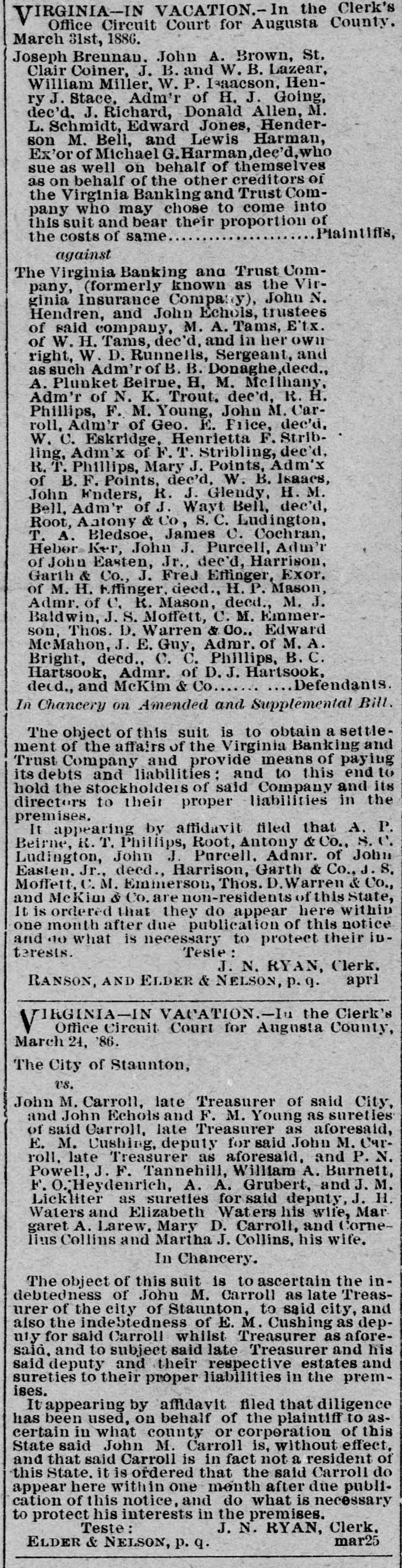

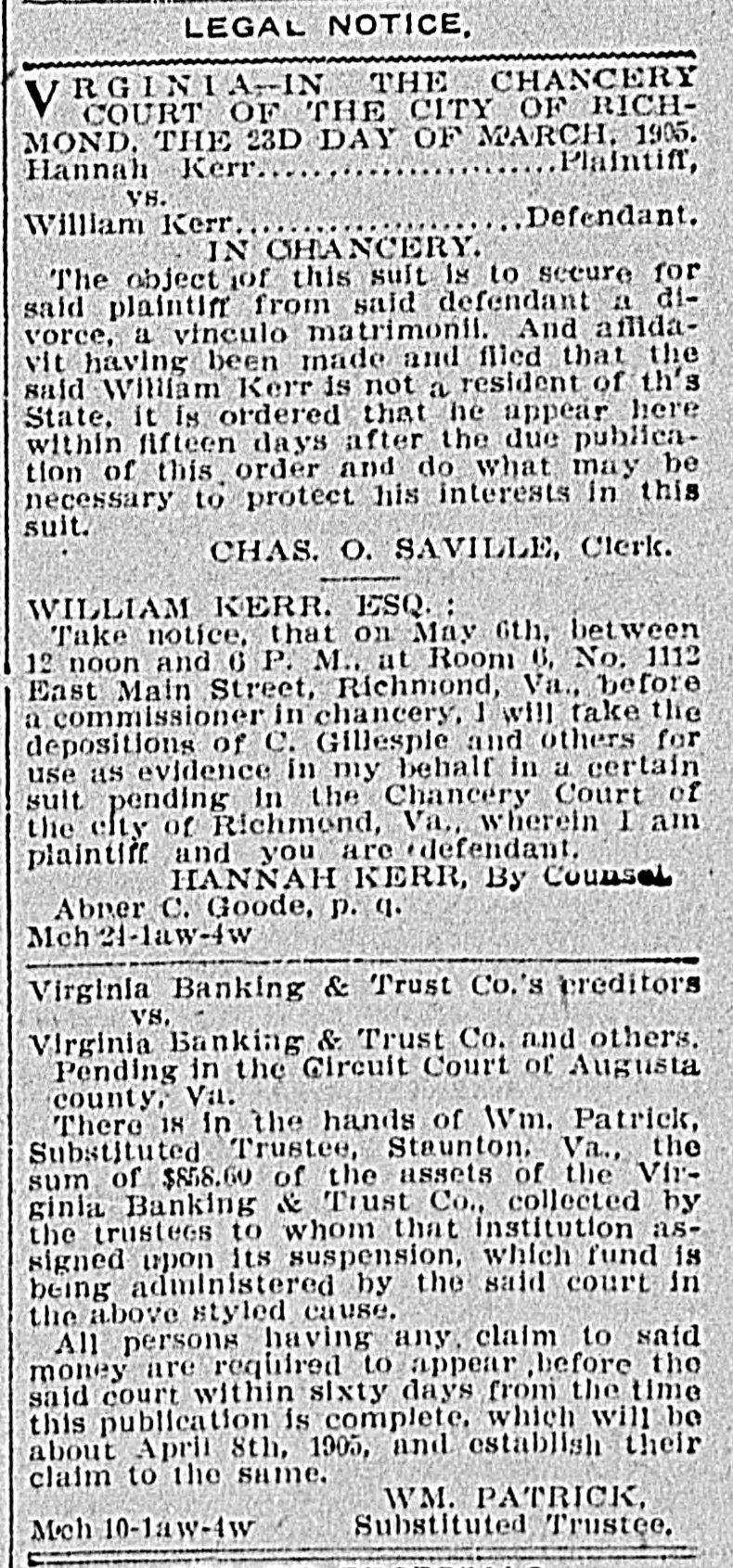

L. Schmidt, Edward Jones, Henderson M. Bell, and Lewis Harman, Ex'or of Michael G. Harman dee'd, who sue as well on behalf of themselves as on behalf of the other creditors of the Virginia Banking and Trust Company who may chose to come into this suit and bear their proportion of Plaintiffs, the costs of same against The Virginia Banking and Trust Company, (formerly known as the Virginia Insurance Company), John N. Hendren, and John Echols, trustees of said company, M. A. Tams, Etx. of W. H. Tams, dec'd, and in her own right, W. D. Runnells, Sergeant, and assuch Adm'r of B. B. Donaghe,decd,, A. Plunket Beirne, H, M. Mellhany, Adm'r of N. K. Trout. dec'd, R. H. Phillips, F. M. Young, John M. Carroll, Adm'r of Geo. E. Fiice, dec'd, W. C. Eskridge, Henrietta F. Stribling, Adm'x of F. T. Stribling, dec'd, R. T. Phillips, Mary J. Points, Adm'x of B. F. Points, dec'd, W. B. Isaacs, John Enders, R. J. Glendy, H. M. Bell, Adm'r of J. Wayt Bell, dec'd, Root, Antony & Co, S. C. Ludington, T. A. Bledsoe, James C. Cochran, Hebor Ker, John J. Purcell, Adm'r of John Easten, Jr., dec'd, Harrison, Garth & Co., J. Fred Effinger, Exor. of M. H. Kffinger, deed., H. P. Mason, Admr. of C, K. Mason, decd., M. J. Baldwin, J. S. Moffett, C. M. Emmerson, Thos. D. Warren & Co., Edward McMahon, J. E. Guy, Admr. of M. A. Bright, decd., C. C. Phillips, B. C. Hartsook, Admr. of D. J. Hartsook, Defendants. decd., and McKim & Co In Chancery on Amended and Supplemental Bill. The object of this suit is to obtain a settlement of the affairs of the Virginia Banking and Trust Company and provide means of paying its debts and liabilities: and to this end to hold the stockholders of said Company and its directors to their proper liabilities in the premises. It appearing by affidavit filed that A. P. Beirne, R. T. Phillips, Root, Antony & Co., S. e. Ludington, John J. Purcell. Admr. of John Easten. Jr., decd., Harrison, Garth & Co., J. S. Moffett, C. M. Emmerson, Thos. D. Warren & Co., and McKim & Co. are non-residents of this State, It is ordered that they do appear here within one month after due publication of this notice and 40 what is necessary to protect their inTeste: terests. J. N. RYAN, Clerk. RANSON, AND ELDER & NELSON, p.q. aprl IRGINIA-IN VACATION.-I the Clerk's V Office Circuit Court for Augusta County, March 24, '86. The City of Staunton, US. John M. Carroll, late Treasurer of said City, and John Echols and F. M. Young as sureties of said Carroll, late Treasurer as aforesaid, E. M. Cushing, deputy for said John M. Carroll, late Treasurer as aforesaid, and P. N. Powel!, J. F. Tannehill, William A. Burnett, F. O.Heydenrich, A. A. Grubert, and J. M. Lickliter as sureties for said deputy, J. H. Waters and Elizabeth Waters his wife, Mar garet A. Larew, Mary D. Carroll, and Cornelius Collins and Martha J. Collins, his wife. In Chancery. The object of this suit is to ascertain the indebtedness of John M. Carroll as late Treasurer of the city of Staunton, to said city, and also the indebtedness of E. M. Cushing as deputy for said Carroll whilst Treasurer as aforesaid, and to subject said late Treasurer and his said deputy and their respective estates and sureties to their proper liabilities in the premises. It appearing by affidavit filed that diligence has been used, on behalf of the plaintiff to ascertain in what county or corporation of this State said John M. Carroll is, without effect, and that said Carroll is in fact not a resident of this State. it is ordered that the said Carroll do appear here within one month after due publication of this notice, and do what is necessary